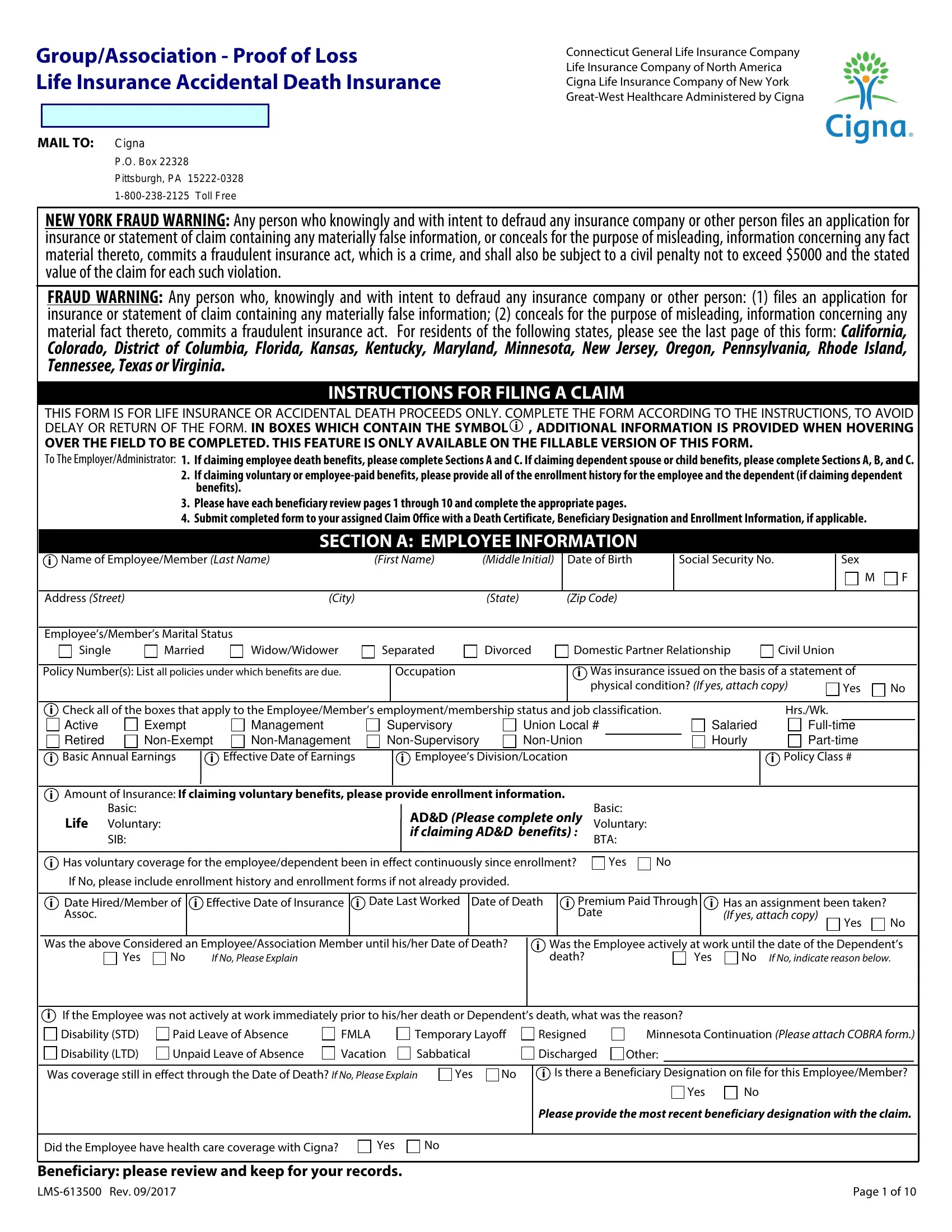

Group/Association - Proof of Loss

Life Insurance Accidental Death Insurance

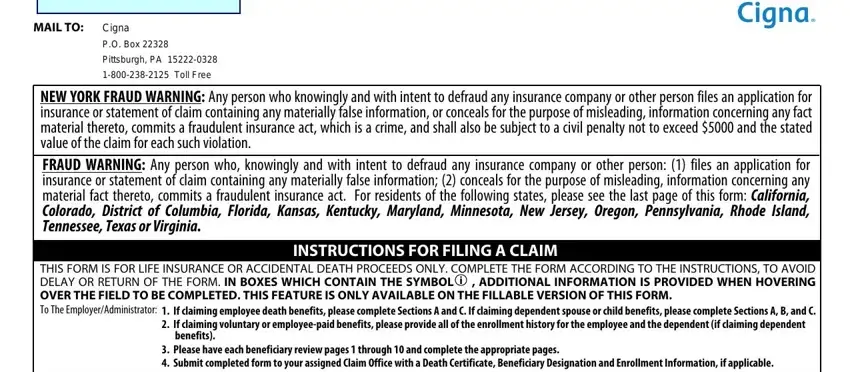

MAIL TO:

Connecticut General Life Insurance Company Life Insurance Company of North America Cigna Life Insurance Company of New York Great-West Healthcare Administered by Cigna

NEW YORK FRAUD WARNING: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed $5000 and the stated value of the claim for each such violation.

FRAUD WARNING: Any person who, knowingly and with intent to defraud any insurance company or other person: (1) files an application for insurance or statement of claim containing any materially false information; (2) conceals for the purpose of misleading, information concerning any material fact thereto, commits a fraudulent insurance act. For residents of the following states, please see the last page of this form: California,

Colorado, District of Columbia, Florida, Kansas, Kentucky, Maryland, Minnesota, New Jersey, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas or Virginia.

INSTRUCTIONS FOR FILING A CLAIM

THIS FORM IS FOR LIFE INSURANCE OR ACCIDENTAL DEATH PROCEEDS ONLY. COMPLETE THE FORM ACCORDING TO THE INSTRUCTIONS, TO AVOID DELAY OR RETURN OF THE FORM. IN BOXES WHICH CONTAIN THE SYMBOL i , ADDITIONAL INFORMATION IS PROVIDED WHEN HOVERING

OVER THE FIELD TO BE COMPLETED. THIS FEATURE IS ONLY AVAILABLE ON THE FILLABLE VERSION OF THIS FORM.

To The Employer/Administrator: 1. If claiming employee death benefits, please complete Sections A and C. If claiming dependent spouse or child benefits, please complete Sections A, B, and C.

2.If claiming voluntary or employee-paid benefits, please provide all of the enrollment history for the employee and the dependent (if claiming dependent benefits).

3.Please have each beneficiary review pages 1 through 10 and complete the appropriate pages.

4.Submit completed form to your assigned Claim Office with a Death Certificate, Beneficiary Designation and Enrollment Information, if applicable.

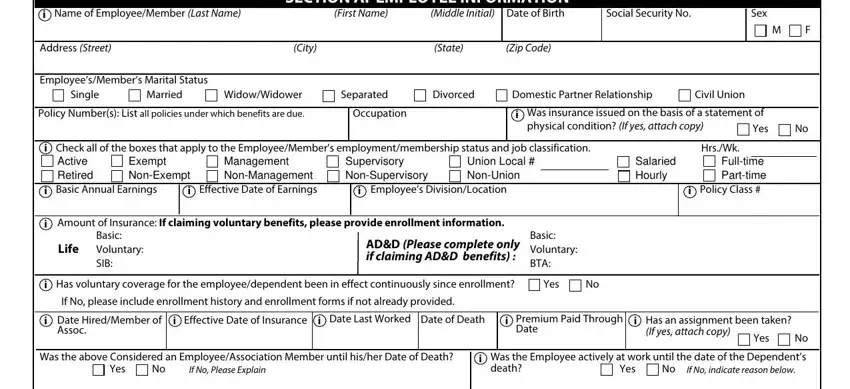

SECTION A: EMPLOYEE INFORMATION

i Name of Employee/Member (Last Name) |

(First Name) |

(Middle Initial) |

|

Address (Street) |

|

|

|

(City) |

|

|

(State) |

|

|

|

(Zip Code) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee’s/Member’s Marital Status |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Single |

Married |

|

Widow/Widower |

Separated |

Divorced |

|

|

Domestic Partner Relationship |

Civil Union |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Policy Number(s): List all policies under which benefits are due. |

|

Occupation |

|

|

|

|

|

i |

Was insurance issued on the basis of a statement of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

physical condition? (If yes, attach copy) |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i Check all of the boxes that apply to the Employee/Member’s employment/membership status and job classification. |

|

|

|

Hrs./Wk. |

|

|

|

|

|

|

Active |

Exempt |

|

Management |

Supervisory |

|

Union Local # |

|

|

Salaried |

|

|

|

|

|

|

|

|

|

|

|

Full-time |

|

|

|

|

|

Retired |

Non-Exempt |

Non-Management |

Non-Supervisory |

Non-Union |

|

|

|

|

Hourly |

Part-time |

|

|

|

|

|

|

|

|

|

|

|

|

|

i |

Basic Annual Earnings |

i Effective Date of Earnings |

|

i Employee’s Division/Location |

|

|

|

|

|

|

i Policy Class # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i Amount of Insurance: If claiming voluntary benefits, please provide enrollment information. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic: |

|

|

|

|

|

|

AD&D (Please complete only |

Basic: |

|

|

|

|

|

|

|

|

|

|

|

Life Voluntary: |

|

|

|

|

Voluntary: |

|

|

|

|

|

|

|

|

|

|

|

SIB: |

|

|

|

|

|

|

if claiming AD&D benefits) : |

BTA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i Has voluntary coverage for the employee/dependent been in effect continuously since enrollment? |

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

If No, please include enrollment history and enrollment forms if not already provided. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

i |

Date Hired/Member of |

i |

Effective Date of Insurance |

i |

Date Last Worked |

Date of Death |

|

i Premium Paid Through |

i |

Has an assignment been taken? |

|

|

|

|

|

Assoc. |

|

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

(If yes, attach copy) |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Was the above Considered an Employee/Association Member until his/her Date of Death? |

|

i |

Was the Employee actively at work until the date of the Dependent’s |

|

|

|

Yes |

No |

If No, Please Explain |

|

|

|

|

|

death? |

|

|

|

Yes |

No |

If No, indicate reason below. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

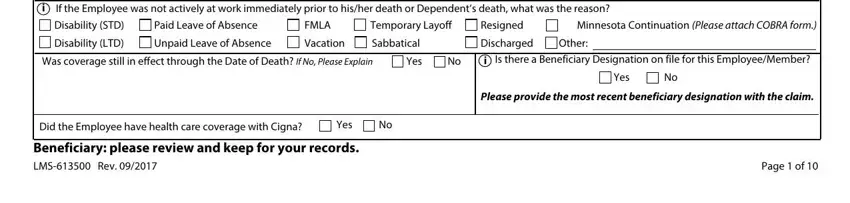

iIf the Employee was not actively at work immediately prior to his/her death or Dependent’s death, what was the reason?

|

Disability (STD) |

Paid Leave of Absence |

FMLA |

Temporary Layoff |

Resigned |

Minnesota Continuation (Please attach COBRA form.) |

|

Disability (LTD) |

Unpaid Leave of Absence |

Vacation |

Sabbatical |

|

Discharged |

Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Was coverage still in effect through the Date of Death? If No, Please Explain |

Yes |

No |

i Is there a Beneficiary Designation on file for this Employee/Member? |

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

Please provide the most recent beneficiary designation with the claim. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Did the Employee have health care coverage with Cigna?

Beneficiary: please review and keep for your records.

LMS-613500 Rev. 09/2017 |

Page 1 of 10 |

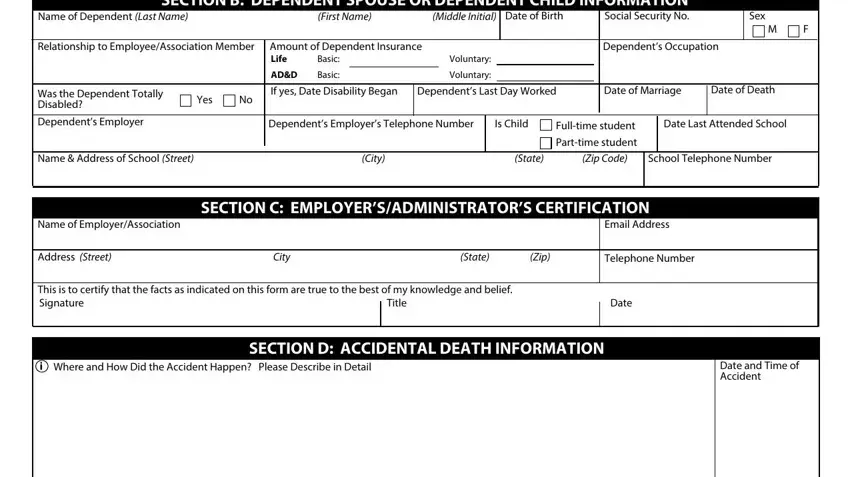

SECTION B: DEPENDENT SPOUSE OR DEPENDENT CHILD INFORMATION

Name of Dependent (Last Name) |

|

|

|

(First Name) |

|

(Middle Initial) |

Date of Birth |

Social Security No. |

|

Sex |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M |

F |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship to Employee/Association Member |

Amount of Dependent Insurance |

|

|

|

|

|

|

|

|

Dependent’s Occupation |

|

|

|

|

|

Life |

Basic: |

|

|

Voluntary: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voluntary: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AD&D |

Basic: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Was the Dependent Totally |

Yes |

No |

If yes, Date Disability Began |

Dependent’s Last Day Worked |

Date of Marriage |

Date of Death |

|

|

Disabled? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dependent’s Employer |

|

|

Dependent’s Employer’s Telephone Number |

|

Is Child |

Full-time student |

Date Last Attended School |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part-time student |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name & Address of School (Street) |

(City) |

(State) |

(Zip Code) |

SECTION C: EMPLOYER’S/ADMINISTRATOR’S CERTIFICATION

Name of Employer/Association

Address (Street) |

City |

(State) |

(Zip) |

This is to certify that the facts as indicated on this form are true to the best of my knowledge and belief.

SECTION D: ACCIDENTAL DEATH INFORMATION

i Where and How Did the Accident Happen? Please Describe in Detail

Date and Time of Accident

SECTION E: BENEFICIARY INFORMATION

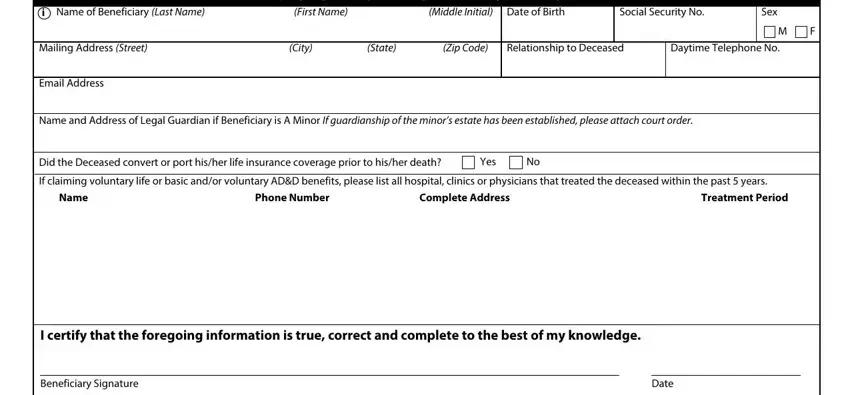

i Name of Beneficiary (Last Name) |

(First Name) |

|

(Middle Initial) |

Date of Birth |

Social Security No. |

Sex |

|

|

|

|

|

|

|

M |

|

|

|

|

|

|

|

|

Mailing Address (Street) |

(City) |

(State) |

(Zip Code) |

Relationship to Deceased |

Daytime Telephone No. |

|

|

|

|

|

|

|

|

Email Address

Name and Address of Legal Guardian if Beneficiary is A Minor If guardianship of the minor’s estate has been established, please attach court order.

Did the Deceased convert or port his/her life insurance coverage prior to his/her death? |

Yes |

No |

If claiming voluntary life or basic and/or voluntary AD&D benefits, please list all hospital, clinics or physicians that treated the deceased within the past 5 years.

Name |

Phone Number |

Complete Address |

Treatment Period |

I certify that the foregoing information is true, correct and complete to the best of my knowledge.

Beneficiary Signature |

Date |

LMS-613500 Rev. 09/2017 |

Page 2 of 10 |

Cignassurance® Program

If your insurance benefit is $5,000 or more, Cigna will automatically open a free, interest-bearing account in your name. This account, called the Cignassurance® Program, is a convenient and secure place to keep your proceeds while you decide how to best use them. Please review the attached Cignassurance® Program Disclosure Notice for full details about the account.* Account balances are the liability of the insurance company and are not insured by the Federal Deposit Insurance Corporation or any federal agency. The insurance company reserves the right to reduce account balances for any payment made in error. If your life insurance benefit is less than $5,000, Cigna will send you a check for the total benefit amount.

*Please read the Cignassurance® Program Disclosure Notice before signing below.

I understand that if my benefit is $5,000 or more, I will receive a Cignassurance® account.

I understand that I may write a draft for the total amount in my account at any time.

I understand that the account balance may be reduced for any benefit payment by the insurance company made in error.

I acknowledge that, if I do not separately sign the Cignassurance® Section of this Claim Form, I am not participating in the Cignassurance® Program and that I will receive a single lump sum check for the proceeds due if my claim is approved.

*Please sign as you would sign on a check, as signature may be used for draft verification.

The issuance of this form is not an admission of the existence of any insurance nor does it recognize the validity of any claim and is without prejudice to the company’s legal rights.

Beneficiary: Please complete and return to the Employer or Cigna.

LMS-613500 Rev. 09/2017 |

Page 3 of 10 |

Disclosure Authorization

NEW YORK FRAUD WARNING: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed $5000 and the stated value of the claim for each such violation.

FRAUD WARNING: Any person who, knowingly and with intent to defraud any insurance company or other person: (1) files an application for insurance or statement of claim containing any materially false information; (2) conceals for the purpose of misleading, information concerning any material fact thereto, commits a fraudulent insurance act. For residents of the following states, please see the last page of this form: California,

Colorado, District of Columbia, Florida, Kansas, Kentucky, Maryland, Minnesota, New Jersey, Oregon, Pennsylvania, Rhode Island, Tennessee, Texas or Virginia.

Deceased’s Name: i |

|

Deceased’s Date of Birth: |

I AUTHORIZE: any doctor, physician, healer, health care practitioner, hospital, clinic, other medical facility, professional, or provider of health care, medically related facility or association, medical examiner, pharmacy, employee assistance plan, insurance company, health maintenance organization or similar entity to give the Insurance Company named below (Company) or their employees and authorized agents or authorized representatives, any medical and nonmedical information or records that they may have concerning the deceased’s health condition, or health history, or regarding any advice, care or treatment provided to the deceased. This information and/or records may include, but is not limited to: cause, treatment, diagnoses, prognoses, consultations, examinations, tests, prescriptions, or advice of the deceased’s physical or mental condition, or other information concerning the deceased which may be needed to determine policy claim benefits with respect to the deceased. This may also include (but is not limited to) information concerning: mental illness, psychiatric, drug or alcohol use and any disability, and also HIV related testing, infection, illness, and AIDS (Acquired Immune Deficiency Syndrome), as well as communicable diseases and genetic testing. I understand that I may choose whether to receive the results of any laboratory tests or medical examinations performed. This information may also be extracted for use in audits or for statistical purposes.

I AUTHORIZE: any financial institution, accountant, tax preparer, insurance company or reinsurer, consumer reporting agency, insurance support organization, Insured’s agent, employer, group policyholder, business associate, benefit plan administrator, family members, friends, neighbors or associates, governmental agency including the Social Security Administration or any other organization or person having knowledge of the deceased to give the Company or their employees and authorized agents, or authorized representatives, any information or records that they have concerning the deceased’s occupation, activities, employee/employment records, earnings or finances, applications for insurance coverage, prior claim files and claim history, work history and work related activities.

I UNDERSTAND: the information obtained will be included as part of the proof of claim and will be used by the Company to determine eligibility for claim benefits, any amounts payable and to administer any other feature described in the plan with respect to the deceased. This authorization shall remain valid and apply to all records, information and events that occur over the duration of the claim, but not to exceed 24 months. A photocopy of this form is as valid as the original and I or my authorized representative may request one. I or my representative may revoke this authorization at any time as it applies to future disclosures by writing the Company. The information obtained will not be released to anyone EXCEPT: a) reinsuring companies; b) the Medical Information Bureau, Inc., which operates Health Claim Index (HCI); c) fraud or overinsurance detection bureaus; d) anyone performing business, medical or legal functions with respect to the claim; e) for audit or statistical purposes; f) as may be required or permitted by law; g) as I may further authorize. A valid authorization or court order for information does not waive other privacy rights.

If the medical information contains information regarding drug or alcohol abuse, I understand that the deceased’s records may be protected under federal (42 CFR Part 2) and some state laws. To the extent permitted under law, I can ask the party that disclosed information to the Company to permit me to inspect and copy the information it disclosed. I understand that I can refuse to sign this disclosure authorization; however, if I do so, Company may deny my claim for benefits pursuant to the plan. The use and further disclosure of information disclosed hereunder may not be subject to the Health Insurance Portability and Accountability Act (HIPAA).

I hereby represent that I am authorized to execute this Disclosure Authorization for the release of this information.

Signature of Claimant or |

|

|

|

Claimant’s Authorized Representative: |

|

|

Date: |

Relationship, |

|

|

|

if other than Claimant: |

|

|

Claimant’s Date of Birth: |

Company Names: Life Insurance Company of North America, Cigna Life Insurance Company of New York, Cigna Worldwide Insurance Company, Great-West Life & Annuity Insurance Company, First Great-West Life & Annuity Company, New England Life Insurance Company, Alta Health & Life Insurance Company, Connecticut General Life Insurance Company.

PROHIBITION ON RE-DISCLOSURE

If the medical information contains information regarding drug or alcohol abuse, it may be protected under federal law. Federal regulations (42 CFR Part 2) prohibit any person or entity who receives such protected information from the Company from making any further disclosure of it without the specific written consent of the person to whom it pertains, or as otherwise permitted by such regulation. A general authorization for the release of medical or other information is not sufficient for this purpose. The federal rules restrict any use of such protected information to criminally investigate or prosecute any alcohol or drug abuse patient.

Beneficiary: Please complete and return to the Employer or Cigna.

LMS-613500 Rev. 09/2017 |

Page 4 of 10 |

|

ELECTRONIC COMMUNICATIONS DISCLOSURE AND CONSENT

Please read this information carefully. Then, print and keep a copy for yourself.

As a valued Cigna customer, we send you information about your benefits through the mail. This information may include:

•Claim forms, authorizations, disclosures, affidavits, electronic funds transfer agreements, privacy notices, and letters letting you know about changes to any of these items;

•Claim status updates letting you know that we’ve received a claim, or that we’ve updated the status of a claim;

•Letters asking you, or someone else, for additional information to help with the review of a claim.

Did you know that you may also give us consent to send you this information electronically?

Cigna has an easy to use tool called Secure Email that allows us to communicate with you electronically. All you need is a computer, internet access, and a personal email address (called a Designated Email).

By giving us your permission, known as consent, you understand you may no longer receive information in paper form and you accept responsibility for promptly reviewing the Secure Emails you receive. This ensures you can take appropriate action so that any benefits you are eligible for are not delayed or that any rights you have are not affected.

What do I need to know before I give my consent?

Access to Paper Copies

At any time, you can still request paper copies of information. Simply email us from your valid Designated Email, call customer service or send us a letter by mail. We keep copies of the information we email for the time periods required by law. We recommend saving or printing copies of the information you get electronically to ensure you have it when you need it.

System Requirements

To use Secure Email, access messages, and keep copies of the information we send you must have a working, personal Designated Email address and a computing or communications device with:

working Internet access,

a Web browser that supports 128-bit encryption (such as Chrome®, Firefox®, Internet Explorer®, or Safari®),

•16 MB of available memory (32 MB of RAM recommended) and

•a program that can view, save and print PDF files (such as Adobe® Reader® 4.0 or higher).

Our Right to Send Paper

We have the right to send you information through the mail even if you agreed to receive it electronically. For example, we may send you a letter through the mail if we have a system outage, if we suspect fraud, if for any reason your Designated Email does not accept emails from us, or if we receive notification that you have not opened your email messages in Secure Email.

Modification of Consent Terms

We reserve the right to modify (change) these terms and conditions if we choose. We will provide you with notice of a modification electronically, and the date it is to go into effect. If you do not agree to the new terms and conditions, you must notify us of your Withdrawal of Consent before the effective date. Failure to withdraw your consent, or follow the instructions in the notice, lets us know that you agree to the new terms.

Withdrawal of Consent

Your consent remains in effect until you tell us otherwise and provide a Withdrawal of Consent. You may withdraw your consent at any time if you decide you want to go back to paper information. To contact us, you may email using the same valid, personal e-mail address you used to register for Secure Email, call us at 1-800-238-2125, or send us a letter by mail. Withdrawing your consent will let us know that you want to stop receiving Secure Emails. It will not change the outcome of any information we have already sent you.

Beneficiary: Please review and keep for your records.

LMS-613500 Rev. 09/2017 |

Page 5 of 10 |

|