Purposes And Objectives

As a rule, not every entrepreneur engaged in business activities, in difficult times, may pay all taxes and fulfill their financial obligations. Especially now, with the pandemic-related restriction, many business companies have gone bankrupt, and some have remained afloat thanks to installments.

The US Internal Revenue Service understands that at this time, it is easier for employers to pay their tax obligations by using the legal right to receive installments. Therefore, this form of paying taxes by taking installments exists, thanks to which entrepreneurs can gradually pay the respective yearly tax amounts.

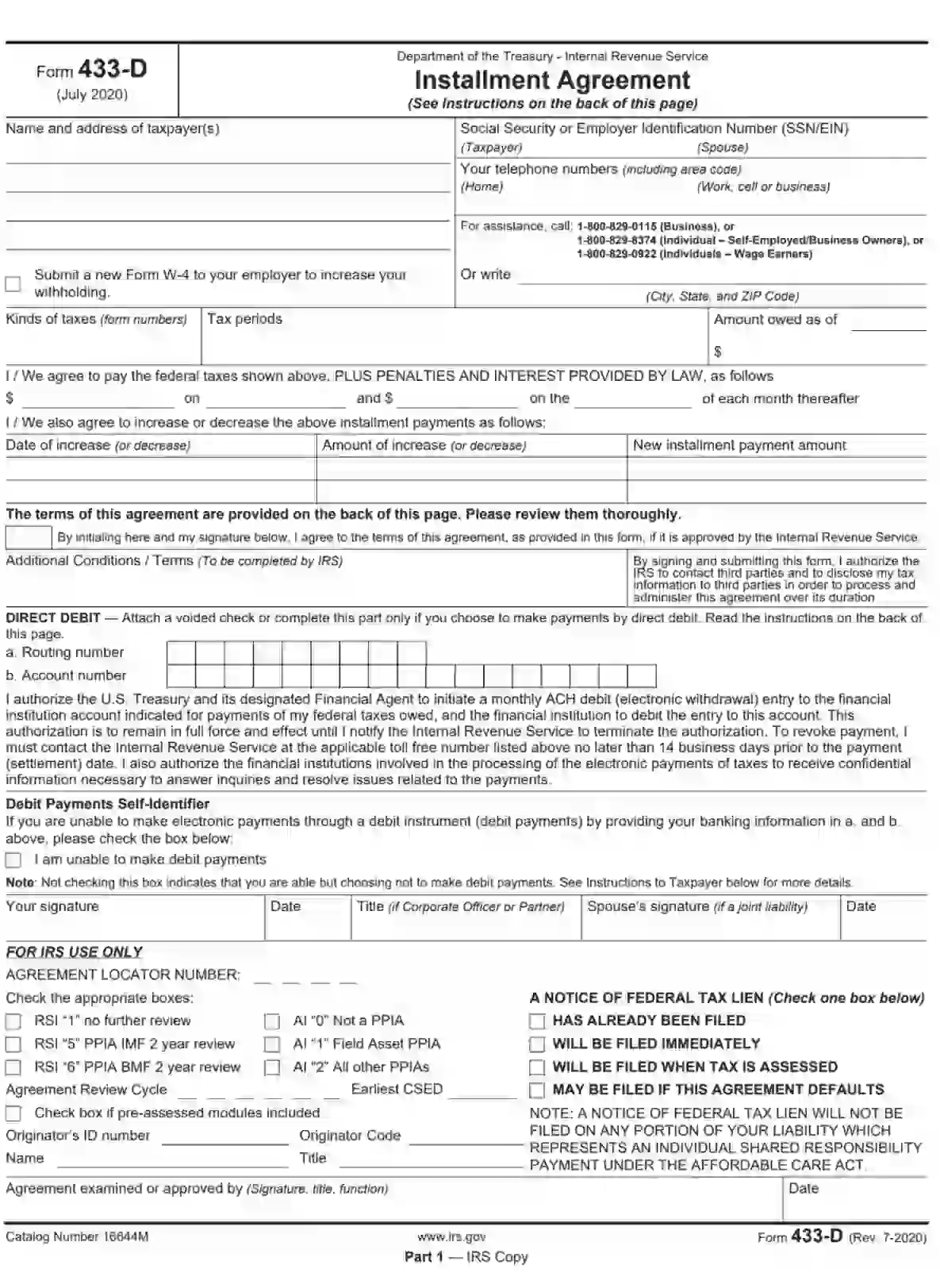

In the United States, taxpayers have this right by law: they can use this form to create an installment agreement and submit it to the tax authorities for obtaining official consent from tax authorities to receive payment by installments by direct debit. Below, we will tell you precisely how this application works and explain how to compile it properly.

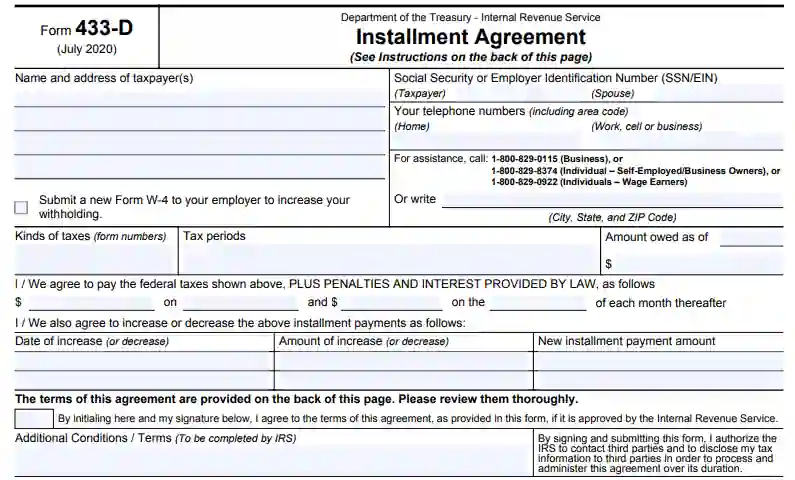

Like any other official document, this IRS form specifies the significant rules for using the described tax payment method. Thus, you should provide the following information in the form:

- How much the taxpayer must pay;

- The maximum installment period;

- The taxpayer’s personal information and financial situation;

- Repayment terms and tax payment methods.

By the way, if you are applying together with your spouse, ensure to enter their personal and taxpayer’s data as well. The installment agreement also contains the taxpayer’s bank details and banking details. In general, every month, the Tax Service removes the payment by installments through the bank.

Who Can Apply?

As we noted earlier, this application is an official document filed for taxation purposes. The form is mainly applicable to those individuals who are subject to withholding federal income tax but do not have sufficient financial resources to cover this matter; so, they want to enter an installment agreement and get involved with a direct debit.

Hereunder is the list of individuals who might find such assistance useful:

- Individual entrepreneurs and freelance employees;

- Owners of business companies and associations of various types;

- Self-employed filers;

- Individual entrepreneurs who have already gone out of business.

If you are part of either category above and need an installment plan, fill out this form, specifying the necessary information. The taxpayer should not submit the document if the monthly payments are most likely to affect their business negatively and cause financial difficulties. For cases not connected to installment, you should use other forms.

Either way, such issues are decided by the Revenue Service. Once they agree to an installment plan or an extension of the tax payment period, you can use the respective forms; otherwise, your requests may be rejected.

Difference Between Tax Forms

Within the tax sphere, the direct debit installment form under review is very similar to Form 9465. So, what is the difference between them? The second application allows the taxpayer to pay the amounts by mail monthly. As for our case, using Form 433-D, you may transfer amounts by direct debit. It is convenient and does not cause any trouble. If necessary, use our form-building software to understand the filling processes.

Basic Conditions

Unfortunately, not everything is so simple in filling out tax documents. Before doing this, be sure to read the basic conditions and requirements to avoid mistakes and penalties. If you agree to sign the blank, remember the mandatory monthly payment. You pay these amounts, including penalties and late payment interest, until the installment payment is fully paid. Usually, the Tax Service charges payments 60 or 90 days after filling out the form. If you suddenly fail to comply with the requirements and do not pay the tax amounts, the state authorities have the right to cancel this agreement and impose penalties. Also, despite receiving installments, continue to keep all tax documentation. It applies to the submission of forms for tax returns.

By the way, from 2020, the Tax Service charges additional service fees. If you make out the documents and submit them online, then pay the required amount. Low payment refers to those who submit a form and pay by direct debit. In general, all additional fees are different and depend on the method of submission of documents.

There is another nuance on the termination of the contract by the Tax Service. If your financial situation has changed significantly and your ability to pay has decreased, the service has the right to terminate the agreement. Right now, the subscription fee is $225, which is deducted from your first installment payment. For low-income entrepreneurs, this amount is equal to $43. Do not neglect the terms of the application. It is entirely your choice.

Other IRS Forms for Individuals

Individual taxpayers might need to file various IRS forms, based on the complexity of their finances. Check some other IRS you will want to be familiar with.

Instructions For Compiling the Form

Please read the instructions carefully before filling out the document. If necessary, use our form-building software to save time and effort.

Basic Information

Like any official document, this form includes information about the taxpayer. Provide your first and last name, current address, and social security or taxpayer-identification number. As a rule, when submitting documents together with your spouse, specify information about this. Don’t forget to write down all available phone numbers and mailing addresses. By the way, if you are submitting the application, but you are not a business owner, provide information about your employer. What else is required? For the Tax Service, it is vital to have a bank account, bank details, and route numbers. You also specify the amount of the first payment and the subsequent ones. It is a mandatory condition of the form. If for some reason your amounts will change and you know about it in advance, provide this information.

All confidential information also passes through banking institutions and tax authorities, so write the account numbers. Be sure to sign the document.

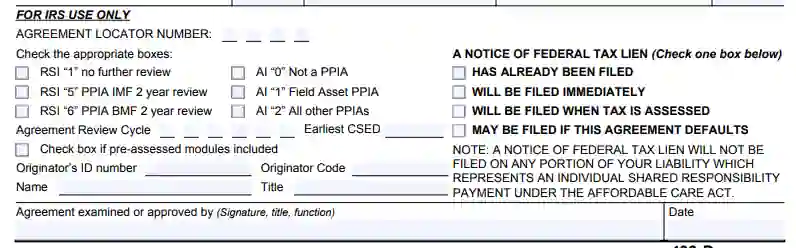

Further Conditions

Besides, you may fill in the information about the federal tax lien. Select the appropriate checkbox and enter the numbers and codes. Choose a suitable address and send documents. In case of emergency circumstances that affect the non-performance of the agreement, contact the service. Attach the explanatory sheet to the following form. If you systematically fail to pay taxes, the IRS may seize your property, homes, cars, and bank accounts.