Whenever you want to fill out maine predetermination, you won't have to install any kind of applications - simply try our PDF tool. To have our tool on the cutting edge of practicality, we aim to implement user-oriented features and enhancements regularly. We're routinely glad to receive feedback - assist us with remolding PDF editing. To start your journey, consider these basic steps:

Step 1: First, access the pdf editor by pressing the "Get Form Button" at the top of this webpage.

Step 2: When you launch the editor, there'll be the form all set to be completed. Other than filling in various fields, you may as well do other sorts of things with the form, such as putting on custom text, changing the initial text, inserting illustrations or photos, signing the document, and more.

It is actually an easy task to complete the pdf with our practical guide! Here is what you should do:

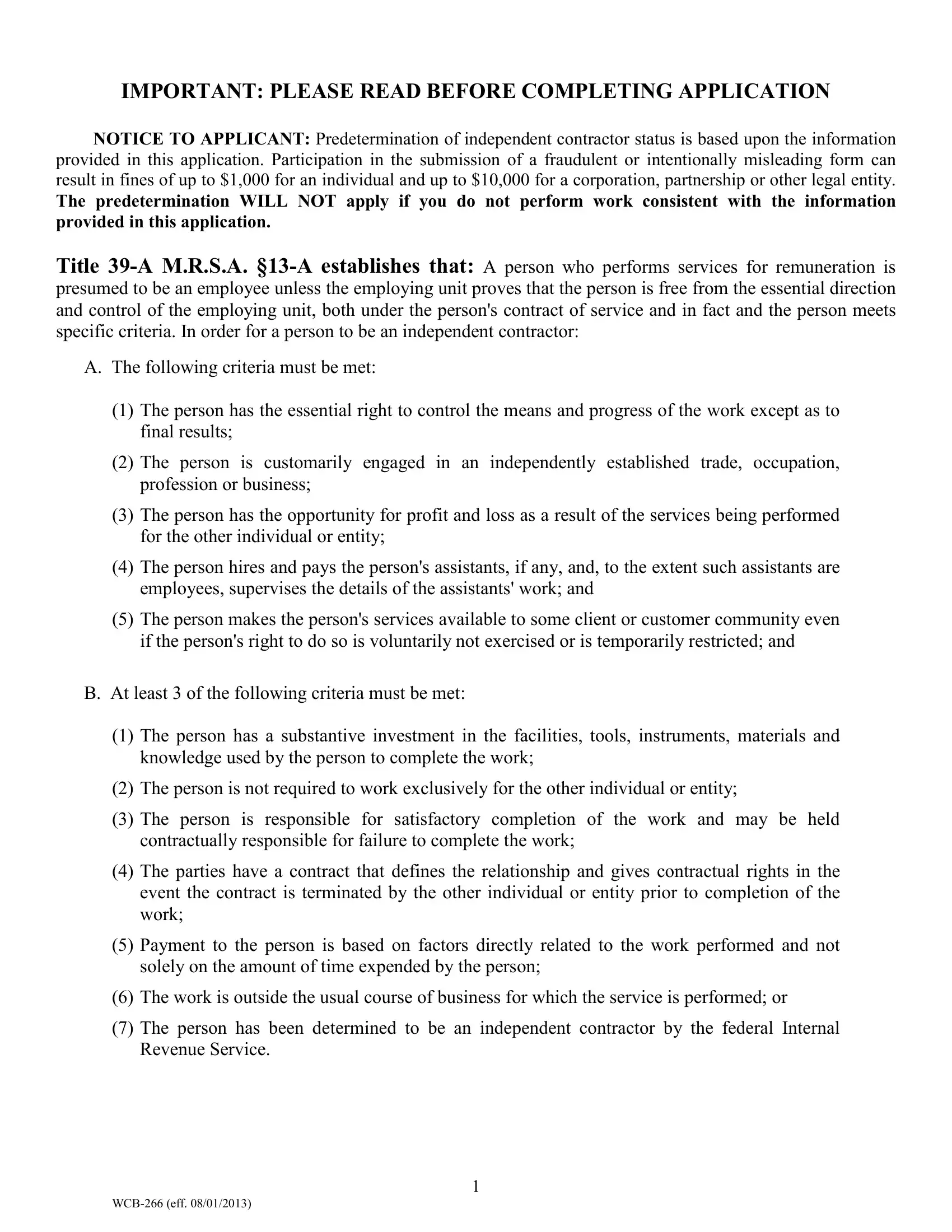

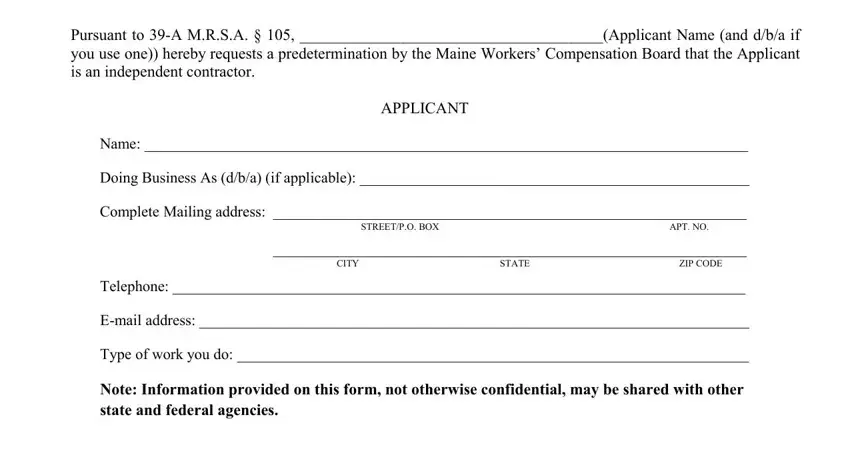

1. To begin with, when completing the maine predetermination, begin with the area that has the next blanks:

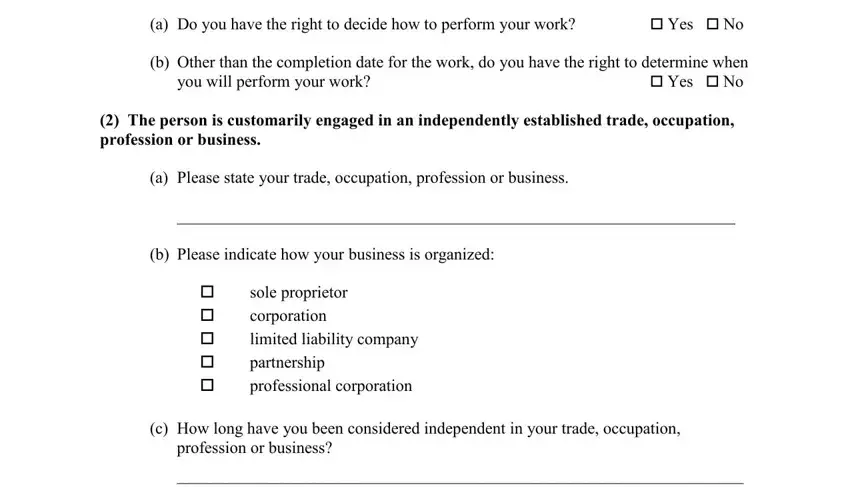

2. Once the previous array of fields is completed, you're ready include the essential particulars in The person has the essential, a Do you have the right to decide, Yes No, b Other than the completion date, you will perform your work, The person is customarily engaged, a Please state your trade, b Please indicate how your, sole proprietor corporation, c How long have you been, and profession or business allowing you to move forward further.

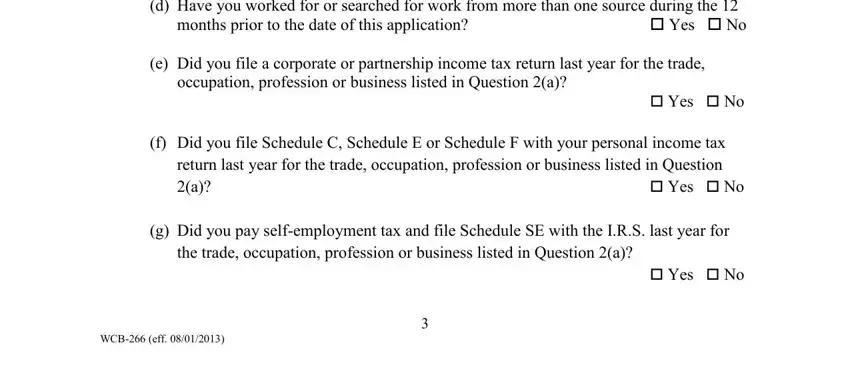

3. In this specific step, look at d Have you worked for or searched, months prior to the date of this, e Did you file a corporate or, occupation profession or business, Yes No, f Did you file Schedule C Schedule, Yes No, g Did you pay selfemployment tax, the trade occupation profession or, Yes No, and WCB eff. All of these will need to be filled in with greatest focus on detail.

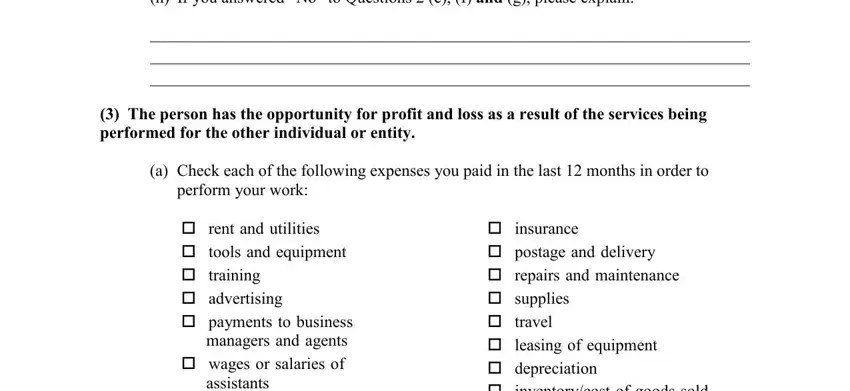

4. Filling out h If you answered No to Questions, The person has the opportunity, a Check each of the following, perform your work, rent and utilities tools and, assistants, and insurance postage and delivery is paramount in the fourth part - make sure you don't rush and take a close look at every single empty field!

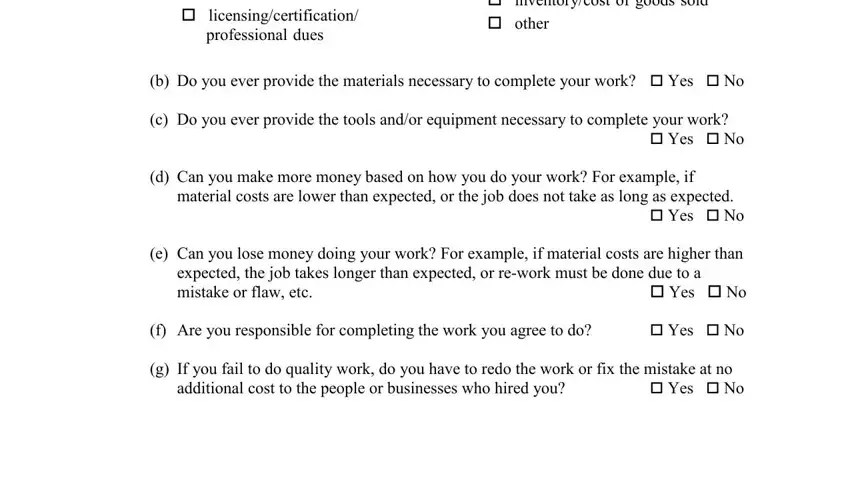

5. As a final point, the following last section is precisely what you have to finish before finalizing the document. The blanks in this instance are the next: assistants, licensingcertification, professional dues, insurance postage and delivery, b Do you ever provide the, c Do you ever provide the tools, Yes No, d Can you make more money based on, material costs are lower than, e Can you lose money doing your, expected the job takes longer than, Yes No, f Are you responsible for, Yes No, and g If you fail to do quality work.

It's simple to get it wrong while filling out your d Can you make more money based on, so be sure to look again before you send it in.

Step 3: Once you have looked over the information you filled in, click on "Done" to complete your FormsPal process. Right after starting afree trial account at FormsPal, it will be possible to download maine predetermination or email it directly. The file will also be accessible via your personal account with your every single modification. FormsPal ensures your data confidentiality by using a protected method that in no way records or distributes any kind of sensitive information typed in. You can relax knowing your docs are kept confidential every time you work with our editor!