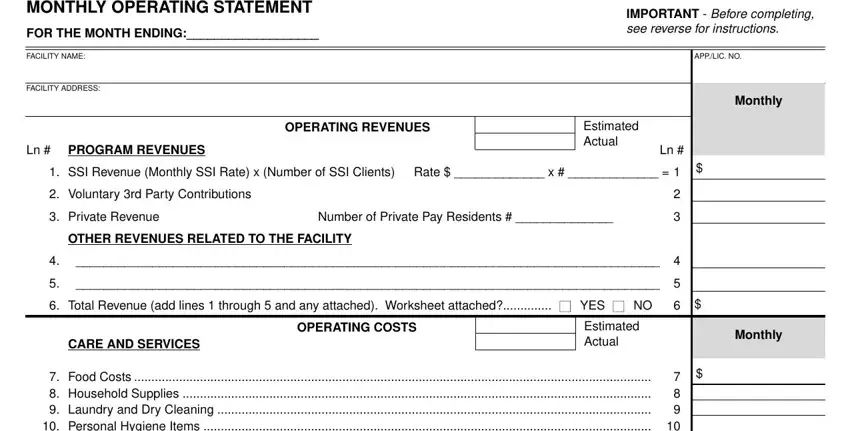

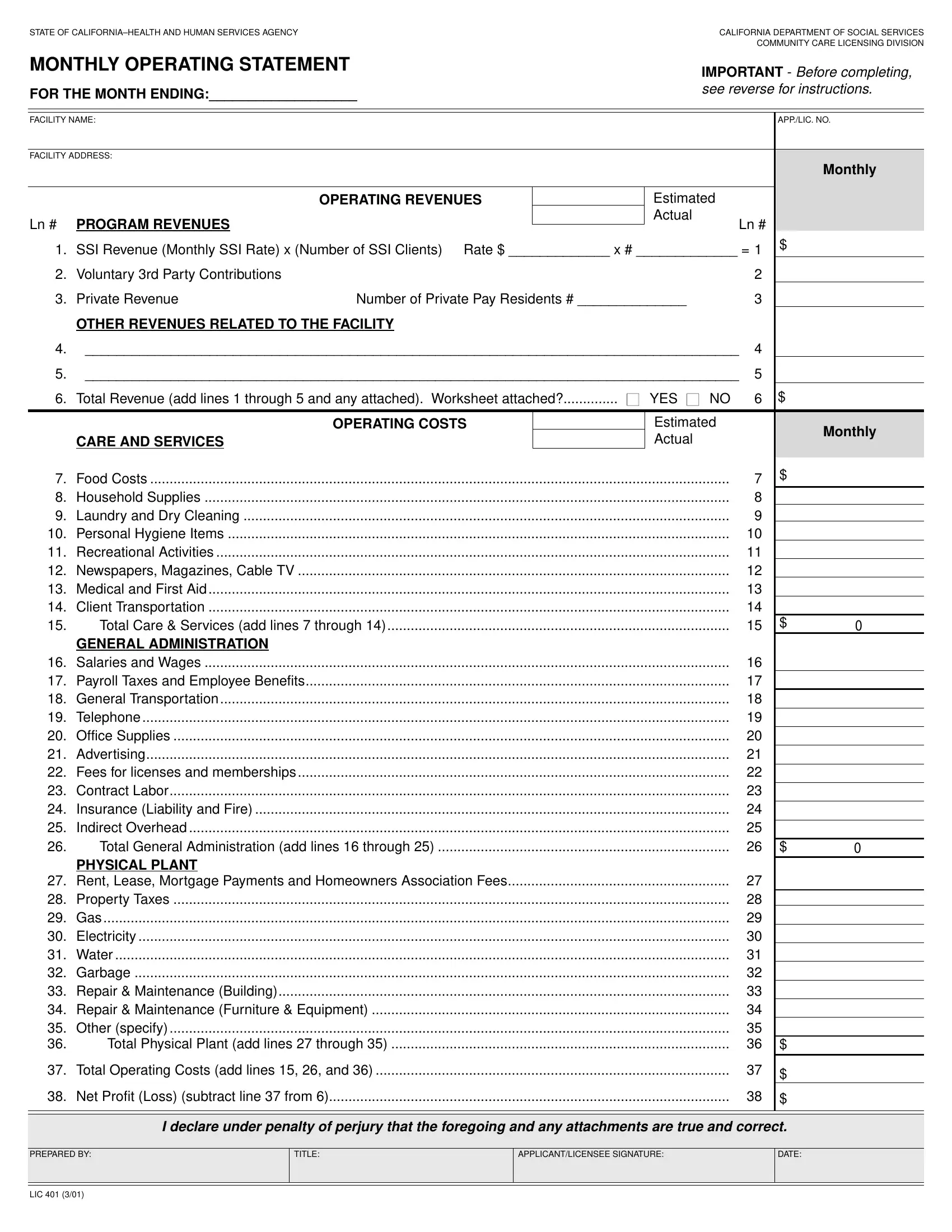

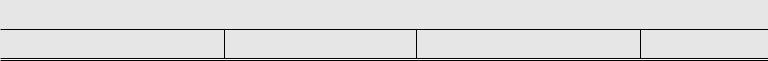

MONTHLY OPERATING STATEMENT

GENERAL INFORMATION AND INSTRUCTIONS

GENERAL INFORMATION - Each applicant/licensee (sole proprietorship, partnership, corporation or limited liability company) must submit a LIC 401, OPERATING STATEMENT, for care facilities in operation or pending (to commence within the next twelve months). In addition, an LIC 401a, Supplemental Financial Information, Part II must be submitted. A separate LIC 401 is to be submitted for each CCLD licensed/pending license operation. A profit and loss statement is to be submitted for other business operations. For CCLD operations already licensed or other ongoing business operations the reported amounts are to be actual rather than estimated. For CCLD operations pending license or other pending business operations the reported amounts may be estimated.

FOR INDIVIDUALS AS SOLE PROPRIETORS - Part I of the LIC 401a must also be completed.

FOR GENERAL PARTNERS - In addition to the LIC 401a, Part II, for the partnership a separate Form LIC 401a must be completed for each general partner. Information reported on this document is subject to verification. Therefore, additional documentation may be requested to support some or all of the items reported.

INSTRUCTIONS Please include the required information at the top of this form to identify the 1) reporting period of the information,

2)facility name, 3) facility address and 4) application or license number.

REVENUES

Line # PROGRAM REVENUES

1.Report the SSI monthly rate, the number of clients/residents and the total monthly revenue.

2.Report all 3rd party voluntary contributions received on behalf of all SSI recipients.

3.Report average monthly rate for private pay clients/residents, the number of private pay clients/residents and the total

monthly revenue.

OTHER REVENUES

4-5. Report all other facility related revenues (i.e. interest income, subleases, insurance reimbursements, sale of assets) individually on lines 4 and 5. If more space is required attach a worksheet and indicate the total on line 5.

OPERATING COSTS

CARE AND SERVICES

7.Costs for food products, and meals for clients, residents and staff.

8.Costs for cleaning supplies (except laundry and dry cleaning).

9.Costs for laundry and dry cleaning.

10.Costs for personal hygiene items provided for the clients and residents.

11.Costs for recreational activities.

12.Costs for newspapers, magazines, cable TV, etc.

13.Costs for medical supplies, first aid, and any other non-reimbursable medical costs.

14.Costs for transporting clients/residents to and from medical appointments, recreational activities, and other allowable transportation costs.

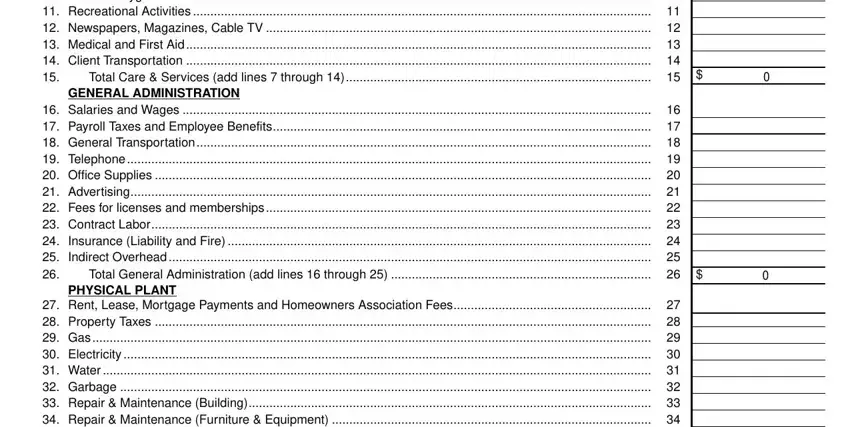

GENERAL ADMINISTRATION

16.Staff salaries and wages (verified to staffing report).

17.Federal and state payroll taxes and the cost of employee benefits including worker’s compensation insurance incurred by the facility.

18.Direct transportation costs, (Include vehicle loan payments, maintenance and fuel).

19.Include all costs for telephone communications (phones, FAX, pagers, etc.).

20.Costs for office supplies and postage.

21.Costs for business related advertising.

22.Costs for business licenses, membership fees and professional fees.

23.All contract to labor.

24.Costs for all other insurance (public liability, property damage, auto, surety bond, etc.).

25.Costs/Expenses required for the support of a corporate or headquarter’s office.

PHYSICAL PLANT

27.Cost to rent, lease or mortgage payments on the facility.

28.Costs for real estate property taxes (average monthly cost).

29.Costs for natural or propane gas used in the facility.

30.Costs for electricity consumed at the facility.

31.Costs for water, including bottled water.

32.Costs for disposal of garbage.

33.Costs for building repair and maintenance.

34.Costs for furniture and equipment repair and maintenance.

35.All other expenses.

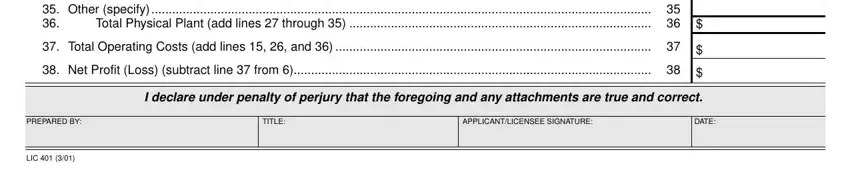

SIGNATURE BLOCK

The name of the preparer is to be printed in the space provided. The applicant or licensee is required to sign this form attesting to the financial information. Failure to sign, date and attest to the accuracy of the information reported on the Monthly Operating Statement (LIC 401) shall constitute non-compliance and the rejection of this report.