In case you want to fill out kyret, you won't need to download any sort of programs - simply try using our online tool. Our tool is continually developing to give the very best user experience achievable, and that's because of our dedication to continual enhancement and listening closely to comments from users. Here's what you'll need to do to start:

Step 1: Just press the "Get Form Button" above on this page to get into our pdf file editor. There you'll find everything that is necessary to fill out your document.

Step 2: When you start the file editor, you will find the document ready to be filled in. Aside from filling out various fields, you might also perform other actions with the Document, namely putting on your own text, modifying the original textual content, adding illustrations or photos, signing the form, and much more.

This document will need specific information; to guarantee accuracy and reliability, remember to adhere to the recommendations further on:

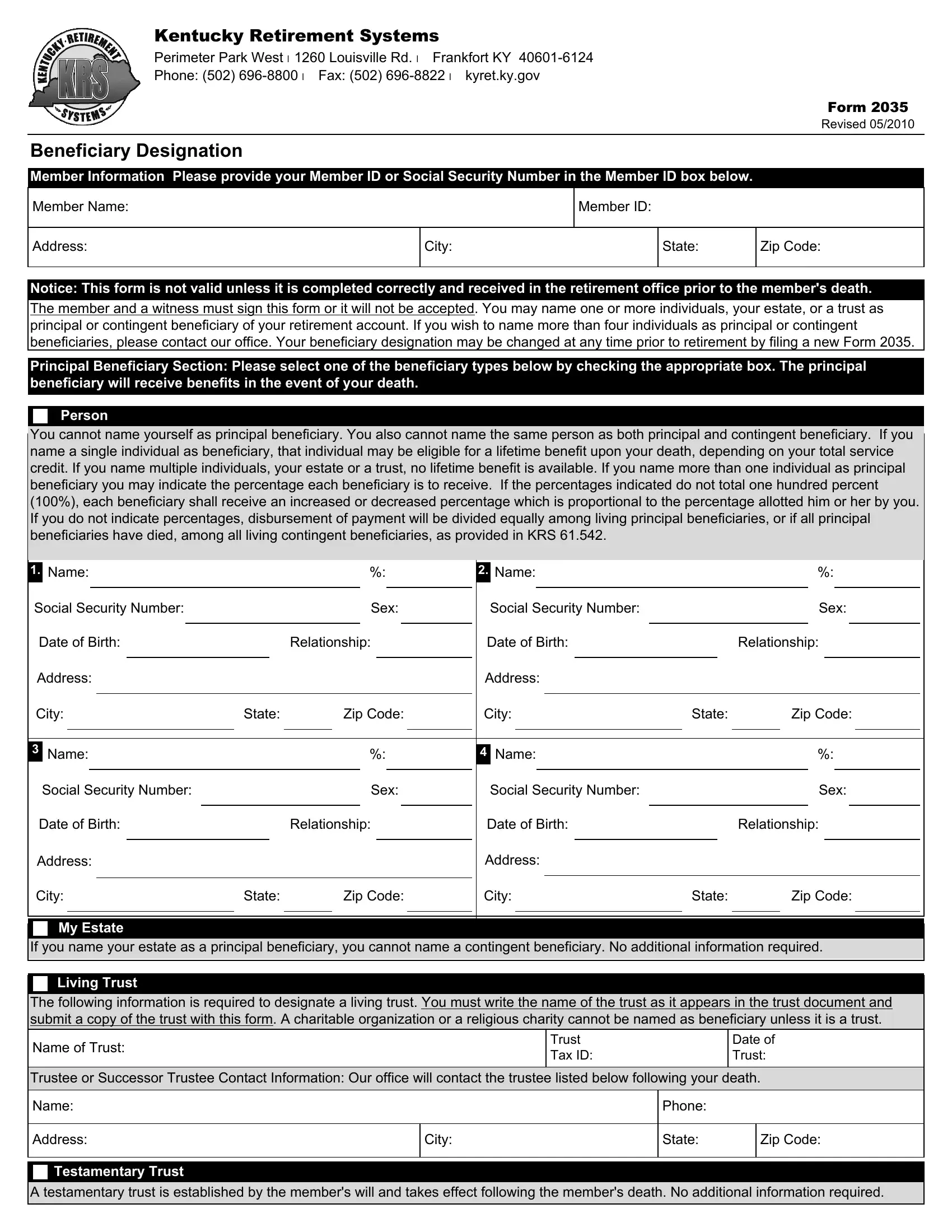

1. The kyret usually requires particular details to be entered. Be sure that the following fields are finalized:

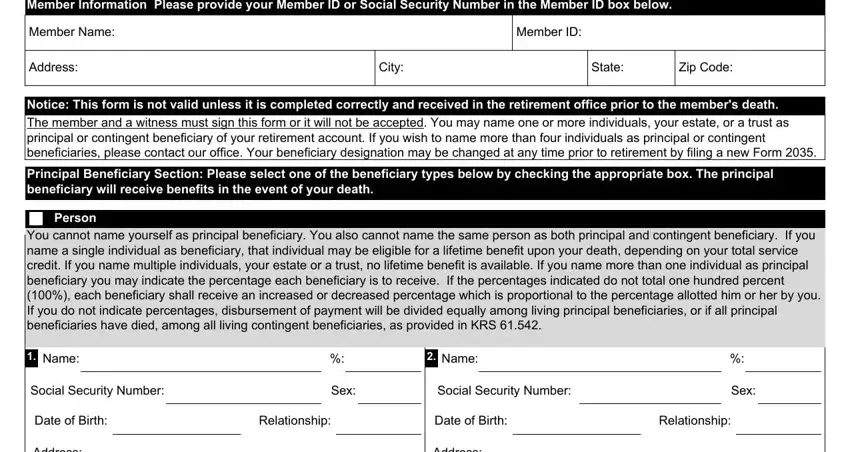

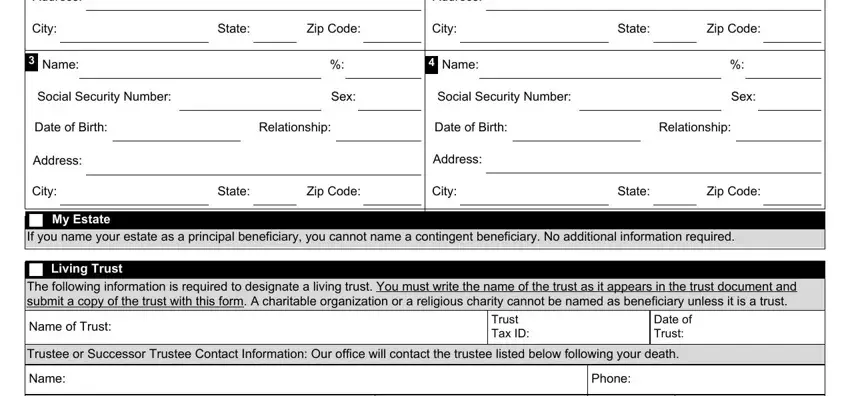

2. After the previous section is finished, you should insert the necessary particulars in Address, City, Name, Social Security Number, State, Zip Code, City, State, Zip Code, Address, Sex, Name, Social Security Number, Sex, and Date of Birth so that you can go to the 3rd part.

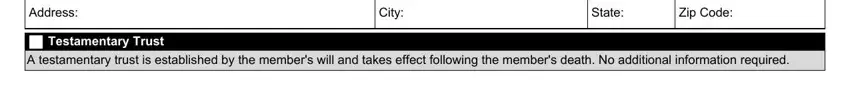

3. This 3rd segment should also be quite uncomplicated, Address, City, State, Zip Code, Testamentary Trust, and A testamentary trust is - these empty fields will need to be filled in here.

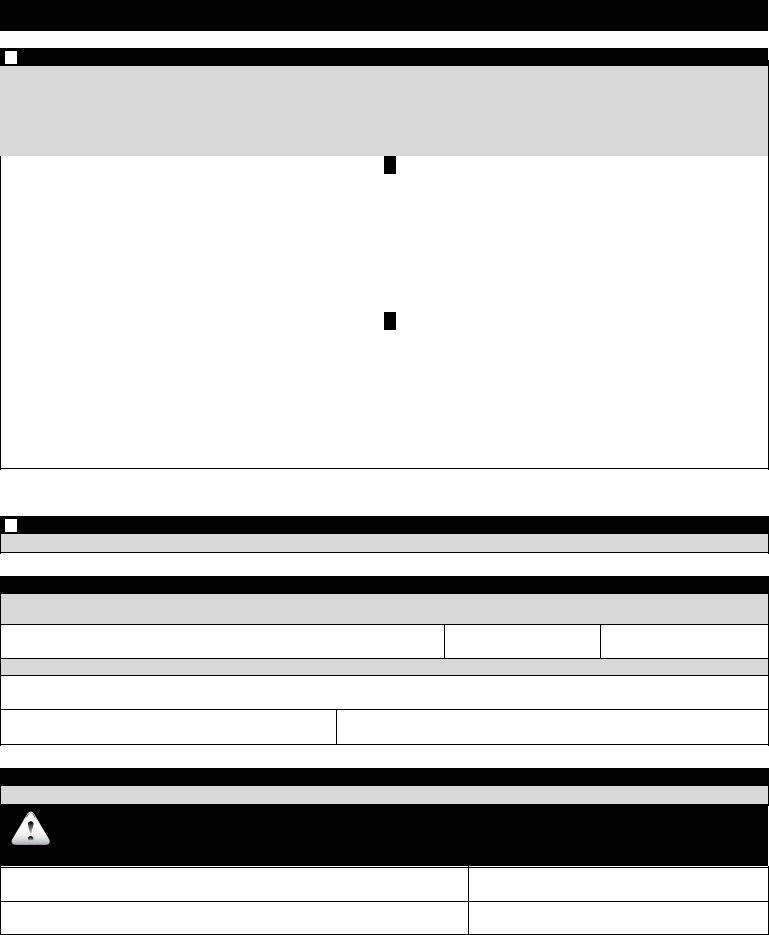

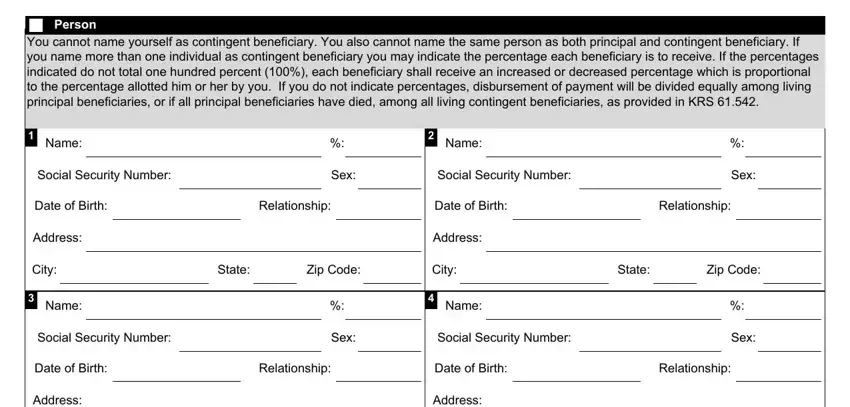

4. The subsequent part needs your details in the following areas: Person, You cannot name yourself as, Name, Social Security Number, Sex, Name, Social Security Number, Sex, Date of Birth, Relationship, Date of Birth, Relationship, Address, City, and Name. Remember to fill out all requested information to go onward.

Always be very careful when completing Name and Social Security Number, because this is where many people make mistakes.

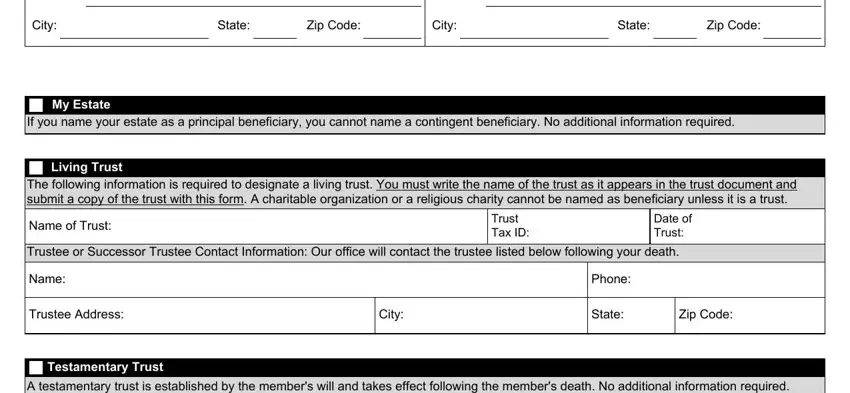

5. Now, this final segment is what you'll have to wrap up prior to submitting the PDF. The blank fields under consideration are the following: Address, City, State, Zip Code, City, State, Zip Code, Address, My Estate, If you name your estate as a, Living Trust, The following information is, Name of Trust, Trust Tax ID, and Date of Trust.

Step 3: Right after you have looked once more at the information you filled in, just click "Done" to complete your form at FormsPal. Right after registering afree trial account with us, it will be possible to download kyret or email it at once. The PDF will also be easily accessible in your personal cabinet with your every single edit. Here at FormsPal, we aim to make certain that your information is maintained secure.