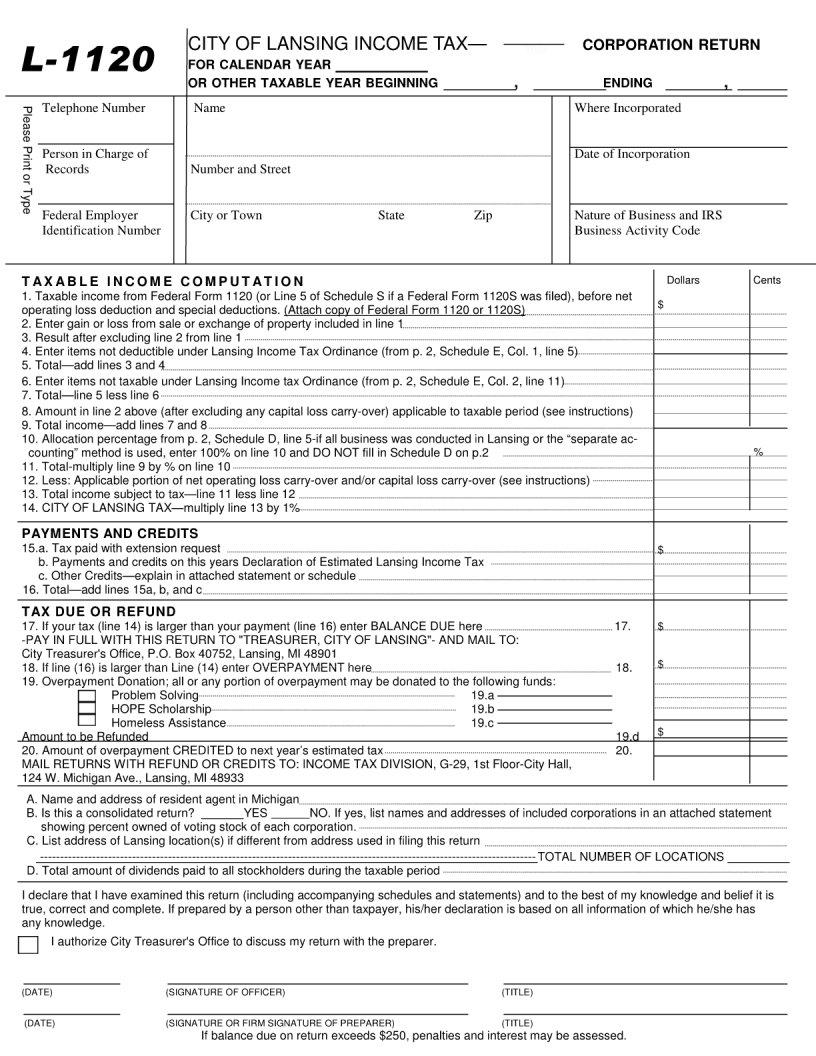

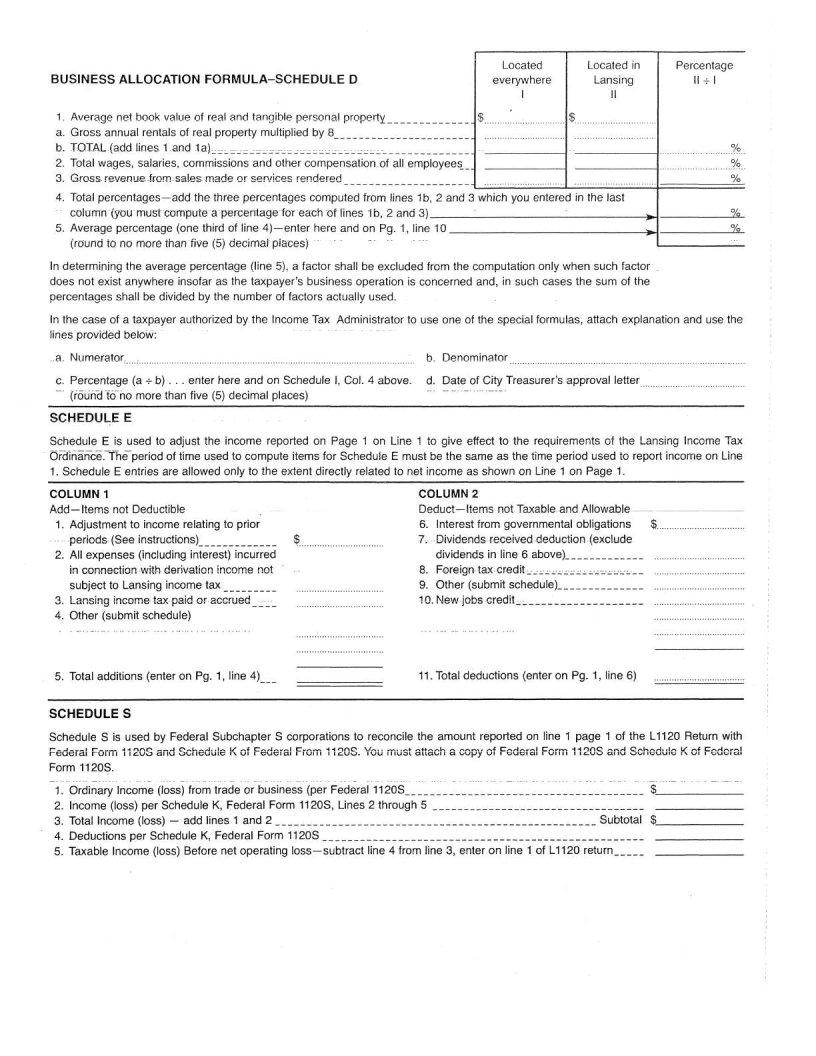

The intricacies of navigating legal paperwork often overwhelm individuals, especially when dealing with taxes, which is where the L 1120 form steps in as a critical document for many. Serving as a fundamental piece in the financial and operational reporting of certain entities, this form is tasked with the heavy lifting of consolidating and presenting crucial data to relevant tax authorities. Its primary purpose extends beyond mere compliance; it aids in ensuring that organizations maintain transparency with their financial dealings, laying out profits, losses, and various deductions with precision. The role of the L 1120 form becomes even more significant considering its implications on an entity's tax obligations and potential refunds. Mastery of this form, therefore, not only eases the administrative burden on entities but also carves a path toward judicious financial management and planning. The nuances packed within each section of the L 1120 form demand careful attention to detail, making it imperative for filers to approach its completion with both knowledge and diligence. Its comprehensive nature, designed to capture an entity's financial stature comprehensively, underscores the form's importance in the larger tapestry of financial and legal responsibilities that entities must navigate.

| Question | Answer |

|---|---|

| Form Name | L 1120 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | city of lansing tax form, city of lansing income tax forms 2018, city of lansing tax forms 2019, east lansing mi tax form |