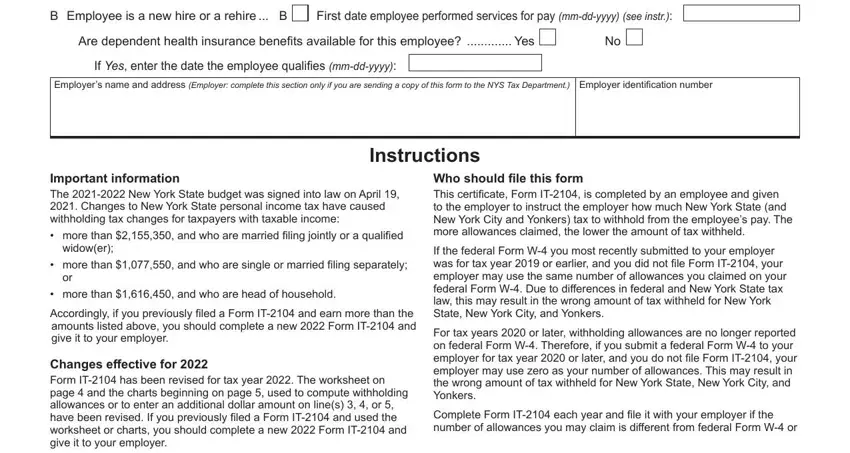

Page 2 of 8 IT-2104 (2022)

has changed. Common reasons for completing a new Form IT-2104 each

year include the following:

•You started a new job.

•You are no longer a dependent.

•Your individual circumstances may have changed (for example, you were married or have an additional child).

•You moved into or out of NYC or Yonkers.

•You itemize your deductions on your personal income tax return.

•You claim allowances for New York State credits.

•You owed tax or received a large refund when you filed your personal income tax return for the past year.

•Your wages have increased and you expect to earn $107,650 or more during the tax year.

•The total income of you and your spouse has increased to $107,650 or more for the tax year.

•You have significantly more or less income from other sources or from another job.

•You no longer qualify for exemption from withholding.

•You have been advised by the Internal Revenue Service that you

are entitled to fewer allowances than claimed on your original federal

Form W-4 (submitted to your employer for tax year 2019 or earlier),

and the disallowed allowances were claimed on your original

Form IT-2104.

•You are a covered employee of an employer that has elected to participate in the Employer Compensation Expense Program.

Exemption from withholding

You cannot use Form IT-2104 to claim exemption from withholding.

To claim exemption from income tax withholding, you must file

Form IT-2104-E, Certificate of Exemption from Withholding, with your employer. You must file a new certificate each year that you qualify for

exemption. This exemption from withholding is allowable only if you had no New York income tax liability in the prior year, you expect none in the current year, and you are over 65 years of age, under 18, or a full-time student under 25. You may also claim exemption from withholding if you are a military spouse and meet the conditions set forth under the

Servicemembers Civil Relief Act as amended by the Military Spouses Residency Relief Act and the Veterans Benefits and Transition Act. If you

are a dependent who is under 18 or a full-time student, you may owe tax if your income is more than $3,100.

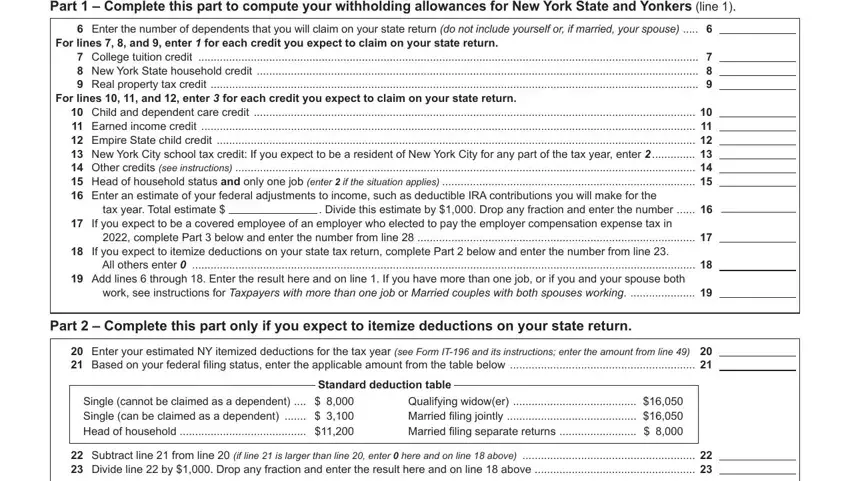

Withholding allowances

You may not claim a withholding allowance for yourself or, if married, your spouse. Claim the number of withholding allowances you compute

in Part 1 and Part 4 of the worksheet on page 4. If you want more tax

withheld, you may claim fewer allowances. If you claim more than

14 allowances, your employer must send a copy of your Form IT-2104 to the New York State Tax Department. You may then be asked to verify your allowances. If you arrive at negative allowances (less than

zero) on lines 1 or 2 and your employer cannot accommodate negative allowances, enter 0 and see Additional dollar amount(s) below.

Income from sources other than wages – If you have more than $1,000 of income from sources other than wages (such as interest,

dividends, or alimony received), reduce the number of allowances claimed on line 1 and line 2 (if applicable) of the IT-2104 certificate by one for each $1,000 of nonwage income. If you arrive at negative

allowances (less than zero), see Withholding allowances above. You

may also consider making estimated tax payments, especially if you have significant amounts of nonwage income. Estimated tax requires

that payments be made by the employee directly to the Tax Department on a quarterly basis. For more information, see the instructions for Form IT-2105, Estimated Tax Payment Voucher for Individuals, or see

Need help? on page 7.

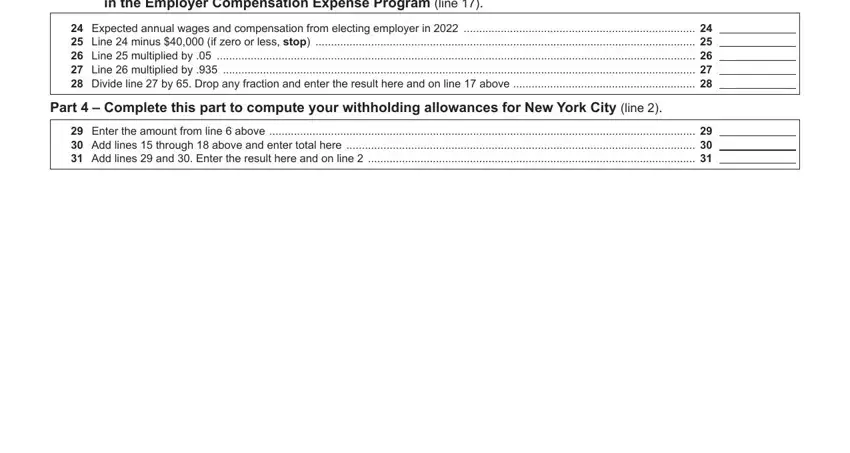

Other credits (Worksheet line 14) – If you will be eligible to claim

any credits other than the credits listed in the worksheet, such as an investment tax credit, you may claim additional allowances.

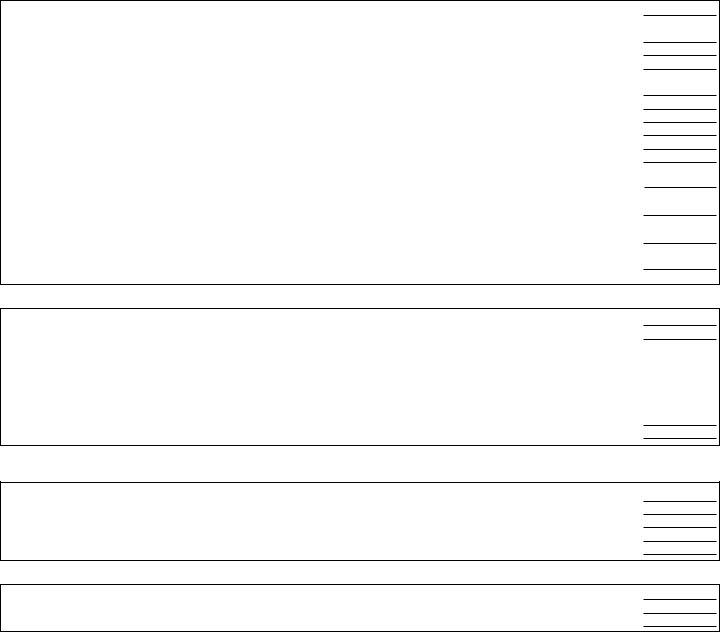

Find your filing status and your New York adjusted gross income (NYAGI)

in the chart below, and divide the amount of the expected credit by the number indicated. Enter the result (rounded to the nearest whole number) on line 14.

|

Single and |

Head of |

Married and |

Divide amount |

|

NYAGI is: |

household and |

NYAGI is: |

of expected |

|

|

NYAGI is: |

|

credit by: |

|

|

|

|

|

|

Less than |

Less than |

Less than |

63 |

|

$215,400 |

$269,300 |

$323,200 |

|

|

|

|

|

|

|

|

Between |

Between |

Between |

|

|

$215,400 and |

$269,300 and |

$323,200 and |

68 |

|

$1,077,550 |

$1,616,450 |

$2,155,350 |

|

|

|

|

|

|

|

Between |

Between |

Between |

|

|

$1,077,550 and |

$1,616,450 and |

$2,155,350 and |

96 |

|

$5,000,000 |

$5,000,000 |

$5,000,000 |

|

|

|

|

|

|

|

Between |

Between |

Between |

|

|

$5,000,000 and |

$5,000,000 and |

$5,000,000 and |

100 |

|

$25,000,000 |

$25,000,000 |

$25,000,000 |

|

|

|

|

|

|

|

Over |

Over |

Over |

110 |

|

$25,000,000 |

$25,000,000 |

$25,000,000 |

|

|

|

|

|

|

|

Example: You are married and expect your New York adjusted gross

income to be less than $323,200. In addition, you expect to receive a

flow-through of an investment tax credit from the S corporation of which you are a shareholder. The investment tax credit will be $160. Divide the expected credit by 63. 160/63 = 2.5397. The additional withholding allowance(s) would be 3. Enter 3 on line 14.

Married couples with both spouses working – If you and your spouse both work, you should each file a separate IT-2104 certificate with your

respective employers. Your withholding will better match your total tax if the higher wage-earning spouse claims all of the couple’s allowances and

the lower wage-earning spouse claims zero allowances. Do not claim more total allowances than you are entitled to. If your combined wages

are:

•less than $107,650, you should each mark an X in the box Married, but withhold at higher single rate on the certificate front, and divide the total number of allowances that you compute on line 19 and line 31 (if applicable) between you and your working spouse.

•$107,650 or more, use the chart(s) in Part 5 and enter the additional withholding dollar amount on line 3.

Taxpayers with more than one job – If you have more than one job, file a separate IT-2104 certificate with each of your employers. Be

sure to claim only the total number of allowances that you are entitled to. Your withholding will better match your total tax if you claim all of

your allowances at your higher-paying job and zero allowances at the lower-paying job. In addition, to make sure that you have enough

tax withheld, if you are a single taxpayer or head of household with two or more jobs, and your combined wages from all jobs are under

$107,650, reduce the number of allowances by seven on line 1 and line 2 (if applicable) on the certificate you file with your higher-paying job employer. If you arrive at negative allowances (less than zero), see

Withholding allowances above.

If you are a single or a head of household taxpayer, and your combined

wages from all of your jobs are between $107,650 and $2,263,265, use the chart(s) in Part 6 and enter the additional withholding dollar amount from the chart on line 3.

If you are a married taxpayer, and your combined wages from all of

your jobs are $107,650 or more, use the chart(s) in Part 5 and enter the

additional withholding dollar amount from the chart on line 3 (Substitute the words Higher-paying job for Higher earner’s wages within the chart).

Dependents – If you are a dependent of another taxpayer and expect your income to exceed $3,100, you should reduce your withholding allowances by one for each $1,000 of income over $2,500. This will ensure that your employer withholds enough tax.

Following the above instructions will help to ensure that you will not owe additional tax when you file your return.

Heads of households with only one job – If you will use the head-of-household filing status on your state income tax return, mark the Single or Head of household box on the front of the certificate. If you

have only one job, you may also wish to claim two additional withholding allowances on line 15.