Any time you would like to fill out irs 906, you don't have to download any software - simply use our PDF tool. FormsPal team is continuously endeavoring to expand the tool and ensure it is much faster for people with its extensive features. Enjoy an ever-improving experience now! With some basic steps, it is possible to start your PDF editing:

Step 1: First, open the pdf tool by pressing the "Get Form Button" at the top of this page.

Step 2: This tool will give you the capability to modify nearly all PDF forms in various ways. Improve it by writing any text, correct original content, and place in a signature - all when you need it!

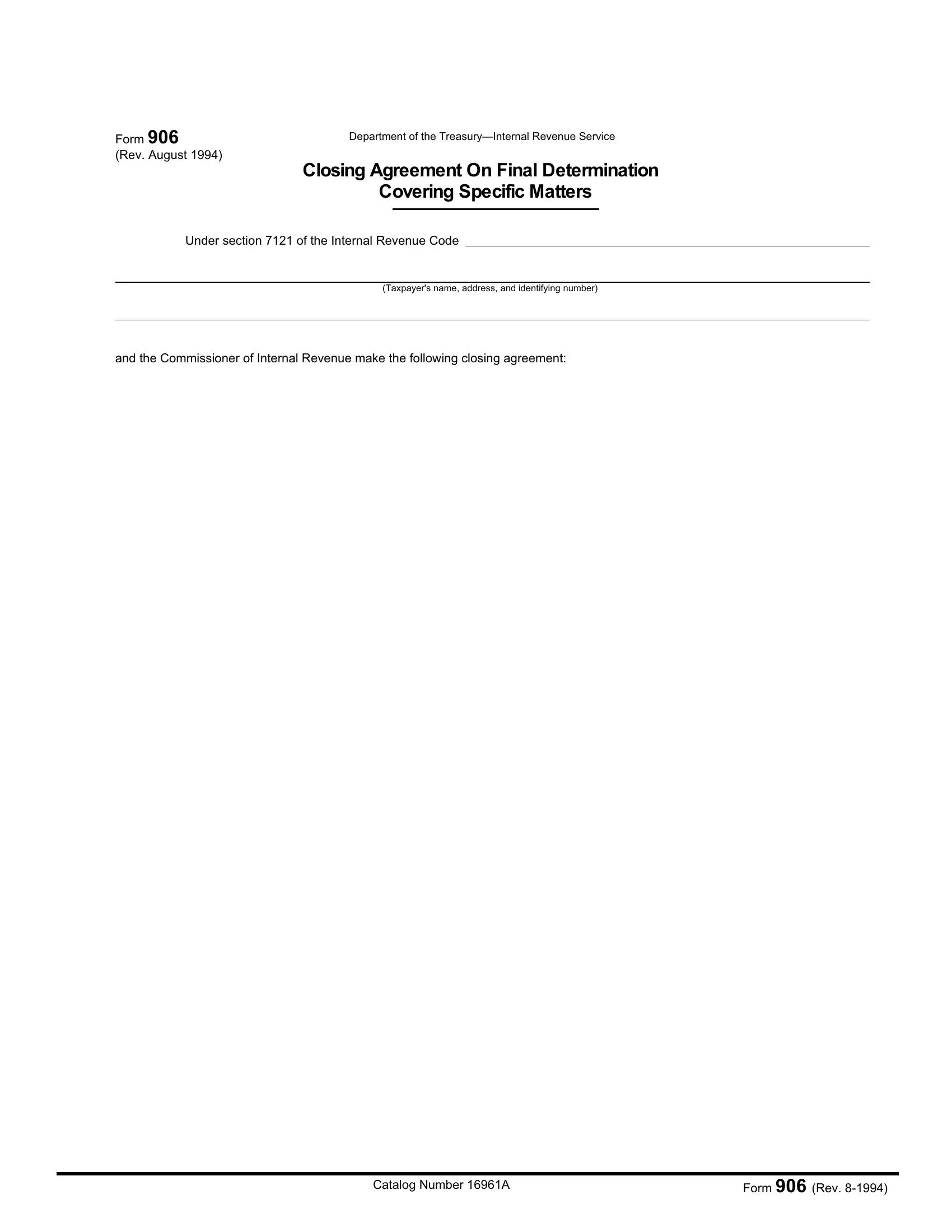

This PDF will require particular details to be filled in, therefore be sure you take whatever time to fill in exactly what is requested:

1. Complete your irs 906 with a group of major blank fields. Get all the important information and make sure there's nothing missed!

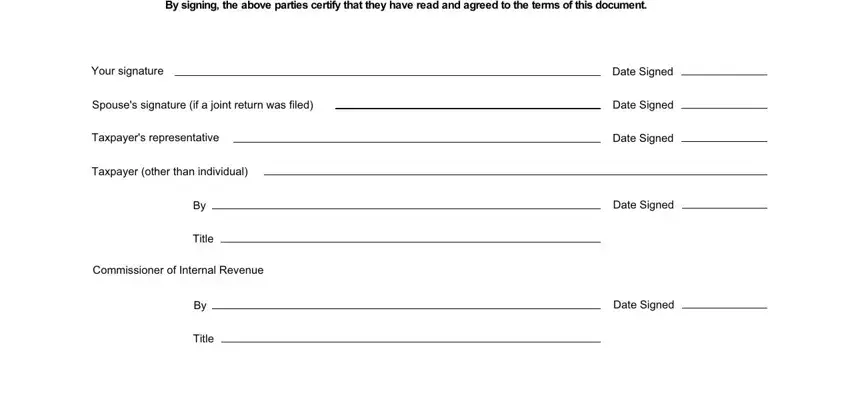

2. The third step is to complete the following blank fields: By signing the above parties, Your signature, Spouses signature if a joint, Taxpayers representative, Taxpayer other than individual, Title, Commissioner of Internal Revenue, Title, Date Signed, Date Signed, Date Signed, Date Signed, and Date Signed.

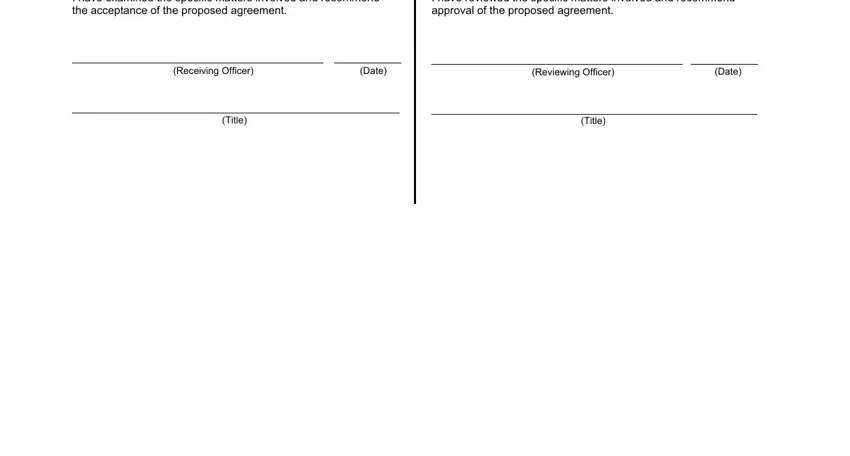

3. Completing I have examined the specific, I have reviewed the specific, Receiving Officer, Date, Reviewing Officer, Date, Title, and Title is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

In terms of I have examined the specific and Receiving Officer, make sure that you review things in this current part. These could be the most important ones in the form.

Step 3: Revise the information you have typed into the form fields and then click on the "Done" button. Get your irs 906 once you sign up for a 7-day free trial. Quickly use the document inside your FormsPal cabinet, with any modifications and adjustments automatically saved! FormsPal is focused on the privacy of our users; we ensure that all information processed by our tool continues to be protected.