It 201 Att Tax Form can be filled in effortlessly. Just try FormsPal PDF tool to accomplish the job quickly. FormsPal professional team is relentlessly endeavoring to improve the editor and make it much easier for clients with its handy features. Make the most of the latest innovative possibilities, and discover a trove of new experiences! Getting underway is easy! All you have to do is stick to these simple steps directly below:

Step 1: Access the form inside our tool by hitting the "Get Form Button" at the top of this page.

Step 2: The tool lets you modify PDF forms in many different ways. Improve it by writing your own text, adjust original content, and place in a signature - all when you need it!

It really is easy to finish the document with our helpful tutorial! Here is what you have to do:

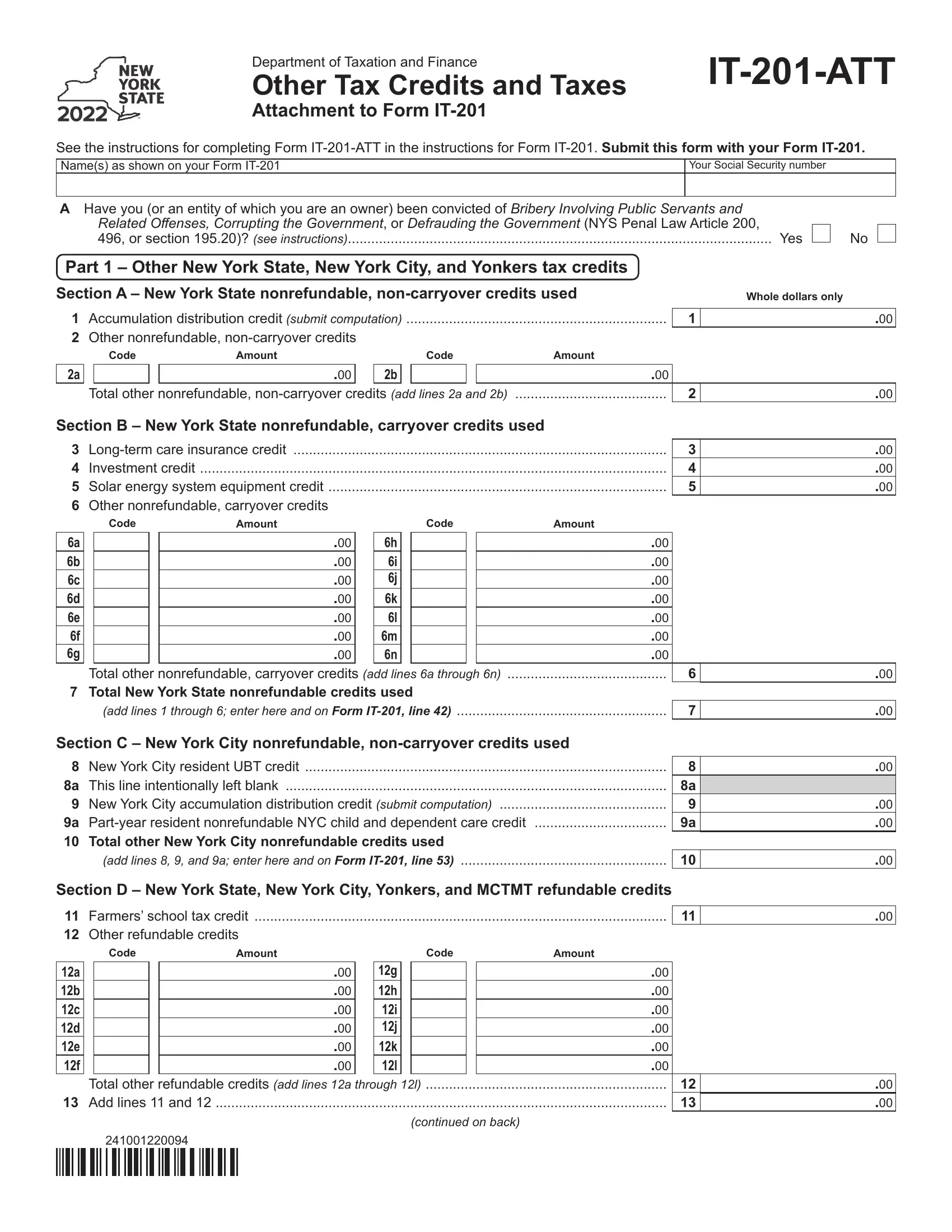

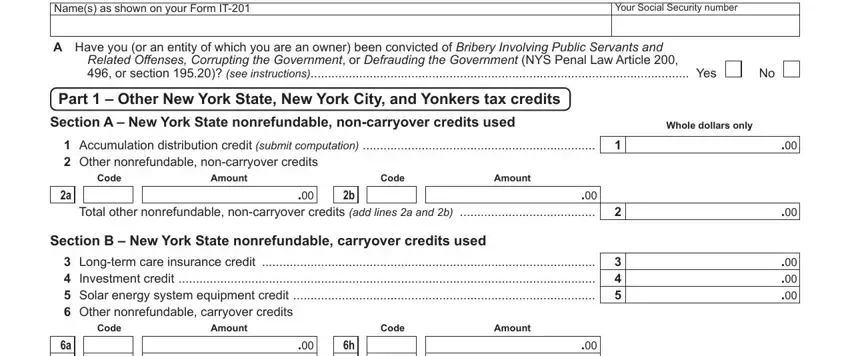

1. It is advisable to fill out the It 201 Att Tax Form properly, thus pay close attention while filling out the segments including all these fields:

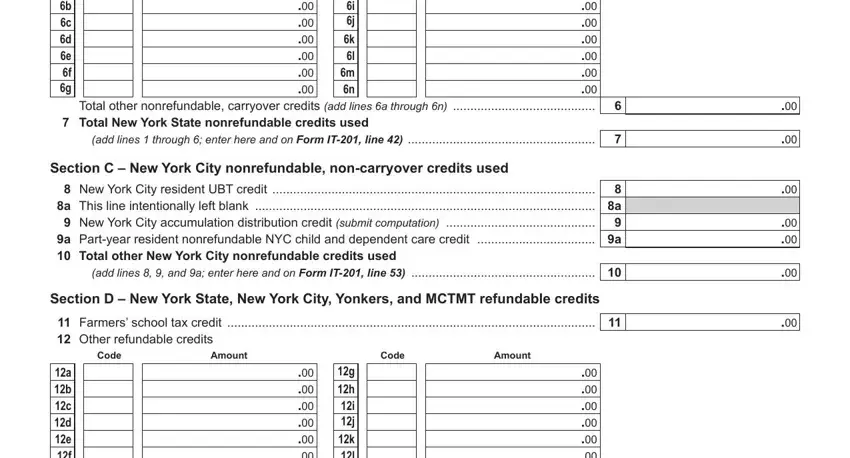

2. Right after filling out the previous step, go to the next part and fill in all required particulars in these blanks - h i j, Total other nonrefundable, a b c d e f g Total New York, add lines through enter here and, k l m n, Section C New York City, New York City resident UBT credit, add lines and a enter here and, Section D New York State New York, Farmers school tax credit, Code, Amount, Code, a b c d e f Total other refundable, and h i j.

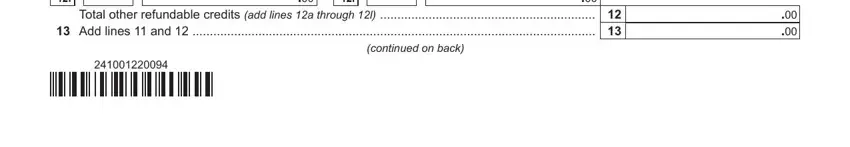

3. In this stage, examine a b c d e f Total other refundable, k l, and continued on back. Each of these should be completed with greatest precision.

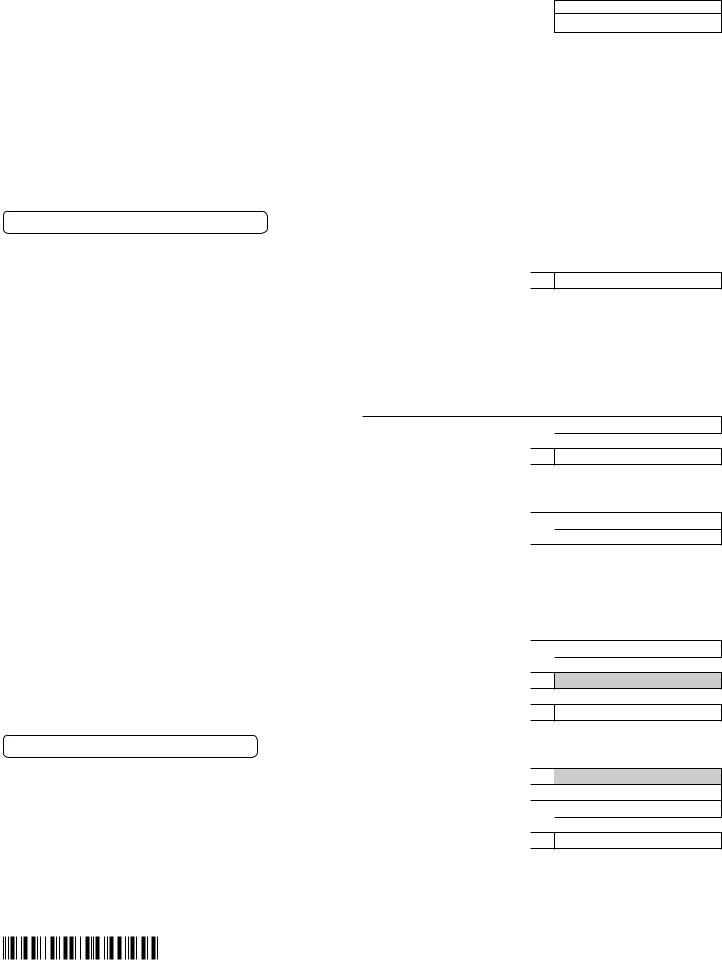

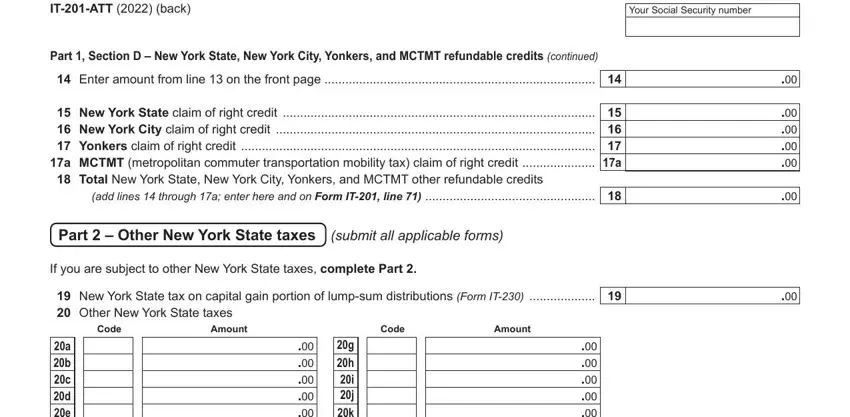

4. To go onward, this fourth section involves typing in a couple of fields. These include ITATT back, Your Social Security number, Part Section D New York State, Enter amount from line on the, New York State claim of right, add lines through a enter here, Part Other New York State taxes, submit all applicable forms, If you are subject to other New, New York State tax on capital, a b c d e f, Code, Amount, Code, and Amount, which you'll find fundamental to continuing with this PDF.

People frequently make mistakes while filling out a b c d e f in this area. Be sure to re-examine what you enter here.

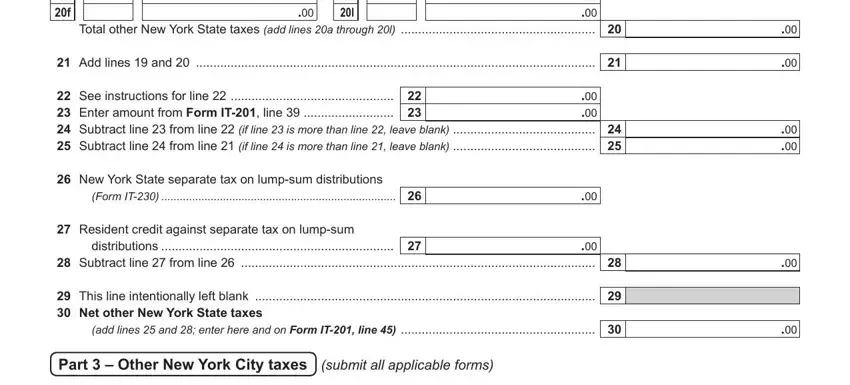

5. This pdf should be concluded within this segment. Below you'll see an extensive listing of fields that must be filled out with appropriate details to allow your form submission to be faultless: a b c d e f, k l, Total other New York State taxes, Add lines and, See instructions for line, New York State separate tax on, Form IT, Resident credit against separate, distributions, This line intentionally left, add lines and enter here and on, and Part Other New York City taxes.

Step 3: Ensure the details are right and click "Done" to proceed further. Go for a 7-day free trial subscription at FormsPal and acquire direct access to It 201 Att Tax Form - downloadable, emailable, and editable from your personal account page. We do not share the information that you use when completing forms at our site.