Making use of the online editor for PDFs by FormsPal, you may fill out or change maap here and now. We are aimed at providing you with the absolute best experience with our editor by consistently introducing new capabilities and upgrades. With these improvements, working with our tool gets easier than ever! It just takes several easy steps:

Step 1: First of all, open the pdf editor by clicking the "Get Form Button" in the top section of this page.

Step 2: Using this state-of-the-art PDF editor, you can actually do more than merely complete blanks. Express yourself and make your forms appear perfect with custom textual content added in, or adjust the original input to excellence - all that backed up by the capability to add stunning graphics and sign the document off.

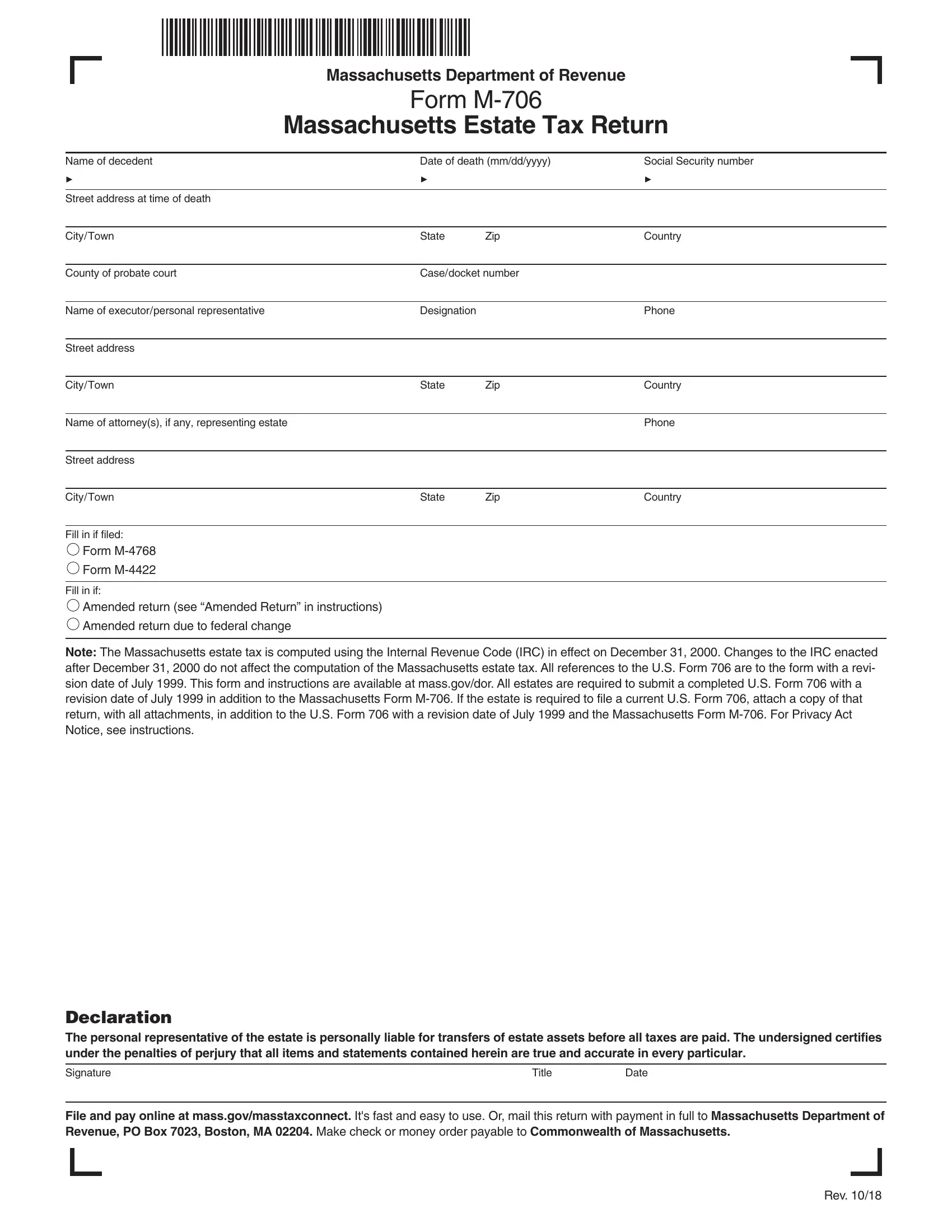

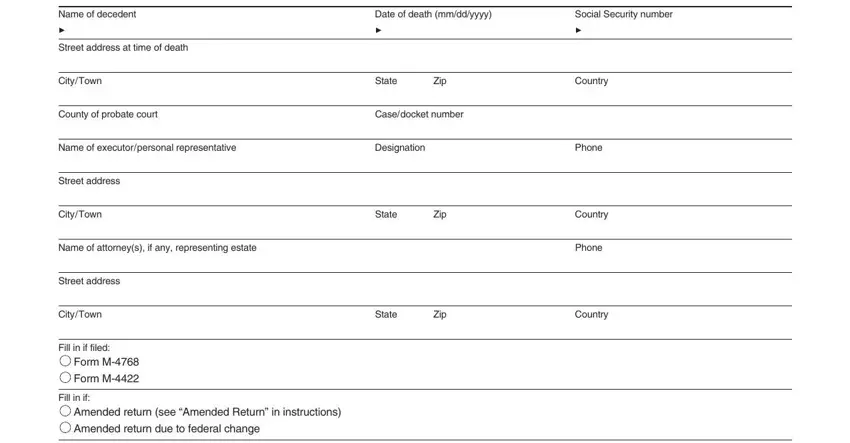

With regards to the fields of this precise document, here's what you should know:

1. The maap will require certain details to be inserted. Make certain the subsequent blank fields are complete:

2. Now that this array of fields is finished, you should include the required particulars in Declaration The personal, Signature, Title, Date, File and pay online at, and Rev in order to move on further.

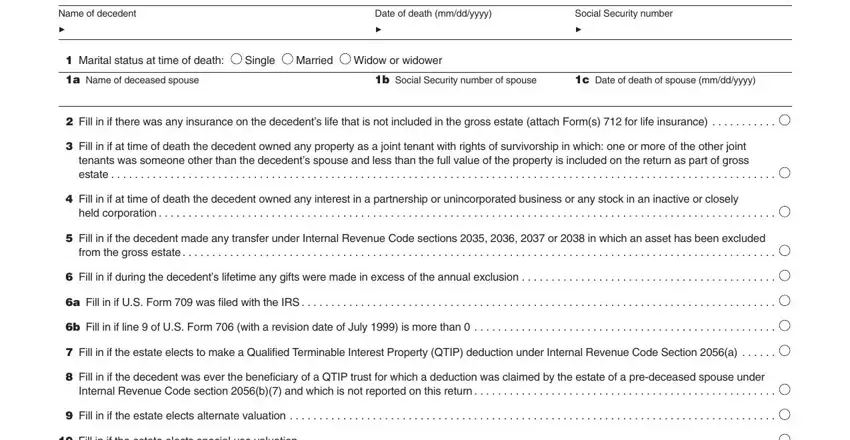

3. This next step is focused on Name of decedent, Date of death mmddyyyy, Social Security number, Marital status at time of death, Single Married Widow or widower, a Name of deceased spouse, b Social Security number of spouse, c Date of death of spouse mmddyyyy, Fill in if there was any, Fill in if at time of death the, Fill in if at time of death the, held corporation, Fill in if the decedent made any, from the gross estate, and Fill in if during the decedents - fill in all of these empty form fields.

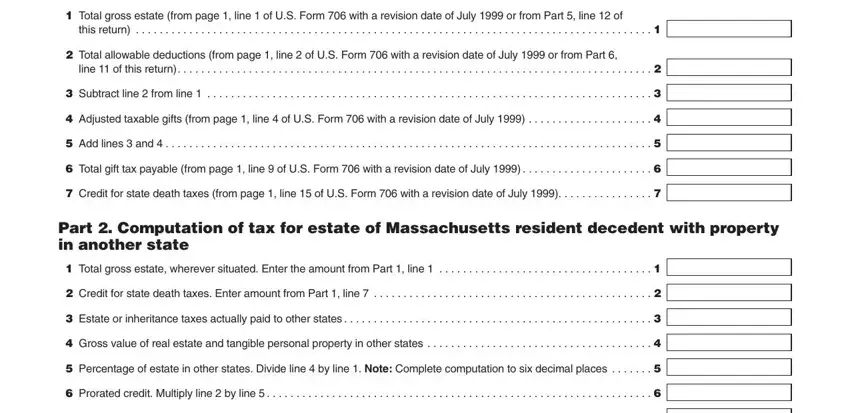

4. To go ahead, this next part will require completing several blank fields. Examples include Part Tentative Massachusetts, Total gross estate from page, this return, Total allowable deductions from, line of this return, Subtract line from line, Adjusted taxable gifts from page, Add lines and, Total gift tax payable from page, Credit for state death taxes from, Part Computation of tax for, Total gross estate wherever, Credit for state death taxes, Estate or inheritance taxes, and Gross value of real estate and, which are integral to continuing with this particular document.

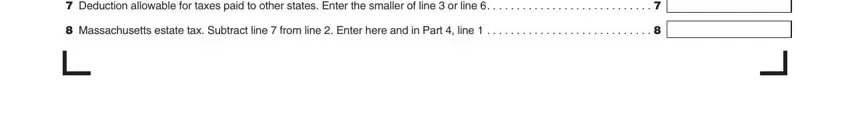

5. This document has to be wrapped up by going through this part. Here there is a comprehensive set of blanks that need accurate details to allow your document submission to be complete: Deduction allowable for taxes, and Massachusetts estate tax Subtract.

When it comes to Deduction allowable for taxes and Deduction allowable for taxes, ensure that you review things in this current part. Both these are thought to be the most important ones in the PDF.

Step 3: Spell-check the details you have entered into the form fields and then press the "Done" button. Sign up with FormsPal now and immediately obtain maap, ready for downloading. Every change made is handily saved , meaning you can change the form further if required. Here at FormsPal.com, we strive to be certain that all your details are kept secure.