It is possible to work with missouri lottery easily in our PDFinity® online tool. The editor is constantly maintained by us, getting new awesome features and growing to be more versatile. To start your journey, consider these simple steps:

Step 1: Open the form inside our tool by clicking the "Get Form Button" in the top area of this page.

Step 2: Using our advanced PDF file editor, it is easy to accomplish more than just fill out blank form fields. Edit away and make your docs appear perfect with customized textual content added in, or tweak the file's original input to excellence - all that backed up by an ability to incorporate stunning photos and sign the file off.

It is an easy task to fill out the document following our detailed tutorial! Here is what you need to do:

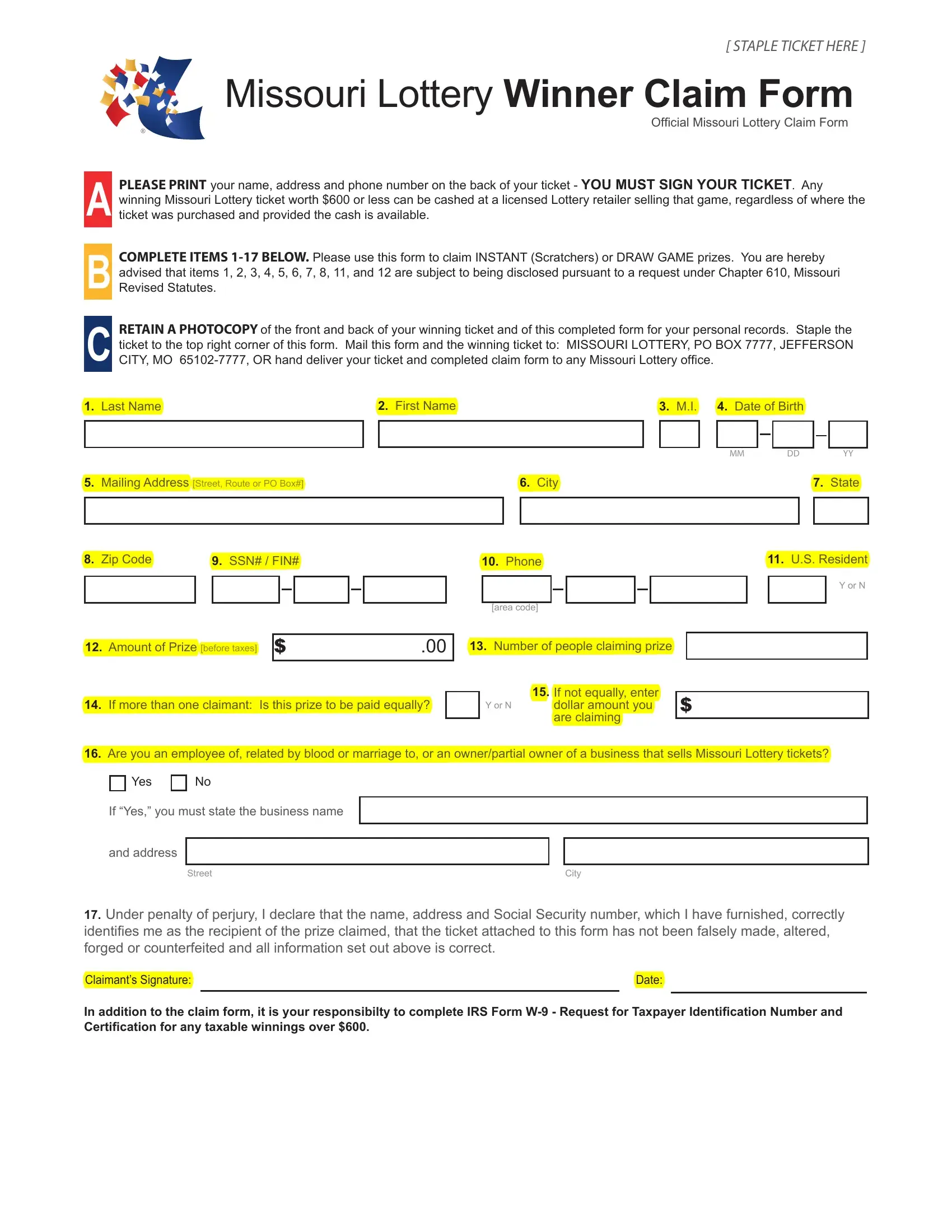

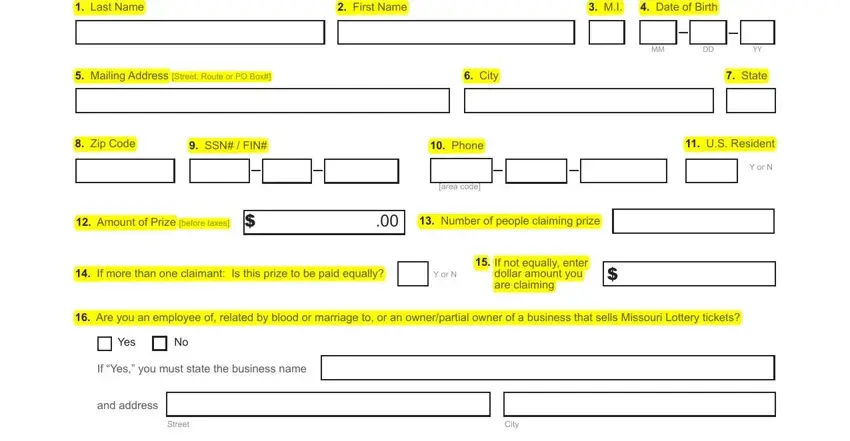

1. Start completing your missouri lottery with a selection of essential blanks. Note all the information you need and make sure not a single thing left out!

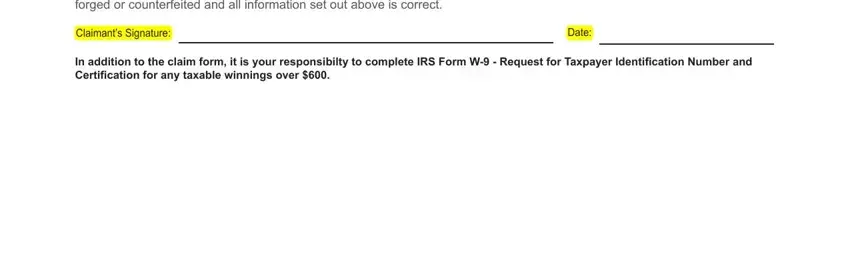

2. The next step is usually to submit the following blank fields: Under penalty of perjury I, Claimants Signature, Date, and In addition to the claim form it.

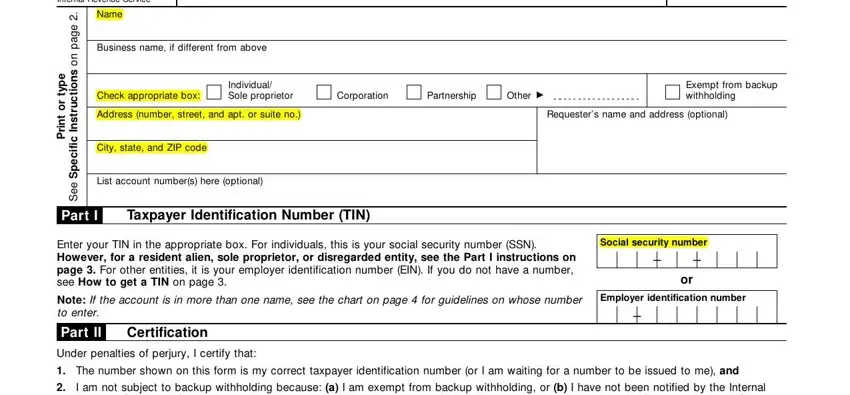

3. Within this step, take a look at Department of the Treasury, Name, Business name if different from, Check appropriate box, Individual Sole proprietor, Address number street and apt or, City state and ZIP code, List account numbers here optional, e p y t r o, t n i r P, e g a p, n o, s n o i t c u r t s n, c i f i c e p S e e S, and Corporation. All of these have to be taken care of with utmost precision.

Many people generally make errors when filling out Name in this part. Don't forget to read twice what you enter right here.

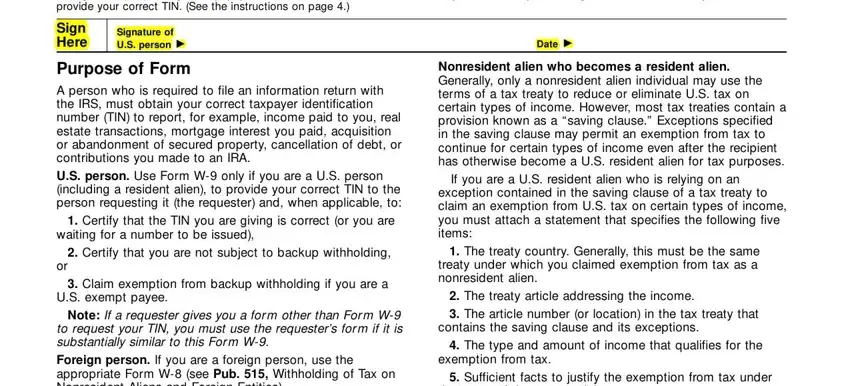

4. Filling out Certification instructions You, Sign Here, Signature of US person, Purpose of Form A person who is, Certify that the TIN you are, waiting for a number to be issued, Certify that you are not subject, Claim exemption from backup, US exempt payee, Note If a requester gives you a, Date, Nonresident alien who becomes a, If you are a US resident alien who, exception contained in the saving, and The treaty country Generally this is essential in this form section - be certain to be patient and fill in each and every field!

Step 3: Check everything you've inserted in the form fields and then hit the "Done" button. Right after creating afree trial account with us, you'll be able to download missouri lottery or send it through email right away. The PDF file will also be easily accessible in your personal account with all your changes. FormsPal ensures your information confidentiality via a protected system that in no way saves or distributes any sort of personal information used. Rest assured knowing your paperwork are kept safe when you use our service!