You may fill out form 618 effectively with our online tool for PDF editing. To have our editor on the leading edge of efficiency, we work to implement user-oriented capabilities and enhancements on a regular basis. We are routinely looking for feedback - play a pivotal part in reshaping PDF editing. Getting underway is simple! All you need to do is stick to the following simple steps below:

Step 1: Simply press the "Get Form Button" at the top of this page to open our pdf editor. There you will find all that is required to work with your file.

Step 2: Once you access the file editor, you'll see the document prepared to be filled out. Besides filling in various blanks, you could also do other actions with the form, particularly writing custom text, changing the original text, adding images, signing the document, and more.

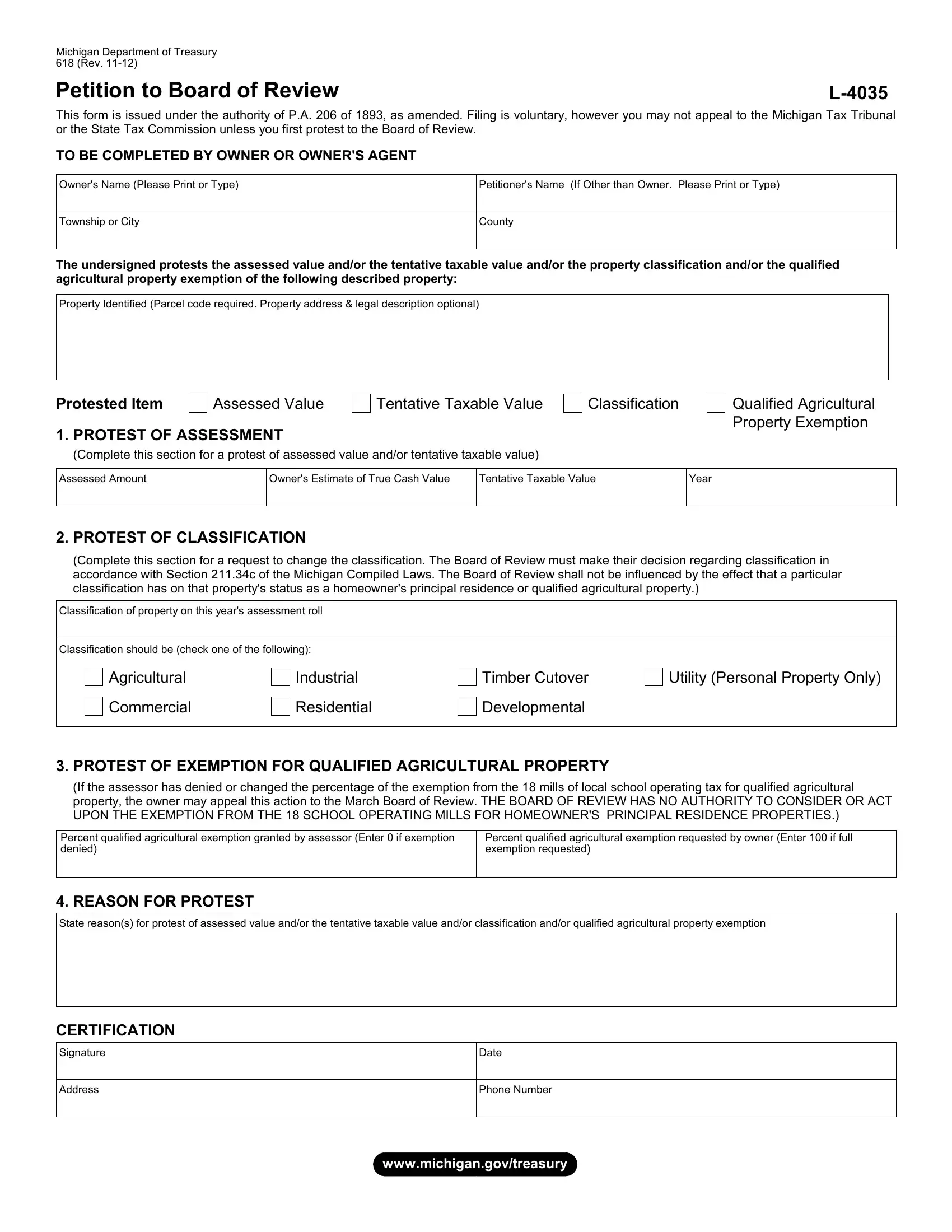

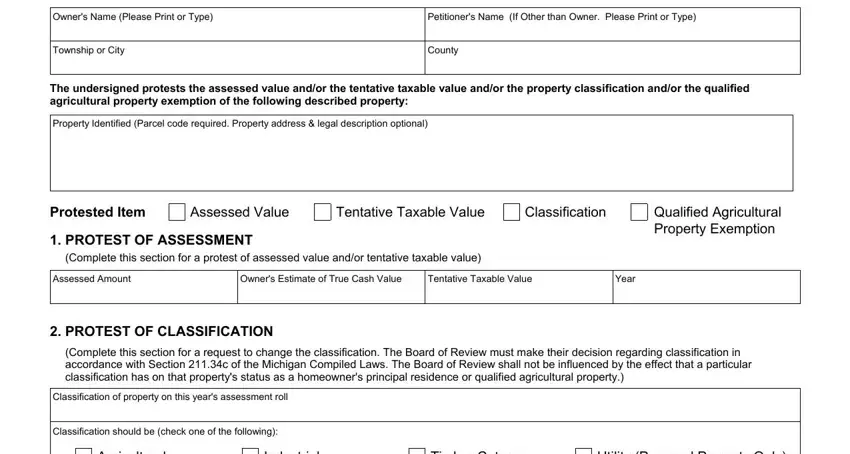

When it comes to blank fields of this specific PDF, here is what you should consider:

1. Fill out your form 618 with a number of necessary fields. Note all the information you need and be sure there is nothing neglected!

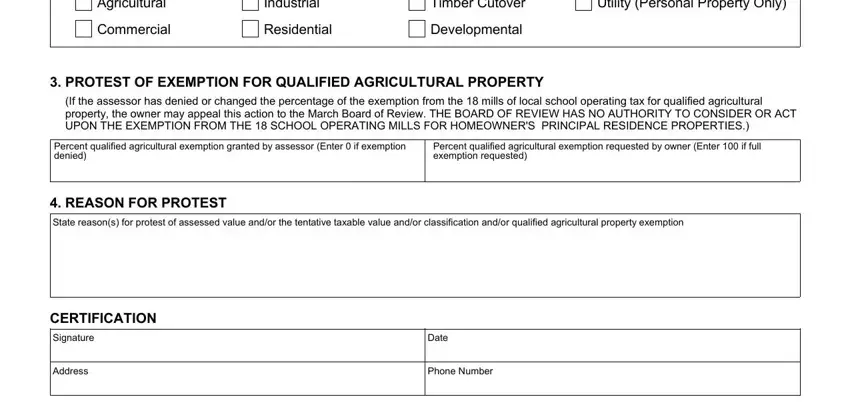

2. Just after performing the previous section, go to the next part and enter all required details in all these blank fields - Agricultural, Commercial, Industrial, Residential, Timber Cutover, Utility Personal Property Only, Developmental, PROTEST OF EXEMPTION FOR, If the assessor has denied or, Percent qualified agricultural, Percent qualified agricultural, REASON FOR PROTEST, State reasons for protest of, CERTIFICATION, and Signature.

It's simple to make errors when filling out your If the assessor has denied or, thus be sure you go through it again before you decide to send it in.

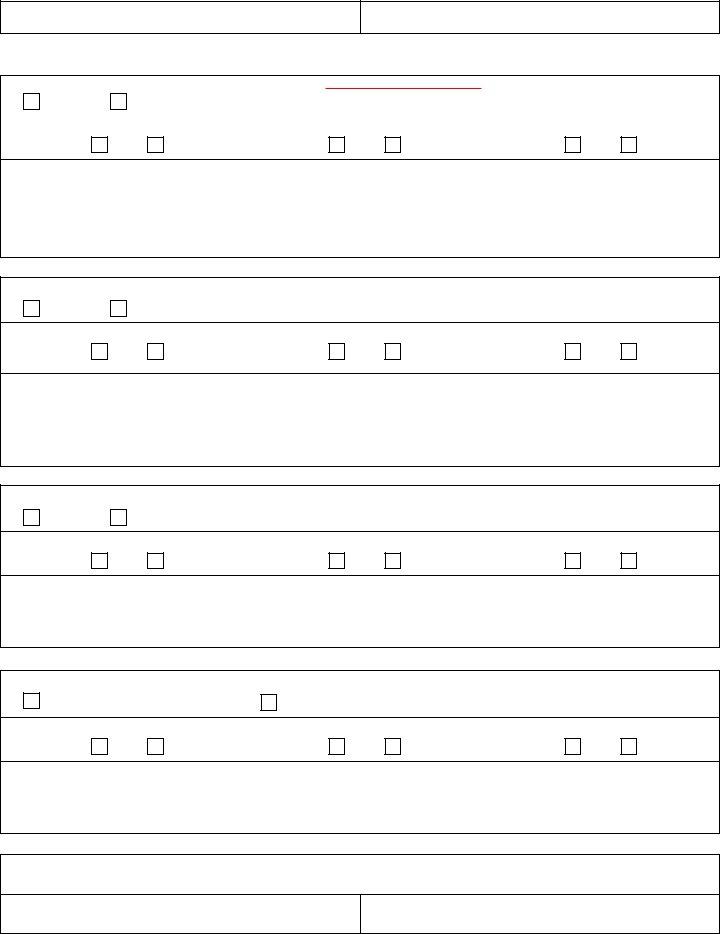

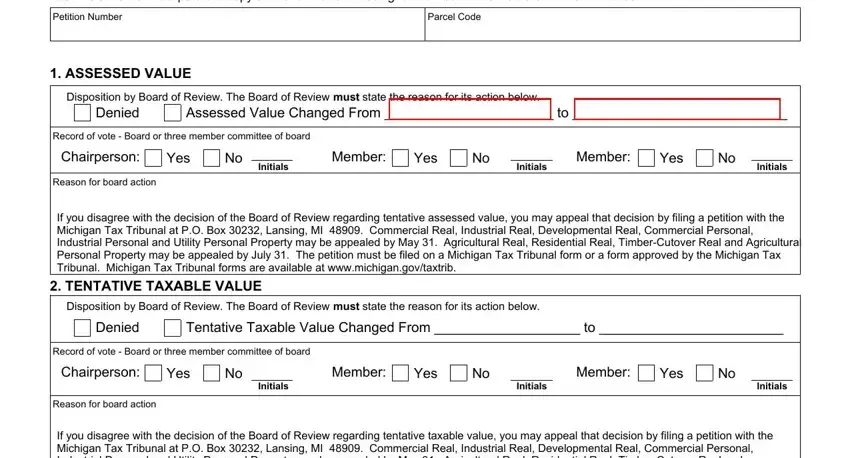

3. This next part should be pretty uncomplicated, Form Page FOR BOARD OF REVIEW, Petition Number, Parcel Code, ASSESSED VALUE, Disposition by Board of Review The, Denied, Assessed Value Changed From to, Record of vote Board or three, Chairperson, Yes, Initials, Member, Yes, Initials, and Member - all of these fields has to be filled out here.

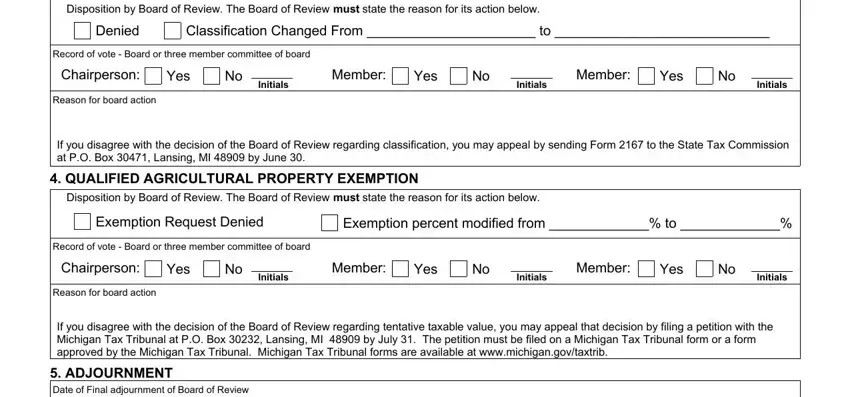

4. The fourth subsection arrives with these particular blanks to enter your details in: Disposition by Board of Review The, Denied, Classification Changed From to, Record of vote Board or three, Chairperson, Yes, Initials, Member, Yes, Initials, Member, Yes, Initials, Reason for board action, and If you disagree with the decision.

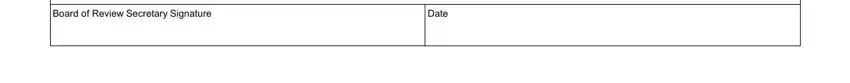

5. When you draw near to the last parts of this document, you'll find several extra points to complete. Mainly, Board of Review Secretary Signature, and Date should be filled out.

Step 3: Prior to moving on, ensure that all blank fields were filled in properly. Once you are satisfied with it, click “Done." Download your form 618 the instant you register online for a free trial. Conveniently view the pdf form from your personal account, together with any modifications and adjustments automatically saved! At FormsPal.com, we aim to guarantee that all of your details are stored protected.