It's super easy to prepare the lincoln benefit life forms. Our editor was built to be easy-to-use and assist you to fill out any form swiftly. These are the four steps to take:

Step 1: On the following website page, select the orange "Get form now" button.

Step 2: So, you can start editing your lincoln benefit life forms. Our multifunctional toolbar is available to you - add, erase, alter, highlight, and carry out other commands with the content in the form.

Enter the appropriate details in each segment to get the PDF lincoln benefit life forms

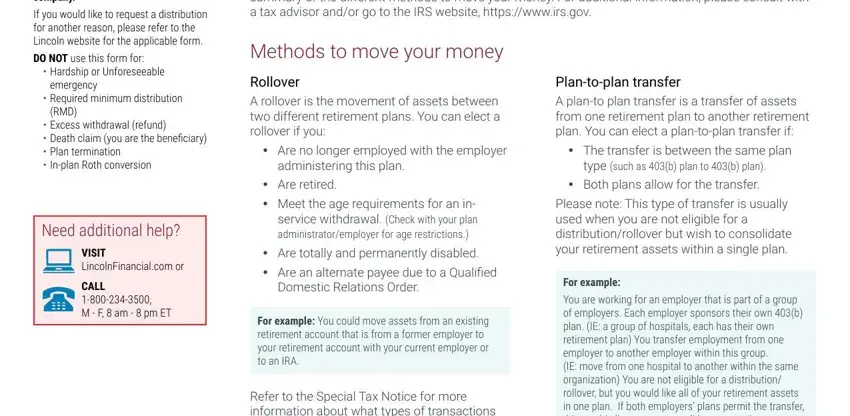

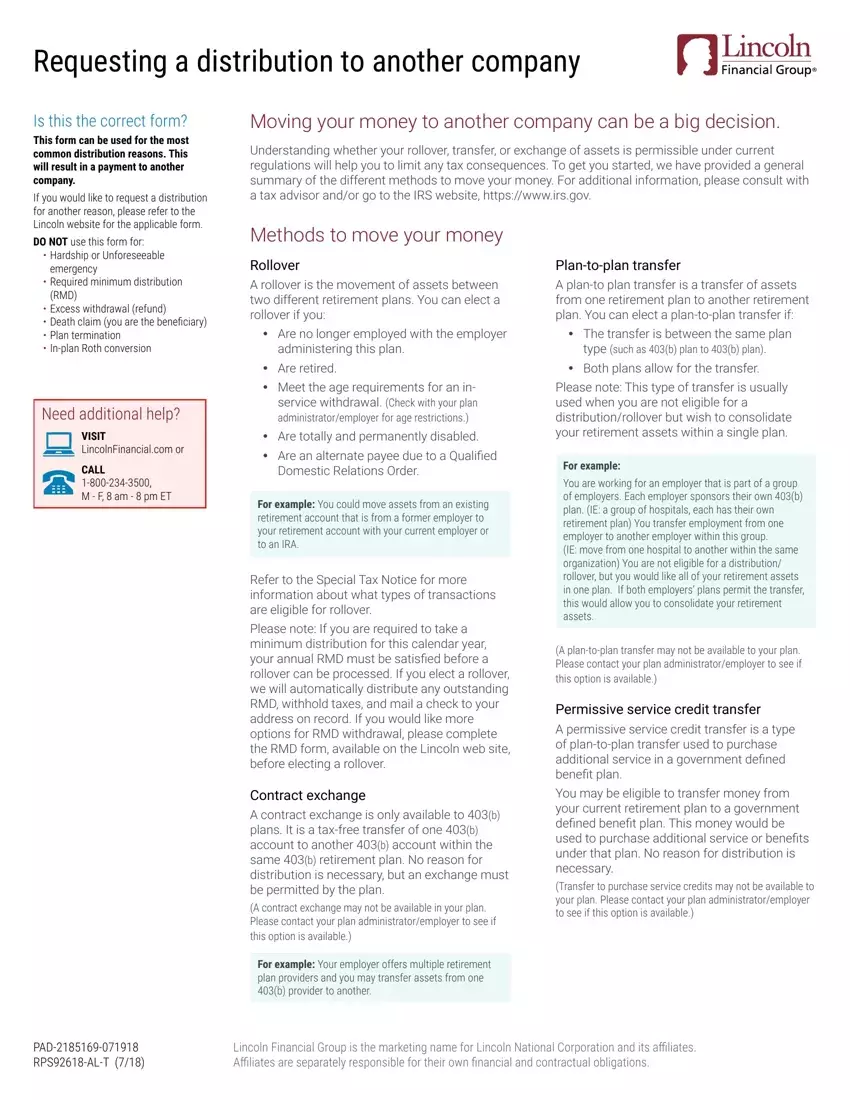

Indicate the data in Is this the correct form This form, If you would like to request a, DO NOT use this form for, Hardship or Unforeseeable, emergency, Required minimum distribution, RMD, Excess withdrawal refund Death, Marital status Please provide your, processing of your distribution, Restrictions may apply depending, If you are totally and permanently, Security Administration is required, For Qualified Domestic Relations, and Name first MI last suffix.

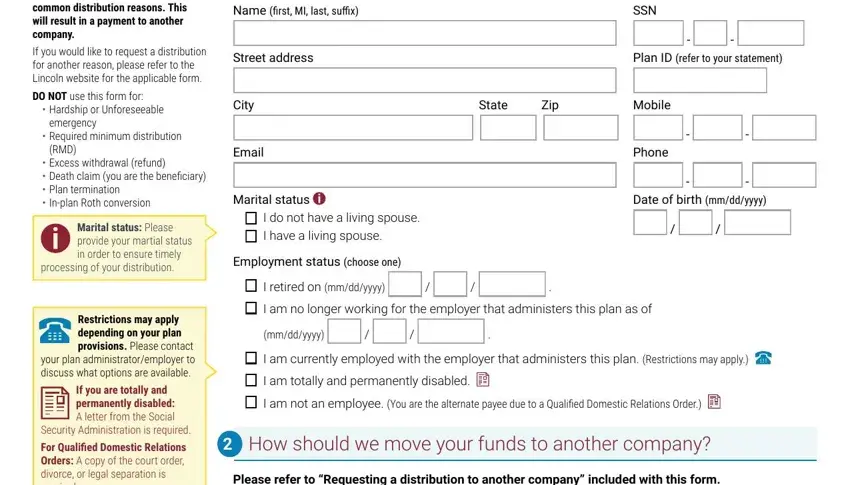

You will be requested for certain crucial data to be able to fill in the If you have Roth andor after tax, When requesting a rollover of, Receiving company information If, I would like to distribute my, Rollover, If you have after tax, Do not include my after tax, Contract exchange Restrictions may, Plantoplan transfer Restrictions, Permissive service credit transfer, Type of receiving planaccount, k b a b governmental, Individual Retirement Account IRA, Roth IRA Defined benefit plan, and Provide information about the section.

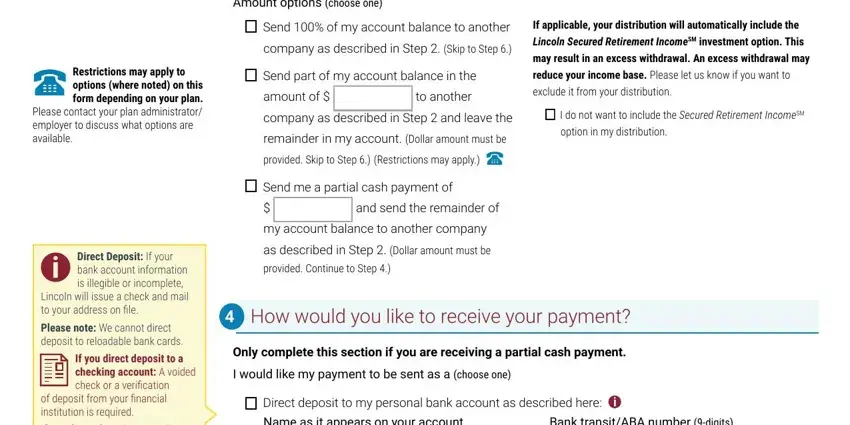

Spell out the rights and obligations of the sides in the paragraph Amount options choose one, Send of my account balance to, company as described in Step Skip, If applicable your distribution, Send part of my account balance in, reduce your income base Please let, exclude it from your distribution, I do not want to include the, amount of, to another, company as described in Step and, remainder in my account Dollar, provided Skip to Step, Send me a partial cash payment of, and and send the remainder of.

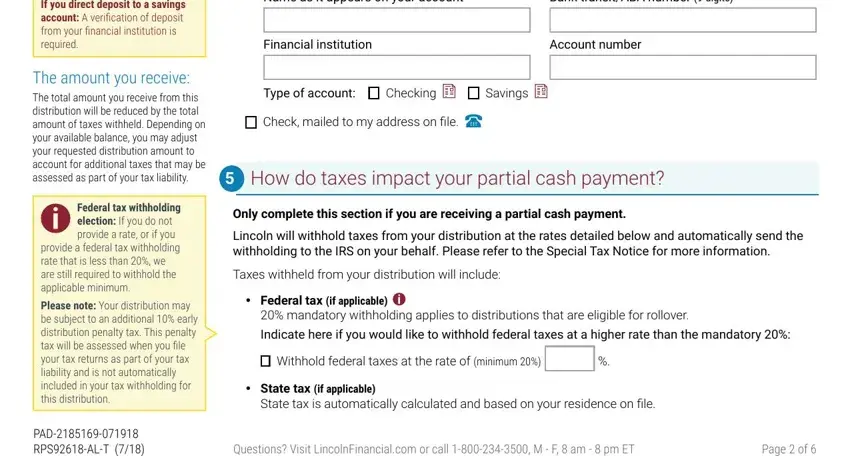

Finalize by checking all these areas and filling them in correspondingly: Name as it appears on your account, Bank transitABA number digits, Financial institution, Account number, Type of account Checking Savings, Check mailed to my address on file, How do taxes impact your partial, Only complete this section if you, Lincoln will withhold taxes from, Taxes withheld from your, y Federal tax if applicable, mandatory withholding applies to, Indicate here if you would like to, Withhold federal taxes at the rate, and y State tax if applicable.

Step 3: Hit "Done". Now you can export your PDF file.

Step 4: It's possible to make copies of the form tokeep away from any possible future complications. You should not worry, we don't publish or track your details.

permanently disabled:

permanently disabled:

I am totally and permanently disabled.

I am totally and permanently disabled.

Defined benefit plan

Defined benefit plan

check or a verification of deposit from your financial institution is required.

check or a verification of deposit from your financial institution is required.

Savings

Savings