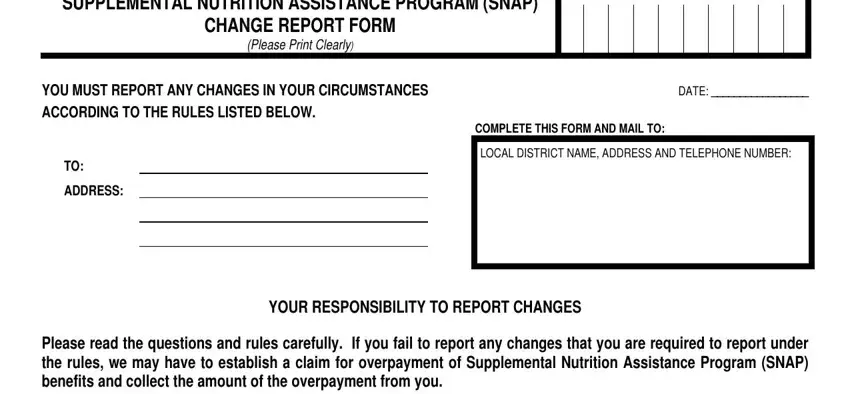

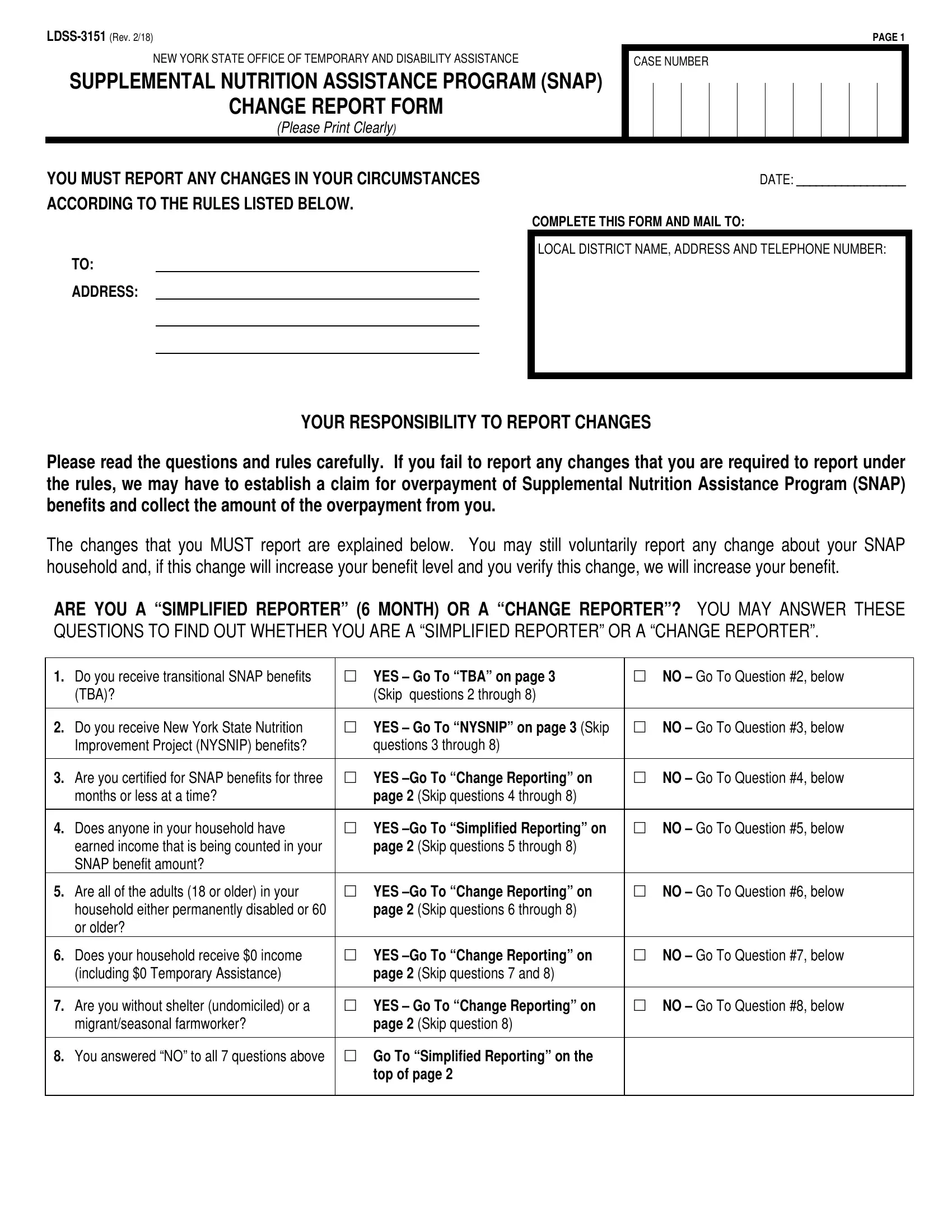

LDSS-3151 (Rev. 2/18)PAGE 1

NEW YORK STATE OFFICE OF TEMPORARY AND DISABILITY ASSISTANCE |

CASE NUMBER |

|

SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM (SNAP)

CHANGE REPORT FORM

(Please Print Clearly)

YOU MUST REPORT ANY CHANGES IN YOUR CIRCUMSTANCES ACCORDING TO THE RULES LISTED BELOW.

TO:

ADDRESS:

DATE: _________________

COMPLETE THIS FORM AND MAIL TO:

LOCAL DISTRICT NAME, ADDRESS AND TELEPHONE NUMBER:

YOUR RESPONSIBILITY TO REPORT CHANGES

Please read the questions and rules carefully. If you fail to report any changes that you are required to report under the rules, we may have to establish a claim for overpayment of Supplemental Nutrition Assistance Program (SNAP) benefits and collect the amount of the overpayment from you.

The changes that you MUST report are explained below. You may still voluntarily report any change about your SNAP household and, if this change will increase your benefit level and you verify this change, we will increase your benefit.

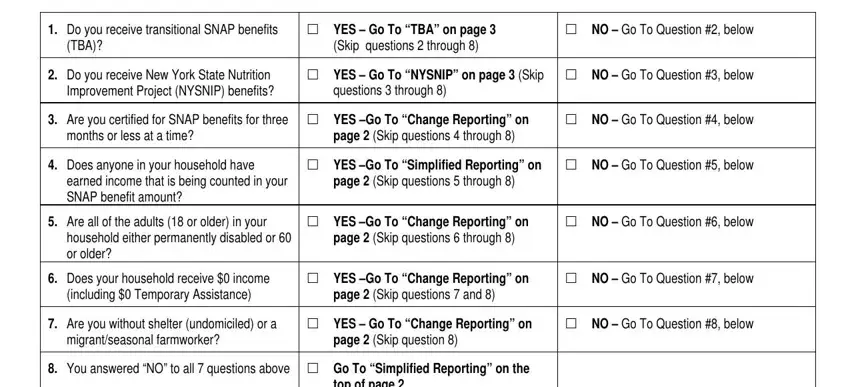

ARE YOU A “SIMPLIFIED REPORTER” (6 MONTH) OR A “CHANGE REPORTER”? YOU MAY ANSWER THESE QUESTIONS TO FIND OUT WHETHER YOU ARE A “SIMPLIFIED REPORTER” OR A “CHANGE REPORTER”.

1. |

Do you receive transitional SNAP benefits |

YES – Go To “TBA” on page 3 |

NO – Go To Question #2, below |

|

(TBA)? |

(Skip questions 2 through 8) |

|

|

|

|

|

2. |

Do you receive New York State Nutrition |

YES – Go To “NYSNIP” on page 3 (Skip |

NO – Go To Question #3, below |

|

Improvement Project (NYSNIP) benefits? |

questions 3 through 8) |

|

|

|

|

|

3. |

Are you certified for SNAP benefits for three |

YES –Go To “Change Reporting” on |

NO – Go To Question #4, below |

|

months or less at a time? |

page 2 (Skip questions 4 through 8) |

|

|

|

|

|

4. |

Does anyone in your household have |

YES –Go To “Simplified Reporting” on |

NO – Go To Question #5, below |

|

earned income that is being counted in your |

page 2 (Skip questions 5 through 8) |

|

|

SNAP benefit amount? |

|

|

5. |

Are all of the adults (18 or older) in your |

YES –Go To “Change Reporting” on |

NO – Go To Question #6, below |

|

household either permanently disabled or 60 |

page 2 (Skip questions 6 through 8) |

|

|

or older? |

|

|

6. |

Does your household receive $0 income |

YES –Go To “Change Reporting” on |

NO – Go To Question #7, below |

|

(including $0 Temporary Assistance) |

page 2 (Skip questions 7 and 8) |

|

|

|

|

|

7. |

Are you without shelter (undomiciled) or a |

YES – Go To “Change Reporting” on |

NO – Go To Question #8, below |

|

migrant/seasonal farmworker? |

page 2 (Skip question 8) |

|

|

|

|

|

8. |

You answered “NO” to all 7 questions above |

Go To “Simplified Reporting” on the |

|

|

|

top of page 2 |

|

|

|

|

|

LDSS-3151 (Rev. 2/18) |

PAGE 2 |

SIMPLIFIED REPORTING RULES: As a SNAP household under the “Simplified Reporting” rules, you are only required to report changes at the time of your next recertification, except for the following three situations:

•If your household’s gross monthly income exceeds 130% of the poverty level, you MUST report this monthly amount to your social services district by telephone, in writing, or in person within 10 days after the end of the calendar month in which you exceed the 130% level. Gross income is the amount of income before taxes and other deductions are taken out, not the amount you receive when you cash your check. We must use the gross income in figuring your eligibility for SNAP benefits. Your worker will explain what 130% of the poverty level means for a family of your size. Any other kind of income that you receive besides earnings must be added to your gross earned income to know if you are over 130% of the poverty level. Examples of other sources of income that count include child support you receive, Unemployment Insurance, Temporary Assistance (TA) payments, Workers Compensation, Social Security Benefits, Supplemental Security Income (SSI) and private disability payments.

If you fail to report that your gross income is above 130% of the poverty level in any calendar month, all benefits received after that month may be considered an overpayment. This is true even if your gross income falls below the 130% poverty level in a future month.

•If your household’s certification period is longer than 6 months: At a six-month checkpoint into your certification period, you will receive a Periodic Report form that you MUST return within ten days after you receive the form. If your household has any of the changes listed below, you MUST report them on the report form that is sent to you at the six-month checkpoint.

List of Changes you must report at the six-month checkpoint:

•Changes in any source of income for anyone in your household

•Changes in your household’s total earned income when it goes up or down by more than $100 a month

•Changes in your household’s total unearned income from a public source such as Social Security Benefits or Unemployment Insurance Benefits when it goes up or down by more than $100 a month

•Changes in your household’s total unearned income from a private source such as Child Support Payments or Private Disability Insurance when it goes up or down by more than $100 a month

•Changes in the amount of legally obligated child support you pay to a child outside of your SNAP household

•Changes in who lives with you

•If you move, your new address and your new rent or mortgage costs, heat/air-conditioning costs and utility costs

•A new or different car, or other vehicle

•Increases in your household’s cash, stocks, bonds, money in the bank or savings institution if the total cash and savings of all household members now amounts to more than $2,250 (more than $3,500 if anyone in your household is disabled or 60 years old or older)

•Any changes in your household that would result in a penalty as described on page 6

•If anyone in your SNAP household is an Able-Bodied Adult Without Dependents (ABAWD), he/she MUST tell the district if their hours go below 80 hours each month within 10 days after the end of that month. The ABAWD can request a qualifying work activity from the district to help him/her meet the federal ABAWD requirement. If anyone in your SNAP household is an ABAWD, he/she should also report if your household has moved to an area with a federally approved ABAWD waiver or if the ABAWD believes he/she should be exempt from the ABAWD requirement.

CHANGE REPORTING RULES:

As a SNAP household under the “Change Reporting” rules, you MUST report the following changes within 10 days after the end of the month in which the change happened:

•Changes in any source of income for anyone in your household

•Changes in your household’s total earned income when it goes up or down by more than $100 a month

•Changes in your household’s total unearned income from a public source such as Social Security Benefits or Unemployment Insurance Benefits when it goes up or down by more than $100 a month

•Changes in your household’s total unearned income from a private source such as Child Support Payments or Private Disability Insurance when it goes up or down by more than $100 a month

•Changes in the amount of legally obligated child support you pay to a child outside of your SNAP household

•Changes in who lives with you

•If you move, your new address and your new rent or mortgage costs, heat/air-conditioning costs and utility costs

•A new or different car, or other vehicle

•Increases in your household’s cash, stocks, bonds, money in the bank or savings institution if the total cash and savings of all household members now amounts to more than $2,250 for a household without an elderly or permanently disabled household member or $3,500 for a household with an elderly or permanently disabled household member.

•If anyone in your SNAP household is an Able-Bodied Adult Without Dependents (ABAWD), he/she MUST tell the district if their hours go below 80 hours each month within 10 days after the end of that month. The ABAWD can request a qualifying work activity from the district to help him/her meet the federal ABAWD requirement. If anyone in your SNAP household is an ABAWD, he/she should also report if your household has moved to an area with a federally approved ABAWD waiver or if the ABAWD believes he/she should be exempt from the ABAWD requirement.

•Any changes in your household that would result in a penalty as described on page 6

LDSS-3151 (Rev. 2/18) |

PAGE 3 |

TBA CHANGE REPORTING for household in receipt of transitional benefits:

•Transitional SNAP benefits can continue for up to five months after your Temporary Assistance case closes.

•You are not required to report changes during the transition period. If you have changes that may increase your benefits you can contact your worker to file an early recertification application at any time during your transitional period to receive the increase. The increase cannot be done until a signed recertification application is filed, and the entire recertification process is completed.

•You must recertify near the end of your transitional period to see if you can continue to receive SNAP benefits after your transitional period ends. We will send you a notice reminding you of this recertification requirement. If you do not recertify, we will not send you any other notice and must close your SNAP case.

NYSNIP CHANGE REPORTING for participants in NYSNIP:

•You will receive a contact letter 24 months after you begin participation in NYSNIP that you must complete and return.

•You are not required to report changes during your certification period other than the 24-month contact letter. You may voluntarily report increases in your medical expenses, rent, heat/air-conditioning costs, or utility costs, or decreases in your income. If you report and verify these changes, you may be eligible for more SNAP benefits. You are not required to, but should report your new address if you move, so that you continue to receive any notices we send to you.

Temporary Assistance (TA) Reporting Rules: The rules listed above apply only to SNAP. If you also receive TA, you are still required to report changes for TA within 10 days of the change, on TA Eligibility Questionnaires and at recertification.

When to use this form:

This form may be used to report any required or voluntary changes. You can also use this form to report changes in the cost of caring for children or disabled adults, or changes in shelter costs even if you haven’t moved. If these expenses go up you may be eligible for more SNAP benefits.

If anyone in your SNAP household is an Able-Bodied Adult Without Dependents (ABAWD), he/she MUST tell the district if their hours go below 80 hours each month within 10 days after the end of that month. The ABAWD can request a qualifying work activity from the district to help him/her meet the federal ABAWD requirement. If anyone in your SNAP household is an ABAWD, he/she should also report if your household has moved to an area with a federally approved ABAWD waiver or if the ABAWD believes he/she should be exempt from the ABAWD requirement.

This form should be mailed, faxed or brought to the agency listed above. If for some reason you can’t mail, fax or bring in this form, you can also report the changes on-line through myBenefits.ny.gov or by calling us at the telephone number listed on Page 1 of this form.

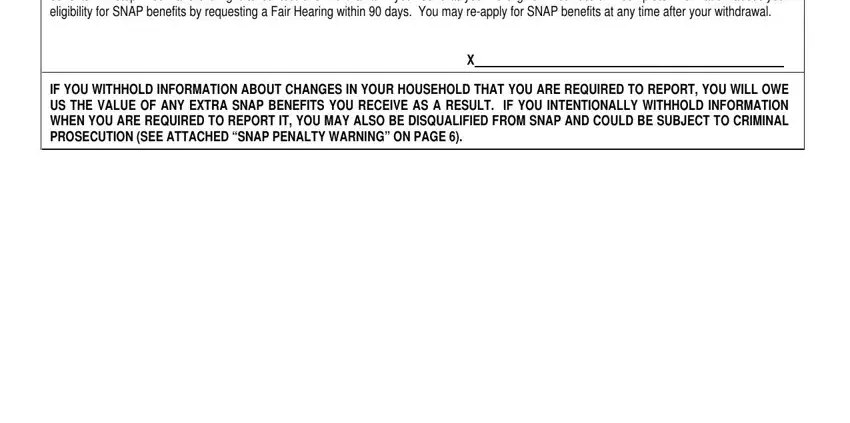

WITHDRAW FROM SNAP - If you no longer want to receive SNAP benefits, sign here to withdraw from participation in SNAP. Your SNAP benefits will stop. You have the right to contest this withdrawal if you feel that you were given incorrect or incomplete information about your eligibility for SNAP benefits by requesting a Fair Hearing within 90 days. You may re-apply for SNAP benefits at any time after your withdrawal.

X

IF YOU WITHHOLD INFORMATION ABOUT CHANGES IN YOUR HOUSEHOLD THAT YOU ARE REQUIRED TO REPORT, YOU WILL OWE US THE VALUE OF ANY EXTRA SNAP BENEFITS YOU RECEIVE AS A RESULT. IF YOU INTENTIONALLY WITHHOLD INFORMATION WHEN YOU ARE REQUIRED TO REPORT IT, YOU MAY ALSO BE DISQUALIFIED FROM SNAP AND COULD BE SUBJECT TO CRIMINAL PROSECUTION (SEE ATTACHED “SNAP PENALTY WARNING” ON PAGE 6).

LDSS-3151 (Rev. 2/18) |

PAGE 4 |

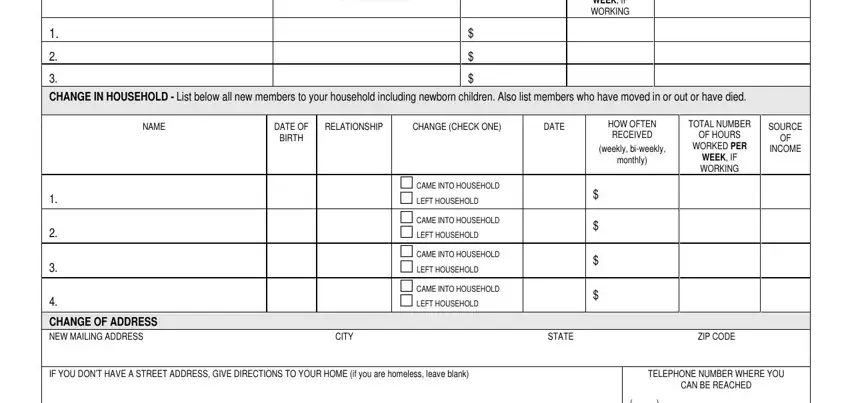

Use the Form Below to Report Changes

CHANGE IN INCOME OR SOURCE OF INCOME – If you are a Simplified Reporter, your reporting rules are explained beginning on Page 2. If you are a Change Reporter, your reporting rules are also explained on Page 2.

|

|

|

TOTAL NUMBER |

HOW OFTEN RECEIVED |

|

NAME OF EMPLOYER OR |

|

OF HOURS |

|

NAME OF PERSON RECEIVING INCOME |

NEW AMOUNT |

WORKED PER |

|

SOURCE OF INCOME |

|

|

|

WEEK, IF |

|

|

|

|

|

|

|

|

WORKING |

|

1. |

|

$ |

|

|

2. |

|

$ |

|

|

3. |

|

$ |

|

|

CHANGE IN HOUSEHOLD - List below all new members to your household including newborn children. Also list members who have moved in or out or have died.

|

NAME |

DATE OF |

RELATIONSHIP |

CHANGE (CHECK ONE) |

DATE |

HOW OFTEN |

TOTAL NUMBER |

SOURCE |

|

RECEIVED |

OF HOURS |

|

|

BIRTH |

|

|

|

OF |

|

|

|

|

|

|

WORKED PER |

|

|

|

|

|

|

(weekly, bi-weekly, |

INCOME |

|

|

|

|

|

|

WEEK, IF |

|

|

|

|

|

|

monthly) |

|

|

|

|

|

|

|

WORKING |

|

|

|

|

|

|

|

|

|

|

|

|

|

CAME INTO HOUSEHOLD |

|

$ |

|

|

|

1. |

|

|

LEFT HOUSEHOLD |

|

|

|

|

|

|

|

CAME INTO HOUSEHOLD |

|

$ |

|

|

|

2. |

|

|

LEFT HOUSEHOLD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAME INTO HOUSEHOLD |

|

$ |

|

|

|

3. |

|

|

LEFT HOUSEHOLD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAME INTO HOUSEHOLD |

|

$ |

|

|

|

4. |

|

|

LEFT HOUSEHOLD |

|

|

|

|

|

|

|

|

|

|

|

CHANGE OF ADDRESS |

|

|

|

|

|

|

|

|

NEW MAILING ADDRESS |

|

CITY |

|

STATE |

|

ZIP CODE |

|

IF YOU DON’T HAVE A STREET ADDRESS, GIVE DIRECTIONS TO YOUR HOME (if you are homeless, leave blank)

TELEPHONE NUMBER WHERE YOU

CAN BE REACHED

( )

AREA CODE

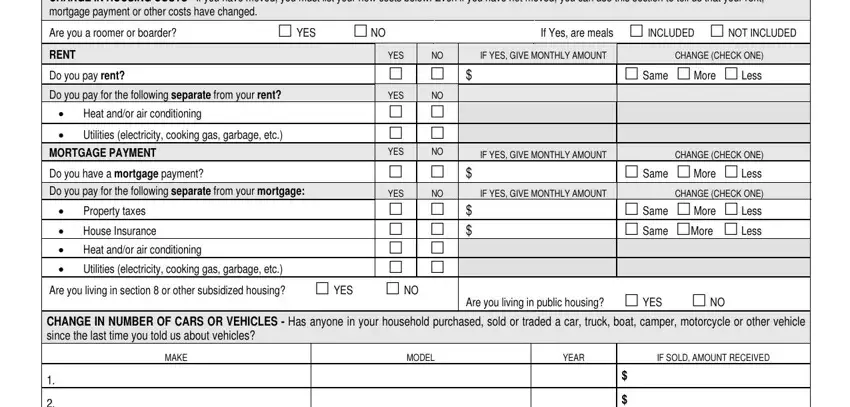

CHANGE IN HOUSING COSTS - If you have moved, you must list your new costs below. Even if you have not moved, you can use this section to tell us that your rent, mortgage payment or other costs have changed.

|

Are you a roomer or boarder? |

YES |

NO |

|

|

If Yes, are meals |

|

INCLUDED NOT INCLUDED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RENT |

|

|

|

|

|

YES |

|

|

NO |

IF YES, GIVE MONTHLY AMOUNT |

|

|

CHANGE (CHECK ONE) |

|

|

Do you pay rent? |

|

|

|

|

|

|

|

$ |

|

Same |

More |

Less |

|

|

Do you pay for the following separate from your rent? |

|

|

|

YES |

|

|

NO |

|

|

|

|

|

|

|

|

• |

Heat and/or air conditioning |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Utilities (electricity, cooking gas, garbage, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

MORTGAGE PAYMENT |

|

|

|

|

YES |

|

|

NO |

|

IF YES, GIVE MONTHLY AMOUNT |

|

|

CHANGE (CHECK ONE) |

|

|

Do you have a mortgage payment? |

|

|

|

|

|

|

|

$ |

|

Same |

More |

Less |

|

|

Do you pay for the following separate from your mortgage: |

|

|

|

YES |

|

|

NO |

|

IF YES, GIVE MONTHLY AMOUNT |

|

|

CHANGE (CHECK ONE) |

|

|

• |

Property taxes |

|

|

|

|

|

|

|

$ |

|

Same |

More |

Less |

|

|

• |

House Insurance |

|

|

|

|

|

|

|

$ |

|

Same |

More |

Less |

|

|

• |

Heat and/or air conditioning |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• |

Utilities (electricity, cooking gas, garbage, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Are you living in section 8 or other subsidized housing? |

YES |

|

|

NO |

|

|

Are you living in public housing? |

|

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHANGE IN NUMBER OF CARS OR VEHICLES - Has anyone in your household purchased, sold or traded a car, truck, boat, camper, motorcycle or other vehicle since the last time you told us about vehicles?

MAKE |

MODEL |

YEAR |

IF SOLD, AMOUNT RECEIVED |

1. |

|

|

$ |

|

|

|

2. |

|

|

$ |

|

|

|

3. |

|

|

$ |

|

|

|

LDSS-3151 (Rev. 2/18) |

PAGE 5 |

CHANGE IN SAVINGS - List the total amount of money that the members of your household now have. Include cash, savings accounts, checking accounts, stocks, bonds or other investments. You must tell us if your household savings have increased to more than $2,250 (more than $3,500 if anyone in your household is 60 years old or older or been determined to be disabled).

CHANGE IN CHILD CARE, DEPENDENT CARE COSTS OR THE AMOUNT OF CHILD SUPPORT PAID - Have your child care or dependent care costs changed? If so, you may be eligible for more SNAP benefits.

|

CHANGE (CHECK ONE) |

FOR WHOM? |

WHOM DO YOU PAY? |

NEW AMOUNT |

HOW OFTEN DO YOU PAY? |

|

|

|

|

|

|

1. |

NO LONGER HAVE COST |

|

|

$ |

|

|

HAVE COST |

|

|

|

|

|

|

|

|

2. |

NO LONGER HAVE COST |

|

|

$ |

|

|

HAVE COST |

|

|

|

|

|

|

|

|

3. |

NO LONGER HAVE COST |

|

|

$ |

|

|

HAVE COST |

|

|

|

|

|

|

|

|

CHANGE IN MEDICAL COSTS (Doctors, Dentists, Hospitals, Prescriptions, etc.) – You are only required to report changes in your medical expenses at recertification. However, you may voluntarily report changes in your medical expenses at any time for household members who are:

•60 years old or older

•disabled spouse or children of a deceased veteran

•getting Supplemental Security Income (SSI)

•getting Social Security Disability payments

•getting veterans’ disability benefits

•getting government disability retirement benefits

•getting Railroad Retirement disability benefits

•getting disability-based medical assistance

If you report and verify an increase in your medical expenses, you may be eligible for more SNAP benefits.

HOW OFTEN IS EACH PAYMENT DUE?

DO YOU EXPECT THE CHANGES YOU HAVE REPORTED TO CONTINUE NEXT MONTH?

CHECK HERE IF YOU HAVE NO CHANGES TO REPORT ABOUT YOUR SNAP HOUSEHOLD

CHANGE OF BENEFITS

We will use your answers on this form to see if your household’s benefits will change. Before we change your benefits, we will send you a notice explaining what will happen. If you don’t agree with our decision, you have the right to a fair hearing to challenge our decision.

BE SURE TO READ AND SIGN PAGE 6

LDSS-3151 (Rev. 2/18) |

PAGE 6 |

SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM (SNAP) PENALTY WARNING

SNAP PENALTY WARNING – Any information you provide in connection with your application for SNAP will be subject to verification by Federal, State and local officials. If any information is incorrect, you may be denied SNAP. You may be subject to criminal prosecution if you knowingly provide incorrect information which affects eligibility of the amount of benefits. Anyone who is violating a condition of probation or parole or anyone who is fleeing to avoid prosecution, custody or confinement for a felony and is actively being pursued by law enforcement is not eligible to receive SNAP benefits.

If a SNAP household member is found to have committed an Intentional Program Violation (IPV), the member will not be able to get SNAP benefits for a period of:

•12 months for the first SNAP-IPV;

•24 months for the second SNAP-IPV;

•24 months for the first SNAP-IPV, that is based on a court finding that the individual used or received SNAP benefits in a transaction involving the sale of a controlled substance (Illegal drugs or certain drugs for which a doctor’s prescription is required);

•120 months if found to have made a fraudulent statement about who you are or where you live in order to get multiple SNAP benefits simultaneously, unless permanently disqualified for a third IPV;

Additionally, a court may bar an individual from participation in SNAP for an additional 18 months.

Permanent disqualification of an individual for:

•The first SNAP-IPV based on a court finding of using or receiving SNAP benefits in a transaction involving the sale of firearms, ammunition or explosives;

•The first SNAP-IPV based on a court conviction for trafficking SNAP benefits for a combined amount of $500 or more (Trafficking includes the illegal use, transfer, acquisition, alteration or possession of SNAP authorization cards or access devices);

•The second SNAP-IPV based on a court finding that an individual used or received SNAP benefits in a transaction involving the sale of controlled substances (Illegal drugs or certain drugs for which a doctor’s prescription is required);

•All third SNAP Intentional Program Violations.

Any person convicted of a felony for knowingly using, transferring, acquiring, altering or possessing SNAP authorization cards or access devices may be fined up to $250,000, imprisoned up to 20 years or both. The individual may also be subject to prosecution under the applicable Federal and State laws.

You may be found ineligible for SNAP or found to have committed an IPV if:

•You make a false or misleading statement, or misrepresent, conceal or withhold facts in order to qualify for benefits or receive more benefits; or

•Purchase a product with SNAP benefits with the intent of obtaining cash by intentionally discarding the product and returning the container for the deposit amount; or

•Commit or attempt to commit any act that constitutes a violation of Federal or State law for the purpose of using, presenting, transferring, acquiring, receiving, possessing or trafficking of SNAP benefits, authorization cards or reusable documents used as part of the Electronic Benefit Transfer (EBT) system.

Additionally, the following is not allowed and, you may be disqualified from receiving SNAP Benefits and/or be subject to penalties for actions that include:

•Using or have in your possession EBT cards that do not belong to you, without the card owner’s consent; or

•Using SNAP benefits to buy nonfood items, such as alcohol or cigarettes, or to pay for food previously purchased on credit; or

•Allowing someone else to use your electronic benefit transfer (EBT) card in exchange for cash, firearms, ammunition or explosives, or drugs or to purchase food for individuals who are not members of the SNAP household.

If you get more SNAP benefits than you should have (overpayment), you must pay them back. If your case is active, we will take back the amount of the overpayment from future SNAP benefits that you get. If your case is closed, you may pay back the overpayment through any unused SNAP benefits remaining in your account, or you may pay cash.

If you have an overpayment that is not paid back, it will be referred for collection, including automated collection by the federal government. Federal benefits (such as Social Security) and tax refunds that you are entitled to receive may be taken to pay back to the overpayment. The debt will also be subject to processing charges.

Any SNAP benefits expunged from your EBT account will be used to reduce current overpayments. If you apply for SNAP again, and have not repaid the amount you owe, your SNAP benefits will be reduced if you begin to get them again. You will be notified, at that time, of the amount of reduced benefits you will get.

CERTIFICATION

I understand the penalty for hiding or giving false information. I also understand I will owe the value of any extra SNAP benefits I receive because I don’t fully report changes in my household. I agree to prove any changes reported if necessary. The answers on this form are correct and complete to the best of my knowledge. I understand that my signature authorizes federal, state and local officials to contact other persons or organizations to verify the information I have provided.