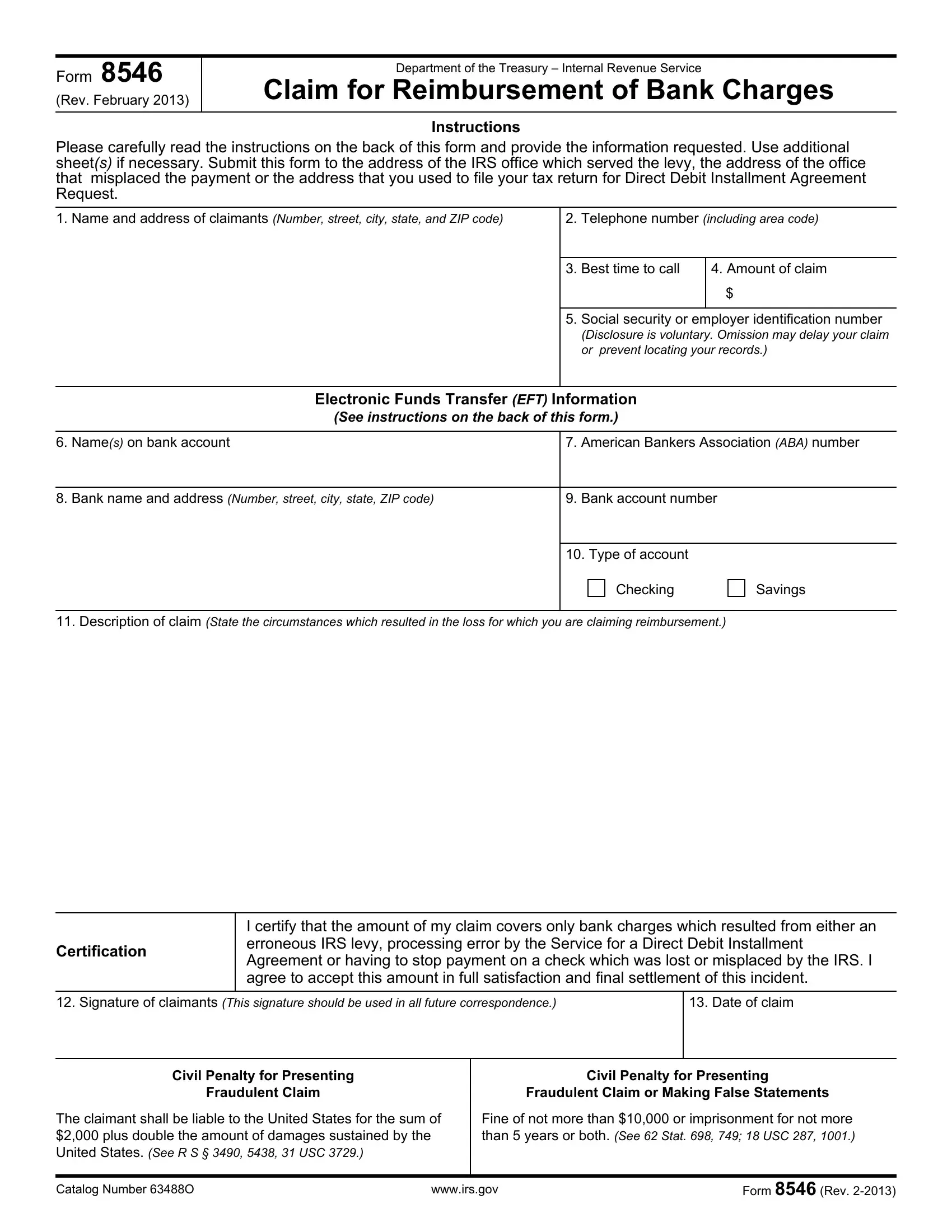

With the online tool for PDF editing by FormsPal, you'll be able to complete or alter where do you send a federal form 8546 here. Our tool is constantly developing to give the best user experience attainable, and that's because of our resolve for constant improvement and listening closely to customer opinions. In case you are seeking to begin, here is what it's going to take:

Step 1: Simply press the "Get Form Button" at the top of this page to open our pdf file editing tool. Here you'll find all that is needed to fill out your document.

Step 2: With our online PDF file editor, it is easy to accomplish more than simply fill out blanks. Try each of the functions and make your documents appear great with customized textual content added in, or modify the original content to excellence - all that comes with an ability to insert almost any images and sign the document off.

Filling out this document demands focus on details. Make sure that every single blank is done correctly.

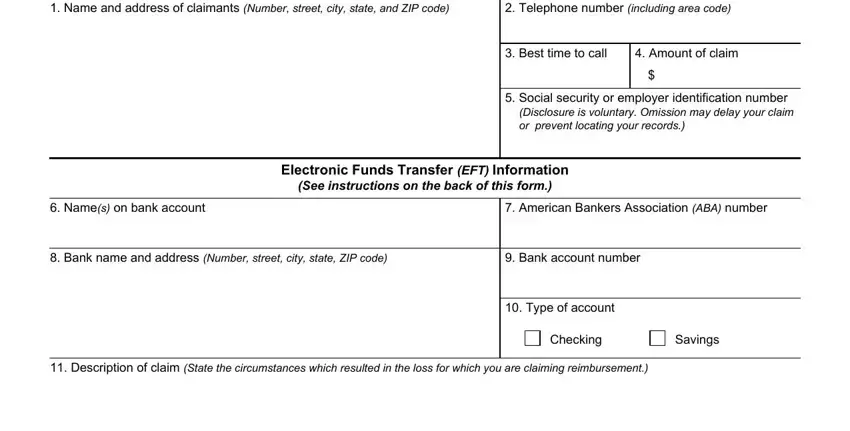

1. You'll want to fill out the where do you send a federal form 8546 accurately, therefore take care while filling in the parts including all of these blank fields:

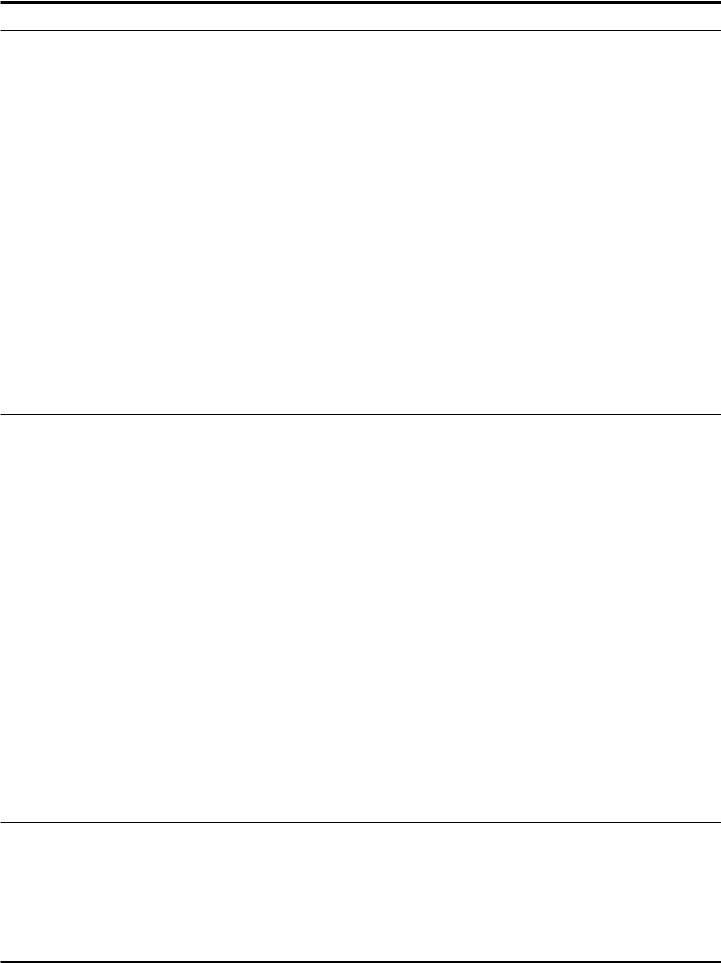

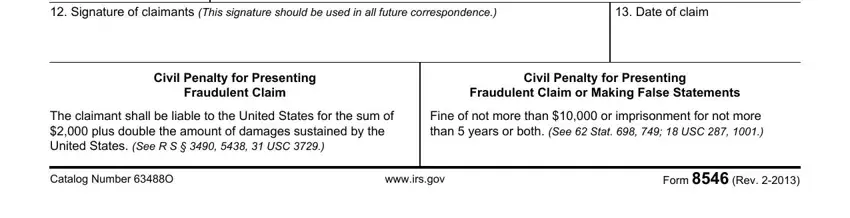

2. Once your current task is complete, take the next step – fill out all of these fields - Signature of claimants This, Date of claim, Civil Penalty for Presenting, Fraudulent Claim, Civil Penalty for Presenting, Fraudulent Claim or Making False, The claimant shall be liable to, Fine of not more than or, Catalog Number O, wwwirsgov, and Form Rev with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

When it comes to Civil Penalty for Presenting and Fine of not more than or, be certain that you double-check them in this current part. These could be the most important ones in this page.

Step 3: Always make sure that the details are right and press "Done" to complete the task. Sign up with FormsPal now and immediately use where do you send a federal form 8546, set for downloading. All adjustments you make are kept , allowing you to customize the file further if needed. We don't share or sell the information that you enter while dealing with forms at FormsPal.