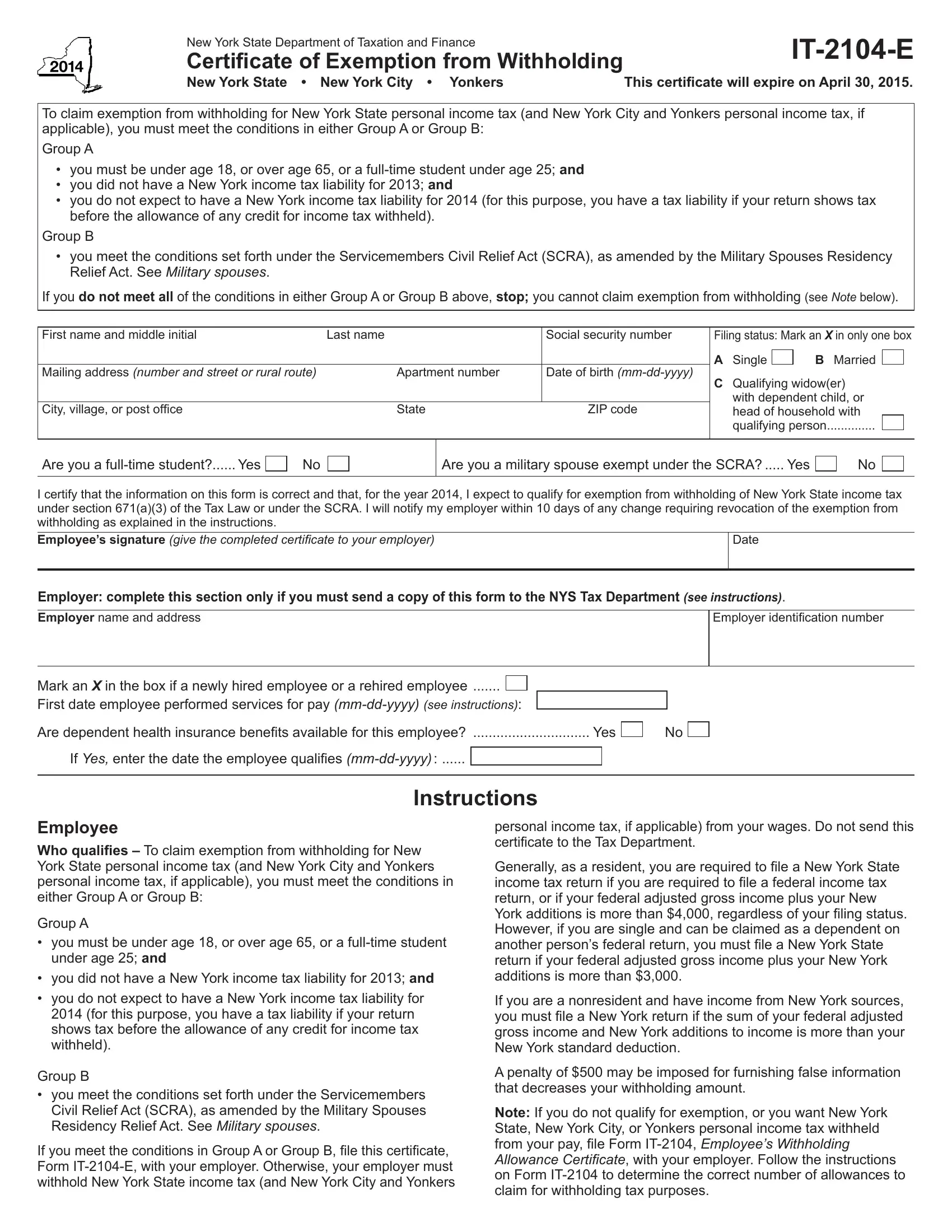

IT-2104-E (2014) (back)

When to claim exemption from withholding – File this certiicate

with your employer if you meet the conditions listed in Group A or Group B above. You must ile a new certiicate each year if you wish to continue to claim the exemption.

Military spouses – Under the Servicemembers Civil Relief Act (SCRA), as amended by the Military Spouses Residency Relief Act,

you may be exempt from New York income tax (and New York City and Yonkers personal income tax, if applicable) on your wages if:

1)your spouse is a member of the armed forces present in New York in compliance with military orders; 2) you are present in New York solely to be with your spouse; and 3) you are domiciled in another state.

Liability for estimated tax – If, as a result of this exemption certiicate, your employer does not withhold income tax from your

wages and you later fail to qualify for exemption from tax, you may

be required to pay estimated tax and be subject to penalty if it is not paid. For further information, see Form IT‑2105, Estimated Income

Tax Payment Voucher for Individuals.

Multiple employers – If you have more than one employer, you may claim exemption from withholding with each employer as long as your total expected income will not cause you to incur a New

York income tax liability for the year 2014 and you had no liability for 2013.

Revocation by employee – You must revoke this exemption certiicate (1) within 10 days from the day you expect to incur a New York income tax liability for the year 2014, (2) on or before December 1, 2014, if you expect to incur a tax liability for 2015, or

(3) when you no longer qualify for exemption under the SCRA.

If you are required to revoke this certiicate, if you no longer meet

the age requirements for claiming exemption, or if you want income

tax withheld from your pay (because, for example, you expect your income to exceed $3,000), you must ile Form IT‑2104, Employee’s Withholding Allowance Certiicate, with your employer. Follow the instructions on Form IT‑2104 to determine the correct number of

allowances to claim for withholding tax purposes.

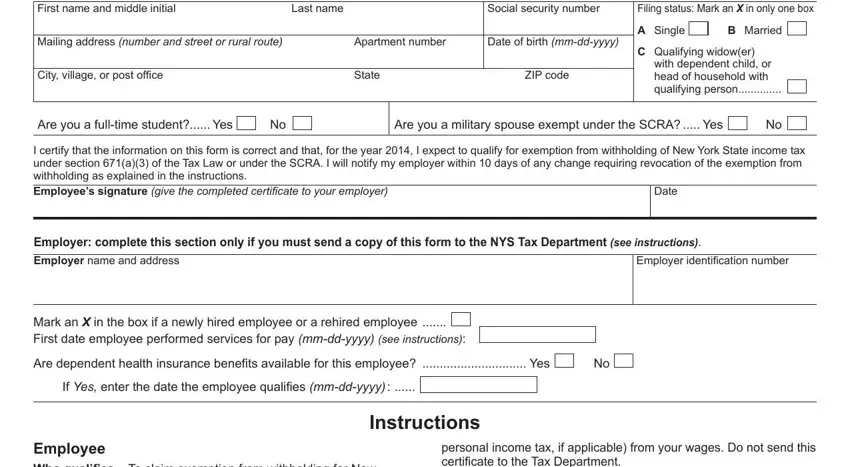

Filing status – Mark an X in one box on Form IT‑2104‑E that shows your present iling status for federal purposes.

Employer

Keep this certiicate with your records. If an employee who claims exemption from withholding on Form IT‑2104‑E usually earns more than $200 per week, you must send a copy of that employee’s Form IT‑2104‑E to: NYS Tax Department, Income Tax Audit Administrator, Withholding Certiicate Coordinator, W A Harriman Campus, Albany NY 12227. If the employee is also

a new hire or rehire, see NOTE below.

The Tax Department will not accept this form if it is incomplete. We will review these certiicates and notify you of any adjustments that

must be made.

Due dates for sending certiicates received from employees who claim exemption and earn more than $200 per week are:

Quarter |

Due date |

Quarter |

Due date |

January – March |

April 30 |

July – September |

October 31 |

April – June |

July 31 |

October – December |

January 31 |

Revocation by employer – You must revoke this exemption within 10 days if, on any day during the calendar year, the date of birth stated on the certiicate iled by the employee indicates the

employee no longer meets the age requirements for exemption. The revocation must be in the form of a written notice to the employee.

New hires and rehires – Mark an X in the box if you are submitting a copy of this form to comply with New York State’s New Hire

Reporting Program. A newly hired or rehired employee means an

employee previously not employed by you, or previously employed by you but separated from such employment for 60 or more consecutive days. Enter the irst day any services are performed

for which the employee will be paid wages, commissions, tips

and any other type of compensation. For services based solely on commissions, this is the irst day an employee working for

commissions is eligible to earn commissions. Also, mark an X in the Yes or No box indicating if dependent health insurance beneits

are available to this employee. If Yes, enter the date the employee qualiies for coverage. Mail the completed form, within 20 days of

hiring, to:

NYS TAX DEPARTMENT

NEW HIRE NOTIFICATION

PO BOX 15119

ALBANY NY 12212-5119