Whenever you intend to fill out maryland 500 form, it's not necessary to download any software - simply give a try to our PDF tool. In order to make our editor better and more convenient to work with, we consistently come up with new features, with our users' suggestions in mind. Here is what you'd need to do to start:

Step 1: Just click on the "Get Form Button" above on this page to get into our pdf file editing tool. There you'll find all that is required to work with your file.

Step 2: As soon as you access the PDF editor, you'll see the document ready to be completed. Other than filling in different blanks, you may as well perform various other things with the file, that is putting on custom textual content, changing the original textual content, inserting graphics, signing the PDF, and a lot more.

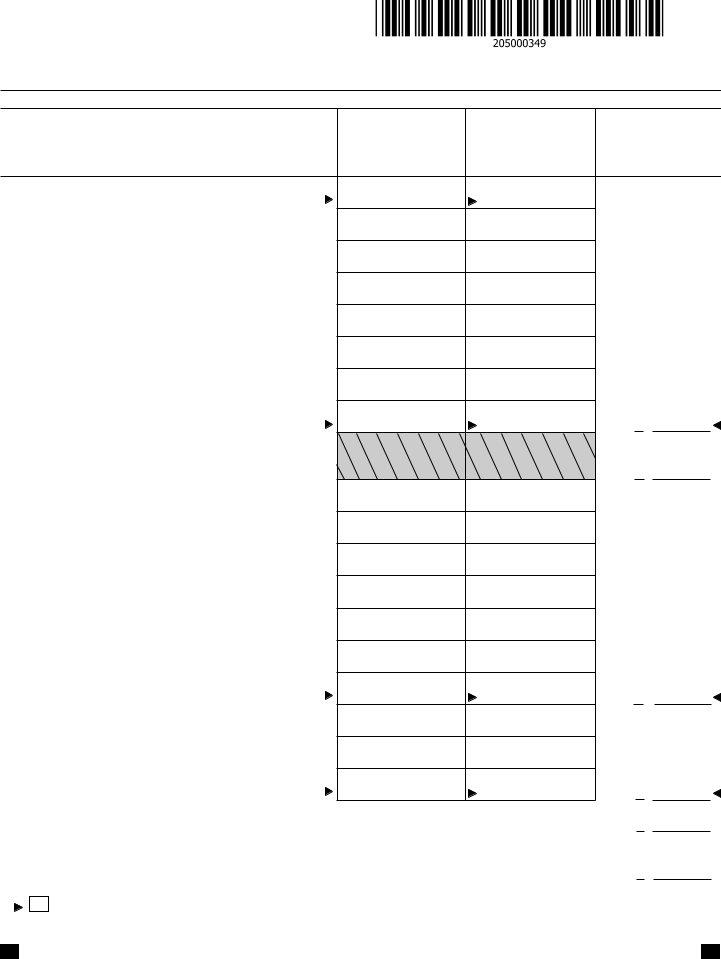

So as to finalize this PDF document, make sure that you enter the necessary details in every blank:

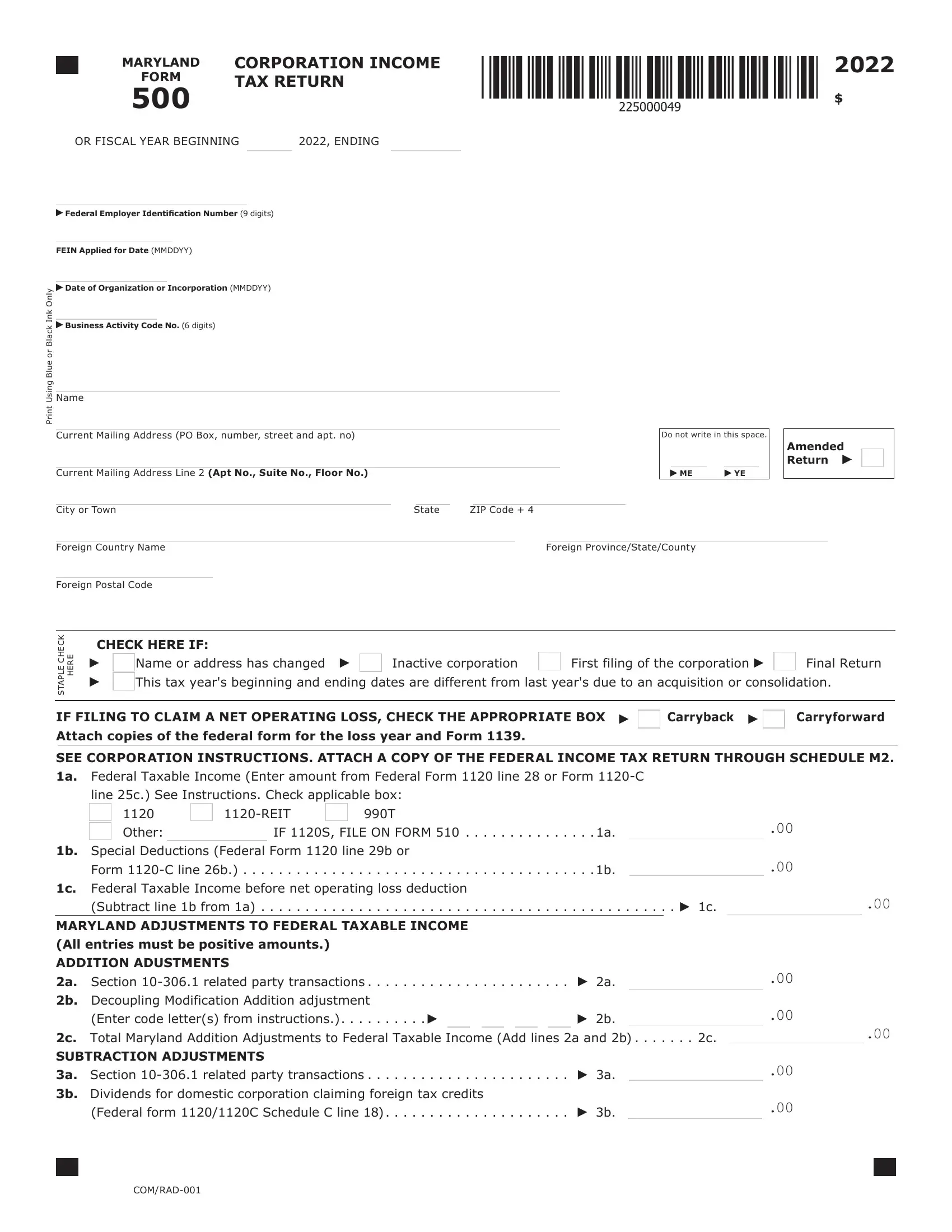

1. Begin completing the maryland 500 form with a group of necessary blanks. Gather all of the information you need and make certain there is nothing omitted!

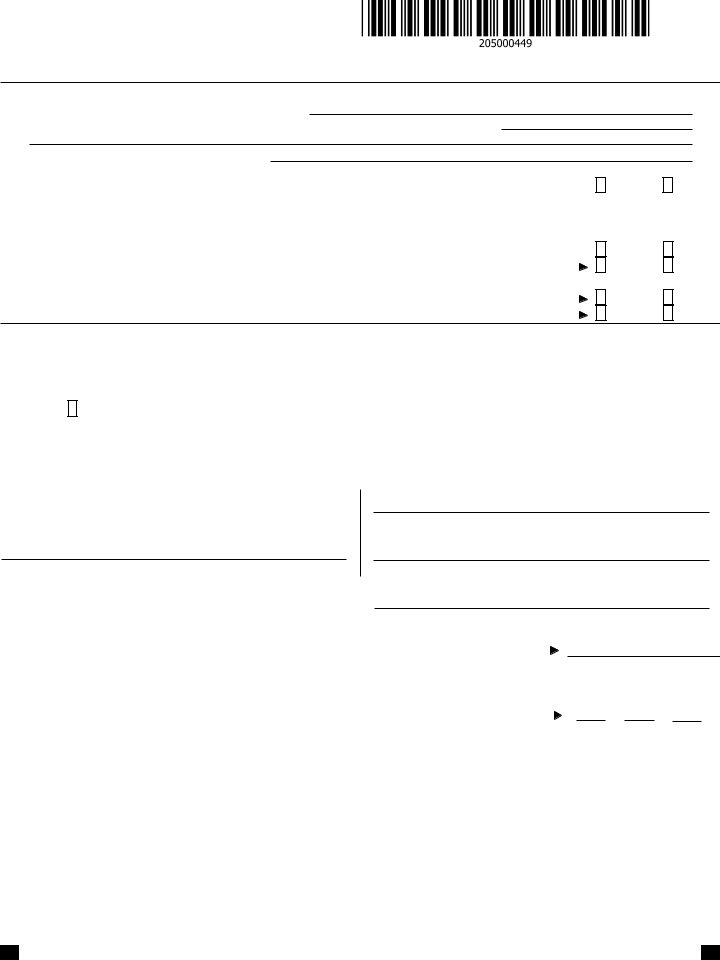

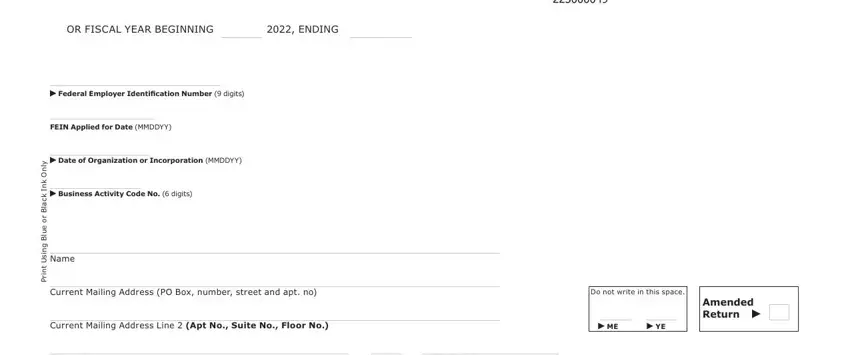

2. After this part is done, go to enter the suitable details in these: City or Town, State, ZIP Code, Foreign Country Name, Foreign Postal Code, Foreign ProvinceStateCounty, K C E H C E L P A T S, E R E H, CHECK HERE IF, Name or address has changed, Inactive corporation, First filing of the corporation, Final Return, This tax years beginning and, and IF FILING TO CLAIM A NET OPERATING.

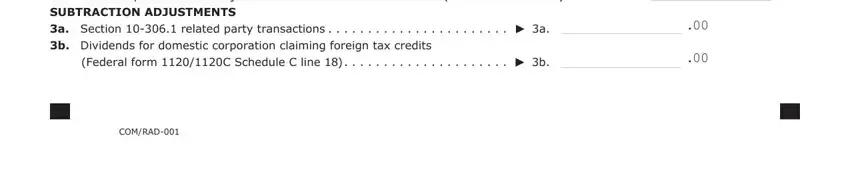

3. This next section is related to c Total Maryland Addition, Federal form C Schedule C line, and COMRAD - fill out all these blanks.

Those who use this PDF frequently make errors when filling out COMRAD in this section. Ensure you reread whatever you type in here.

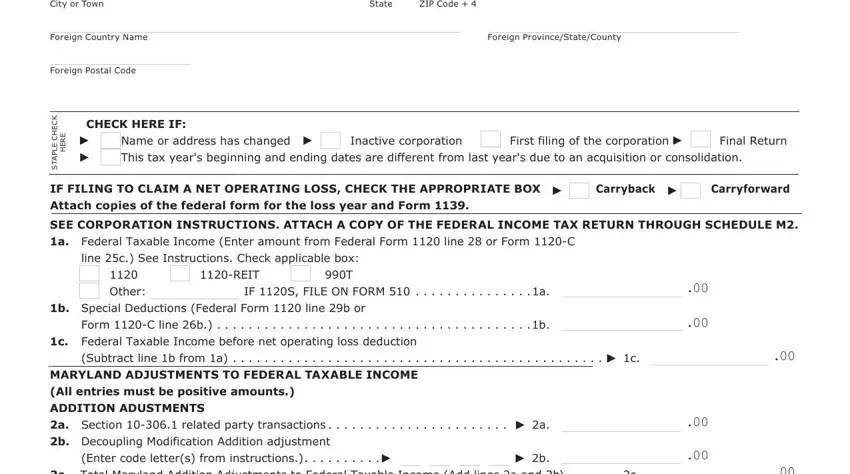

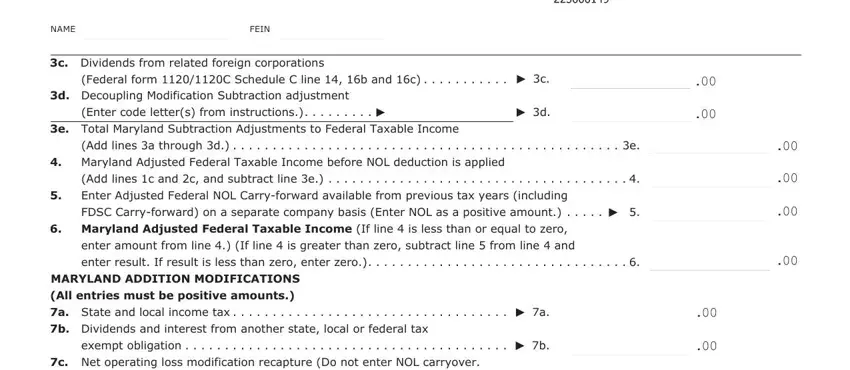

4. This next section requires some additional information. Ensure you complete all the necessary fields - NAME, FEIN, c Dividends from related foreign, Federal form C Schedule C line b, d Decoupling Modification, Enter code letters from, e Total Maryland Subtraction, Add lines a through d, Maryland Adjusted Federal Taxable, Add lines c and c and subtract, Enter Adjusted Federal NOL, FDSC Carryforward on a separate, Maryland Adjusted Federal Taxable, enter result If result is less, and MARYLAND ADDITION MODIFICATIONS - to proceed further in your process!

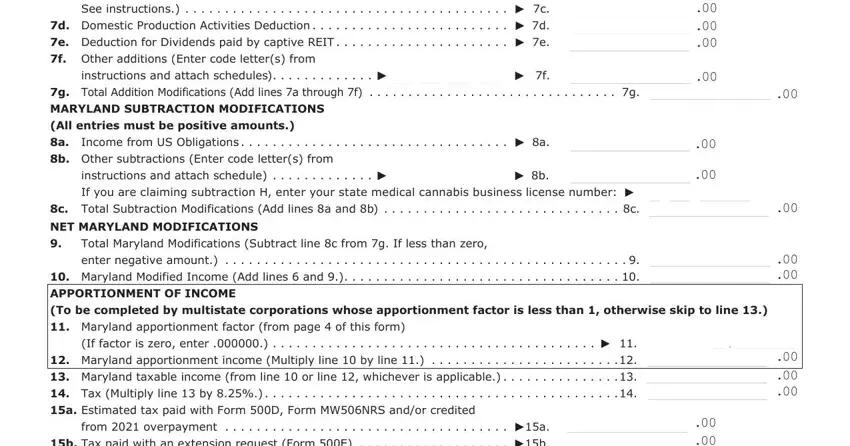

5. When you come near to the completion of your form, you will find a few more things to complete. In particular, c Net operating loss modification, See instructions, instructions and attach schedules, g Total Addition Modifications Add, instructions and attach schedule, If you are claiming subtraction H, c Total Subtraction Modifications, Total Maryland Modifications, enter negative amount, If factor is zero enter, Maryland apportionment income, from overpayment, and b Tax paid with an extension must be filled in.

Step 3: Immediately after double-checking your fields and details, press "Done" and you are done and dusted! Sign up with FormsPal now and instantly gain access to maryland 500 form, all set for download. All alterations you make are preserved , which enables you to edit the pdf at a later point anytime. Whenever you work with FormsPal, you'll be able to complete documents without needing to be concerned about information incidents or entries being distributed. Our secure software ensures that your personal details are kept safely.