It is possible to complete ks10 printable form easily with our online tool for PDF editing. In order to make our editor better and easier to utilize, we continuously design new features, taking into account feedback from our users. Starting is effortless! All you should do is adhere to these simple steps down below:

Step 1: Click on the "Get Form" button above. It will open up our tool so that you could begin filling out your form.

Step 2: With the help of our advanced PDF editor, you may accomplish more than just fill in blank form fields. Express yourself and make your documents seem professional with custom text added, or optimize the original content to excellence - all comes along with the capability to incorporate your own pictures and sign it off.

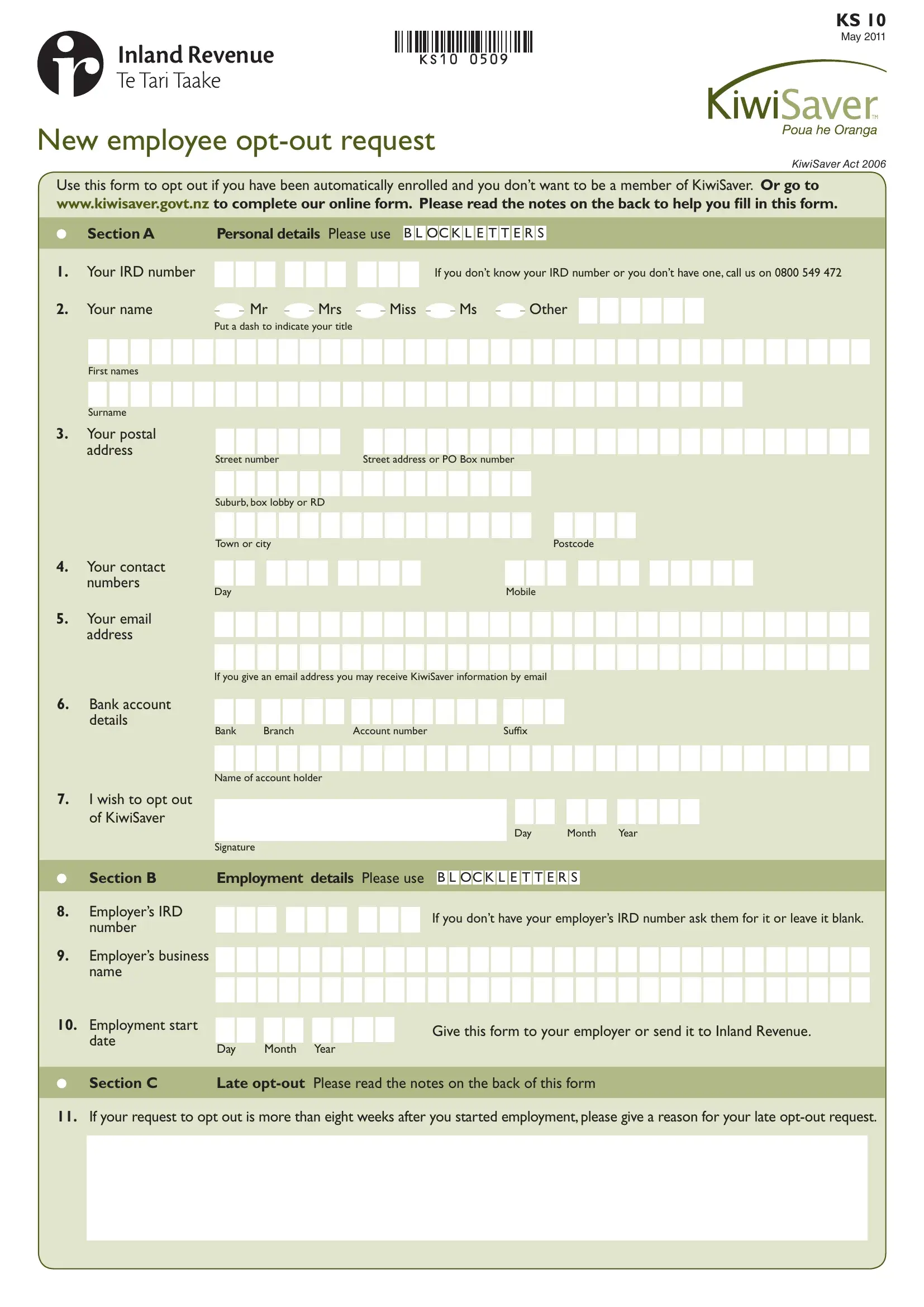

This form requires specific info to be entered, thus ensure that you take whatever time to fill in what is expected:

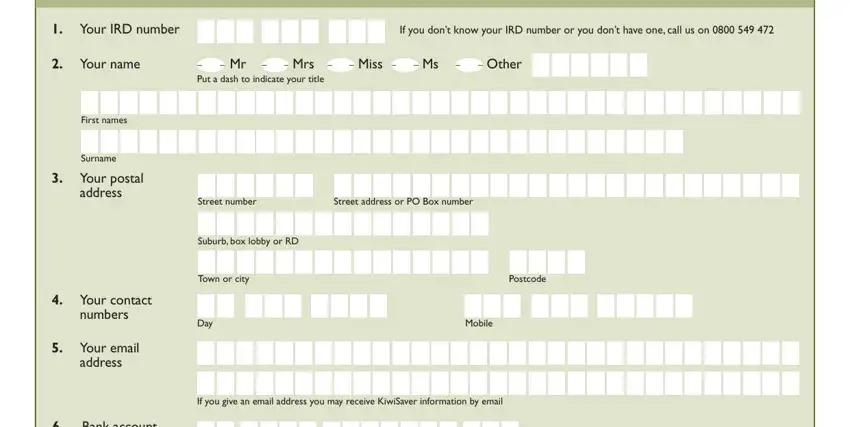

1. You will want to fill out the ks10 printable form accurately, thus be attentive when filling out the areas that contain all these blanks:

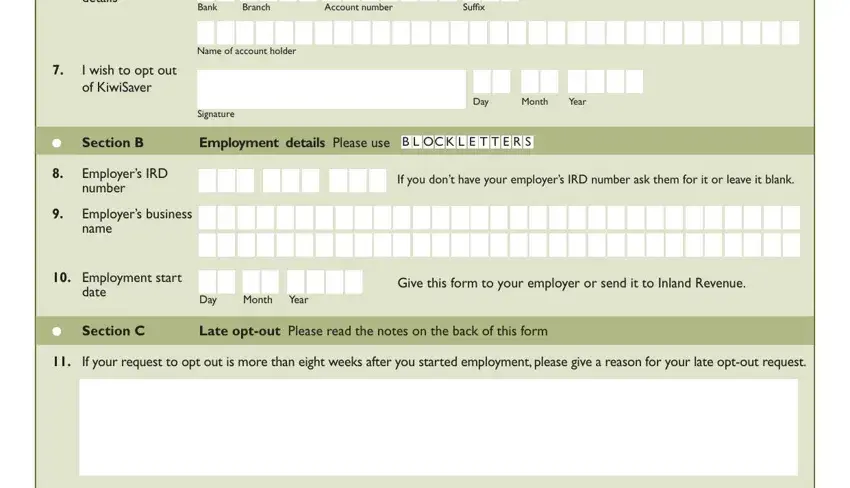

2. Once your current task is complete, take the next step – fill out all of these fields - Bank account, details, I wish to opt out of KiwiSaver, Bank Branch, Account number, Sufix, Name of account holder, Signature, Day, Month, Year, Section B, Employment details Please use B L, Employers IRD number, and Employers business name with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

When it comes to Sufix and Employers business name, make sure that you don't make any errors here. These are definitely the most important ones in this form.

Step 3: You should make sure your details are accurate and click "Done" to progress further. Get hold of the ks10 printable form the instant you sign up for a 7-day free trial. Easily get access to the pdf file in your personal account page, with any modifications and changes being automatically synced! Here at FormsPal, we do everything we can to make sure all of your information is stored secure.