It's quite simple to prepare the louisiana tax exempt certificate. Our PDF tool was intended to be assist you to fill in any form swiftly. These are the basic steps to follow:

Step 1: Press the "Get Form Now" button to get going.

Step 2: When you have accessed the louisiana tax exempt certificate editing page you may discover all the actions you can conduct about your document within the upper menu.

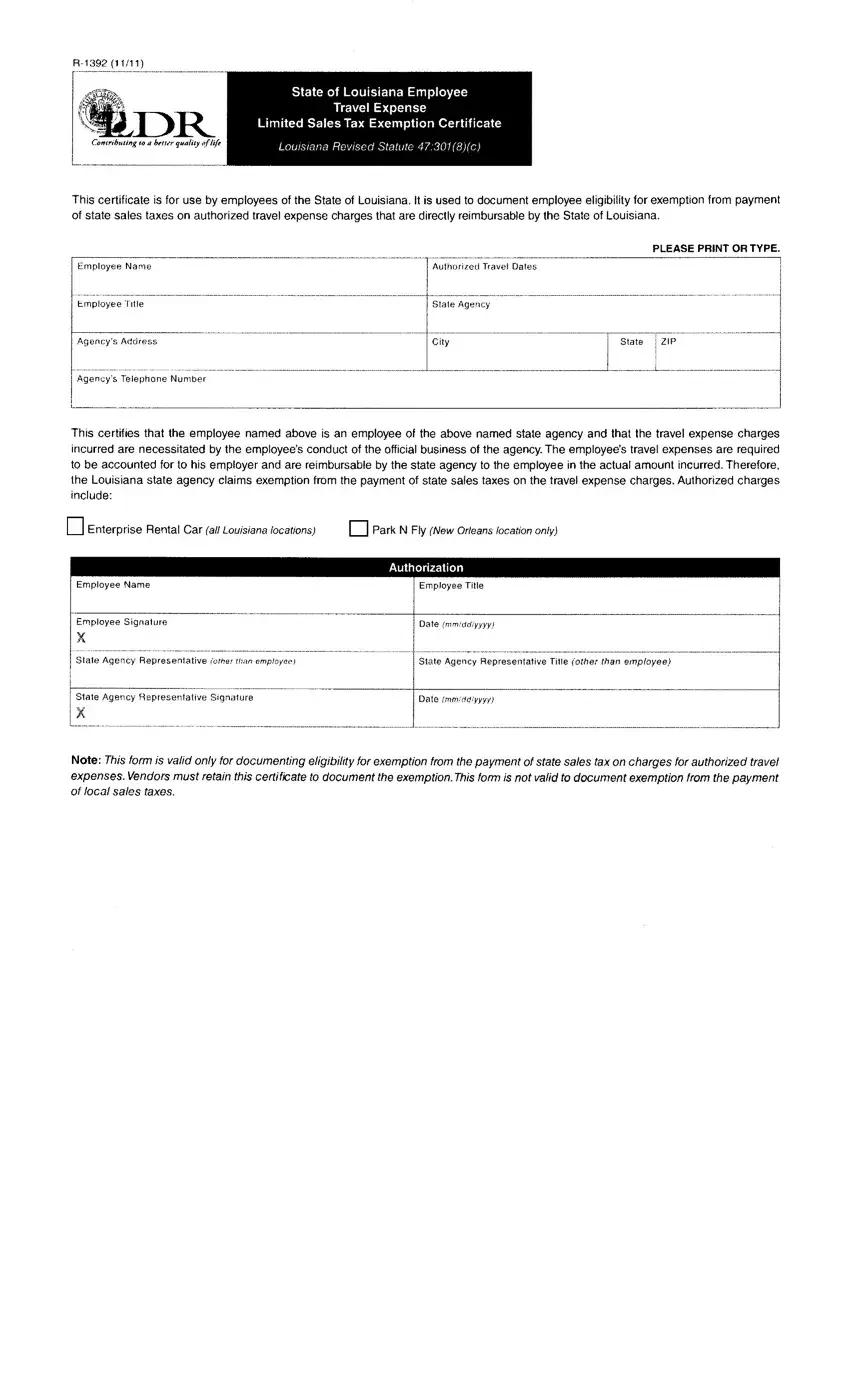

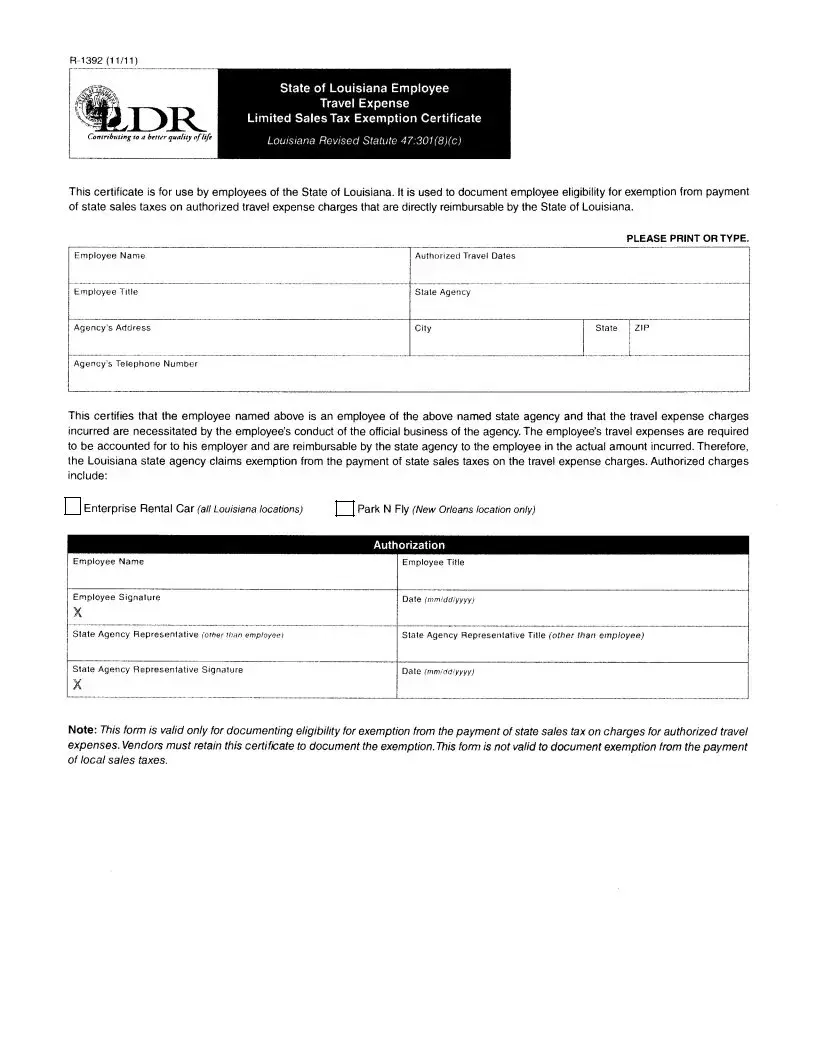

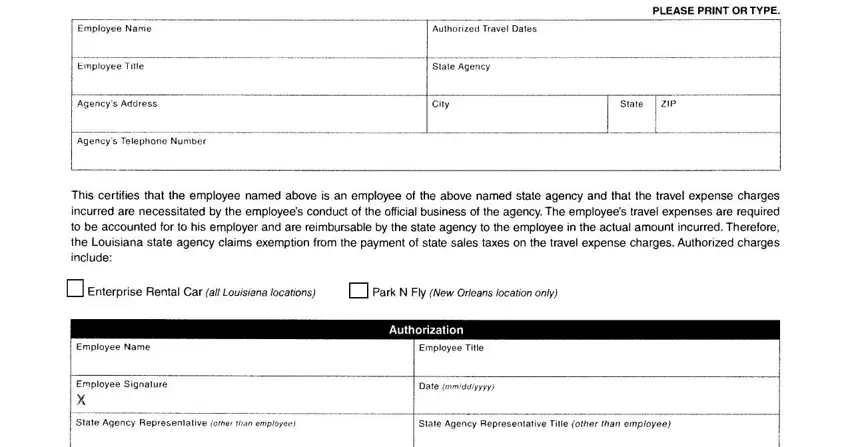

The PDF template you desire to fill out will include the next areas:

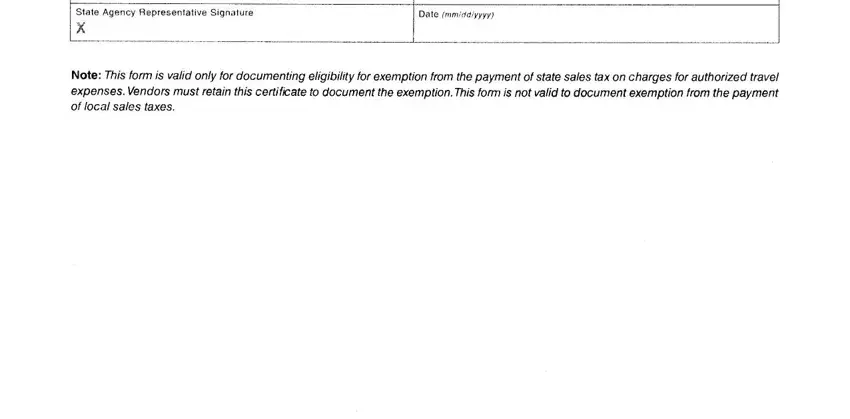

Put down the information in the Note This form is valid only for field.

Step 3: Press the Done button to confirm that your finished document is available to be transferred to every device you select or sent to an email you specify.

Step 4: It's going to be safer to create duplicates of the file. You can rest easy that we will not display or see your details.