kutalooro alpam song downlod can be filled in online without difficulty. Simply open FormsPal PDF editing tool to accomplish the job in a timely fashion. To maintain our editor on the leading edge of practicality, we work to implement user-driven features and enhancements regularly. We are routinely glad to receive feedback - join us in reshaping how we work with PDF forms. All it requires is a couple of simple steps:

Step 1: Access the form inside our editor by clicking the "Get Form Button" above on this page.

Step 2: The tool helps you change PDF documents in a range of ways. Transform it with your own text, adjust original content, and include a signature - all close at hand!

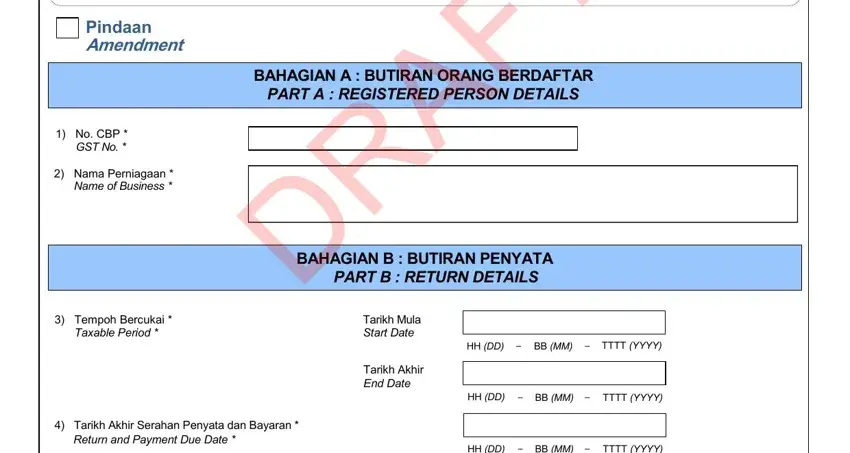

This PDF doc will involve specific details; in order to ensure consistency, you should adhere to the guidelines down below:

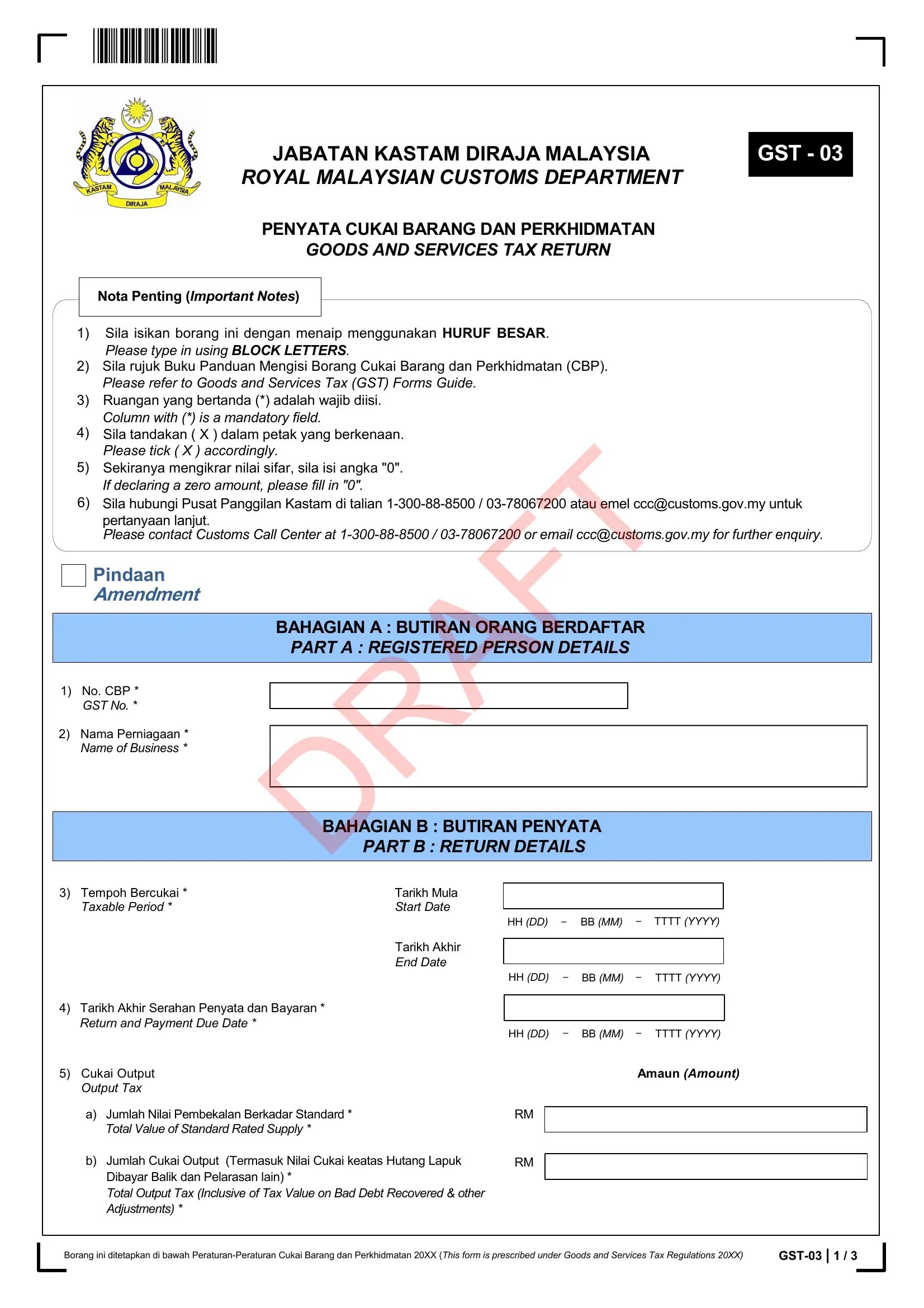

1. The kutalooro alpam song downlod requires specific information to be typed in. Be sure that the next blanks are finalized:

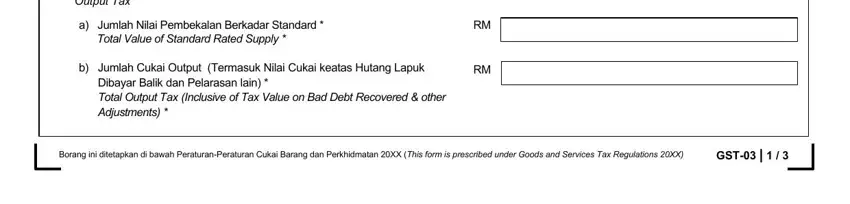

2. After completing this part, head on to the next part and enter the necessary details in all these blanks - Output Tax, a Jumlah Nilai Pembekalan Berkadar, Total Value of Standard Rated, Jumlah Cukai Output Termasuk Nilai, Borang ini ditetapkan di bawah, and GST.

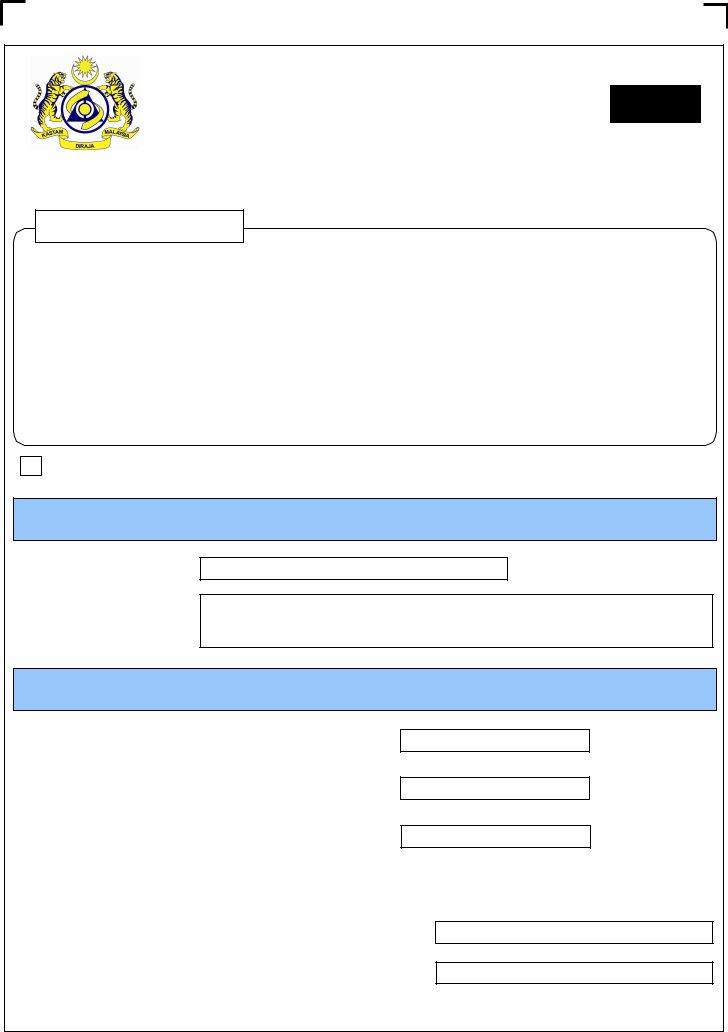

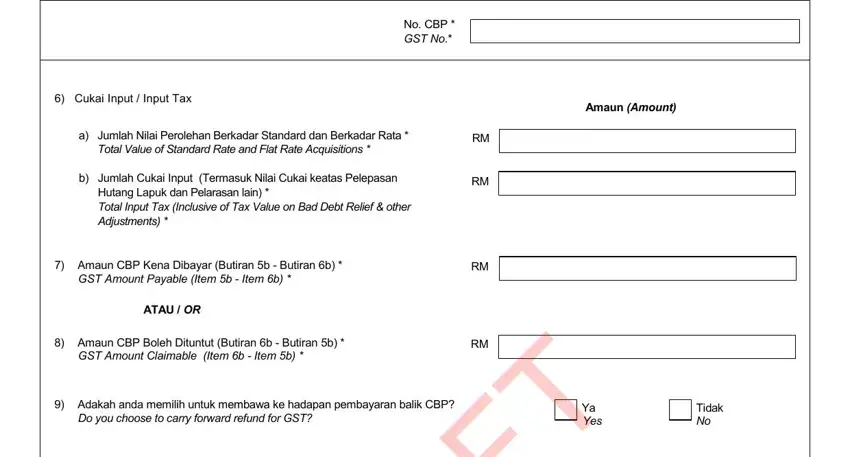

3. The following portion will be about No CBP GST No, Cukai Input Input Tax, Amaun Amount, a Jumlah Nilai Perolehan Berkadar, Total Value of Standard Rate and, Jumlah Cukai Input Termasuk Nilai, Amaun CBP Kena Dibayar Butiran b, GST Amount Payable Item b Item b, ATAU OR, Amaun CBP Boleh Dituntut Butiran, GST Amount Claimable Item b Item, Adakah anda memilih untuk membawa, Do you choose to carry forward, Ya Yes, and Tidak No - type in all these empty form fields.

Always be very attentive while filling in Do you choose to carry forward and GST Amount Payable Item b Item b, because this is where a lot of people make errors.

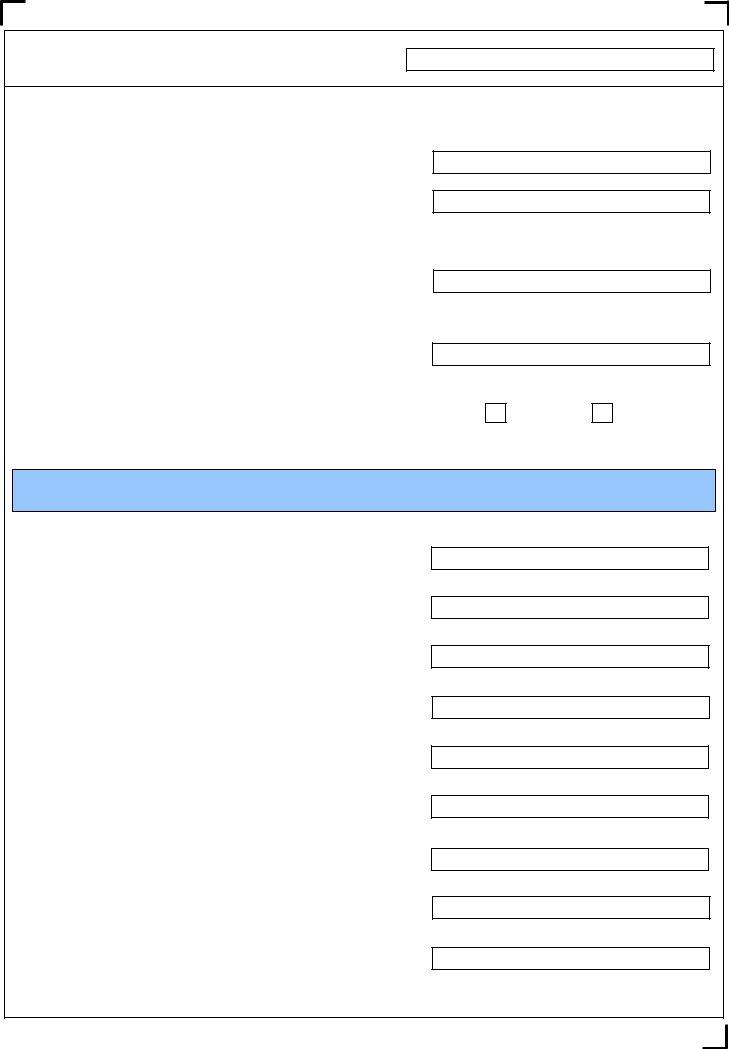

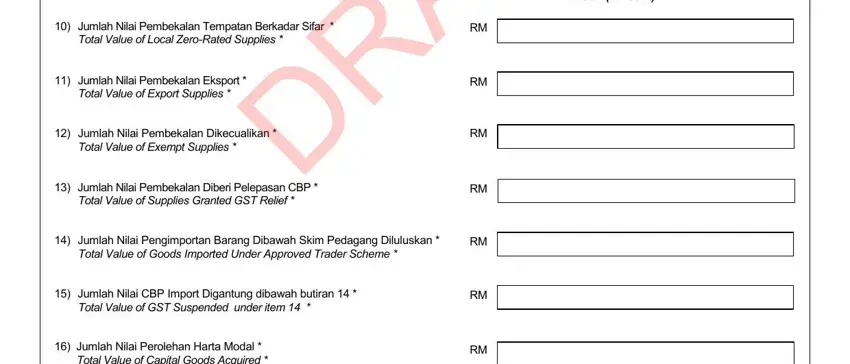

4. To go ahead, this next stage involves completing several blank fields. These comprise of Jumlah Nilai Pembekalan Tempatan, Total Value of Local ZeroRated, Jumlah Nilai Pembekalan Eksport, Total Value of Export Supplies, Jumlah Nilai Pembekalan, Total Value of Exempt Supplies, Jumlah Nilai Pembekalan Diberi, Total Value of Supplies Granted, Jumlah Nilai Pengimportan Barang, Total Value of Goods Imported, Jumlah Nilai CBP Import Digantung, Total Value of GST Suspended under, Jumlah Nilai Perolehan Harta, and Amaun Amount, which you'll find essential to continuing with this form.

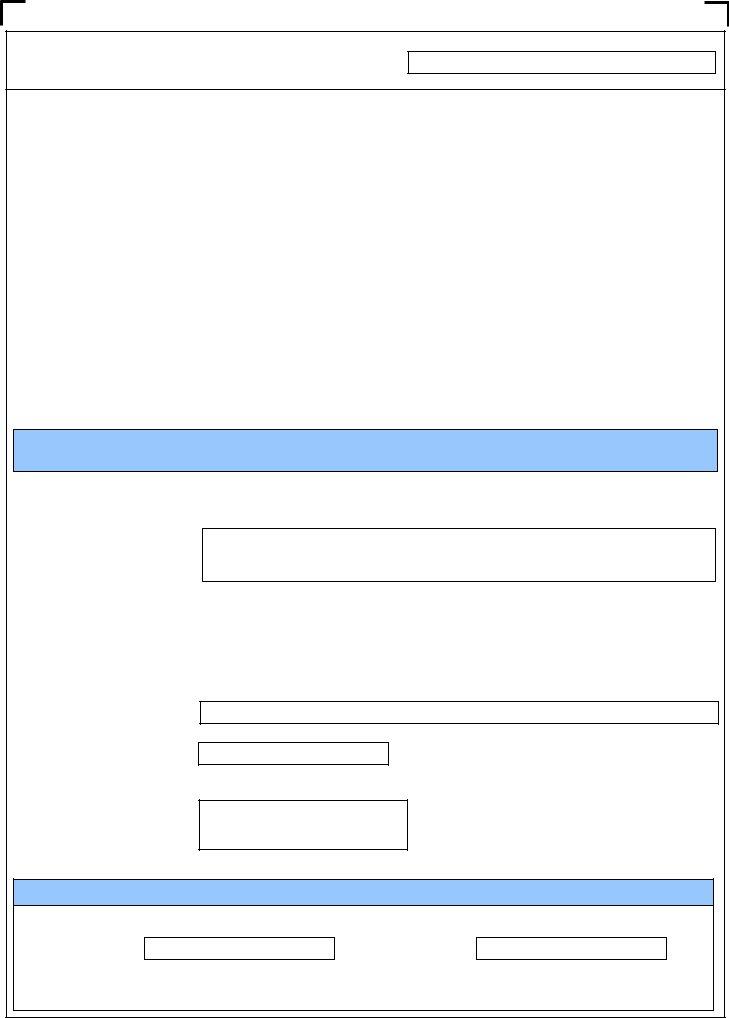

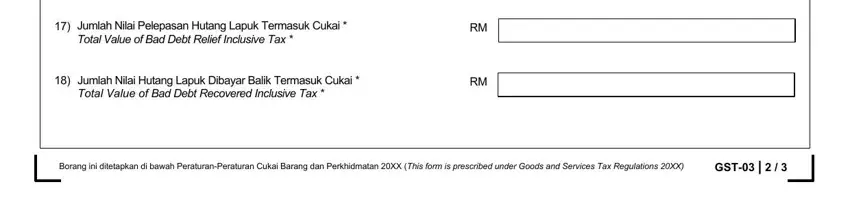

5. To conclude your document, the particular part features some extra fields. Filling in Jumlah Nilai Pelepasan Hutang, Jumlah Nilai Hutang Lapuk Dibayar, Borang ini ditetapkan di bawah, and GST should conclude everything and you can be done quickly!

Step 3: Make sure that your information is correct and then press "Done" to finish the process. Go for a free trial plan with us and get instant access to kutalooro alpam song downlod - which you'll be able to then work with as you would like in your personal account page. FormsPal offers risk-free document completion with no data record-keeping or sharing. Feel comfortable knowing that your information is secure with us!