In case you need to fill out r 6922, it's not necessary to download any kind of software - simply try our online PDF editor. To keep our editor on the cutting edge of efficiency, we work to integrate user-oriented features and improvements on a regular basis. We are always happy to receive suggestions - play a vital role in remolding PDF editing. This is what you would need to do to begin:

Step 1: Firstly, open the pdf editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: As soon as you start the file editor, you will get the document made ready to be filled in. Aside from filling in different fields, you can also do other sorts of actions with the form, specifically adding your own words, modifying the original text, adding graphics, affixing your signature to the document, and much more.

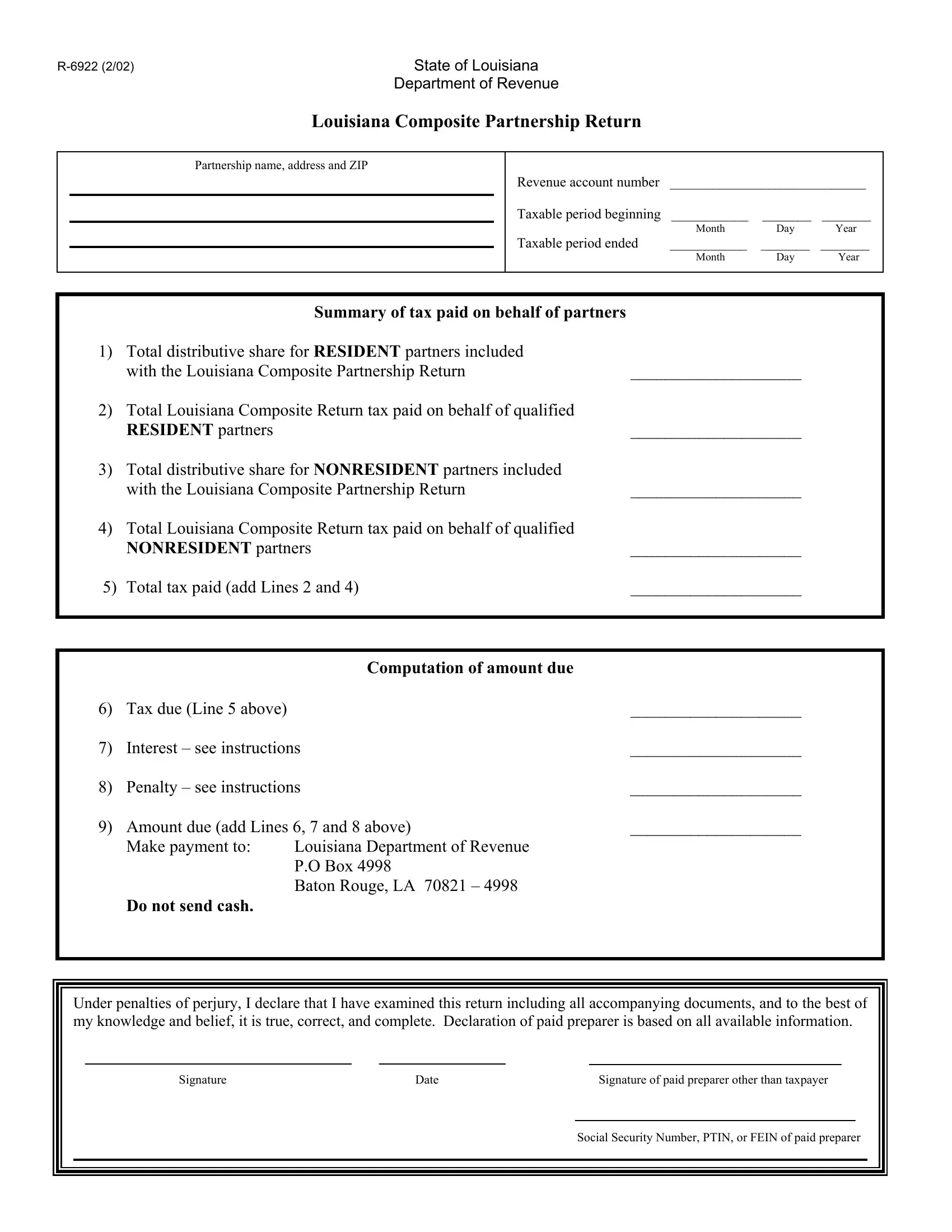

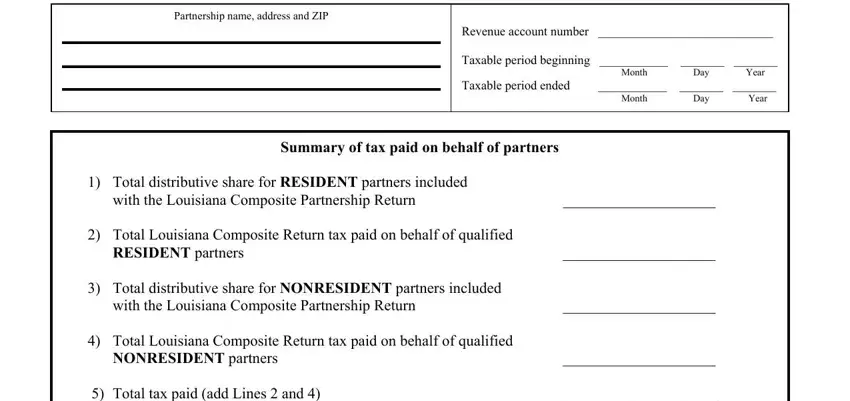

With regards to the fields of this specific form, here is what you should consider:

1. The r 6922 usually requires specific information to be typed in. Be sure the subsequent blanks are completed:

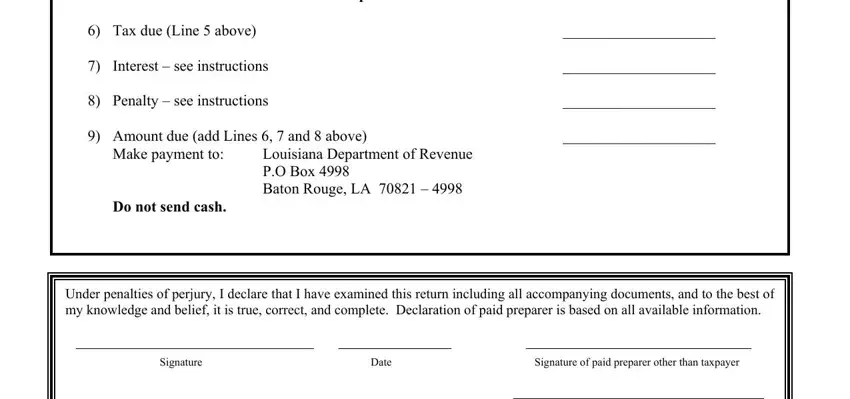

2. After the prior part is filled out, proceed to enter the relevant information in these - Computation of amount due, Tax due Line above Interest, Penalty see instructions, Amount due add Lines and above, Make payment to, Do not send cash, Louisiana Department of Revenue PO, Under penalties of perjury I, Signature, Date, and Signature of paid preparer other.

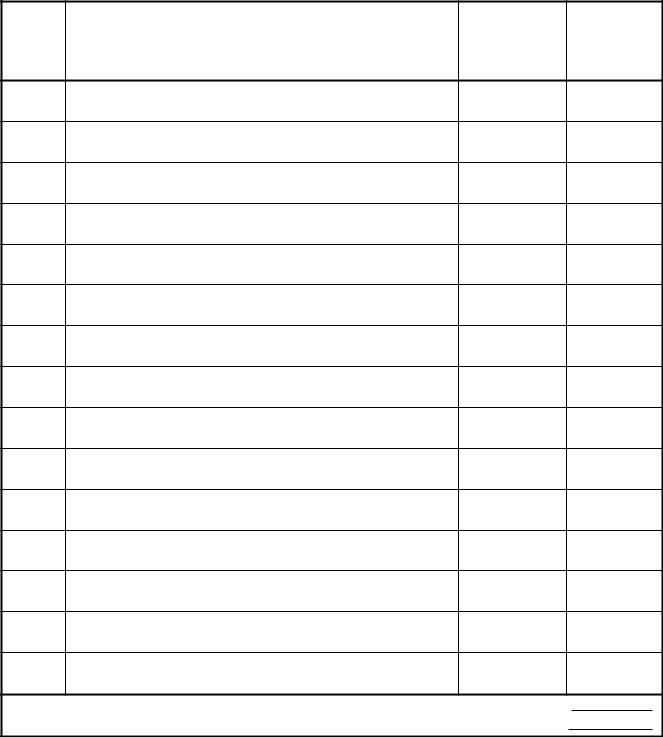

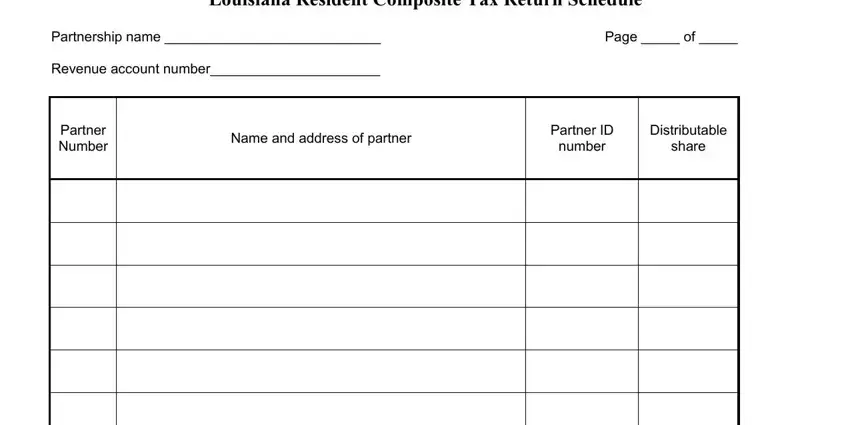

3. The next part is normally straightforward - fill in every one of the form fields in Louisiana Resident Composite Tax, Partnership name Revenue account, Page of, Partner Number, Name and address of partner, Partner ID, number, Distributable, and share to complete this part.

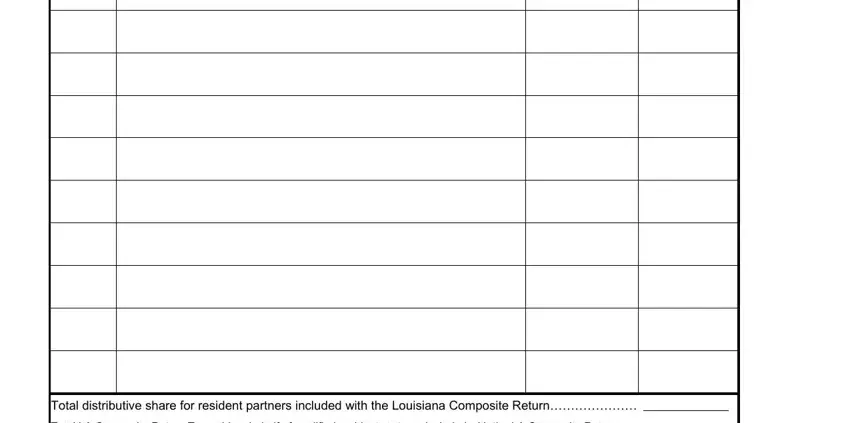

4. Filling out Total distributive share for, and Total LA Composite Return Tax paid is essential in this section - you'll want to invest some time and be mindful with each and every empty field!

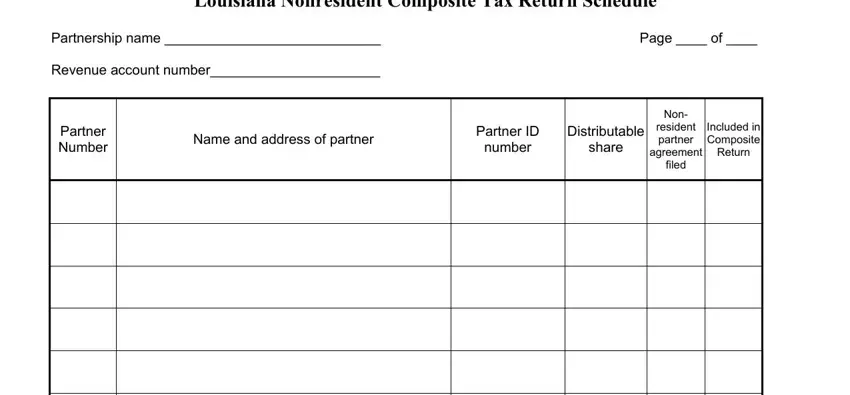

5. To wrap up your form, this last part requires a few extra blanks. Typing in Louisiana Nonresident Composite, Partnership name Revenue account, Page of, Partner Number, Name and address of partner, Partner ID, Distributable, number, share, Non, resident partner, Included in Composite, agreement, Return, and filed should wrap up everything and you can be done very quickly!

Be extremely mindful while completing number and agreement, since this is where many people make errors.

Step 3: When you've reread the information you filled in, just click "Done" to conclude your document creation. After getting afree trial account at FormsPal, it will be possible to download r 6922 or email it without delay. The PDF document will also be easily accessible in your personal account page with all of your changes. At FormsPal.com, we endeavor to ensure that all of your information is stored private.