When you intend to fill out narrowly, you don't need to download and install any kind of programs - simply try using our online PDF editor. We at FormsPal are devoted to providing you with the ideal experience with our tool by constantly adding new functions and enhancements. With all of these updates, working with our tool gets better than ever before! It just takes a couple of basic steps:

Step 1: Click on the "Get Form" button at the top of this webpage to get into our tool.

Step 2: The editor allows you to change almost all PDF documents in a variety of ways. Transform it with your own text, adjust existing content, and place in a signature - all when you need it!

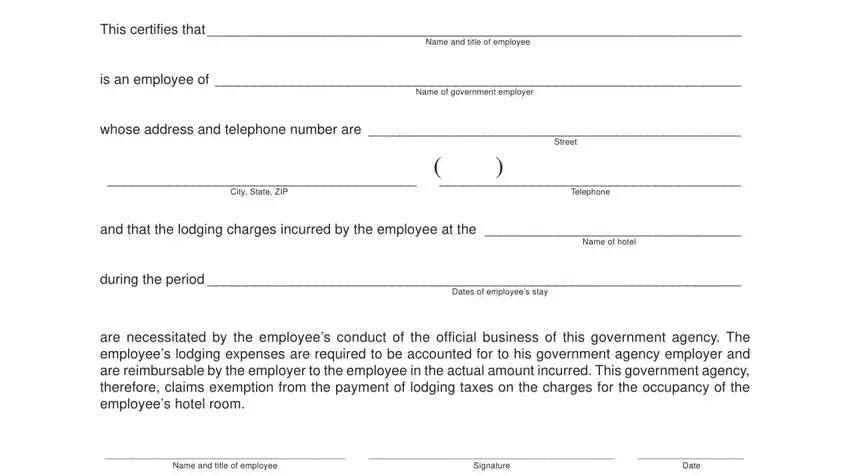

This document will require particular information to be filled in, so ensure that you take the time to enter what's required:

1. The narrowly necessitates particular details to be entered. Ensure the subsequent blank fields are completed:

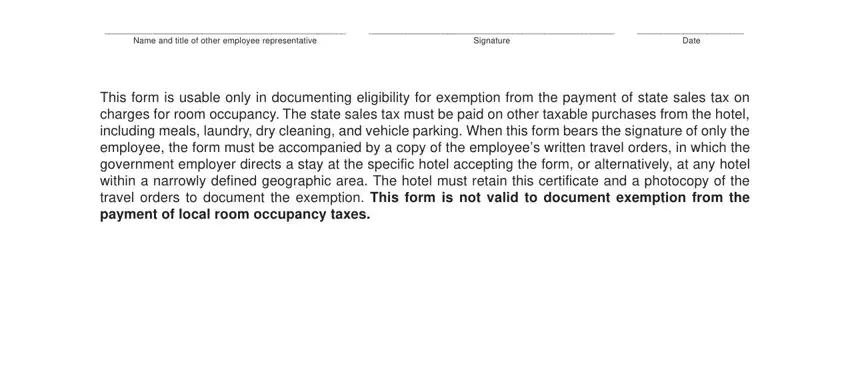

2. Soon after completing the last step, go on to the subsequent step and fill out the necessary particulars in these blanks - Name and title of other employee, Signature, Date, and This form is usable only in.

Be very attentive while completing This form is usable only in and Date, since this is the section in which most users make mistakes.

Step 3: Right after you've glanced through the details in the fields, simply click "Done" to complete your form. Go for a 7-day free trial option at FormsPal and gain direct access to narrowly - which you'll be able to then start using as you would like inside your FormsPal cabinet. FormsPal offers safe form editor without personal information recording or sharing. Be assured that your data is secure here!