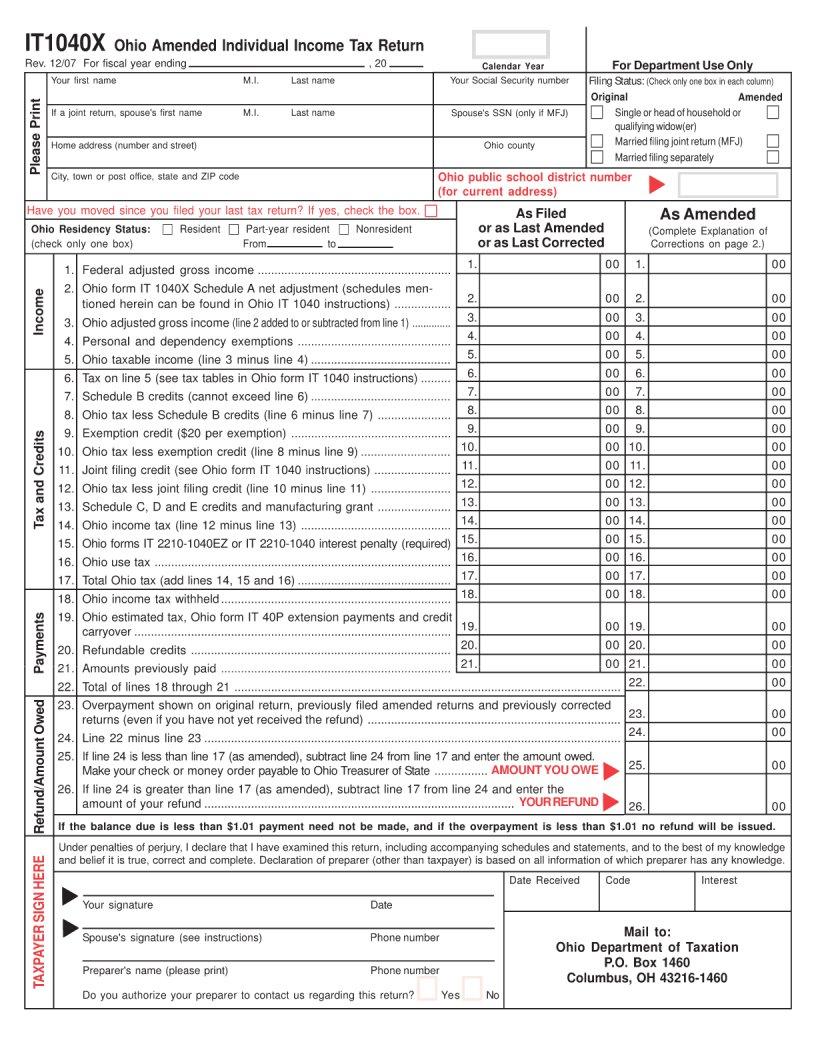

Mistakes happen, and when they do on your tax return, the IT1040X form is the solution to correct them. Filing an amended tax return might seem daunting, but it's a straightforward process designed to ensure you can adjust your income, deductions, or credits that were either reported incorrectly or missed on your original tax return. The IT1040X form acts as your opportunity to make things right with the IRS, potentially leading to a refund if you overpaid taxes or, conversely, requiring an additional payment if you underpaid. It is important to note, however, that this form isn't just for correcting errors; it can also be used to report changes in your filing status or to add any additional information that was not previously included. With tax laws frequently changing, the need to file an amended return is not uncommon. Whether these changes arise from a simple oversight or from the complexities of the tax code, the IT1040X form provides a critical pathway to ensuring your tax obligations are accurate and up to date.

| Question | Answer |

|---|---|

| Form Name | It1040X Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | PIT_1040X it1040x form |