When you need to fill out ky 740 x, you won't have to install any sort of programs - simply try our online PDF editor. FormsPal team is devoted to providing you with the best possible experience with our tool by consistently presenting new functions and enhancements. With all of these improvements, working with our tool becomes better than ever before! Starting is simple! All that you should do is follow these simple steps down below:

Step 1: Open the PDF file inside our tool by pressing the "Get Form Button" above on this page.

Step 2: Using this advanced PDF file editor, you're able to accomplish more than just complete blank fields. Try each of the functions and make your forms seem high-quality with custom text put in, or modify the original content to perfection - all that comes with the capability to insert any graphics and sign the document off.

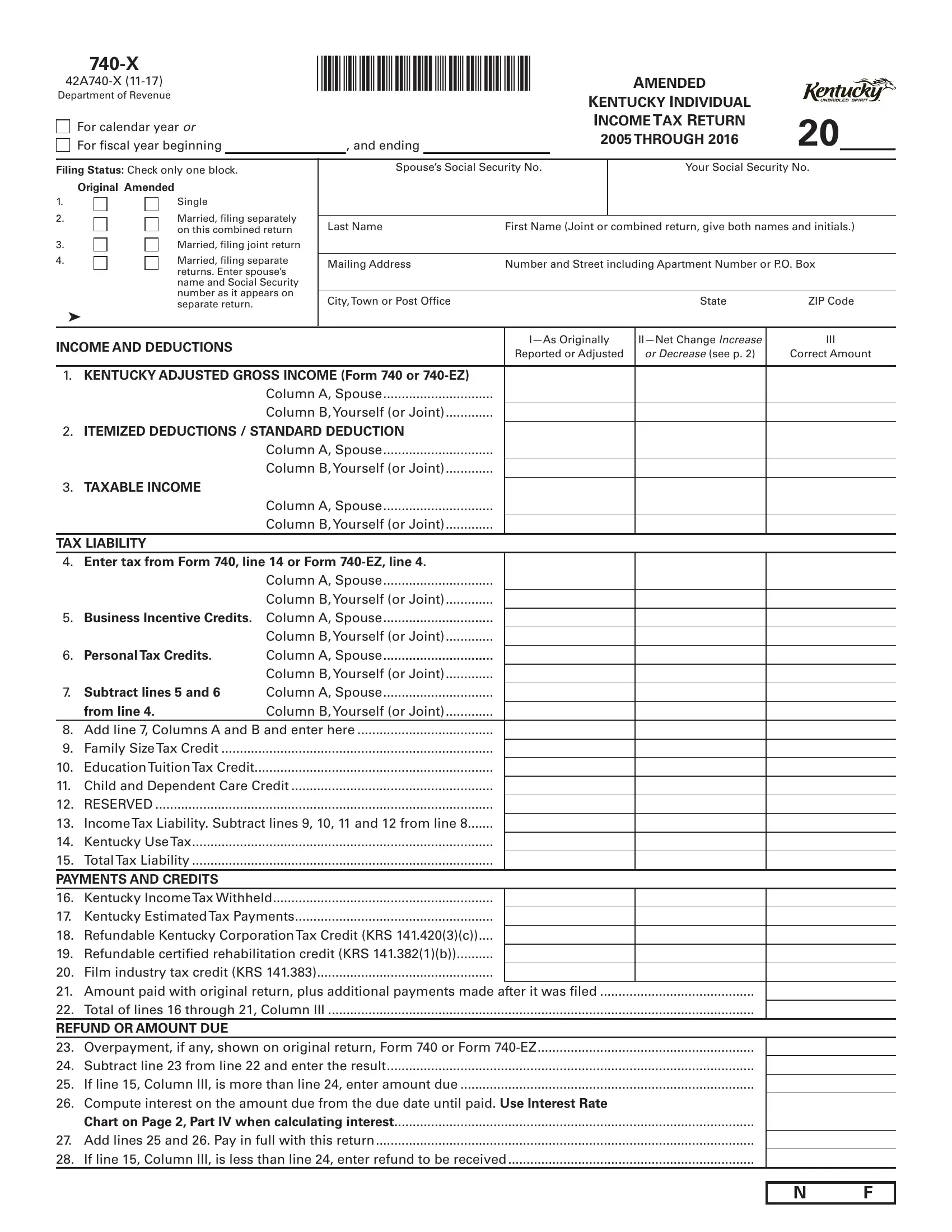

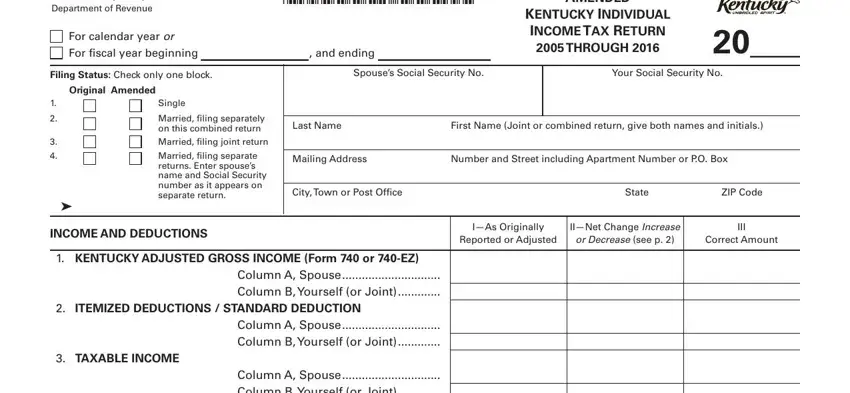

This PDF will require specific info to be typed in, so ensure that you take your time to fill in exactly what is asked:

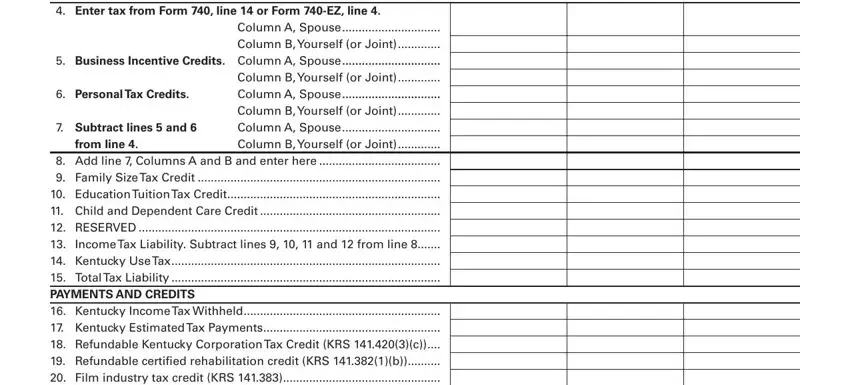

1. You will want to fill out the ky 740 x properly, so be attentive while filling in the sections comprising these particular fields:

2. Just after the first array of blanks is done, go on to type in the suitable details in all these: from line, and KENTUCKY ADJUSTED GROSS INCOME.

Always be very mindful while filling out from line and KENTUCKY ADJUSTED GROSS INCOME, as this is the part where most users make mistakes.

3. Within this part, look at KENTUCKY ADJUSTED GROSS INCOME. All these are required to be completed with greatest accuracy.

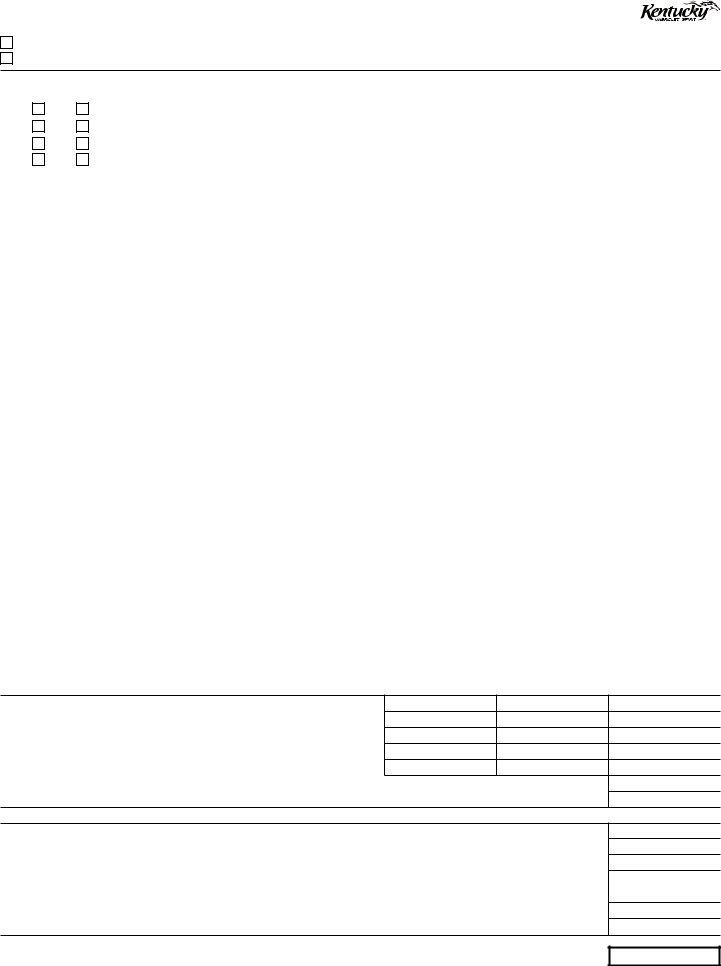

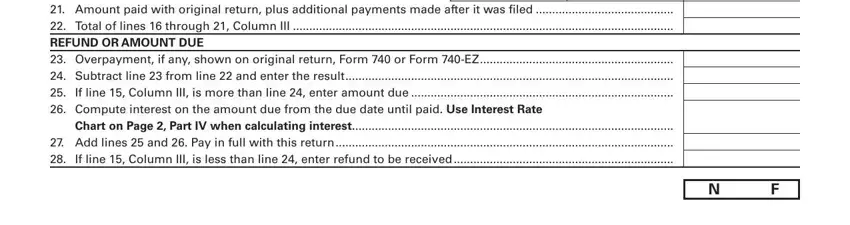

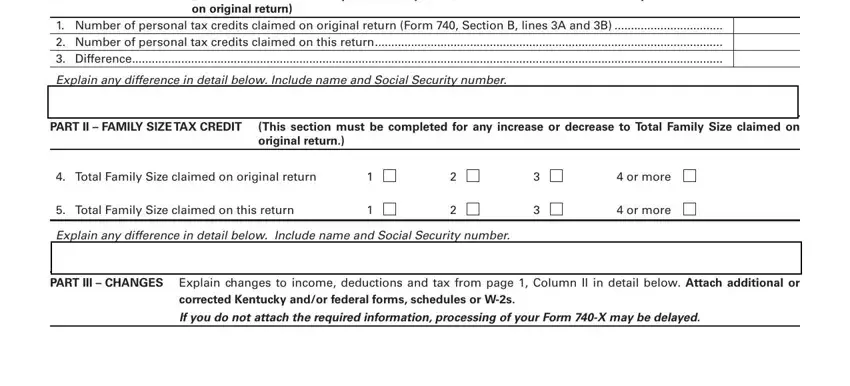

4. This particular section comes next with all of the following empty form fields to consider: PART I TAX CREDITS, This section must be completed for, Number of personal tax credits, Explain any difference in detail, PART II FAMILY SIZE TAX CREDIT, This section must be completed for, Total Family Size claimed on, Total Family Size claimed on this, or more, or more, Explain any difference in detail, PART III CHANGES Explain changes, corrected Kentucky andor federal, and If you do not attach the required.

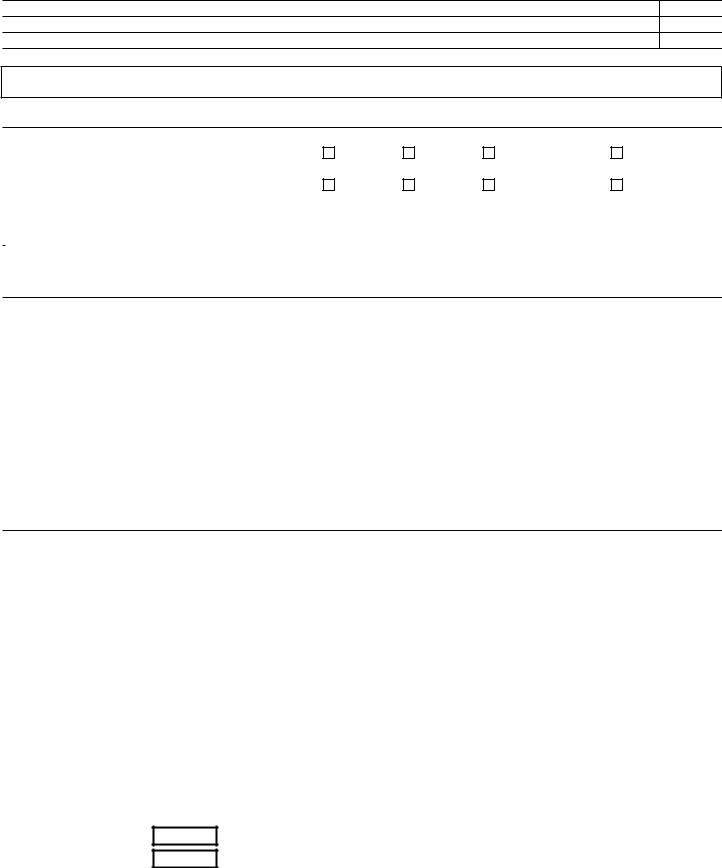

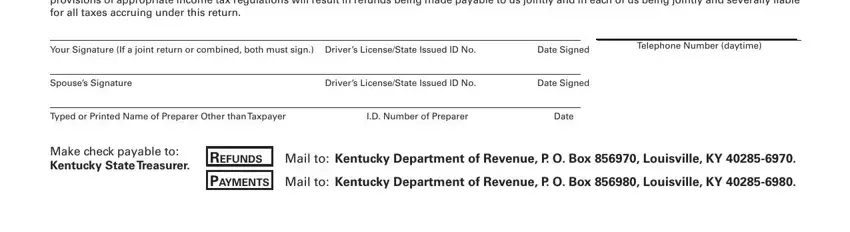

5. Now, this final section is precisely what you'll want to complete prior to submitting the document. The blank fields under consideration include the following: I the undersigned declare under, Your Signature If a joint return, Date Signed, Spouses Signature, Drivers LicenseState Issued ID No, Date Signed, Typed or Printed Name of Preparer, ID Number of Preparer, Date, Telephone Number daytime, Make check payable to Kentucky, REFUNDS Mail to Kentucky, and PAYMENTS Mail to Kentucky.

Step 3: After you have looked over the information in the document, just click "Done" to conclude your form at FormsPal. After getting afree trial account here, it will be possible to download ky 740 x or send it via email promptly. The PDF document will also be at your disposal in your personal cabinet with your edits. We do not share the details that you type in while working with documents at FormsPal.