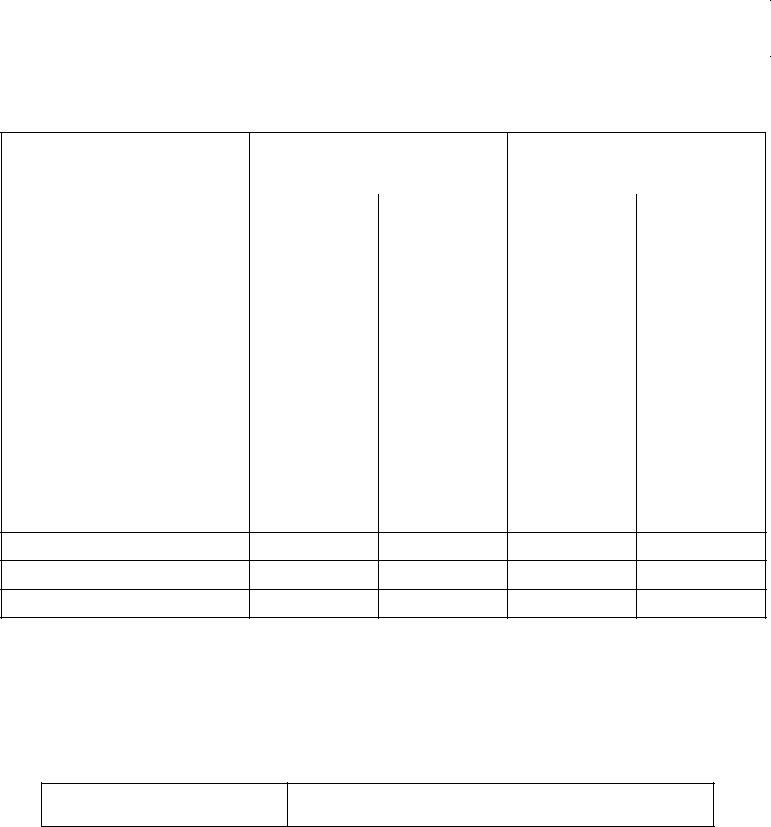

Navigating the regulatory pathways for businesses engaging in the sale of wine in Michigan requires familiarity with specific documentation, like the LCC 3890 form, mandated by the Michigan Department of Licensing and Regulatory Affairs through the Michigan Liquor Control Commission (MLCC). This essential document, titled the Michigan Wine Tax Report, serves as a monthly or quarterly declaration, depending on the nature of the business, to account for wine sales and the applicable taxes due. By outlining general information about the licensee, the reporting period, and detailed tax calculations based on wine volume and strength, the form ensures adherence to state tax obligations. Completion of this form, due on the 15th day following the reporting period, is not just a legal requirement but a testament to a business's commitment to compliance, with potential penalties for late or incorrect submissions. The form further simplifies tax reporting through a structured breakdown of wine categories and a clear calculation methodology for determining the tax owed, augmented by dire warnings of fines, interest penalties, or even license revocation for non-compliance, thereby emphasizing the importance of accuracy and timeliness in fulfilling state tax obligations.

| Question | Answer |

|---|---|

| Form Name | Lcc 3890 Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | licensee, licensees, michigan wine tax report lcc3890, 15th |

Michigan Department of Licensing and Regulatory Affairs

MICHIGAN LIQUOR CONTROL COMMISSION (MLCC)

7150 Harris Drive, P.O. Box 30005 - Lansing, Michigan

MICHIGAN WINE TAX REPORT

1. General Information |

|

2.Reporting Period |

4. Verification of Tax Report |

|

Name: |

|

Month or Qtr/Year: |

I declare that the information in this report is correct. |

|

|

|

|

______________________________ |

|

Street: |

|

|

||

|

|

|

Signature |

|

City, State, Zip: |

|

3. License No: |

|

|

|

______________________________ |

|||

|

|

|

Title |

Date |

Business Phone: ( |

) |

|

||

|

|

|

||

|

|

|

|

|

INSTRUCTIONS

This report MUST be filed on or before the 15th day of the month following the reporting period whether or not any transactions have occurred. Reports or payments postmarked after the 15th of the reporting period will be subject to a $25 late charge and 1% interest.

[See back for further instructions.]

5. Case/Liter Tally |

|

16% OR LESS |

|

OVER 16% |

Pack Size |

Liters/Case |

Tax = $0.135/Liter |

|

Tax = $0.20/Liter |

|

|

|

||

|

Cases |

Total Liters |

Cases |

Total Liters |

|

|

|

|

|

4/5 Liter |

20 |

|

|

|

|

|

|

|

|

4/4 Liter |

16 |

|

|

|

|

|

|

|

|

4/3 Liter |

12 |

|

|

|

|

|

|

|

|

6/1.5 Liter |

9 |

|

|

|

|

|

|

|

|

12/1 Liter |

12 |

|

|

|

|

|

|

|

|

12/750 ML |

9 |

|

|

|

|

|

|

|

|

6/750 ML |

4.5 |

|

|

|

|

|

|

|

|

24/375 ML |

9 |

|

|

|

|

|

|

|

|

12/375 ML |

4.5 |

|

|

|

|

|

|

|

|

24/355 ML |

8.52 |

|

|

|

|

|

|

|

|

48/187 |

8.98 |

|

|

|

|

|

|

|

|

24/187 |

4.49 |

|

|

|

TOTALS

6. TAX CALCULATION |

A. Total liters of wine 16% or less |

__________ X $0.135 = $ ___________________ |

|

B. Total liters of wine over 16% |

__________ X $0.20 = ___________________ |

|

C. LESS: MLCC Authorized Credit |

___________________ |

|

D. PLUS: PENALTY |

___________________ |

|

E. TOTAL TAX DUE |

$ ___________________ |

|

|

|

Cashier Validation |

|

|

LARA is an equal opportunity employer/program.

Auxiliary aids, services and other reasonable accommodations are available upon request to individuals with disabilities.

INSTRUCTIONS

Who must file: Any Michigan winery that produces and sells wine in Michigan and any out of state licensee (Out State Seller of Wine) who is authorized by the Michigan Liquor Control Commission (MLCC) to either ship or import wine into the State of Michigan. The Commission designates the winery or person that ships or imports the wine into Michigan as the taxpayer.

When to file: Taxpayers, with the exception of licensed direct shippers, must file monthly reports FOR ALL MONTHS EVEN

WHEN THERE IS NO ACTIVITY. In this instance, indicate ‘No Activity’ on the report and send it along to the MLCC. All reports

and payments must be postmarked no later than the 15th of the month following the reporting period. Example: Tax reports for January must be postmarked by February 15th.

Direct Shippers file QUARTERLY. Tax reports for direct shippers must be postmarked by April 15th, July 15th, October 15th, and January 15th.

What to include: Direct Shipper licensees must submit, along with your report, copies of all invoices for shipments made directly to the consumers in Michigan. Ship Compliant reports are acceptable instead of individual invoices.

Out State Seller of Wine licensees must submit, along with your report, copies of all invoices for wine either shipped or imported into the State of Michigan.

Penalties: Any report postmarked after the 15th of the month following the reporting period, missing reports, or missing tax payments will be subject to a $25 late charge and a 1% per month interest charge until the taxes are paid.

ALL ITEMS REFER TO CORRESPONDING NUMBER ON THE FRONT OF FORM

BOX 1 Enter licensee name, business address, and telephone number

BOX 2 Enter reporting period and year

BOX 3 Enter license number

BOX 4 Sign the report, enter your title and today’s date

BOX 5 Locate appropriate pack size and enter total cases shipped in the column labeled

‘Cases’. Use the blank boxes for pack sizes that are not preprinted on the form. Multiply ‘Case’ by corresponding ‘Liters/Case’.

Enter ‘Total Liters’ as a result of the calculations above.

BOX 6

A.) Sum all totals in columns labeled ‘Total Liters, 16% or less’ and enter this amount on Line A. Multiply this amount by the tax rate of .135. Enter this amount in the space provided.

B.) Sum all totals in columns labeled ‘Total Liters, over 16%’ and enter this amount on Line B. Multiply this amount by the tax rate of .20. Enter this amount in the space provided.

C.) Enter amount of any authorized credits on Line C. (Taxpayers must have Commission approval prior to taking a credit on the tax report.

D.) Enter any penalties that you owe on Line D.

E.) Subtract Line C from the sum of Lines A and B. Add Line D to this amount and enter the ‘Total Tax Due’ on Line E.

QUESTIONS? Call Sandy Konieczny at