Any time you wish to fill out 2nd, it's not necessary to download and install any sort of programs - simply use our online tool. To have our tool on the forefront of convenience, we strive to put into practice user-oriented capabilities and improvements regularly. We're routinely happy to get suggestions - play a pivotal part in revolutionizing how you work with PDF forms. With a few easy steps, you may start your PDF journey:

Step 1: Simply click on the "Get Form Button" in the top section of this webpage to launch our form editor. Here you will find everything that is necessary to fill out your document.

Step 2: After you open the PDF editor, you'll see the form ready to be filled in. Besides filling in various blank fields, you may also do some other things with the file, namely writing any textual content, modifying the original text, adding images, putting your signature on the document, and a lot more.

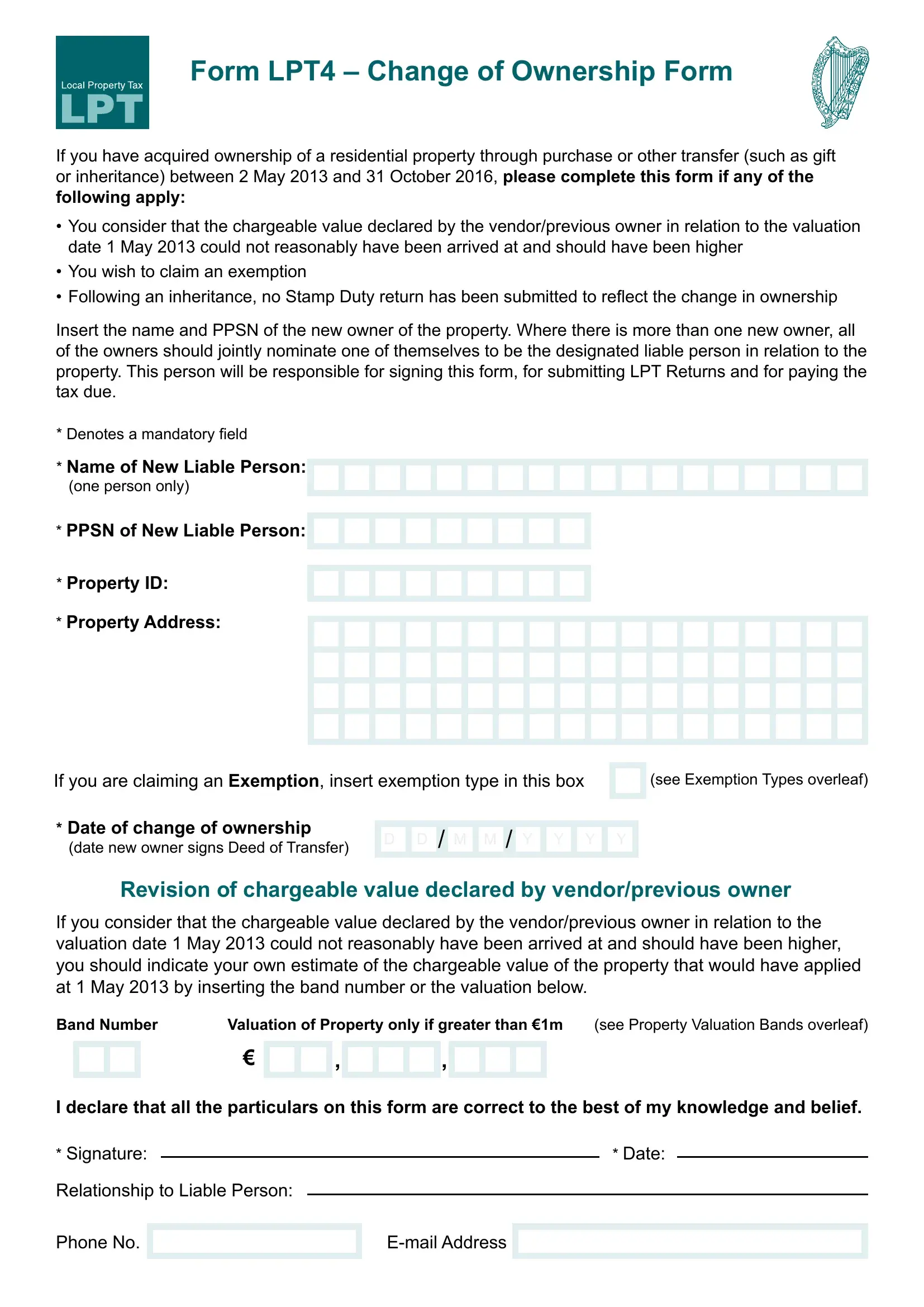

As for the fields of this particular PDF, here is what you should do:

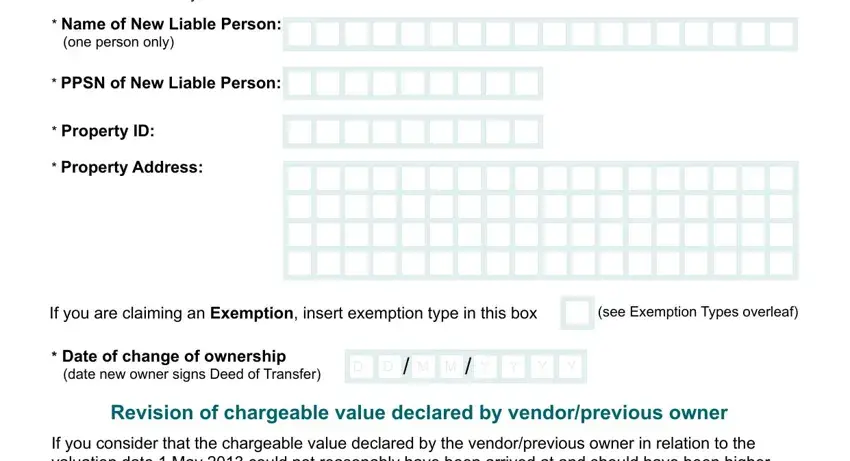

1. It is crucial to complete the 2nd correctly, hence be mindful when filling out the areas containing all these fields:

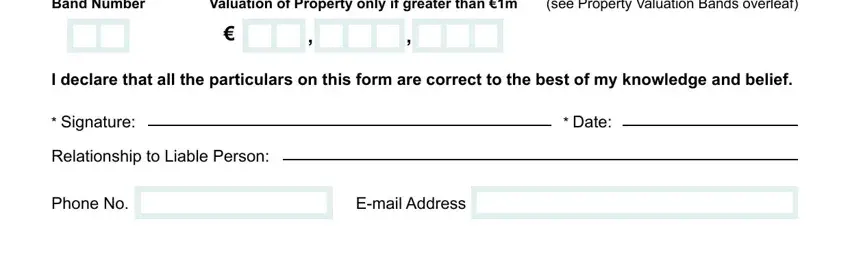

2. Right after this section is filled out, go to type in the suitable details in these - Band Number, Valuation of Property only if, see Property Valuation Bands, I declare that all the particulars, Signature, Relationship to Liable Person, Date, Phone No, and Email Address.

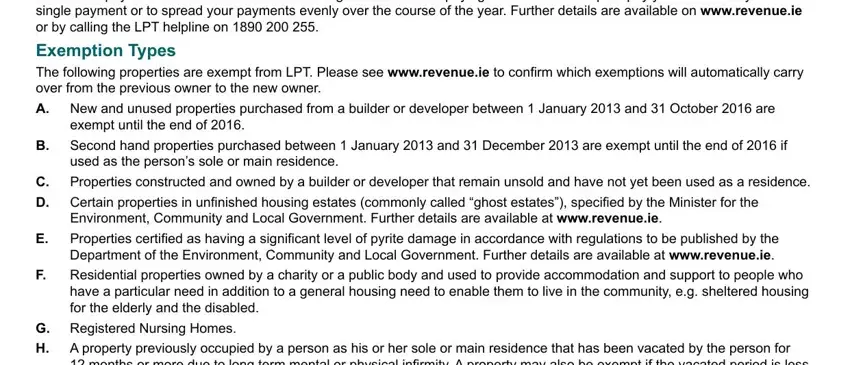

3. Completing Payment of Local Property Tax LPT, Exemption Types The following, A New and unused properties, exempt until the end of, B Second hand properties purchased, used as the persons sole or main, C Properties constructed and owned, Environment Community and Local, E Properties certiied as having a, Residential properties owned by a, G Registered Nursing Homes, H A property previously occupied, and months or more due to long term is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

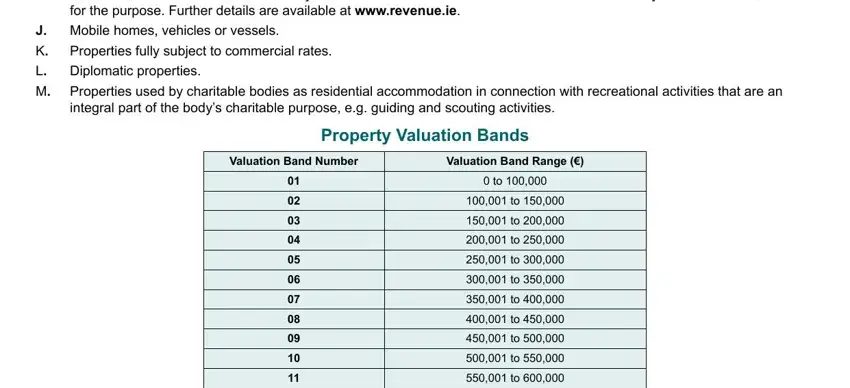

4. You're ready to fill out this next section! In this case you'll have all of these Properties purchased or adapted, J Mobile homes vehicles or vessels, K Properties fully subject to, L Diplomatic properties, M Properties used by charitable, integral part of the bodys, Property Valuation Bands, Valuation Band Number, and Valuation Band Range empty form fields to complete.

It's easy to make a mistake when filling in your Valuation Band Range, for that reason be sure you look again before you send it in.

Step 3: Go through what you've inserted in the blanks and then press the "Done" button. Make a 7-day free trial option with us and get immediate access to 2nd - with all changes preserved and accessible inside your personal cabinet. We do not share the details that you provide when working with forms at our site.