Making use of the online PDF editor by FormsPal, you may fill out or edit Kpers Substitute W 4P Form here and now. Our professional team is ceaselessly endeavoring to develop the tool and insure that it is even better for users with its cutting-edge functions. Unlock an constantly revolutionary experience today - explore and find out new possibilities as you go! By taking several simple steps, you are able to start your PDF editing:

Step 1: Hit the "Get Form" button above. It will open our editor so that you can start completing your form.

Step 2: This editor will give you the opportunity to modify your PDF file in a variety of ways. Transform it by writing your own text, correct existing content, and place in a signature - all doable within minutes!

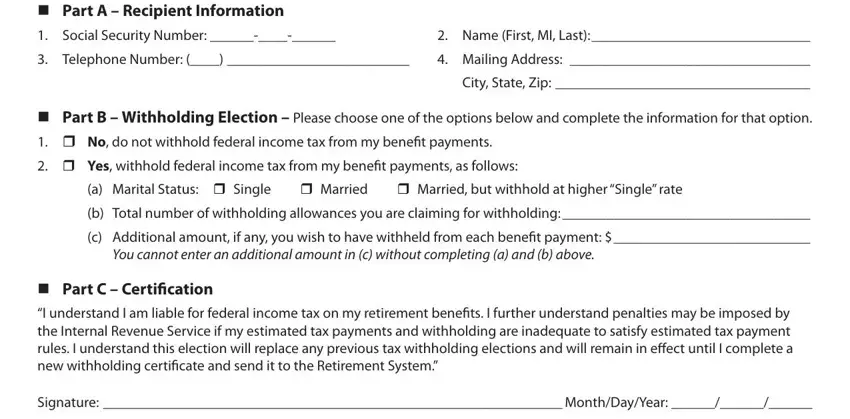

This form will involve some specific details; in order to ensure correctness, please make sure to bear in mind the following steps:

1. While filling in the Kpers Substitute W 4P Form, be sure to complete all essential blank fields in their corresponding part. It will help facilitate the process, allowing your details to be processed without delay and correctly.

Step 3: Prior to addressing the next stage, it's a good idea to ensure that blanks were filled out the correct way. When you are satisfied with it, press “Done." Right after setting up a7-day free trial account with us, you'll be able to download Kpers Substitute W 4P Form or email it right away. The form will also be easily accessible via your personal account menu with your every single edit. Here at FormsPal.com, we do everything we can to be certain that your information is kept secure.