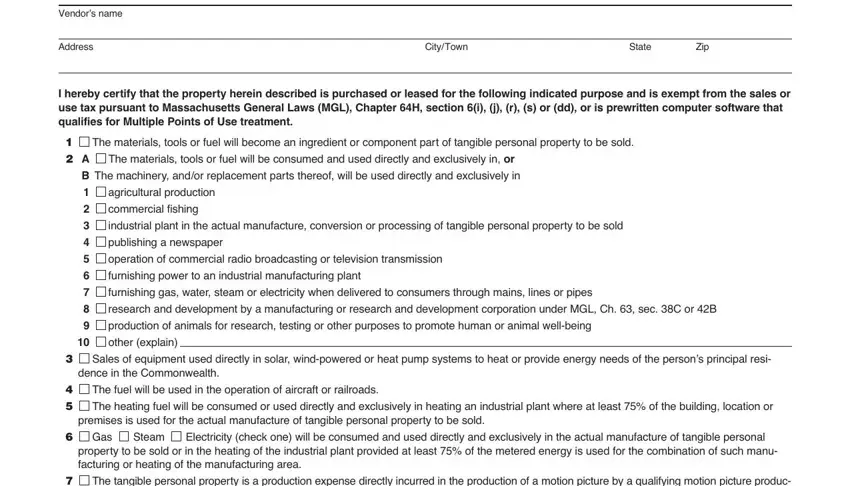

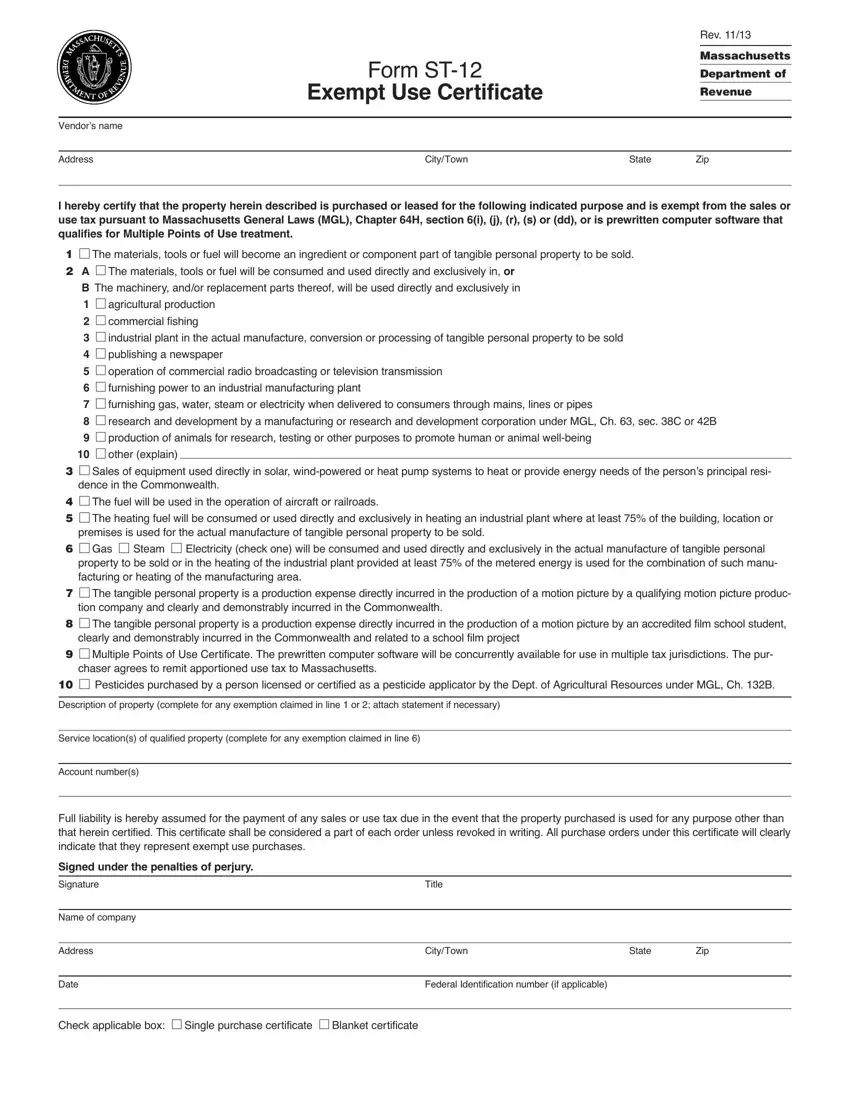

Vendor’s name

Address |

City/Town |

State |

Zip |

I hereby certify that the property herein described is purchased or leased for the following indicated purpose and is exempt from the sales or use tax pursuant to Massachusetts General Laws (MGL), Chapter 64H, section 6(i), (j), (r), (s) or (dd), or is prewritten computer software that qualifies for Multiple Points of Use treatment.

1 The materials, tools or fuel will become an ingredient or component part of tangible personal property to be sold.

The materials, tools or fuel will become an ingredient or component part of tangible personal property to be sold.

2A  The materials, tools or fuel will be consumed and used directly and exclusively in, or B The machinery, and/or replacement parts thereof, will be used directly and exclusively in 1

The materials, tools or fuel will be consumed and used directly and exclusively in, or B The machinery, and/or replacement parts thereof, will be used directly and exclusively in 1  agricultural production

agricultural production

2  commercial fishing

commercial fishing

3  industrial plant in the actual manufacture, conversion or processing of tangible personal property to be sold 4

industrial plant in the actual manufacture, conversion or processing of tangible personal property to be sold 4  publishing a newspaper

publishing a newspaper

5 operation of commercial radio broadcasting or television transmission

operation of commercial radio broadcasting or television transmission

6 furnishing power to an industrial manufacturing plant

furnishing power to an industrial manufacturing plant

7 furnishing gas, water, steam or electricity when delivered to consumers through mains, lines or pipes

furnishing gas, water, steam or electricity when delivered to consumers through mains, lines or pipes

8 research and development by a manufacturing or research and development corporation under MGL, Ch. 63, sec. 38C or 42B

research and development by a manufacturing or research and development corporation under MGL, Ch. 63, sec. 38C or 42B

9 production of animals for research, testing or other purposes to promote human or animal well-being

production of animals for research, testing or other purposes to promote human or animal well-being

10 other (explain)

other (explain)

3 Sales of equipment used directly in solar, wind-powered or heat pump systems to heat or provide energy needs of the person’s principal resi- dence in the Commonwealth.

Sales of equipment used directly in solar, wind-powered or heat pump systems to heat or provide energy needs of the person’s principal resi- dence in the Commonwealth.

4 The fuel will be used in the operation of aircraft or railroads.

The fuel will be used in the operation of aircraft or railroads.

5 The heating fuel will be consumed or used directly and exclusively in heating an industrial plant where at least 75% of the building, location or premises is used for the actual manufacture of tangible personal property to be sold.

The heating fuel will be consumed or used directly and exclusively in heating an industrial plant where at least 75% of the building, location or premises is used for the actual manufacture of tangible personal property to be sold.

6 Gas

Gas  Steam

Steam  Electricity (check one) will be consumed and used directly and exclusively in the actual manufacture of tangible personal property to be sold or in the heating of the industrial plant provided at least 75% of the metered energy is used for the combination of such manu- facturing or heating of the manufacturing area.

Electricity (check one) will be consumed and used directly and exclusively in the actual manufacture of tangible personal property to be sold or in the heating of the industrial plant provided at least 75% of the metered energy is used for the combination of such manu- facturing or heating of the manufacturing area.

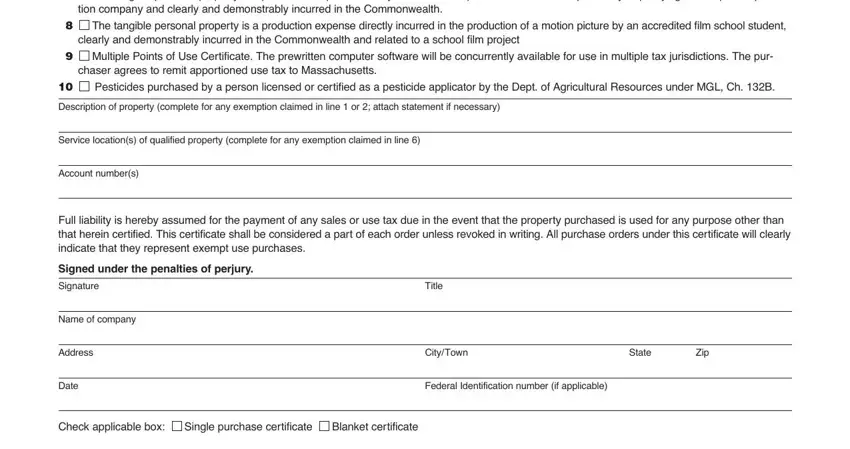

7 The tangible personal property is a production expense directly incurred in the production of a motion picture by a qualifying motion picture produc- tion company and clearly and demonstrably incurred in the Commonwealth.

The tangible personal property is a production expense directly incurred in the production of a motion picture by a qualifying motion picture produc- tion company and clearly and demonstrably incurred in the Commonwealth.

8 The tangible personal property is a production expense directly incurred in the production of a motion picture by an accredited film school student, clearly and demonstrably incurred in the Commonwealth and related to a school film project

The tangible personal property is a production expense directly incurred in the production of a motion picture by an accredited film school student, clearly and demonstrably incurred in the Commonwealth and related to a school film project

9 Multiple Points of Use Certificate. The prewritten computer software will be concurrently available for use in multiple tax jurisdictions. The pur- chaser agrees to remit apportioned use tax to Massachusetts.

Multiple Points of Use Certificate. The prewritten computer software will be concurrently available for use in multiple tax jurisdictions. The pur- chaser agrees to remit apportioned use tax to Massachusetts.

10 Pesticides purchased by a person licensed or certified as a pesticide applicator by the Dept. of Agricultural Resources under MGL, Ch. 132B.

Pesticides purchased by a person licensed or certified as a pesticide applicator by the Dept. of Agricultural Resources under MGL, Ch. 132B.

Description of property (complete for any exemption claimed in line 1 or 2; attach statement if necessary)

Service location(s) of qualified property (complete for any exemption claimed in line 6)

Account number(s)

Full liability is hereby assumed for the payment of any sales or use tax due in the event that the property purchased is used for any purpose other than that herein certified. This certificate shall be considered a part of each order unless revoked in writing. All purchase orders under this certificate will clearly indicate that they represent exempt use purchases.

Signed under the penalties of perjury.

Signature |

Title |

|

|

|

|

|

|

Name of company |

|

|

|

|

|

|

|

Address |

City/Town |

State |

Zip |

|

|

|

|

Date |

Federal Identification number (if applicable) |

|

|

The materials, tools or fuel will become an ingredient or component part of tangible personal property to be sold.

The materials, tools or fuel will become an ingredient or component part of tangible personal property to be sold. The materials, tools or fuel will be consumed and used directly and exclusively in,

The materials, tools or fuel will be consumed and used directly and exclusively in,  agricultural production

agricultural production commercial fishing

commercial fishing industrial plant in the actual manufacture, conversion or processing of tangible personal property to be sold

industrial plant in the actual manufacture, conversion or processing of tangible personal property to be sold  publishing a newspaper

publishing a newspaper operation of commercial radio broadcasting or television transmission

operation of commercial radio broadcasting or television transmission furnishing power to an industrial manufacturing plant

furnishing power to an industrial manufacturing plant furnishing gas, water, steam or electricity when delivered to consumers through mains, lines or pipes

furnishing gas, water, steam or electricity when delivered to consumers through mains, lines or pipes research and development by a manufacturing or research and development corporation under MGL, Ch. 63, sec. 38C or 42B

research and development by a manufacturing or research and development corporation under MGL, Ch. 63, sec. 38C or 42B production of animals for research, testing or other purposes to promote human or animal

production of animals for research, testing or other purposes to promote human or animal  other (explain)

other (explain) Sales of equipment used directly in solar,

Sales of equipment used directly in solar,  The fuel will be used in the operation of aircraft or railroads.

The fuel will be used in the operation of aircraft or railroads. The heating fuel will be consumed or used directly and exclusively in heating an industrial plant where at least 75% of the building, location or premises is used for the actual manufacture of tangible personal property to be sold.

The heating fuel will be consumed or used directly and exclusively in heating an industrial plant where at least 75% of the building, location or premises is used for the actual manufacture of tangible personal property to be sold. Gas

Gas  Steam

Steam  Electricity (check one) will be consumed and used directly and exclusively in the actual manufacture of tangible personal property to be sold or in the heating of the industrial plant provided at least 75% of the metered energy is used for the combination of such manu- facturing or heating of the manufacturing area.

Electricity (check one) will be consumed and used directly and exclusively in the actual manufacture of tangible personal property to be sold or in the heating of the industrial plant provided at least 75% of the metered energy is used for the combination of such manu- facturing or heating of the manufacturing area. The tangible personal property is a production expense directly incurred in the production of a motion picture by a qualifying motion picture produc- tion company and clearly and demonstrably incurred in the Commonwealth.

The tangible personal property is a production expense directly incurred in the production of a motion picture by a qualifying motion picture produc- tion company and clearly and demonstrably incurred in the Commonwealth. The tangible personal property is a production expense directly incurred in the production of a motion picture by an accredited film school student, clearly and demonstrably incurred in the Commonwealth and related to a school film project

The tangible personal property is a production expense directly incurred in the production of a motion picture by an accredited film school student, clearly and demonstrably incurred in the Commonwealth and related to a school film project Multiple Points of Use Certificate. The prewritten computer software will be concurrently available for use in multiple tax jurisdictions. The pur- chaser agrees to remit apportioned use tax to Massachusetts.

Multiple Points of Use Certificate. The prewritten computer software will be concurrently available for use in multiple tax jurisdictions. The pur- chaser agrees to remit apportioned use tax to Massachusetts. Pesticides purchased by a person licensed or certified as a pesticide applicator by the Dept. of Agricultural Resources under MGL, Ch. 132B.

Pesticides purchased by a person licensed or certified as a pesticide applicator by the Dept. of Agricultural Resources under MGL, Ch. 132B.

Single purchase certificate

Single purchase certificate

Blanket certificate

Blanket certificate

printed on recycled paper

printed on recycled paper