Using PDF documents online is certainly very easy with our PDF tool. Anyone can fill out louisiana 540b here without trouble. Our team is devoted to making sure you have the best possible experience with our editor by regularly presenting new functions and enhancements. Our tool is now a lot more helpful with the newest updates! So now, working with documents is easier and faster than ever. With just a couple of simple steps, you are able to begin your PDF journey:

Step 1: Click on the "Get Form" button above. It is going to open up our pdf editor so you can start filling out your form.

Step 2: As soon as you access the editor, you'll notice the document ready to be filled in. In addition to filling out various blank fields, you may as well perform many other actions with the PDF, particularly writing your own words, modifying the initial text, inserting images, putting your signature on the PDF, and more.

Filling out this form will require care for details. Make sure that all mandatory areas are done accurately.

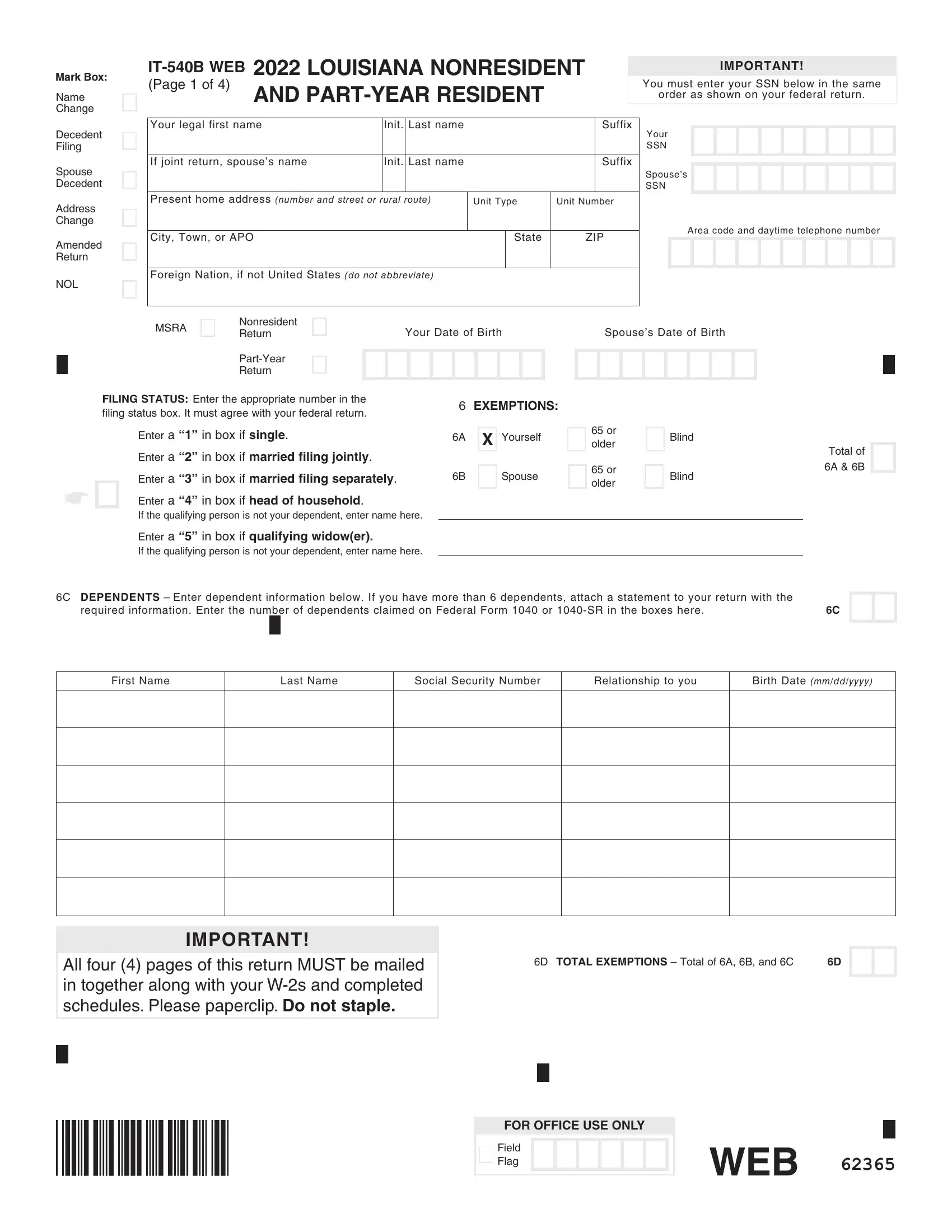

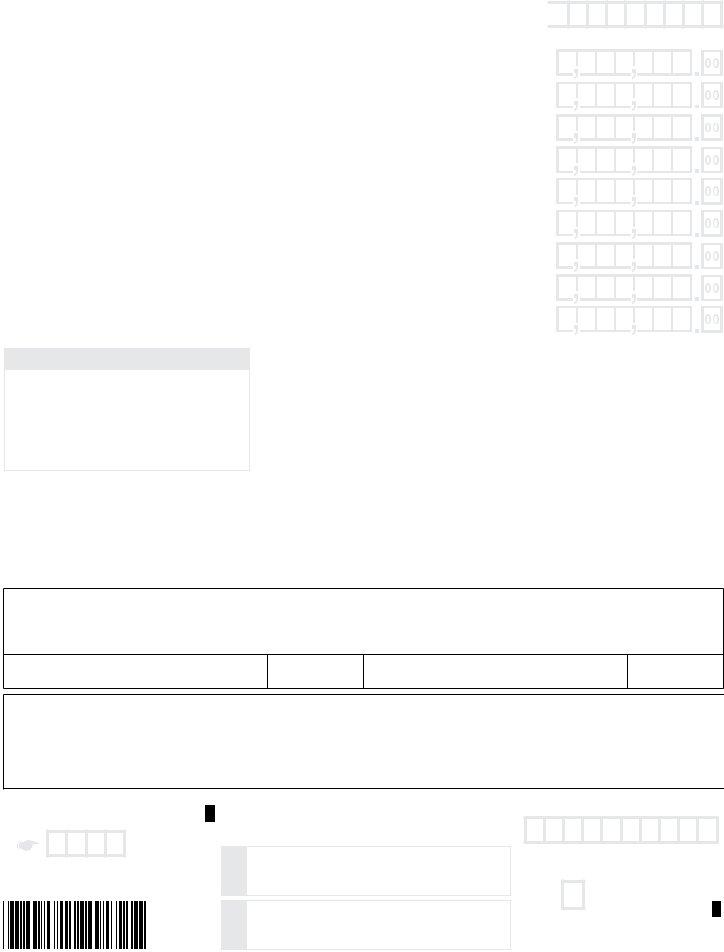

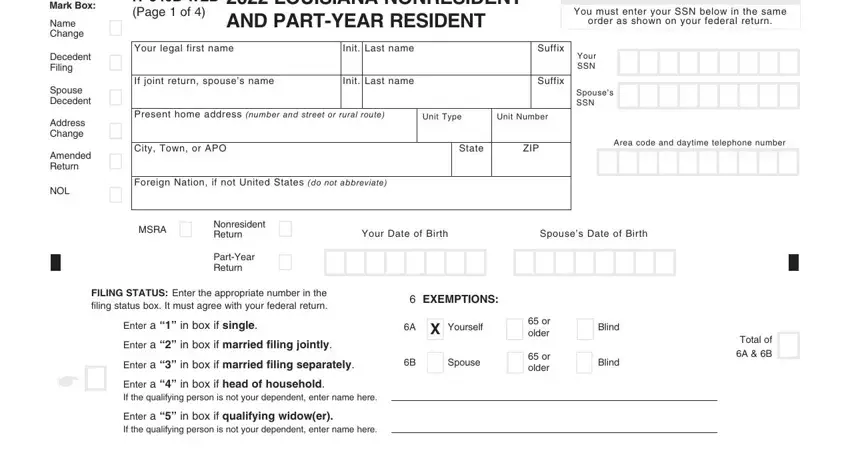

1. To get started, when filling in the louisiana 540b, begin with the form section that features the subsequent blanks:

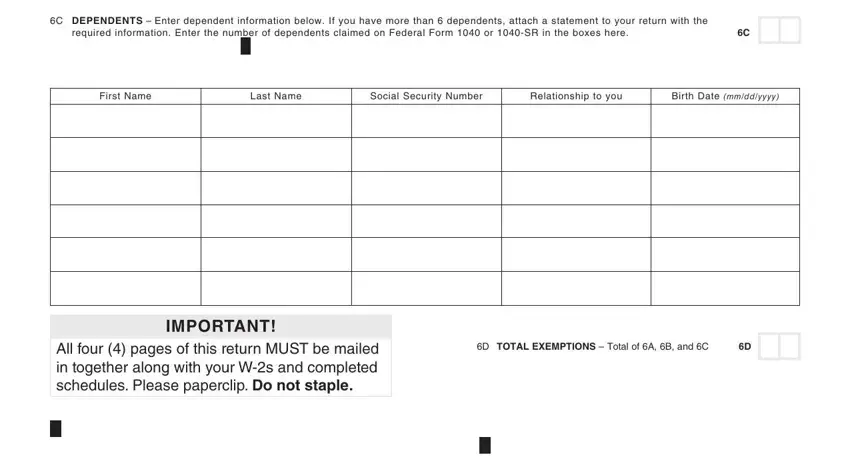

2. Once the first part is completed, go to enter the suitable details in all these - C DEPENDENTS Enter dependent, required information Enter the, First Name, Last Name, Social Security Number, Relationship to you, Birth Date mmddyyyy, IMPORTANT, All four pages of this return, and D TOTAL EXEMPTIONS Total of A B.

You can easily make an error when completing the Social Security Number, hence make sure to go through it again before you decide to finalize the form.

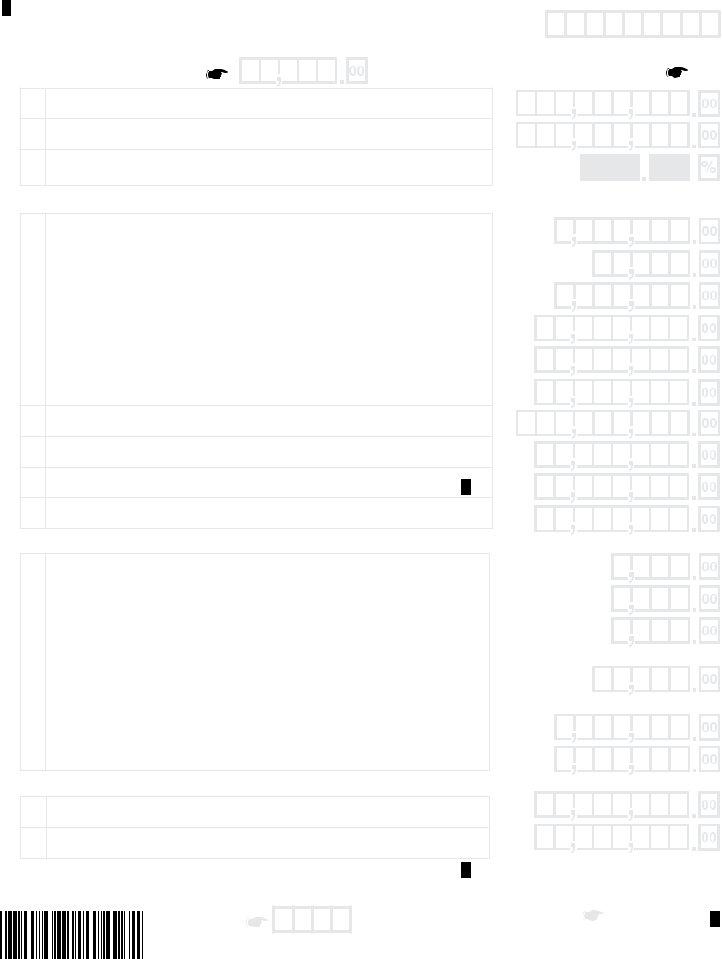

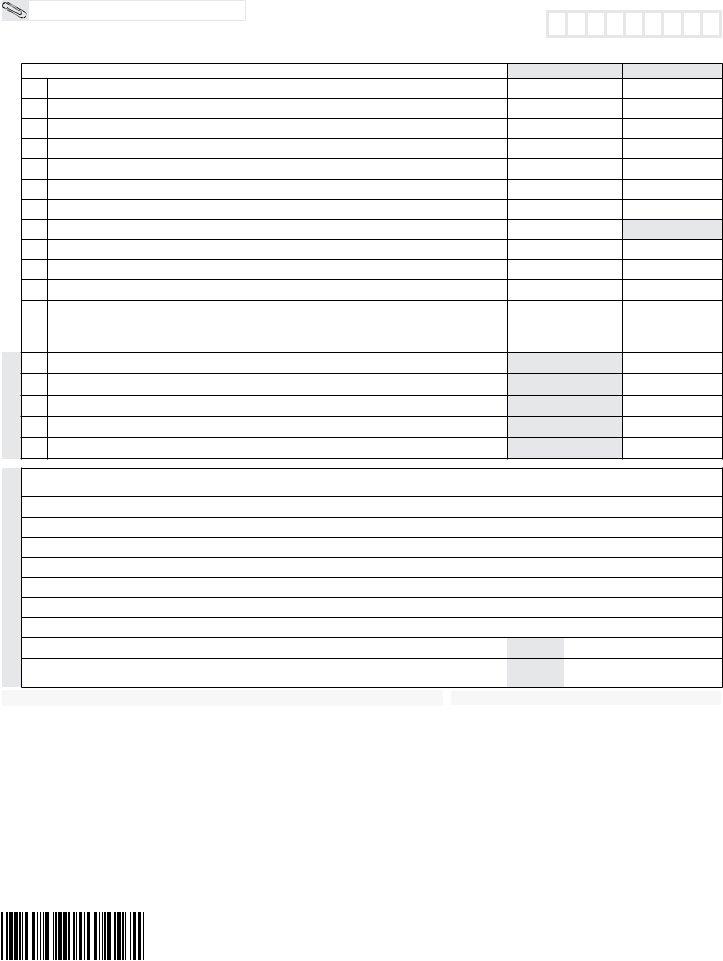

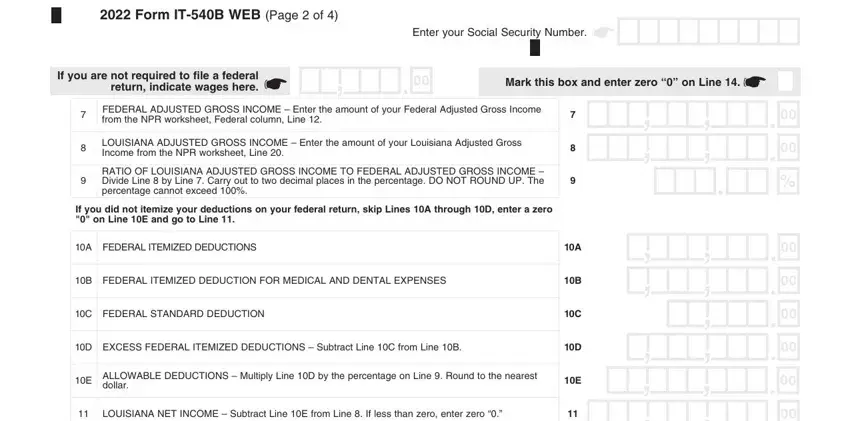

3. This subsequent section is generally pretty uncomplicated, Form ITB WEB Page of, Enter your Social Security Number, If you are not required to file a, Mark this box and enter zero on, FEDERAL ADJUSTED GROSS INCOME, LOUISIANA ADJUSTED GROSS INCOME, RATIO OF LOUISIANA ADJUSTED GROSS, If you did not itemize your, A FEDERAL ITEMIZED DEDUCTIONS, B FEDERAL ITEMIZED DEDUCTION FOR, C FEDERAL STANDARD DEDUCTION, D EXCESS FEDERAL ITEMIZED, ALLOWABLE DEDUCTIONS Multiply, and LOUISIANA NET INCOME Subtract - every one of these fields needs to be filled in here.

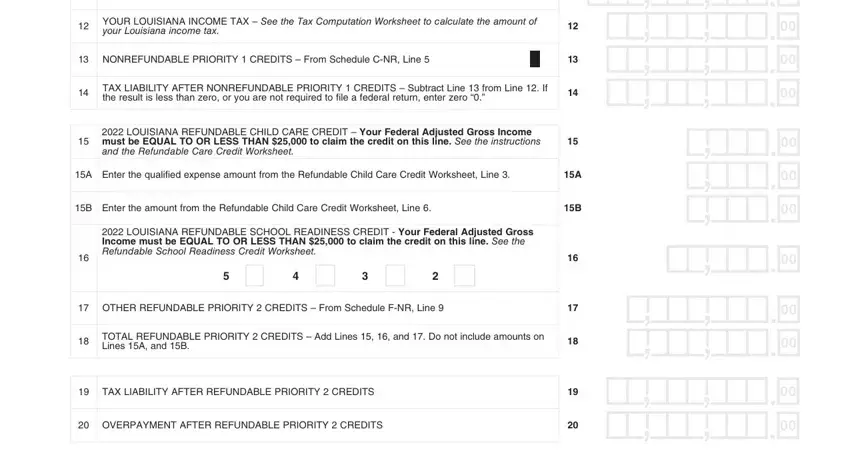

4. The next section requires your input in the subsequent parts: YOUR LOUISIANA INCOME TAX See the, NONREFUNDABLE PRIORITY CREDITS, TAX LIABILITY AFTER NONREFUNDABLE, LOUISIANA REFUNDABLE CHILD CARE, A Enter the qualified expense, B Enter the amount from the, LOUISIANA REFUNDABLE SCHOOL, OTHER REFUNDABLE PRIORITY, TOTAL REFUNDABLE PRIORITY CREDITS, S T, D E R C, X A T, E L B A D N U F E R, TAX LIABILITY AFTER REFUNDABLE, and OVERPAYMENT AFTER REFUNDABLE. Always fill in all requested information to go further.

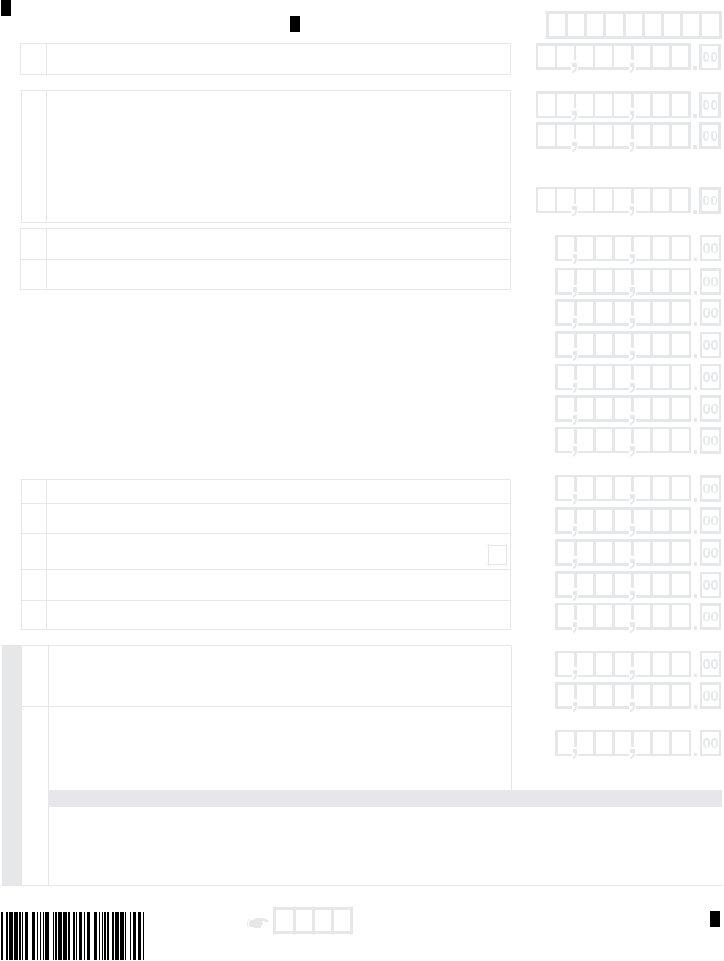

5. This form needs to be finalized with this particular segment. Here you'll see an extensive set of fields that must be filled in with accurate information for your document usage to be faultless: Enter the first letters of your, CONTINUE ON NEXT PAGE, and WEB.

Step 3: Proofread all the details you have typed into the form fields and then press the "Done" button. Join us now and instantly access louisiana 540b, ready for downloading. Every single edit made is conveniently kept , which enables you to customize the pdf at a later point anytime. If you use FormsPal, you'll be able to complete forms without stressing about data incidents or entries being distributed. Our protected software makes sure that your personal data is kept safely.