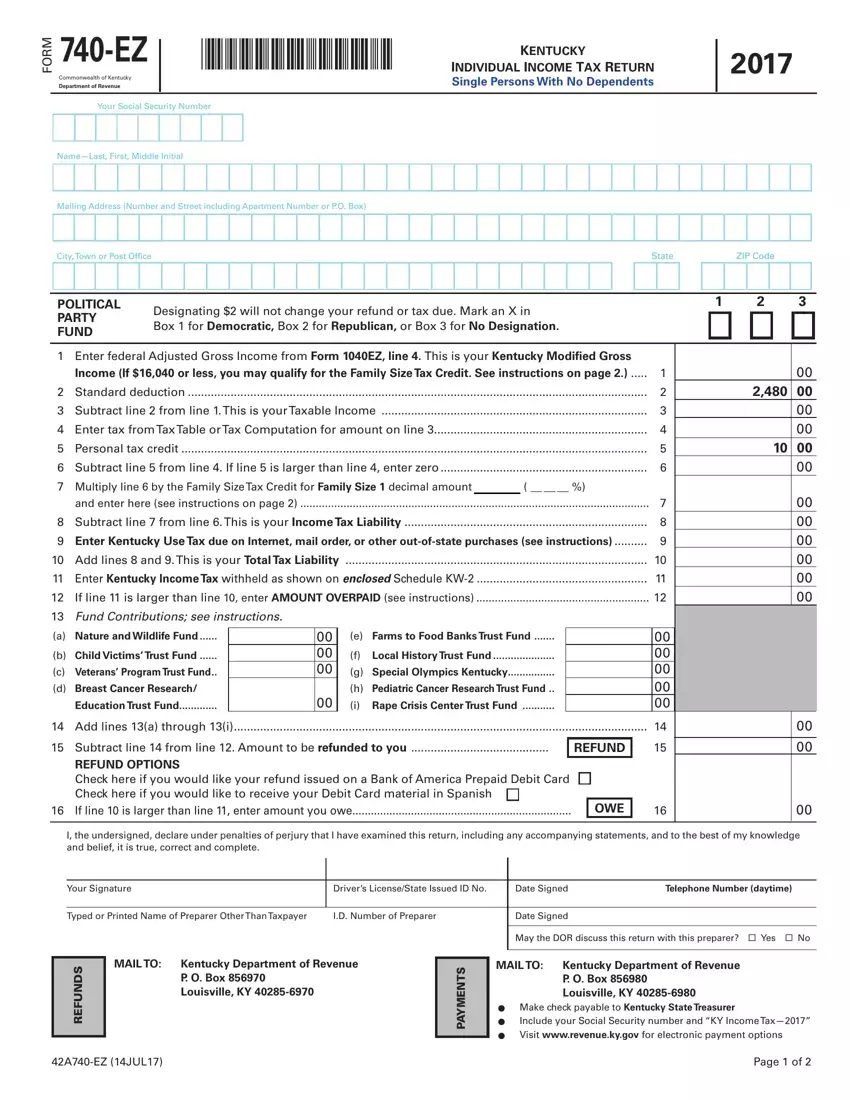

Who May Use Form 740-EZ—You may use Form 740-EZ if all five of the following apply:

you were a Kentucky resident for the entire year;

you are filing federal Form 1040EZ;

your filing status is single;

you do not claim additional credits for being age 65 or over, blind, or a member of the Kentucky National Guard at the end of 2017; and

you had only wages, salaries, tips, unemployment compensation, taxable scholarship or fellowship grants, and your taxable interest was $1,500 or less.

If you do not meet all five of the above requirements, see Form 740 instructions.

When to File—The 2017 Form 740-EZ and any tax due must be postmarked no later than April 17, 2018, to avoid penalties and interest.

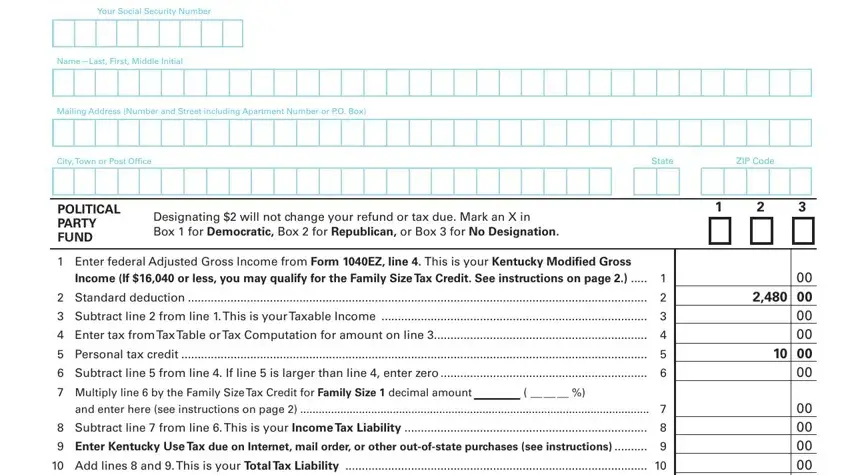

Social Security Number—You are required to provide your social security number per Section 405, Title 42, of the United States Code. This information will be used to establish your identity for tax purposes only.

COMPLETING FORM 740-EZ—For more information, see the General Instructions. You may also contact the Department of Revenue in Frankfort at (502) 564-4581 or a KentuckyTaxpayer Service Center.

Please print your numbers inside the boxes with black ink. Do not use dollar signs.

Political Party Fund Designation—You may designate $2 of your taxes to either the Democratic or Republican party if you have a tax liability of at least $2.

LINE-BY-LINE INSTRUCTIONS

Line 1—Enter federal adjusted gross income from Form 1040EZ, Line 4. (Do not confuse federal adjusted gross income with federal taxable income shown on the federal return.) If $16,040 or less, see instructions for Line 7 and enter the decimal amount on Line 7.

If you are not required to file a federal income tax return, enter the total income from sources within and without Kentucky.

Line 2—The standard deduction of $2,480 has been preprinted. If your itemized deductions exceed $2,480, it will benefit you to file Form 740 and itemize your deductions on Schedule A.

Line 4—Compute your tax using the following tax rate schedule.

If taxable income is: |

Tax before credit is: |

$ |

0 |

— |

$3,000 |

................. 2% of taxable income |

$ |

3,001 |

— |

$4,000 |

................. 3% of taxable income minus $30 |

$ |

4,001 |

— |

$5,000 |

................. 4% of taxable income minus $70 |

$ |

5,001 |

— |

$8,000 |

................. 5% of taxable income minus $120 |

$ |

8,001 |

— $75,000 |

................. 5.8% of taxable income minus $184 |

$75,001 and up |

6% of taxable income minus $334 |

Example: (Taxable income) $8,500 x 5.8% – $184 = $309

Note: An optional tax table is available online at www.revenue.ky.gov or by calling the Department of Revenue, (502) 564-4581.

Line 7—Family Size Tax Credit—For single persons eligible to file Form 740-EZ, Kentucky family size is one and Kentucky modified gross income is equal to federal adjusted gross income. A family size tax credit is allowed for single persons whose Kentucky modified gross income is not over $16,040. If over $16,040, you do not qualify for this tax credit. Skip Line 7.

Enter in the space provided the decimal amount from the following table.

Family Size |

Percent ofTax |

|

One |

|

as Family SizeTax Credit |

|

|

|

|

If the Kentucky modified |

Enter decimal amount |

|

gross income (Line 1) is: |

on Line 7 |

|

|

|

|

|

|

over |

but not over |

|

|

|

$ 0 |

$12,060 |

1.00 |

(100%) |

|

$12,060 |

$12,542 |

0.90 |

(90%) |

|

$12,542 |

$13,025 |

0.80 |

(80%) |

|

$13,025 |

$13,507 |

0.70 |

(70%) |

|

$13,507 |

$13,990 |

0.60 |

(60%) |

|

$13,990 |

$14,472 |

0.50 |

(50%) |

|

$14,472 |

$14,954 |

0.40 |

(40%) |

|

$14,954 |

$15,316 |

0.30 |

(30%) |

|

$15,316 |

$15,678 |

0.20 |

(20%) |

|

$15,678 |

$16,040 |

0.10 |

(10%) |

|

|

|

|

|

|

Multiply amount on Line 6 by decimal amount. Enter result on Line 7. This is your Family Size Tax Credit.

Line 9, Kentucky UseTax—Enter 6 percent of out-of-state purchases for use in Kentucky on which sales tax was not charged. Include Internet and catalog purchases, subscriptions, furniture, carpet, boats, etc.

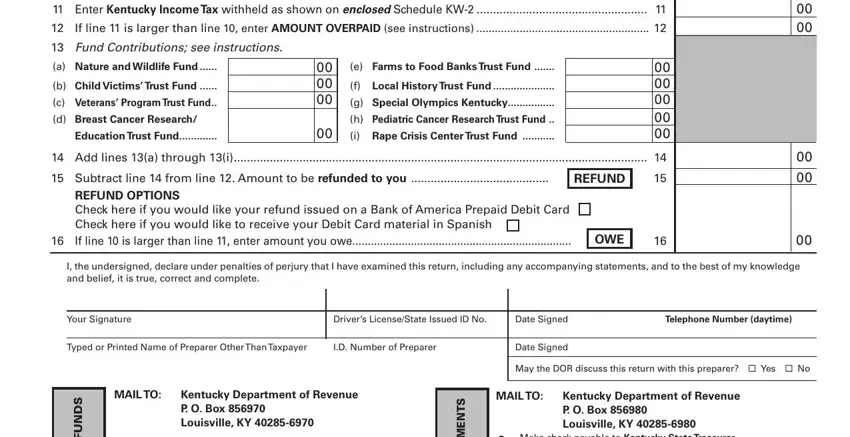

Line 11, Kentucky Tax Withheld—Enter the amount of Kentucky income tax withheld as shown on your Schedule KW-2. This schedule must be enclosed with your return. It is no longer necessary to submit FormW-2s, 1099s, andW2-Gs with your return. Please retain these forms with your records and provide upon request.

Line 12—If the amount on Line 11 (Kentucky Tax Withheld) is more than the amount on Line 10 (Total Tax Liability), you have an overpayment and are due a refund. Subtract Line 10 from Line 11, and enter the difference on Line 12 as an overpayment. However, if your Total Tax Liability on Line 10 is larger than Line 11, you owe additional tax. Subtract Line 11 from Line 10 and enter on Line 16.

Line 13—If you show an overpayment on Line 12, you may contribute to: (a) the Nature and Wildlife Fund, (b) the Child Victims’ Trust Fund, (c) the Veterans’ Program Trust Fund, (d) the Breast Cancer Research and Education Trust Fund, (e) the Farms to Food Banks Trust Fund, (f) the Local History Trust Fund, (g) Special Olympics Kentucky, (h) the Pediatric Cancer Research Trust Fund, and/or

(i)the Rape Crisis Center Trust Fund. Donations are voluntary and amounts donated will be deducted from your refund.

Enter the amount(s) you wish to contribute on Lines 13(a) through 13(i). The total of these amounts cannot exceed the amount of the overpayment.

Line 16—You must pay any tax due shown on Line 16. Make check payable to Kentucky State Treasurer, and attach it to your return. On the face of the check, please write “KY Income Tax–2017” and your Social Security number.

Underpayment of Estimated Tax—You may have to pay a penalty if the amount owed is more than $500 and the amount owed is more than 30 percent of the income tax liability on Line 8. You may choose to have the Department of Revenue calculate the penalty for you. If you owe a penalty a bill will be sent. However, if you want to calculate the penalty yourself on Form 2210-K, you must file Form 740 to do so.

Interest and Penalties—File your return and pay any additional tax due by April 17, 2018, to avoid interest and penalties. See the General Instructions or contact the Department of Revenue for additional information.