General Instructions

Section and subtitle A references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 8948 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/form8948.

What's New

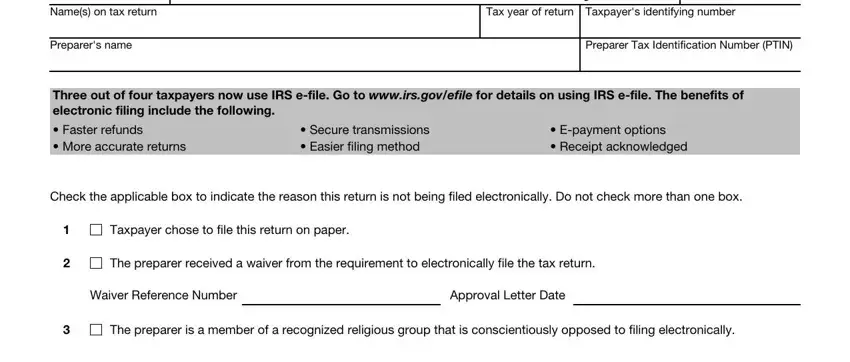

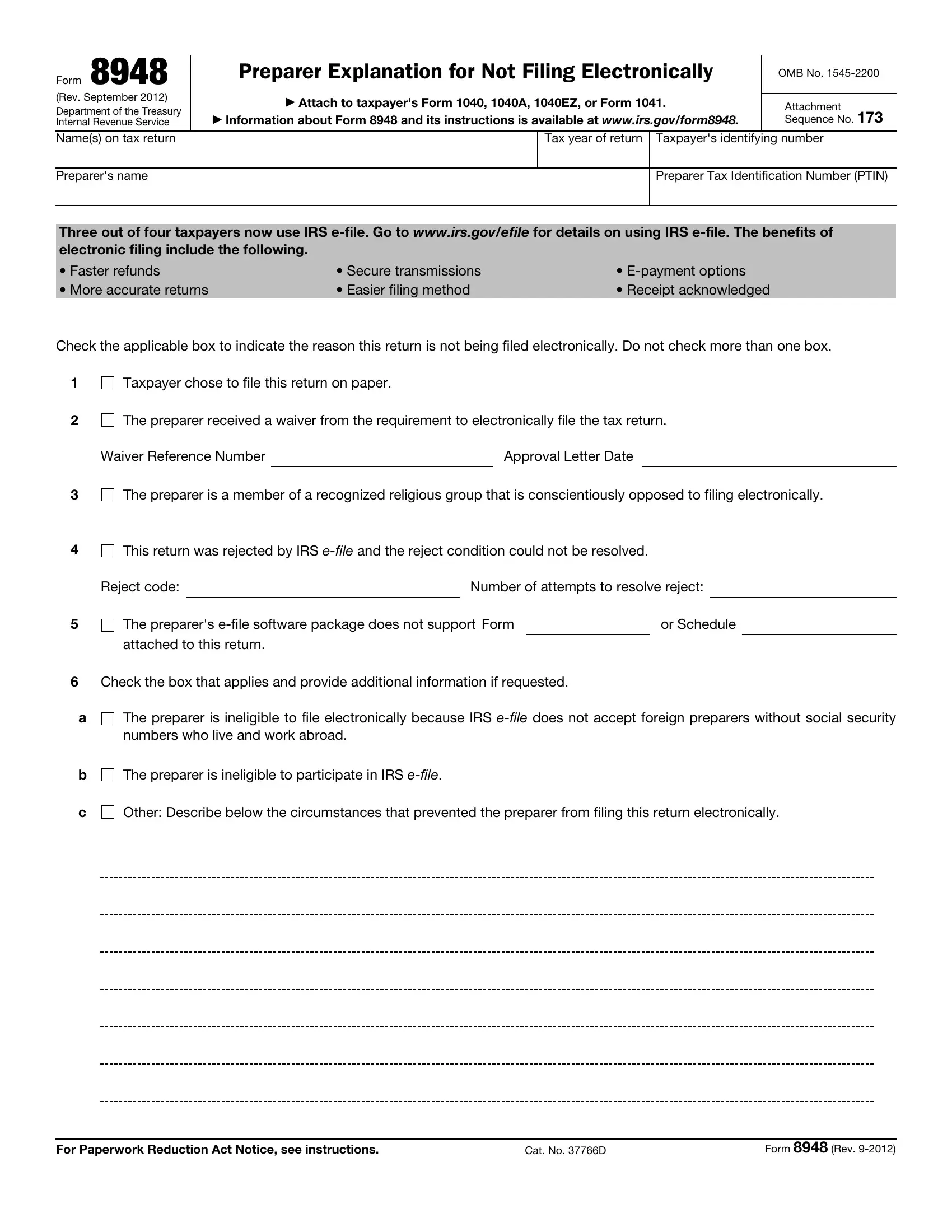

The tax year of the tax return associated with Form 8948 must be entered. The name and preparer tax identification number (PTIN) of the preparer must also be entered on the form.

Purpose of Form

Form 8948 is used only by specified tax return preparers (defined below) to explain why a particular return is being filed on paper. A specified tax return preparer may be required by law to electronically file (e-file) certain covered returns (defined below). There are exceptions to this requirement, and Form 8948 is used by specified tax return preparers to identify returns that meet allowable exceptions.

When To File

Attach this form to the paper tax return you prepare and furnish to the taxpayer for the taxpayer's signature. File Form 8948 with the tax return that is filed on paper.

Form 8944 and Form 8948. Specified tax return preparers who submitted Form 8944, Preparer e-file Hardship Waiver Request, and received an approval letter, should file Form 8948 with the tax return that is being sent to the IRS.

▲The taxpayer choice statement, which is described in Regulations ! 301.6011-7(a)(4)(ii), is a separate document that should be kept with

CAUTION the preparer's records. Do not attach the taxpayer choice statement to the tax return or otherwise send it to the IRS.

Specified Tax Return Preparer

A specified tax return preparer is a tax return preparer, as identified in section 7701(a)(36) and Regulations section 301.7701-15, who is a preparer of covered returns and who reasonably expects (if the preparer is a member of a firm, the firm's members in the aggregate reasonably expect) to file 11 or more covered returns during a calendar year.

Aggregate filing of returns. For the e-file requirement, “aggregate” means the total number of covered returns reasonably expected to be filed by the firm as a whole. For example, if a firm has 2 preparers and each preparer in the firm reasonably expects to prepare and file 6 covered returns, the aggregate for the firm equals 12 covered returns, and each preparer is a specified tax return preparer.

When a return is considered filed by a preparer. For the e-file requirement, a return is considered filed by a preparer if the preparer or any member, employee, or agent of the preparer or the preparer’s firm submits the tax return to the IRS on the taxpayer’s behalf, either electronically or in paper format. For example, the act of submitting includes having the preparer or a member of the preparer’s firm drop the return in a mailbox for the taxpayer. Acts such as providing filing or delivery instructions, an addressed envelope, postage estimates, stamps, or similar acts designed to assist the taxpayer in the taxpayer’s efforts to correctly mail or otherwise deliver a paper return to the IRS do not constitute filing by the preparer as long as the taxpayer actually mails or otherwise delivers the return to the IRS.

Covered Returns

Covered returns include any return of tax imposed by subtitle A on individuals, estates, or trusts. This includes any return of income tax in the Form 1040 series such as Form 1040, U.S. Individual Income Tax Return; Form 1040A, U.S. Individual Income Tax Return; and Form 1040EZ, U.S. Income Tax Return for Single and Joint Filers with No Dependents. It also includes Form 1041, U.S. Income Tax Return for Estates and Trusts.

Covered returns that cannot be filed electronically. Some covered returns are not currently capable of being accepted electronically by the IRS. In certain instances, the IRS has instructed taxpayers not to file some covered returns electronically. Additionally, certain covered returns cannot be e-filed if they have attached forms, schedules, or documents that the IRS does not accept electronically and these forms, schedules, or documents cannot be sent to the IRS separately using Form 8453 or Form 8453-F as a transmittal document. In any of these situations, the preparer does not need to complete and submit Form 8948. However, if the forms, schedules, or documents can be sent to the IRS separately using Form 8453 or Form

8453-F as a transmittal document, the rest of the return must be e-filed. For more information, see Form 8453, Form 8453-F, and Notice 2011-26, 2011-17 I.R.B. 720.

Specific Instructions

Names on Tax Return, Tax Year of Return, and Taxpayer's Identifying Number. Enter the taxpayer's name(s), the tax year, and identifying number (SSN or EIN) that appear on the tax return with which Form 8948 will be filed. If the return is an individual tax return using the Married Filing Joint filing status, enter the first SSN listed on the tax return.

Name and PTIN of Preparer. Enter the preparer's name and PTIN. Enter all the numbers of the PTIN.

Line 1. Check this box if the taxpayer has chosen to file on paper and the return is prepared by the preparer, but will be submitted by mail by the taxpayer. See Revenue Procedure 2011-25, 2011-17 I.R.B. 725 for information on documenting a taxpayer's choice to file on paper. Form 8948 does not meet the criteria of a taxpayer choice statement as set forth in Revenue Procedure 2011-25.

Line 2. Check this box if the preparer applied for and received an approved undue hardship waiver for the calendar year in which the return is being filed. Enter the waiver reference number and date of the approval letter. Do not submit the approval letter with this form.

Line 3. Check this box if the preparer is a member of a recognized religious group that is conscientiously opposed to its members using electronic technology, including the filing of income tax returns electronically, and the group has existed continuously since December 31, 1950.

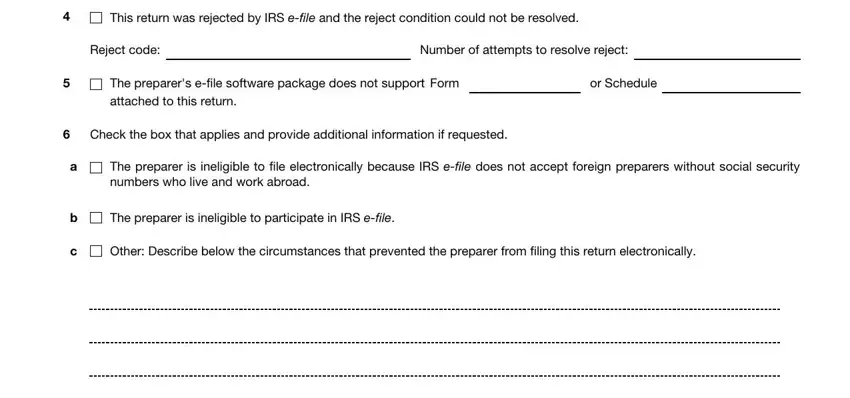

Line 4. Check this box if the preparer attempted to e-file this return but was unable to do so because the return was rejected and the reject condition could not be resolved. Enter the reject code and the number of attempts made to resolve the reject.

Line 5. Check this box if the preparer attempted to e-file this return but the software package used to e-file did not support one or more of the forms or schedules that are a part of this return. Enter the form and/or schedule numbers the software did not support.

▲Do not check this box if the reason you could not e-file this return is ! that the IRS does not electronically accept a form or schedule

CAUTION attached to this return.

Line 6a. Check this box if the preparer is a foreign person without a social security number who cannot enroll in e-file and the preparer is not a member of a firm that is eligible to e-file. To qualify to check this box, the preparer must have applied for a PTIN and submitted Form 8946, PTIN Supplemental Application For Foreign Persons Without a Social Security Number. Do not attach the PTIN application or Form 8946 to the return.

Line 6b. Check this box if the preparer is ineligible to e-file due to an IRS sanction. To qualify, the preparer must have received a letter from the IRS enforcing the sanction and the sanction must be in effect for some or all of the calendar year in which the return is being filed. Do not attach the sanction letter to the return. The preparer may check this box until such time as the sanction period ends or the IRS accepts the preparer into the IRS e- file program, whichever occurs first. If the preparer has filed a pending application for the IRS e-file program at the same time the sanction period ends, the preparer may continue to check this box until the IRS makes a decision about the preparer’s application.

Line 6c. Check the box if the preparer is unable to e-file because of other verifiable and documented technological difficulties experienced by the preparer that are not described elsewhere on this form. Describe the circumstances in the space provided.

Paperwork Reduction Act Notice. We ask for the information on these forms to carry out the Internal Revenue laws of the United States. You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by Code section 6103.

The time needed to provide this information would vary depending on individual circumstances. The estimated average time is:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Recordkeeping |

. . . |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

57 |

min. |

Learning about the law |

|

|

|

|

|

|

|

|

|

|

|

|

|

or the form |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

30 |

min. |

Preparing and sending |

|

|

|

|

|

|

|

|

|

|

|

|

|

the form |

. . . . . |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

. |

32 |

min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Internal Revenue Service, Tax Products Coordinating Committee, SE:W:CAR:MP:T:M:S, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Do not send this form to this office. Instead, see When To File, earlier.