k40es 2019 can be filled out online easily. Just make use of FormsPal PDF editor to do the job fast. Our expert team is ceaselessly working to enhance the editor and insure that it is even easier for people with its cutting-edge functions. Take your experience to the next level with continuously improving and exciting possibilities available today! With a few basic steps, you'll be able to start your PDF journey:

Step 1: Click the "Get Form" button above. It is going to open up our pdf editor so that you can begin filling in your form.

Step 2: This editor helps you modify your PDF file in a range of ways. Change it by writing personalized text, adjust what is originally in the PDF, and include a signature - all readily available!

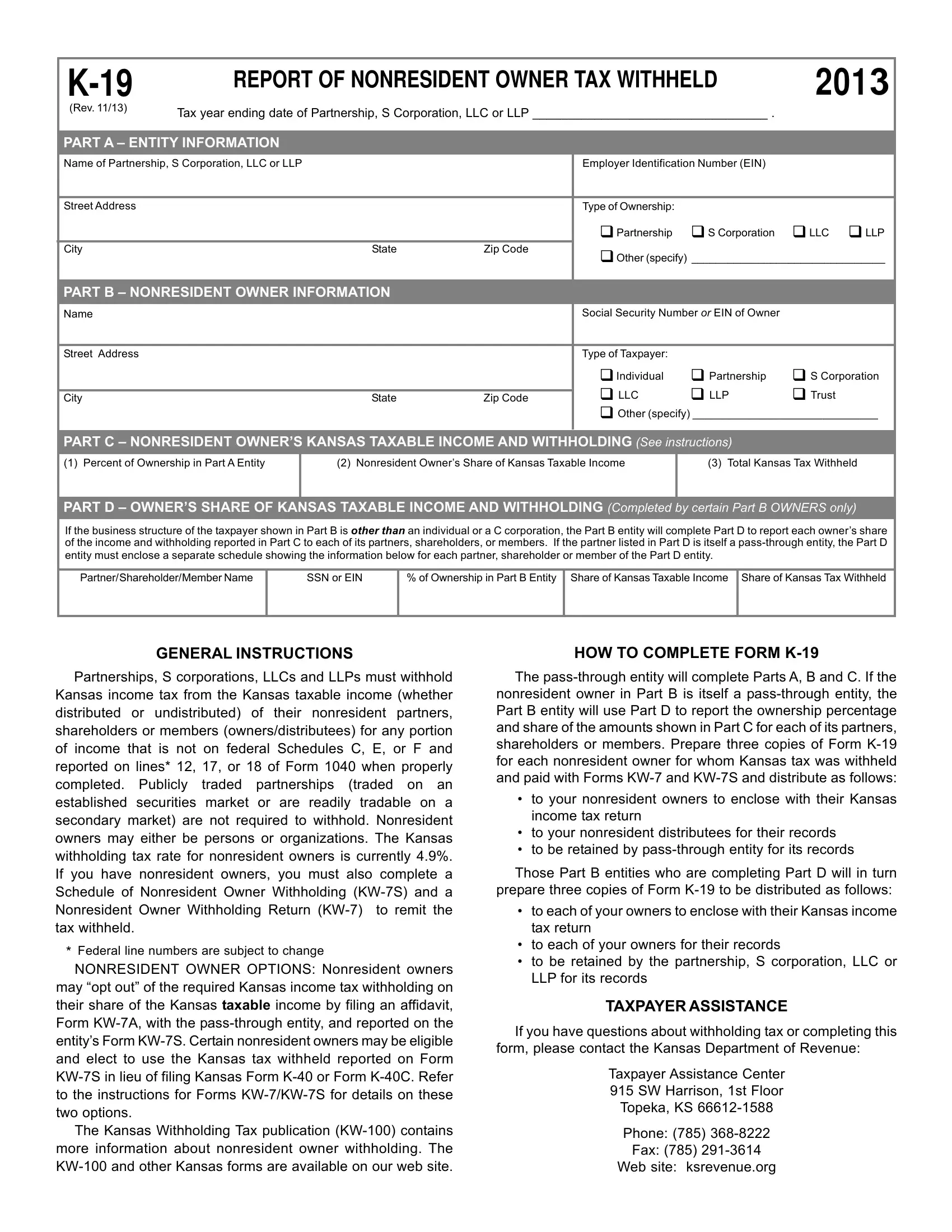

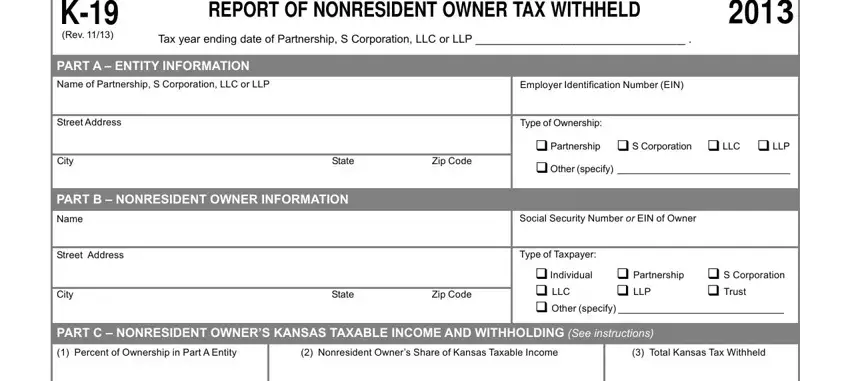

With regards to the blank fields of this particular PDF, this is what you should consider:

1. Firstly, while filling out the k40es 2019, beging with the form section that includes the following blank fields:

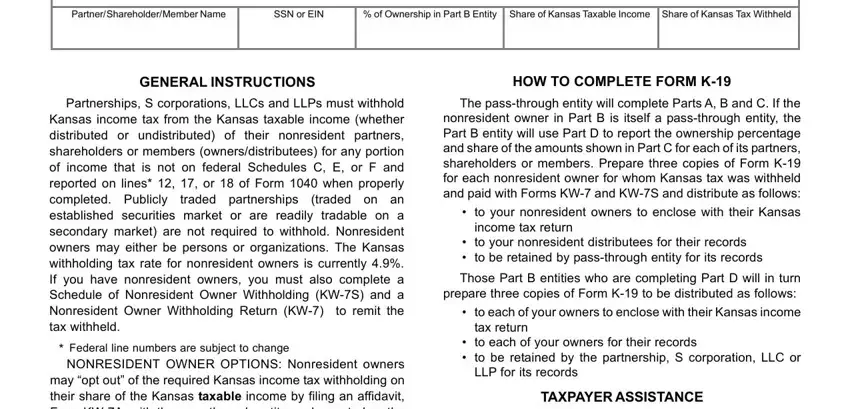

2. After performing this part, go on to the subsequent stage and fill out all required details in these blanks - If the business structure of the, PartnerShareholderMember Name, SSN or EIN, of Ownership in Part B Entity, GENERAL INSTRUCTIONS, HOW TO COMPLETE FORM K, Partnerships S corporations LLCs, traded partnerships, Federal line numbers are subject, NONRESIDENT OWNER OPTIONS, The passthrough entity will, cid to your nonresident owners to, income tax return, cid to your nonresident, and Those Part B entities who are.

Be very careful while filling out cid to your nonresident owners to and HOW TO COMPLETE FORM K, as this is where a lot of people make errors.

Step 3: As soon as you have looked over the information entered, simply click "Done" to finalize your form. Right after getting afree trial account here, you'll be able to download k40es 2019 or send it through email right off. The PDF document will also be readily available in your personal cabinet with all your edits. FormsPal guarantees your data confidentiality by using a secure system that in no way records or distributes any type of personal information typed in. Rest assured knowing your documents are kept protected whenever you use our service!