With the help of the online editor for PDFs by FormsPal, you are able to fill out or modify sample of sale agreement in nigeria here and now. Our development team is relentlessly endeavoring to enhance the tool and insure that it is much faster for clients with its multiple features. Make use of present-day innovative opportunities, and find a heap of emerging experiences! Starting is effortless! All you should do is adhere to these easy steps directly below:

Step 1: Simply click the "Get Form Button" above on this site to launch our pdf editor. Here you'll find everything that is needed to fill out your document.

Step 2: The tool will let you work with almost all PDF files in a range of ways. Transform it with any text, correct original content, and add a signature - all at your convenience!

It will be an easy task to complete the pdf with our detailed guide! Here's what you should do:

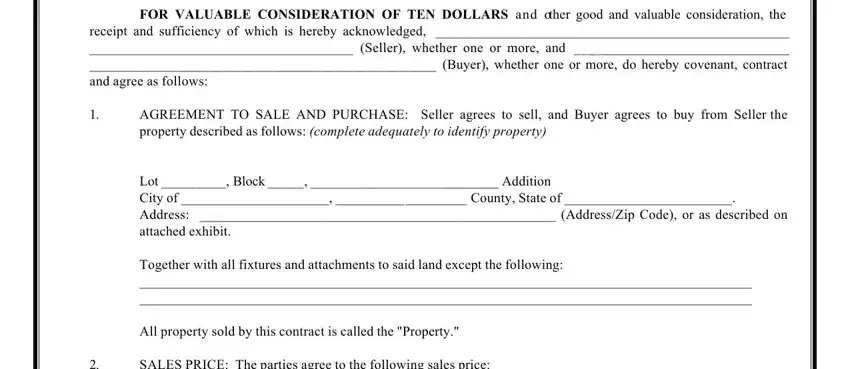

1. You should fill out the sample of sale agreement in nigeria properly, thus be careful while filling in the areas that contain all these fields:

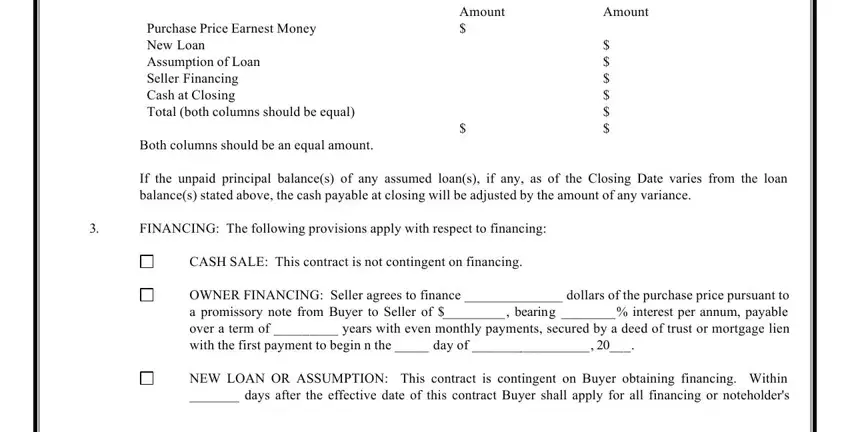

2. Just after performing the previous part, head on to the subsequent step and complete the necessary particulars in these fields - Purchase Price Earnest Money New, Both columns should be an equal, Amount, Amount, If the unpaid principal balances, FINANCING The following provisions, CASH SALE This contract is not, OWNER FINANCING Seller agrees to, and NEW LOAN OR ASSUMPTION This.

3. Through this step, examine Buyer Initials, and Seller Initials. Each of these should be filled in with utmost awareness of detail.

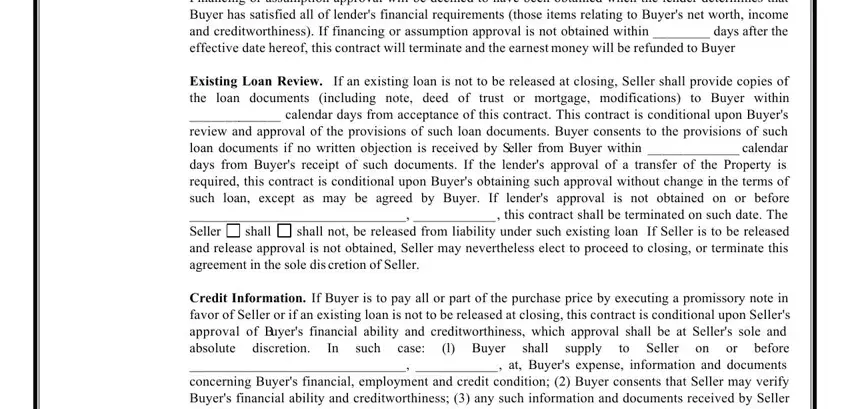

4. The next section needs your input in the subsequent areas: FORM USB approval of any, Existing Loan Review If an, shall, such, case, Credit Information If Buyer is to, l Buyer, supply, and shall. Ensure you give all of the required info to move forward.

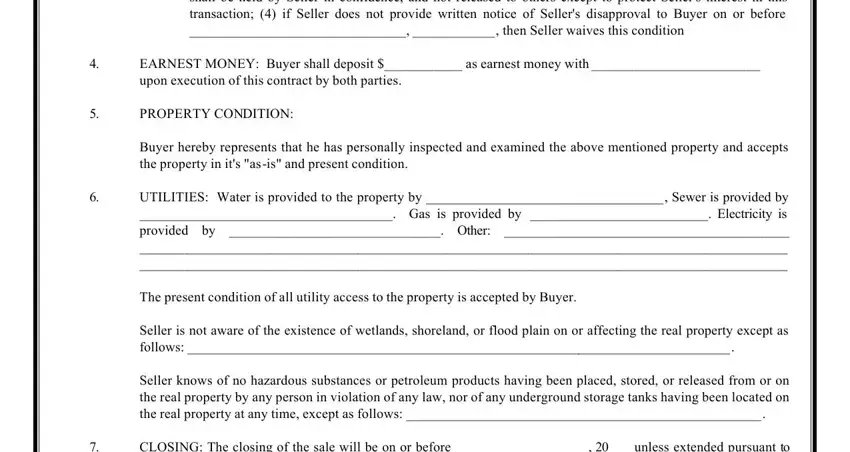

5. To conclude your document, the last segment incorporates a couple of extra fields. Typing in Credit Information If Buyer is to, EARNEST MONEY Buyer shall deposit, PROPERTY CONDITION, Buyer hereby represents that he, UTILITIES Water is provided to the, The present condition of all, Seller is not aware of the, Seller knows of no hazardous, and CLOSING The closing of the sale will conclude the process and you can be done very fast!

Always be very mindful while completing EARNEST MONEY Buyer shall deposit and The present condition of all, because this is the section where a lot of people make mistakes.

Step 3: Ensure that the information is accurate and then just click "Done" to continue further. Join us today and immediately use sample of sale agreement in nigeria, set for downloading. Every last modification you make is conveniently kept , meaning you can change the file at a later time if necessary. Here at FormsPal.com, we strive to ensure that all your details are maintained private.