In case you intend to fill out it370, you don't have to download and install any kind of programs - just make use of our online tool. FormsPal team is dedicated to providing you with the best possible experience with our tool by continuously introducing new features and enhancements. Our editor is now a lot more useful thanks to the newest updates! Currently, filling out PDF forms is a lot easier and faster than ever. Starting is easy! Everything you need to do is adhere to the next easy steps below:

Step 1: First of all, access the editor by pressing the "Get Form Button" at the top of this site.

Step 2: This tool provides you with the ability to customize PDF files in various ways. Improve it by writing personalized text, adjust what's already in the file, and place in a signature - all at your disposal!

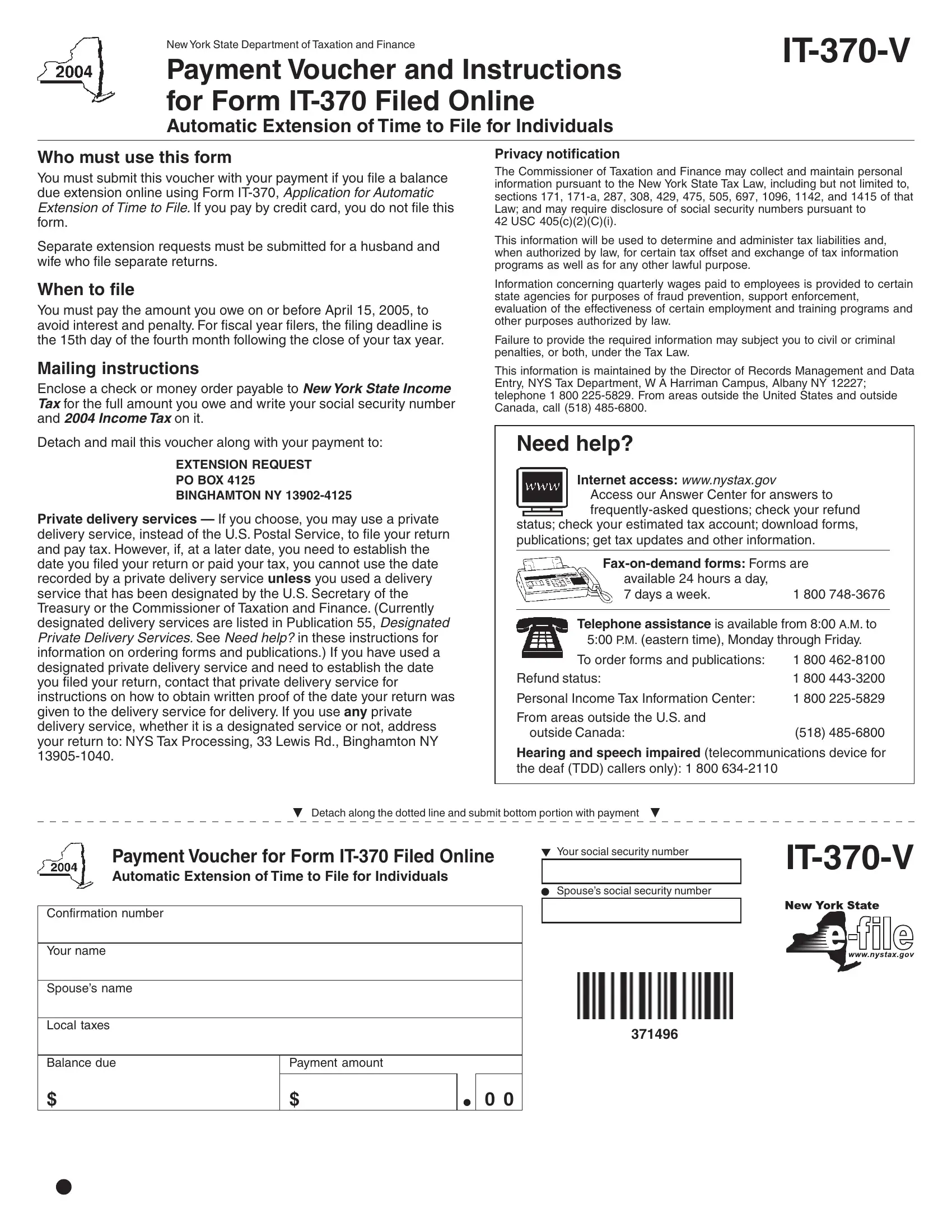

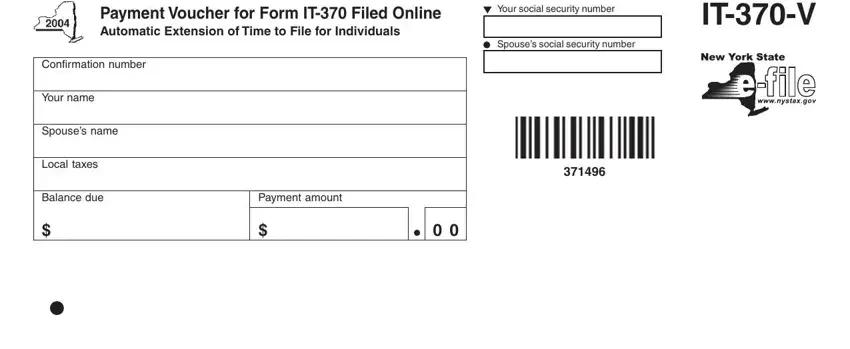

This form will involve specific information; in order to ensure correctness, please be sure to take into account the next steps:

1. The it370 requires certain details to be inserted. Ensure the following blanks are finalized:

Step 3: After going through your entries, press "Done" and you are all set! Right after starting afree trial account here, it will be possible to download it370 or email it promptly. The PDF file will also be readily available via your personal account menu with all of your edits. At FormsPal.com, we aim to ensure that all your information is maintained private.