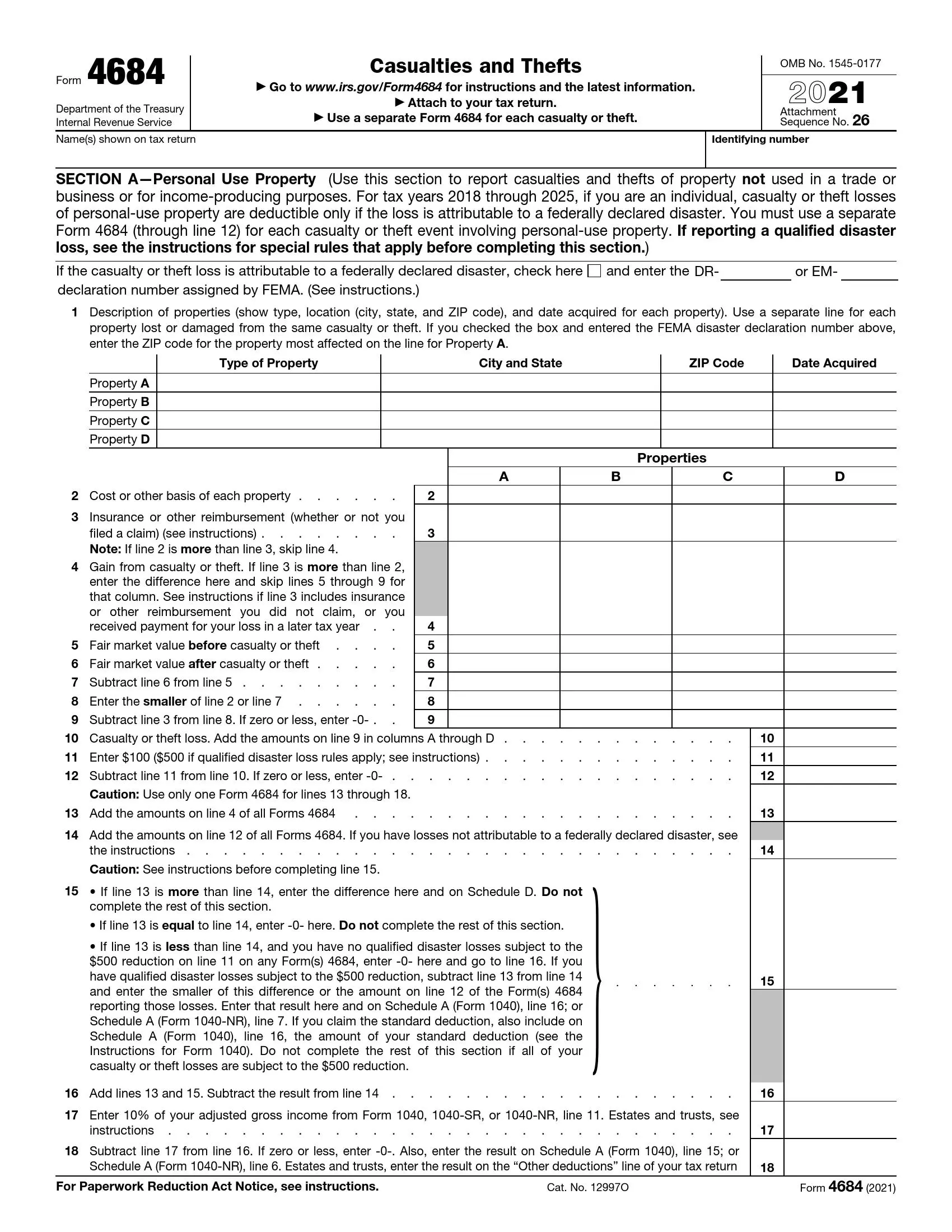

IRS Form 4684 is a tax document that reports casualties and thefts during the tax year and calculates the deductible loss resulting from these events. Taxpayers who have experienced a casualty loss, such as damage to property from a natural disaster, fire, or accident, or who have suffered a theft loss, such as the theft of property or embezzlement, may need to file this form to claim a deduction on their federal income tax return. The form helps taxpayers accurately report and calculate their deductible losses, which can help offset their taxable income and reduce their overall tax liability. The essential information provided on Form 4684 includes:

- The taxpayer’s personal information, such as name, address, and Social Security number (SSN),

- Details about the casualty or theft event, including the date it occurred and a description of the property lost or damaged,

- The fair market value of the property before and after the casualty or theft,

- And any insurance or other reimbursement received for the loss.

By completing Form 4684, taxpayers provide the Internal Revenue Service (IRS) with the necessary information to assess their eligibility for a casualty or theft loss deduction and to calculate the allowable amount of the deduction. This form helps taxpayers receive the appropriate tax relief for their losses and helps the IRS verify the accuracy of their claims.

Other IRS Forms for Individuals

The Form 4684 will be of use if you have faced a casualty or theft. Here are some other IRS forms that might be needed in more favourable life situations.

How to Fill out Form 4684

When filling out an application for losses and profits from theft, natural disasters, and fires, use the universal instructions. It will allow you to avoid financial illiteracy, tax mistakes, and miscalculations. If necessary, use our form-building software.

This form consists of several sections, each of which corresponds to the type of property. The applicant may use the first section of the subject form to claim a deduction if their personal property not related to business is affected by disasters. The second section applies directly to trade that has been affected by accidents, disasters, and thefts. The last part is related to your losses in the machinations of network structures and financial institutions. At the same time, fill in all the information without any lies. Otherwise, the IRS will not approve your application.

1. Enter Into on Personal Property

So, the first section refers to personal use, not related to business. Any form asks for your details, including your first name, last name, and employer identification number.

In the first line, describe each property that is damaged from a sudden accident. Specify the date of its acquisition. Also, enter your declaration number and, if necessary, the zip code of the most affected property.

Next, specify the original value of your property, the amount of insurance or compensation. According to the existing rules, you are required to include insurance coverage regardless of whether you are filing a compensation claim. If you haven’t received a refund yet, still enter the expected amount of the compensation.

In general, before the ninth point, you must define both the property and the damage caused to it. Consider the market price, which sets the conditions for the purchase and sale of a particular item. In case of property damage, this price is reduced accordingly. The estimated value immediately after the harm is adjusted to reflect the extent of the damage. This estimate allows you to determine the value of the item before the accident.

Keep in mind that the compensation amounts include the money invested in the improvement of the property. If you have made expensive repairs to your car, home, or another damaged real estate, specify this data in the lines.

The following items ask for specific amounts, so calculate them based on the events that occurred. Filling in the fifteenth line depends on the circumstances. If the sum in the 13th line exceeds the amount in the 14th line, you have a net profit. In this case, you must report this result in the form. If the opposite is true and line 13 is less, it is a net loss. Fill in the remaining items below, considering the relevant information.

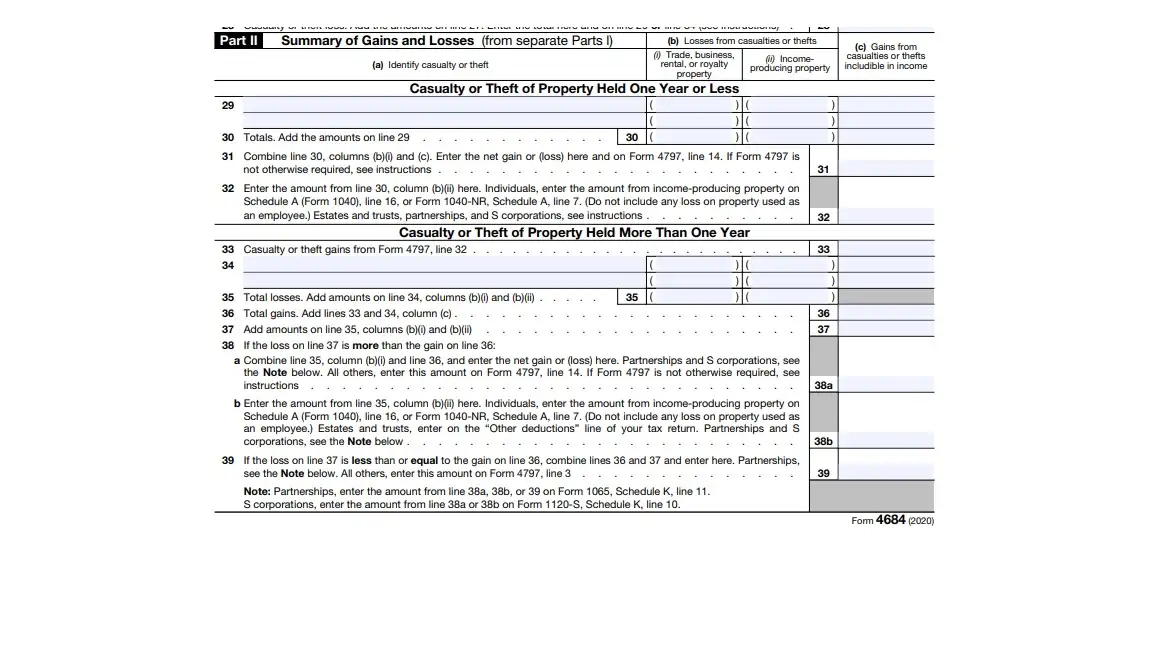

2. Provide Data on Business and Trade

The second section of the application has two parts and relates to damage to business property. Fill in the name of the organization and its identification number. Describe in detail the information about each damaged business item. If there are not enough lines, attach an additional sheet with a list of the property. As for passive earnings, it is practically not taken into account. If you have suffered losses in such activities, you will not receive benefits in the form of tax recalculation.

The second part summarizes the final total for the damaged property. When filling in these lines, be sure to check the entered numbers several times. You may also add losses from promotional frauds and investment schemes to your application.

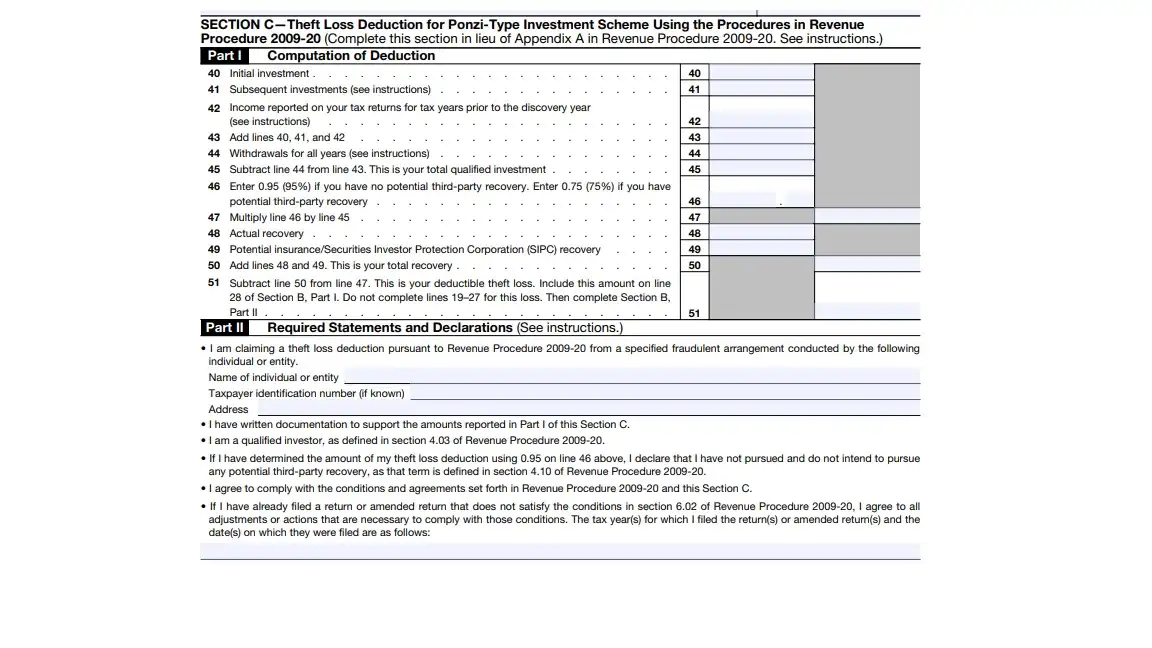

3. Indicate Stocks and Investments

Any theft, vandalism, and financial fraud harm your business and its development. As a result of the actions of intruders, many companies suffer losses up to bankruptcy. Therefore, this form includes accidents caused by investment fraud.

Pyramid schemes appear in countries where there are gaps in the legislation governing finance. The higher the literacy rate of the population, the fewer investments in a dubious organization. The main reasons for the appearance of financial pyramids are the thirst for easy money and greed. Not to become a victim of them, you must know the signs of financial pyramids.

However, no one is immune from such organizations. Therefore, you may specify in the form the losses incurred due to the financial pyramid schemes. Enter your employer’s ID number, name, and address. Calculate the exact amounts as it is shown in the following section of the guide.

Use the following plan to fill in the form’s items:

- Enter the initial investment amount;

- Specify the amount of money invested during the entire period of the investment agreement;

- Provide information about the net income;

- Enter the amount withdrawn during the agreement’s validity period;

- Calculate the total amount of losses (if qualified).

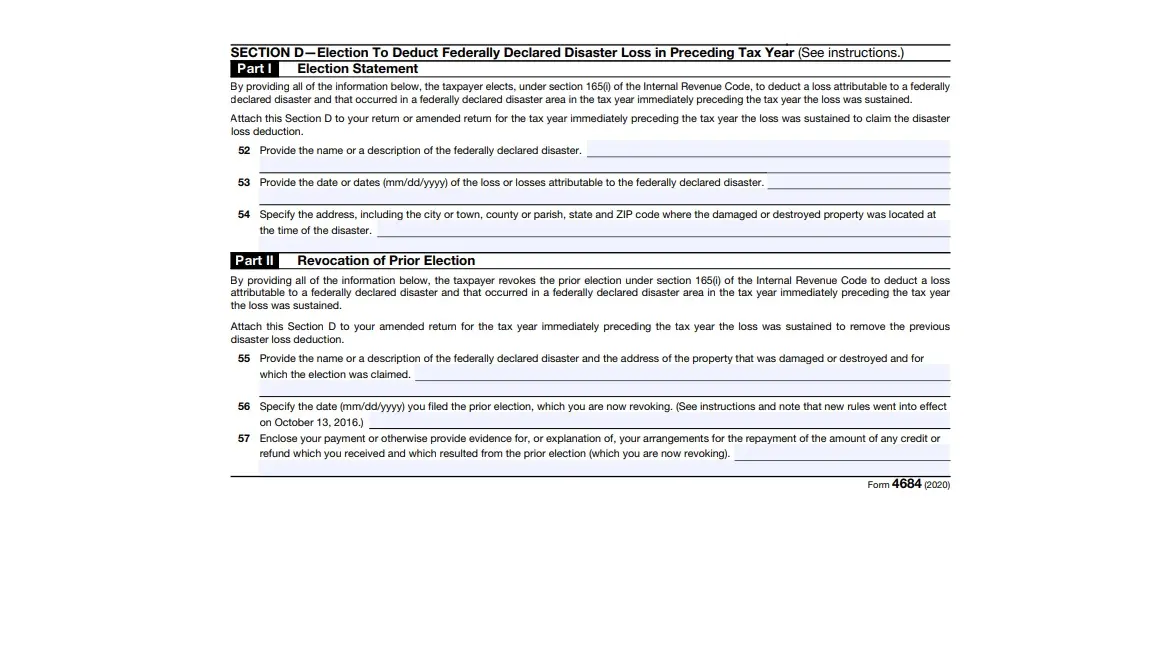

4. Define the Disaster Losses

The final section refers to the cancellation of any tax amounts related to a particular tax year. If you cancel the pre-selection of the losses of the federal disaster, fill out this section. Attach this section to your completed tax return and send it to the IRS. The second part also relates to the cancellation of the preliminary elections.

Use our form-building software to save time on understanding all the subtleties. Besides, with the help of a highly qualified specialist (tax representative or lawyer), the filing process will become significantly easier.