Handling PDF documents online is certainly super easy with our PDF tool. Anyone can fill out La R 1203 Form here painlessly. To retain our editor on the cutting edge of efficiency, we strive to integrate user-driven features and enhancements regularly. We are routinely looking for feedback - play a pivotal role in reshaping the way you work with PDF files. To get the process started, go through these basic steps:

Step 1: Simply click the "Get Form Button" in the top section of this page to access our pdf form editing tool. This way, you will find everything that is needed to fill out your document.

Step 2: With this handy PDF editing tool, you'll be able to accomplish more than simply fill in blank form fields. Try all the features and make your forms appear high-quality with custom textual content put in, or modify the original content to excellence - all that comes with the capability to add your own photos and sign it off.

In order to fill out this PDF form, be sure you provide the information you need in each and every field:

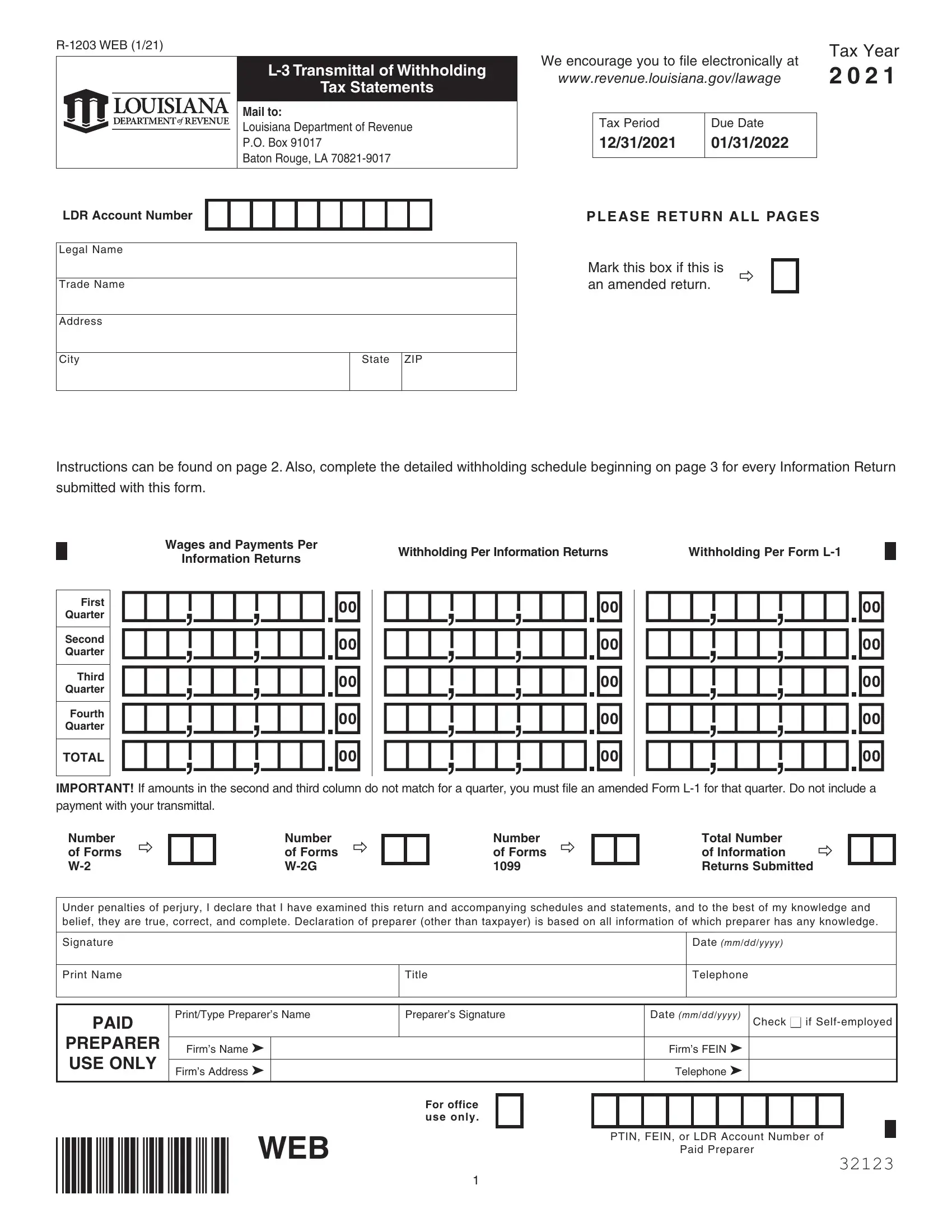

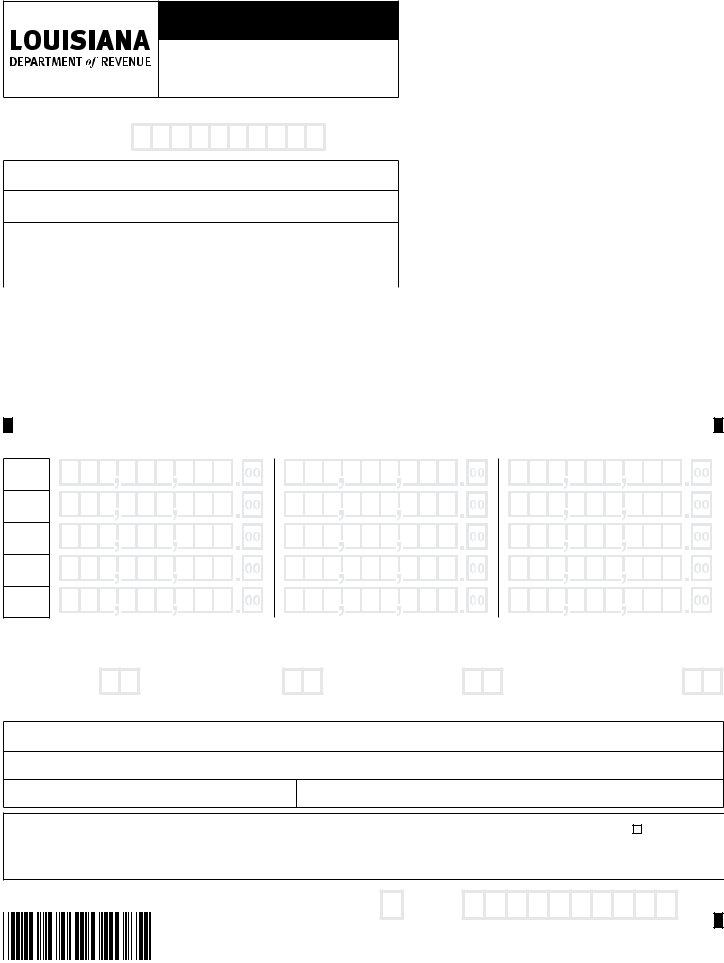

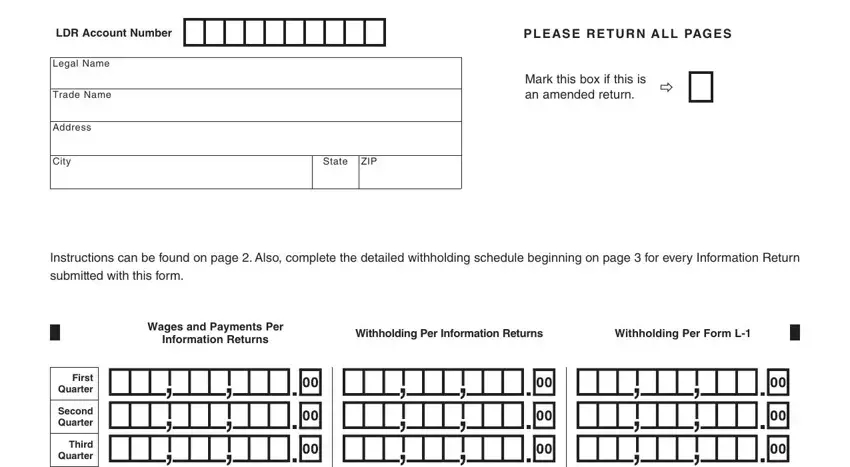

1. To begin with, while filling out the La R 1203 Form, start with the part that has the following blanks:

2. Now that this segment is done, it is time to include the essential particulars in Fourth Quarter, TOTAL, IMPORTANT If amounts in the second, Number of Forms W, Number of Forms WG, Number of Forms, Total Number of Information, Under penalties of perjury I, Signature, Print Name, PAID, PREPARER USE ONLY, Title, Date mmddyyyy, and Telephone so you're able to move forward further.

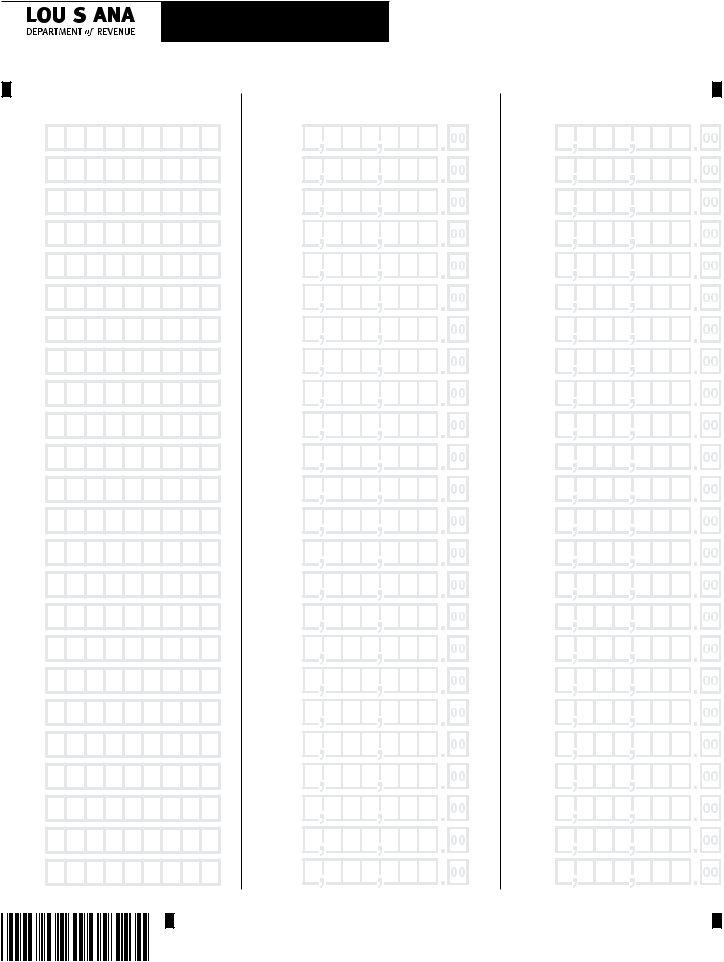

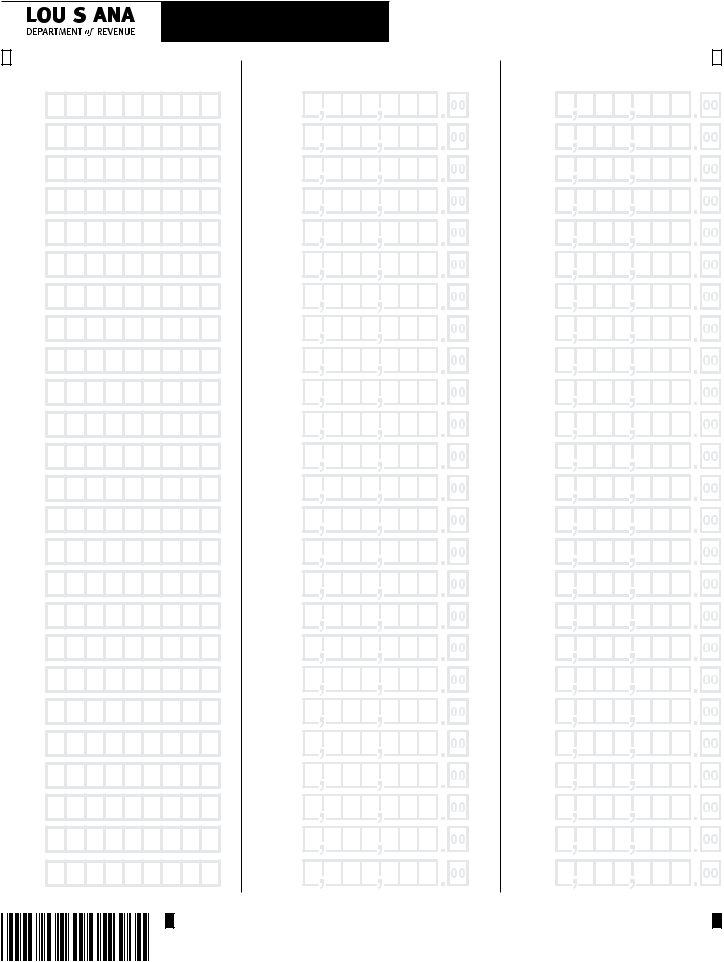

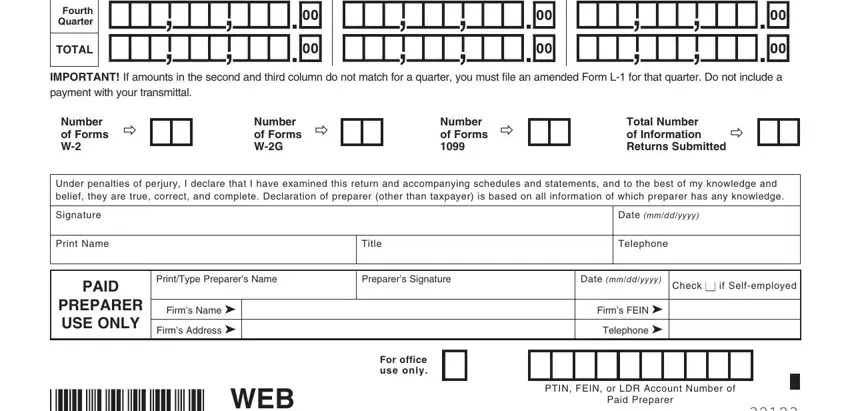

3. Completing L Transmittal of Withholding, LDR Account Number, Schedule, Tax Year, Complete the following table below, Social Security Number SSN, Louisiana State Wages or Payments, and Louisiana State Income Tax Withheld is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

It is easy to get it wrong while filling out the Louisiana State Wages or Payments, so make sure that you reread it before you'll send it in.

4. Filling in is key in this section - make certain that you don't rush and fill in every field!

5. To wrap up your document, this final part has some extra blank fields. Filling out WEB is going to wrap up the process and you will be done before you know it!

Step 3: Immediately after rereading the form fields you have filled in, click "Done" and you're done and dusted! Right after getting afree trial account with us, it will be possible to download La R 1203 Form or send it via email right away. The PDF will also be readily accessible through your personal account page with your every change. We don't share the information you provide while working with forms at our site.