If you are a Kentucky resident who has decided to start a business, then you may have heard of the need to file Form 765. This form is critical in filing an income tax return as it determines the apportionment of income among taxable jurisdictions and reports relationships between parties that bear on taxability. Whether you’re just beginning your entrepreneurial journey or are already established, understanding what Form 765 is and how it works is essential for staying organized and compliant with all relevant tax requirements. So let's get into exactly why this form matters for Kentucky businesses.

| Question | Answer |

|---|---|

| Form Name | Kentucky Form 765 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | kentucky partnership return instructions 2020, kentucky partnership tax return, ssin 765, 2020 ky form 765 |

|

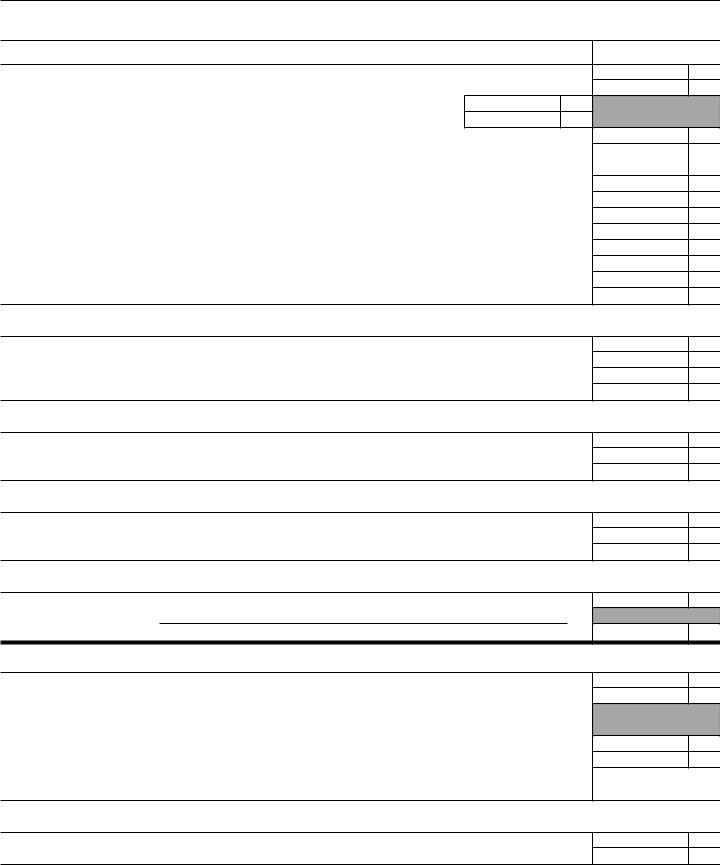

Form 765 |

|

KENTUCKY |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

42A765 |

PARTNERSHIP INCOM E RETURN |

|

|

|

|||

|

Departm ent of Revenue |

➤ Attach a complete copy of the federal return. |

|

|

|

|||

|

|

For calendar year 2004 or fiscal year |

|

|

|

2004 |

||

|

|

|

|

|

||||

A. Date business com m enced or |

|

|

|

|||||

|

|

|

|

|

||||

|

|

|

|

|

|

|||

|

qualified |

|

|

|

|

|

|

|

|

|

beginning _________________ |

, 2004, and ending __________________ , 2005. |

|

|

|||

|

|

|

|

|

|

|

|

|

B. |

Num ber of partners (attach |

Nam e |

|

|

|

E. |

Federal Em ployer |

|

|

|

|

|

|

|

|

Identification Num ber |

|

|

|

|

|

|

|

|

|

|

|

|

Num ber and street or P.O. box |

|

|

|

|

|

|

C. |

NAICS business code num ber |

|

|

|

F. |

Kentucky Withholding |

||

|

|

|

|

|||||

|

|

|

|

|

|

|

Account Num ber |

|

|

|

|

|

|

|

|

|

|

|

|

City, tow n or post office |

County |

State |

ZIP code |

|

|

|

D. |

Partnership telephone num ber |

G. |

Sales and Use Tax |

|||||

|

|

|

|

|||||

|

|

|

|

|

|

|

Perm it Num ber |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

H. |

Check applicable boxes: |

Initial return |

Final return |

Am ended return |

|

|

|

|

|

I. |

Check type of entity: |

General partnership |

Lim ited partnership |

Lim ited liability com pany |

|

|

Lim ited liability partnership |

|

|

|

|

|

|

|

J. |

Are disregarded entities included in this return? |

Yes |

No |

|

|

If yes, attach a schedule listing nam e and federal identification num ber of the disregarded entity. |

|||

|

|

|

|

|

K.Qualified investm ent partnership (Check box only if you are a general partnership or a lim ited partnership that has been form ed as a qualified investm ent partnership.)

1. |

Federal ordinary incom e (loss) (Form 1065, line 22) |

1 |

2. |

Federal depreciation from Form 4562 |

2 |

3. |

Other (attach schedule) (see instructions) |

3 |

4. |

Total (add lines 1, 2 and 3) |

4 |

SUBTRACTIONS: |

|

|

5. |

Federal w ork opportunity credit |

5 |

6. |

Kentucky depreciation from revised Form 4562 |

6 |

7. |

Other (attach schedule) (see instructions) |

7 |

8. |

Total (add lines 5, 6 and 7) |

8 |

9. |

Ordinary income (loss) (line 4 less line 8) |

9 |

✍I declare under the penalties of perjury that this return (including any accom panying schedules and statem ents) has been exam ined by m e and, to the best of m y know ledge and belief, is a true, correct and com plete return.

Signature of partner or m em ber |

Identification num ber of partner or m em ber |

Date |

|

|

|

Typed or printed nam e of preparer other than taxpayer |

Identification num ber of preparer |

Date |

M ail to Kentucky Department of Revenue, Frankfort, Kentucky 40620.

Form 765 (2004) |

Page 2 |

|

|

Schedule

SECTION I

Income or (Loss)

|

|

(a) Distributive Share Items |

|

(b) Total Amount |

1. |

Ordinary incom e or (loss) from trade or business activities (page 1, line 9) |

................................................. |

1 |

|

2. |

Net incom e or (loss) from rental real estate activities (from attached federal schedule) |

2 |

||

3. |

a |

Gross incom e from other rental activities |

3a |

|

|

b |

M inus expenses (attach schedule) |

3b |

|

|

c |

Net incom e or (loss) from other rental activities |

3c |

|

4. |

Portfolio incom e or (loss): |

|

|

|

|

a |

Interest incom e |

4a |

|

|

b |

Dividend incom e |

4b |

|

|

c |

Royalty incom e |

4c |

|

|

d |

Net |

4d |

|

|

e |

Net |

4e |

|

|

f |

Other portfolio incom e or (loss) (attach schedule) |

4f |

|

5. |

Guaranteed paym ents to partners |

5 |

||

6. |

Net gain or (loss) under IRC Section 1231 (other than due to casualty or theft) (attach federal Form 4797) 6 |

|||

7. |

Other incom e or (loss) (attach schedule) |

7 |

||

Deductions |

|

|

||

8. |

Charitable contributions (attach list) and housing for hom eless deduction (attach Schedule HH) |

8 |

||

9. |

IRC Section 179 expense deduction (attach federal Form 4562 and Kentucky revised Form 4562) |

9 |

||

10. Deductions related to portfolio incom e (do not include investm ent interest expense) |

10 |

|||

11. |

Other deductions (attach schedule) |

11 |

||

Investment Interest |

|

|

||

12. |

a Interest expense on investm ent debts |

12a |

||

|

b |

(1) Investm ent incom e included on lines 4a, 4b, 4c and 4f above |

12b(1) |

|

|

|

(2) Investm ent expenses included on line 10 above |

12b(2) |

|

Credits |

|

|

|

|

13. Kentucky Unem ploym ent Tax Credit (attach Schedule UTC) |

13 |

|||

14. Recycling and Com posting Equipm ent Tax Credit (attach approved Schedule RC) |

14 |

|||

15. |

Other (see instructions) ➤ |

..................... |

15 |

|

Other |

|

|

|

|

16. |

a Total expenditures to w hich IRC Section 59(e)(2) election m ay apply |

16a |

||

|

b |

Type of expenditures |

|

16b |

17. Other item s and am ounts not reported above (attach schedule) |

17 |

|||

SECTION |

|

|

||

1. |

Partnership’s Kentucky property and payroll |

1 |

2. |

Partnership’s total property and payroll |

2 |

If line 1 is equal to line 2, enter 100 percent on Schedule

3. |

Partnership’s Kentucky gross receipts |

3 |

4. |

Partnership’s total gross receipts |

4 |

5. |

Nonresident partner’s taxable percentage (line 3 divided by line 4). Enter the percentage on |

|

|

Schedule |

5 |

%

SECTION

1. |

Individual nonresident partners' net distributive share of taxable incom e |

1 |

2. |

Individual nonresident partners' net distributive share w ithheld |

2 |