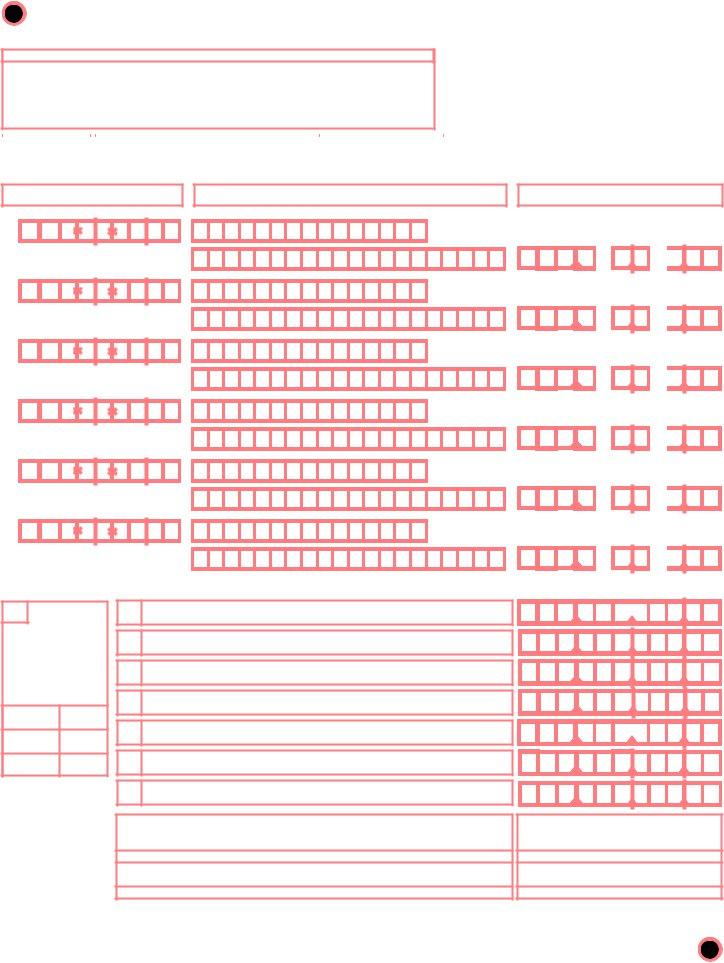

The Louisiana Wage Report form is an essential document for employers within the state, designed to streamline the process of reporting employee wages to the appropriate state department. As of January 31, 2012, the mandate that employers with 100 or more employees must file this report electronically underscores the state's move towards digital efficiency via the LAWorks website. The form requires precise employee data, including social security numbers, total wages paid (rounded to the nearest dollar), and the names of each employee. For those managing payroll for more than six employees, additional continuation sheets are necessary, ensuring the state has a comprehensive record of wages paid within the reporting period. Particularly notable is the necessity to report on Item 14 the total of all reported employees’ excess wages, with detailed instructions provided for calculating these amounts based on wage bases that have been updated since 2010. Moreover, the form includes provisions for adjustments based on tax overpayments or underpayments, highlighting the importance of accuracy in reporting to calculate contributions correctly. Employers are reminded that failure to report, or correctly report, employee wages may result in the application of interest and penalties to their account, with specific examples given to help calculate these additional charges. Overall, the Louisiana Wage Report form serves as a critical tool for both employers and the state in managing employment contributions and ensuring workers are adequately accounted for in the state's economic framework.

| Question | Answer |

|---|---|

| Form Name | Louisiana Wage Report Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | louisiana wfc wage reporting, louisiana workforce quarterly wage and tax report form for online filing, louisiana quarterly wage report, lawage reporting |

,>$$$

5,, |

|

6""& |

|

7!; |

|

8$#,& |

|

|

|

|

|

|

|

:#1#)!:)'

? "0 02/ %)>(78 >!47@8

'

9<= |

+ |

|

|

4 |

|

|

|

|

0 |

|

|

|

|

2 |

|

|

|

|

|

5

6

7

8

9

IMPORTANT: Reports on disks will no longer be accepted after Jan. 31, 2012. Employers reporting 100 or more employees MUST file electronically at www.laworks.net.

& 0*$

?A2A?$

"*$

2$ A2"2"$2

52 "22

# B

:2

5$ :2

6$ :2

#" 22

2

$ ""

7>0!*=

5 2%'

6 2+#"$02'

7 #(" 344$*$'

8 (&2+'

9 .,/,))!)/,,)01)!0)#

4

!"#"$#$% "&'

(=%$%

|

|

|

|||

|

|

|

|

||

|

|||||

|

|

||||

|

|

||||

|

|

||||

|

|||||

|

|||||

,

%2&

*004BC1101* *999999920101*

7>0 |

5 |

YEAR/QUARTER |

(PREPRINT) |

EMPLOYER ACCOUNT NUMBER |

(PREPRINT) |

!"#

/'. 0#1,)&*2)**3

+.' .

►Items 1, 2, 3, 4, 5 and 6 have been pre)printed on the report. IMPORTANT: Do not alter the preprinted information on this document. Changes must be reported on the Employer’s Report of Change Form, found at www.laworks.net.

►In Item 7, enter number of continuation sheets.

►In Items 8, 9 and 10, enter on lines 1 thru 6 the employee's social security number, the total wages paid (including tips), and the first and last name of each employee. Round to the nearest dollar amount. (up or down; I.E. $1081.49 shall be rounded to $1081.00 and $1081.50 shall be rounded to $1082.00). If you are reporting more than 6 employees, you will need a continuation sheet. If continuation sheets are needed go to www.laworks.net to download the Employer's Wage Report)Continuation Sheet.

Wage totals must be entered on each sheet; total wages this quarter, including continuation sheets, should be entered on line 13.

NOTE: In order to receive proper credit for the wages paid to your employees the social security numbers must be listed.

►In Item 11, enter the number of covered workers in each pay period including the 12th of each month (Do not include workers on strike).

►Total the wages entered for the employees on the front of this form and enter this amount in Item 12.

►In item 13, enter the total from Item 12 and the totals from each continuation sheet you have attached.

SIGNATURE: Each report must be signed and dated by the proprietor, officer of the corporation, partner or duly authorized individual. Please provide title and telephone number.

IF YOU HAD NO EMPLOYMENT IN ANY PAY PERIOD YOU MUST FILE THIS REPORT ENTERING ZERO ()0)) WAGES.

NOTE: THE WAGE BASE WAS $7000 PRIOR TO THE YEAR 2010.

►In Item 14, enter the total of all reported employees’ excess wages for the quarter.

The following is an example of an excess wage calculation based on a wage base of $7700.00. Jan Doe earned $3500 in the 1st quarter (Jan., Feb., Mar.). You will have )0) excess wages. Jan Doe earned $3000 in the 2nd quarter (Apr., May, June). You will have )0) excess wages. Jan Doe earned $3000 in the 3rd quarter (July, Aug., Sept.). You will have $1800 excess wages. Jan Doe earned $2500 in the 4th quarter (Oct., Nov., Dec.). You will have $2500 excess wages.

NOTE: EXCESS WAGES NEVER EXCEED TOTAL WAGES IN A QUARTER.

IMPORTANT: For your information only...(Effective Jan. 1, 1998)

To compute the total amount of the contributions you paid which may be reported on your FUTA 940 tax form.

Multiply this factor |

(REPRINT) |

times the tax due ___________ |

If you received a Notice of Tax Overpayment (Form T287ES) you may use any part of this credit toward your contributions due. Enter the amount of the overpayment you wish to use on line 17 of the Employer’s Quarterly Wage and Tax Report.

(NOTE : Overpayments equal to or less than $500 will be preprinted in this field. Underpayments equal to or less than $5 will be preprinted in this field.)

If you are filing after the due date for this quarter a portion of the interest and penalty due will be subtracted from the remittance. To calculate interest and penalty see the example below.

EXAMPLE: Assume the report is 15 days past the due date for the 1st quarter of 2000 (04/30/00).

The tax due = $350.00 and an underpayment of $2.50 is on the account. This brings the total due to $352.50. The interest calculation at 1% per month is 0.50% times the $352.50 tax due totaling $1.74.

The penalty calculation at 5% per month is of tax due + interest due , totals $17.71. The total payment equals $352.50 + 1.74 + 17.71 = $371.95.

Add the interest and penalty calculated to the tax due and enter on line 18 as total remittance.

QUESTIONS CAN BE DIRECTED TO: (PREPRINT) |

.___________________________________________ |

%1#4%556##%##56##4#78%9%6#%11