If you desire to fill out printable form ls 56, you won't have to download any kind of programs - simply try our PDF tool. Our team is devoted to making sure you have the ideal experience with our tool by regularly presenting new functions and enhancements. With these improvements, working with our editor gets better than ever before! This is what you would need to do to begin:

Step 1: Open the PDF file inside our tool by clicking the "Get Form Button" in the top area of this webpage.

Step 2: The editor provides the ability to customize PDF documents in a variety of ways. Improve it by writing your own text, adjust what is originally in the file, and include a signature - all when it's needed!

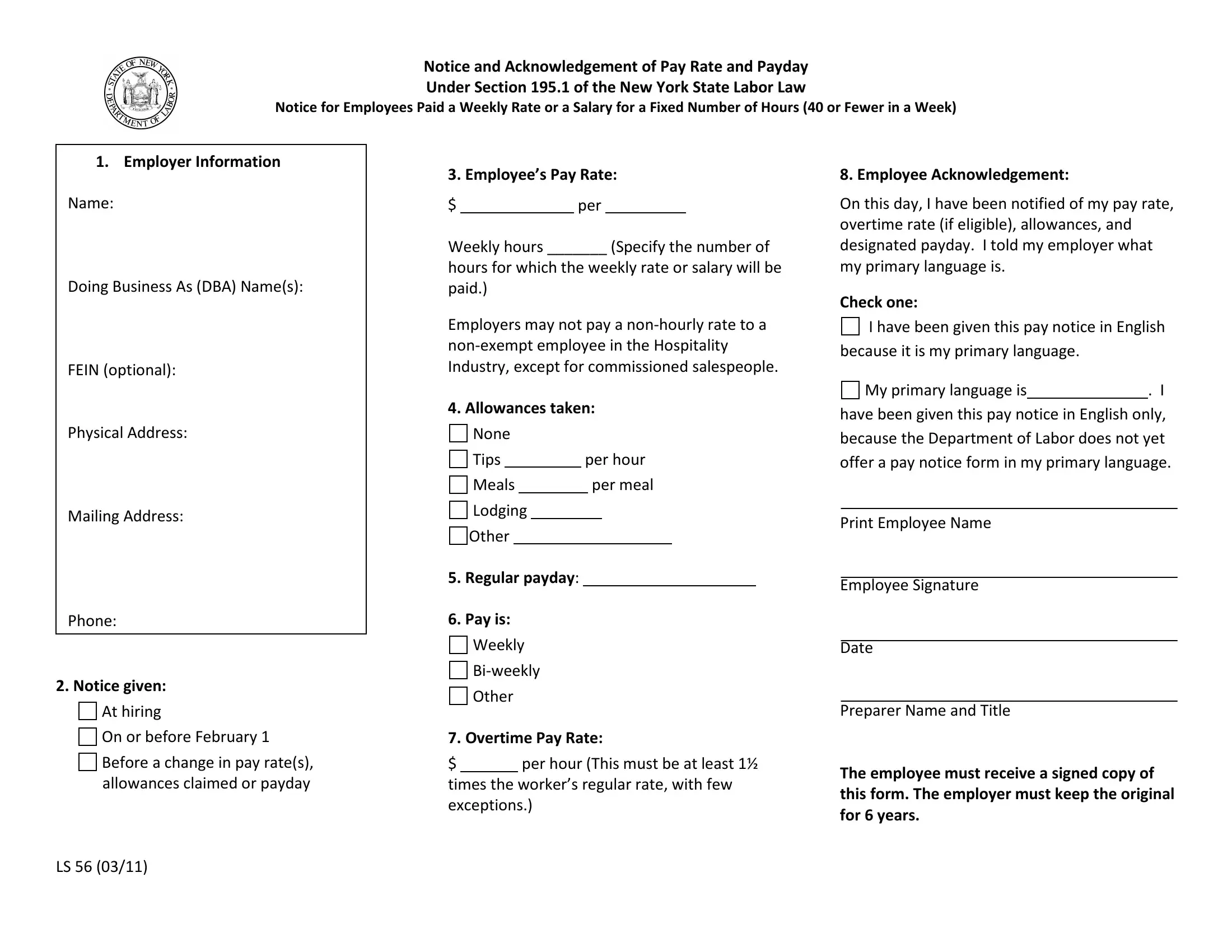

This document requires specific details; to ensure accuracy and reliability, make sure you take into account the suggestions further down:

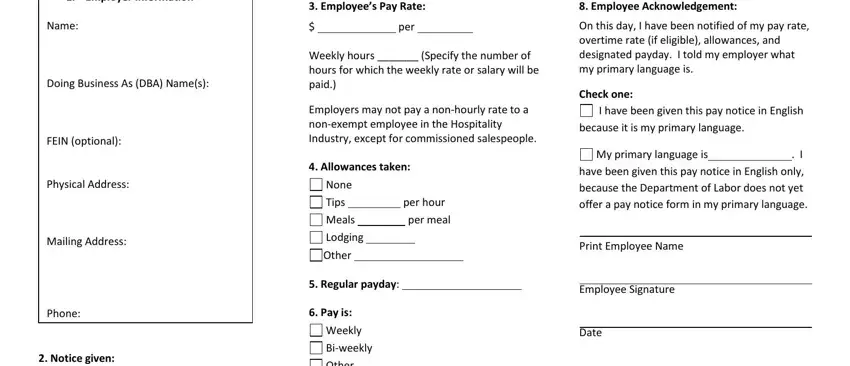

1. It is recommended to fill out the printable form ls 56 correctly, therefore be attentive while working with the areas containing these fields:

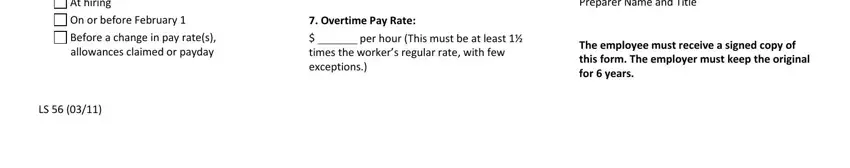

2. Given that the previous part is finished, you need to include the required specifics in At hiring, On or before February, Before a change in pay rates, Overtime Pay Rate, per hour This must be at least, times the workers regular rate, and Print Employee Name Employee so you can move forward further.

A lot of people frequently make mistakes while filling in Overtime Pay Rate in this part. You should revise whatever you enter here.

Step 3: Before addressing the next step, ensure that blank fields are filled in right. Once you believe it is all fine, click “Done." After setting up afree trial account here, you will be able to download printable form ls 56 or email it immediately. The PDF document will also be readily accessible via your personal account menu with your each modification. Here at FormsPal, we strive to make sure that all your information is maintained protected.