You are able to complete Maryland Form 503 effortlessly with our PDFinity® online tool. To make our editor better and more convenient to work with, we constantly develop new features, taking into consideration suggestions coming from our users. Here is what you would need to do to get going:

Step 1: Click on the orange "Get Form" button above. It's going to open up our tool so you could begin filling out your form.

Step 2: Using our online PDF file editor, it is possible to do more than simply fill out blank form fields. Edit away and make your forms appear professional with customized textual content incorporated, or tweak the original input to excellence - all that backed up by an ability to incorporate stunning graphics and sign the document off.

As for the blank fields of this specific PDF, this is what you should know:

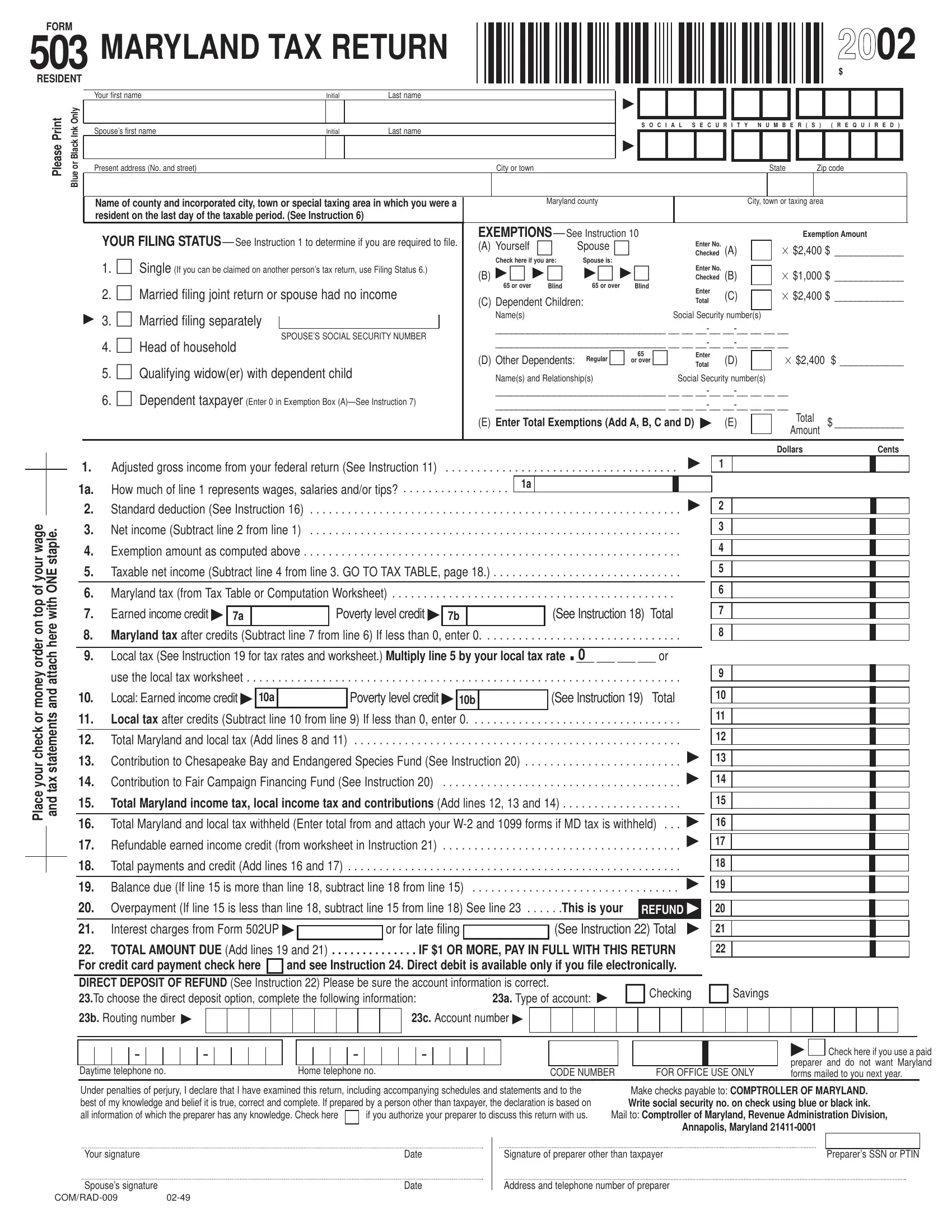

1. First of all, once filling in the Maryland Form 503, begin with the page with the subsequent blanks:

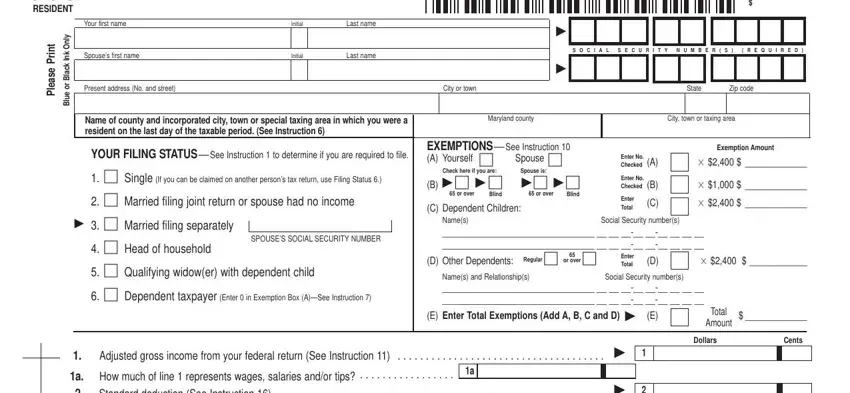

2. Once your current task is complete, take the next step – fill out all of these fields - e g a w, r u o y f o, p o t, n o, r e d r o, y e n o m, r o, k c e h c r u o y e c a l P, e l p a t s E N O h t i, w e r e h, h c a t t a, d n a s t n e m e t a t s x a t, d n a, How much of line represents wages, and Net income Subtract line from with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

A lot of people frequently get some points incorrect when completing p o t in this section. Ensure you re-examine whatever you enter here.

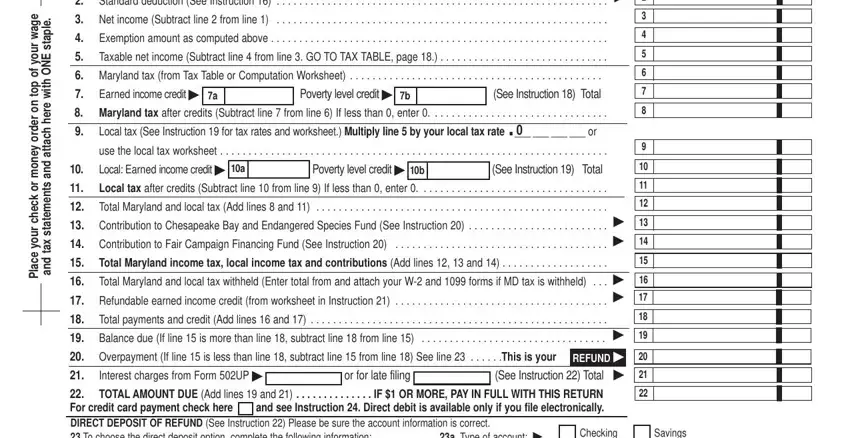

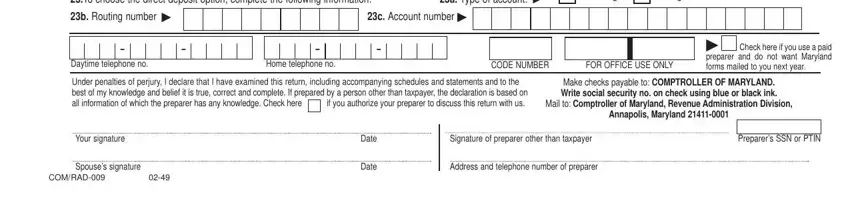

3. This next section is relatively uncomplicated, TOTAL AMOUNT DUE Add lines and, a Type of account, Checking, Savings, b Routing number, c Account number, Daytime telephone no, Home telephone no, CODE NUMBER, FOR OFFICE USE ONLY, Check here if you use a paid, Under penalties of perjury I, Make checks payable to COMPTROLLER, Mail to Comptroller of Maryland, and Annapolis Maryland - all of these blanks will need to be filled in here.

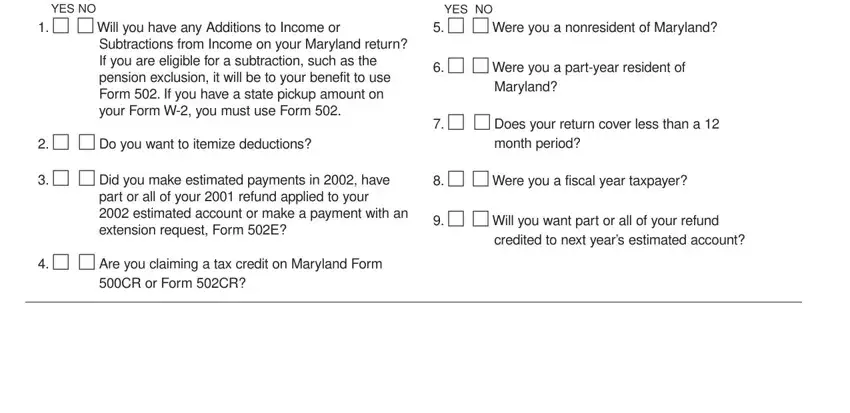

4. It's time to complete this next part! Here you will have all of these YES NO, YES NO, Will you have any Additions to, Were you a nonresident of, Subtractions from Income on your, Were you a partyear resident of, Maryland, Does your return cover less, Do you want to itemize, month period, Did you make estimated payments, Were you a fiscal year taxpayer, part or all of your refund, Are you claiming a tax credit, and CR or Form CR empty form fields to complete.

Step 3: Soon after proofreading the form fields you've filled out, click "Done" and you're good to go! Acquire your Maryland Form 503 as soon as you register online for a 7-day free trial. Readily gain access to the pdf file in your FormsPal account page, with any edits and adjustments all preserved! When you use FormsPal, you can certainly complete forms without having to be concerned about database incidents or data entries being shared. Our protected platform ensures that your private information is kept safely.