Dealing with PDF files online is certainly very simple with this PDF tool. You can fill in maryland domestic partnership affidavit here effortlessly. The editor is consistently improved by us, getting new features and growing to be greater. By taking a few simple steps, you are able to start your PDF editing:

Step 1: Simply click the "Get Form Button" in the top section of this page to access our pdf form editor. Here you will find everything that is necessary to fill out your file.

Step 2: Using this advanced PDF tool, it is possible to do more than just fill in blank form fields. Express yourself and make your forms look high-quality with custom textual content added, or adjust the file's original input to excellence - all that accompanied by an ability to insert any type of graphics and sign the PDF off.

This PDF form requires particular data to be entered, therefore ensure that you take some time to enter precisely what is requested:

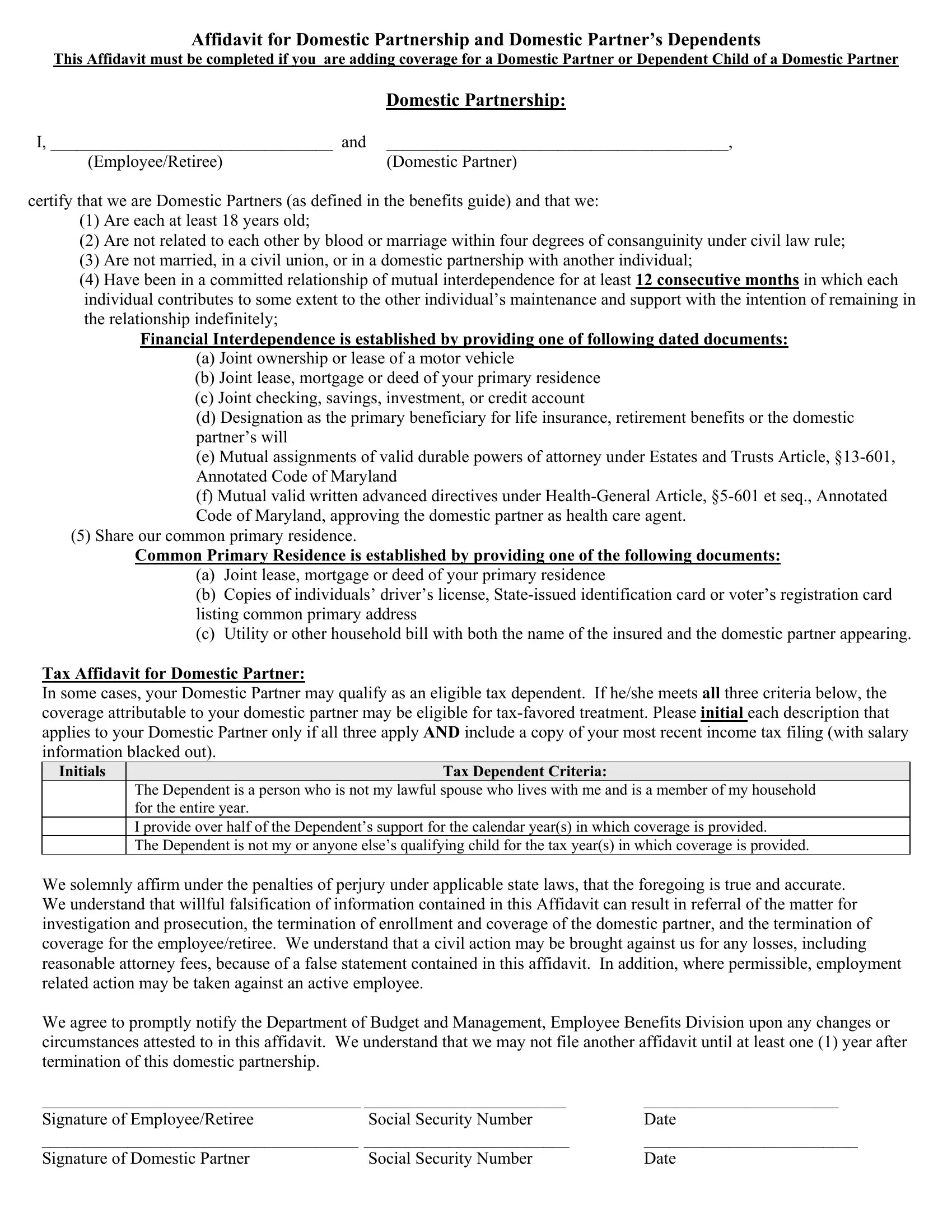

1. Complete your maryland domestic partnership affidavit with a selection of essential blanks. Collect all of the required information and ensure absolutely nothing is left out!

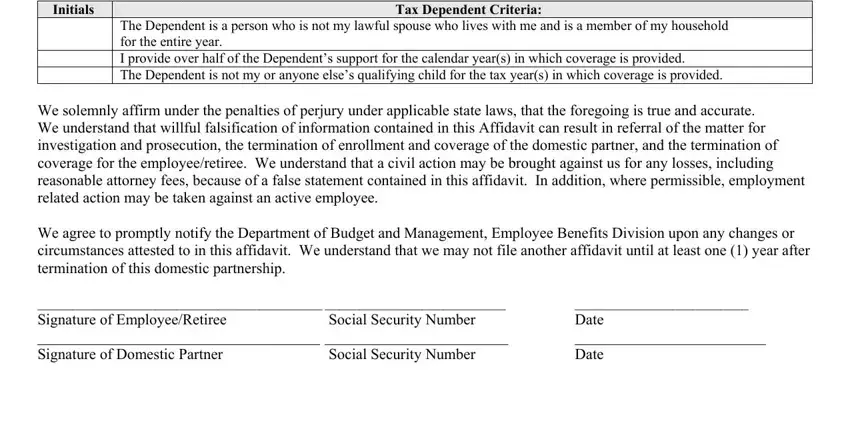

2. The subsequent stage is to complete these particular fields: Tax Affidavit for Domestic Partner, Tax Dependent Criteria, The Dependent is a person who is, We solemnly affirm under the, Signature of EmployeeRetiree, Social Security Number, Social Security Number, and Date Date.

Be extremely mindful while completing We solemnly affirm under the and Tax Dependent Criteria, because this is where a lot of people make errors.

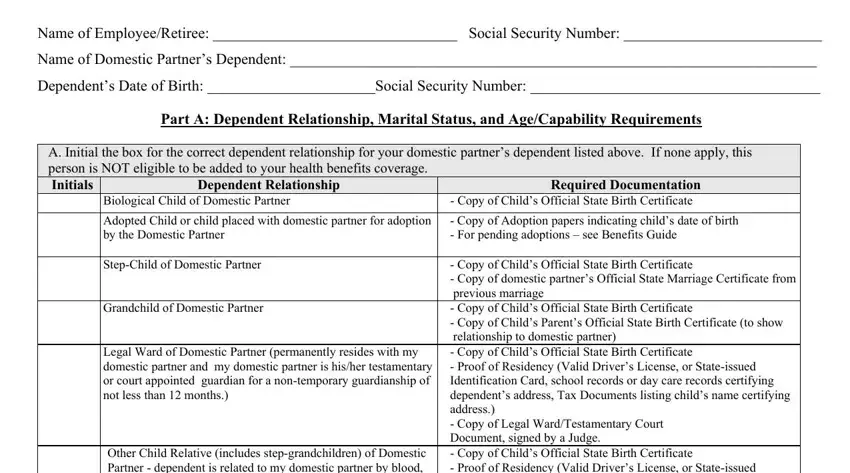

3. Completing Name of EmployeeRetiree Social, Name of Domestic Partners, Dependents Date of Birth Social, Part A Dependent Relationship, A Initial the box for the correct, Dependent Relationship, Required Documentation Copy of, Biological Child of Domestic, Adopted Child or child placed with, Copy of Adoption papers, StepChild of Domestic Partner, Grandchild of Domestic Partner, Legal Ward of Domestic Partner, Other Child Relative includes, and Copy of Childs Official State is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

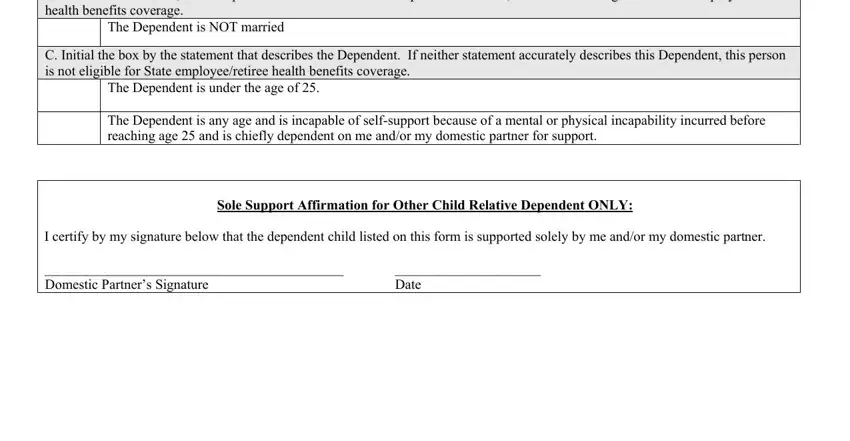

4. The subsequent section requires your input in the following parts: B Initial the box below if the, The Dependent is NOT married, C Initial the box by the statement, The Dependent is under the age of, Sole Support Affirmation for Other, I certify by my signature below, and Date. It is important to enter all requested details to move onward.

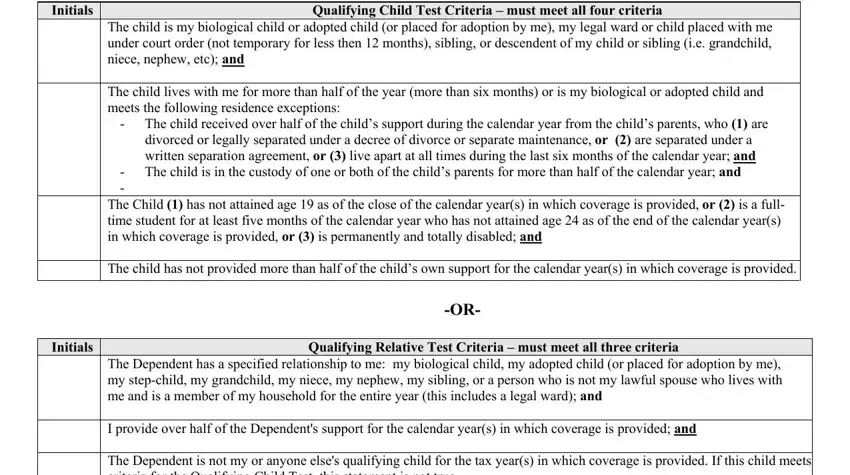

5. Because you come close to the finalization of your document, you will find a couple more requirements that should be fulfilled. Particularly, In some cases the dependent of, Initials, Qualifying Child Test Criteria, The child is my biological child, The child received over half of, divorced or legally separated, The child is in the custody of, The Child has not attained age, Initials, Qualifying Relative Test Criteria, and The Dependent has a specified should be done.

Step 3: Go through all the information you've inserted in the form fields and press the "Done" button. Join us now and immediately access maryland domestic partnership affidavit, all set for download. Each and every change you make is handily kept , which means you can modify the form further if required. When you use FormsPal, you can easily fill out forms without the need to be concerned about personal information breaches or records being shared. Our secure system ensures that your private information is stored safe.