Working with PDF files online is actually simple with our PDF editor. Anyone can fill in 2011 here and try out various other options available. Our team is always endeavoring to improve the tool and enable it to be even faster for people with its multiple functions. Uncover an endlessly revolutionary experience now - explore and find new opportunities as you go! Should you be seeking to get going, here's what it will require:

Step 1: Access the PDF file inside our tool by clicking on the "Get Form Button" above on this page.

Step 2: With our handy PDF editor, you could accomplish more than just complete blanks. Try each of the functions and make your documents appear perfect with custom text put in, or optimize the file's original input to perfection - all that accompanied by an ability to insert any kind of pictures and sign it off.

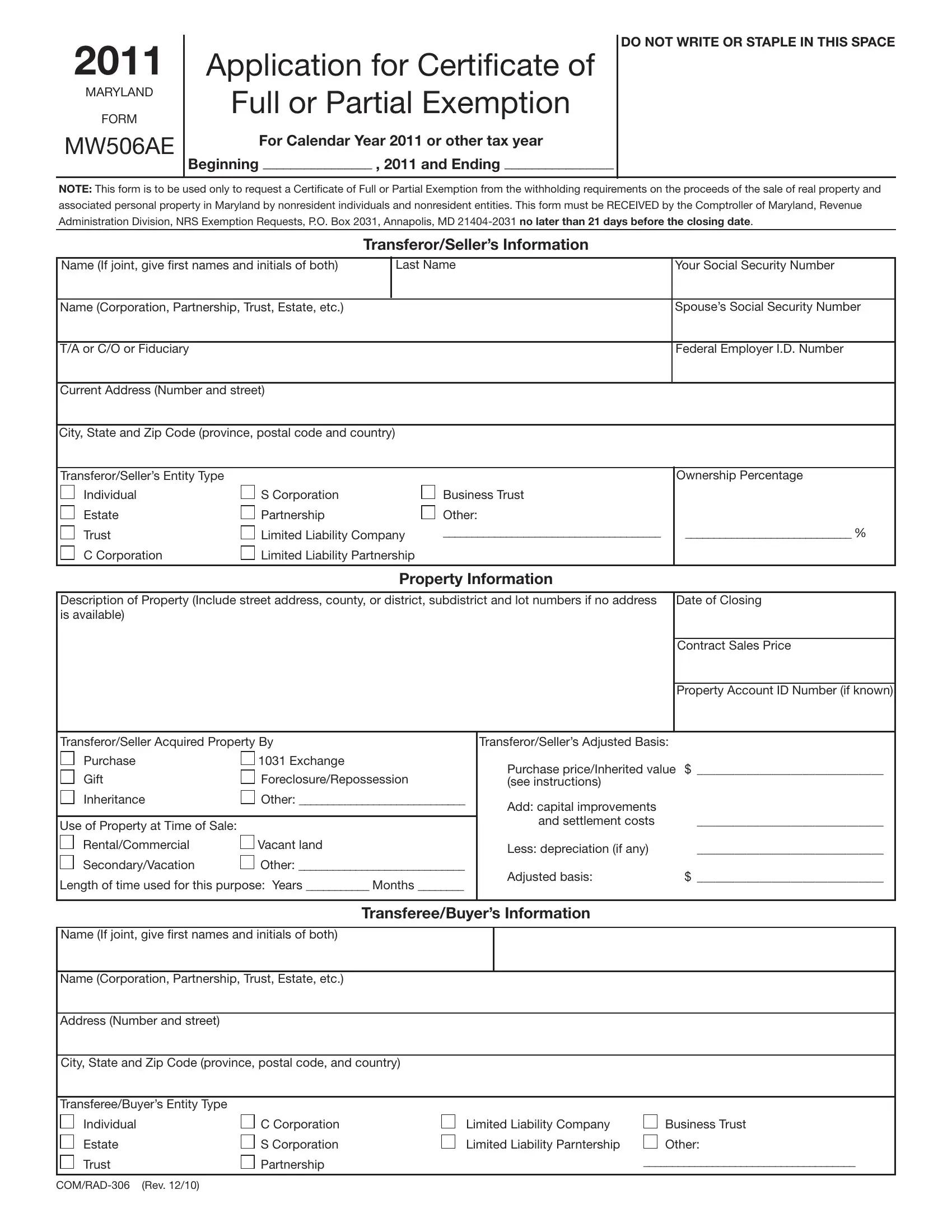

This PDF form requires particular information to be entered, so ensure that you take the time to type in exactly what is expected:

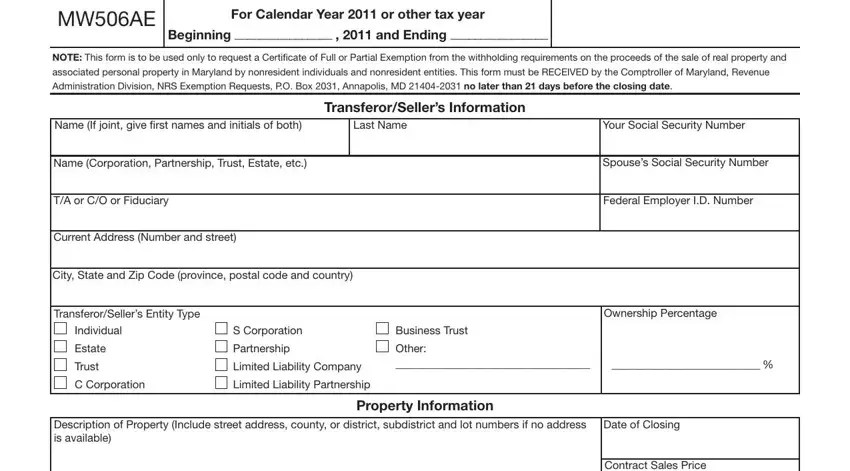

1. The 2011 needs specific information to be typed in. Ensure the subsequent blank fields are complete:

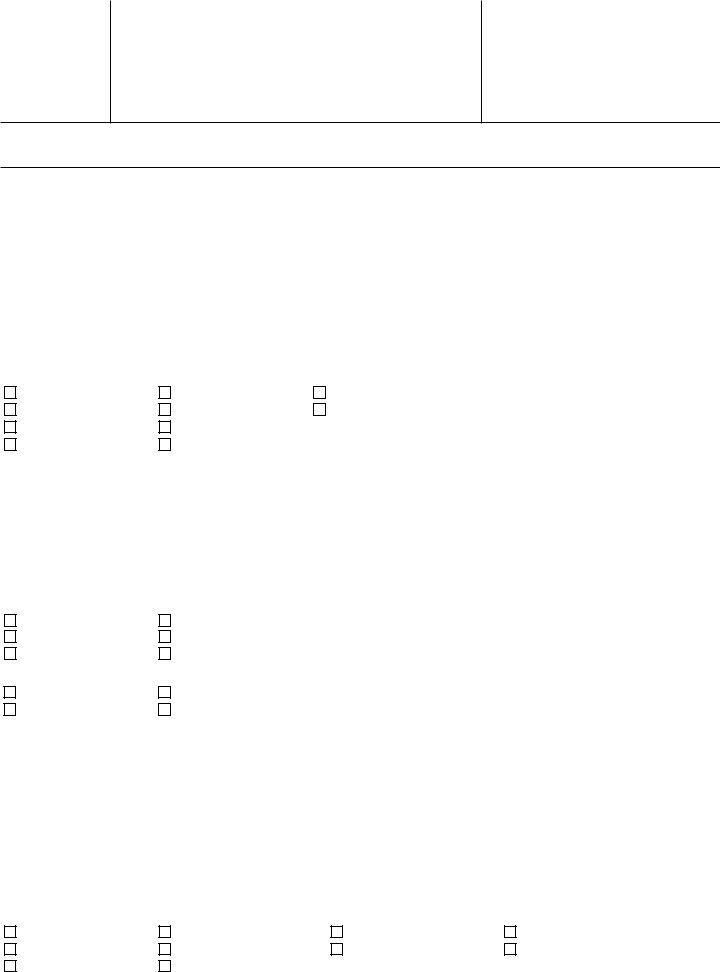

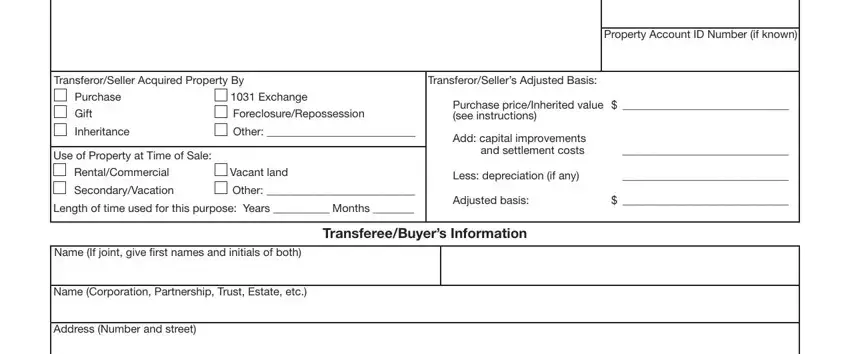

2. After filling in this section, go on to the next step and fill in the necessary particulars in these blanks - Contract Sales Price, Property Account ID Number if known, TransferorSeller Acquired Property, TransferorSellers Adjusted Basis, Purchase Gift, Inheritance, Exchange ForeclosureRepossession, Other, Use of Property at Time of Sale, RentalCommercial, Vacant land, SecondaryVacation, Other, Length of time used for this, and Purchase priceInherited value.

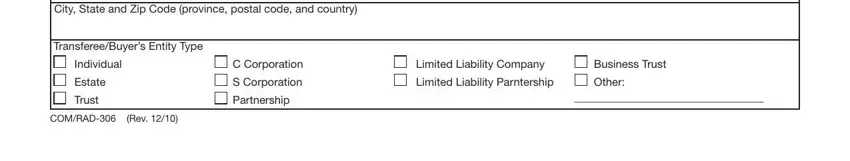

3. In this particular stage, look at City State and Zip Code province, TransfereeBuyers Entity Type, Individual, Estate, Trust, COMRAD Rev, C Corporation, S Corporation, Partnership, Limited Liability Company, Business Trust, Limited Liability Parntership, and Other. All these need to be taken care of with highest precision.

You can certainly make a mistake while completing the Partnership, so make sure that you go through it again before you finalize the form.

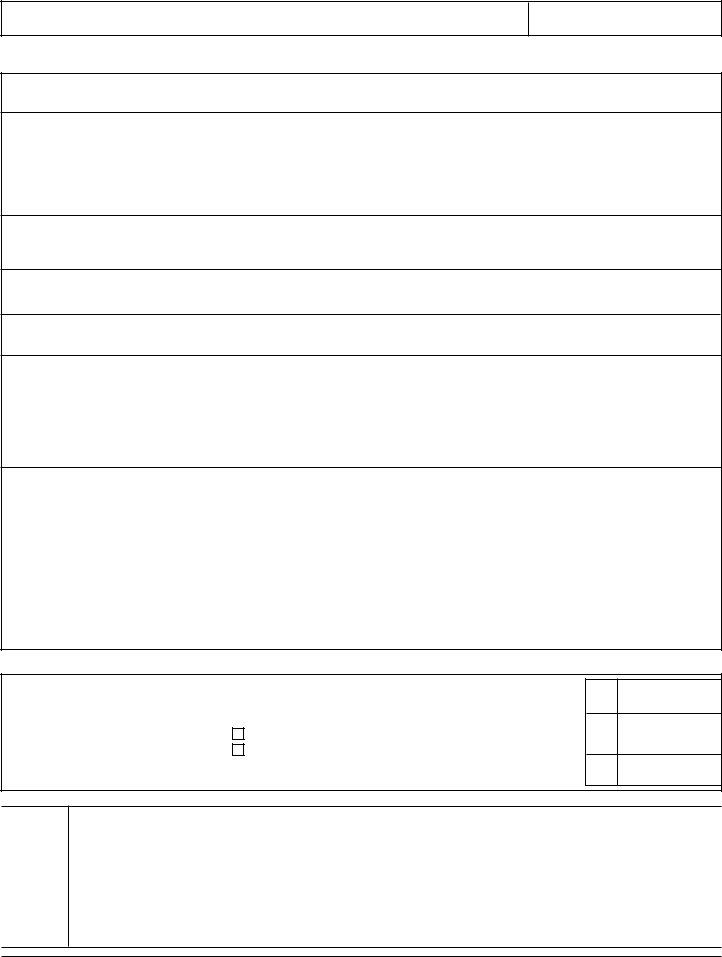

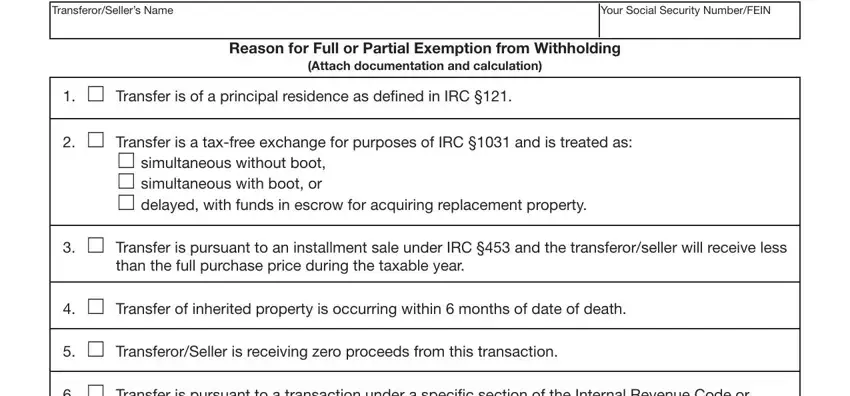

4. This next section requires some additional information. Ensure you complete all the necessary fields - MARYLAND FORM MWAE, Your Social Security NumberFEIN, Reason for Full or Partial, Attach documentation and, Transfer is of a principal, Transfer is a taxfree exchange, simultaneous without boot, Transfer is pursuant to an, than the full purchase price, Transfer of inherited property, TransferorSeller is receiving, and Transfer is pursuant to a - to proceed further in your process!

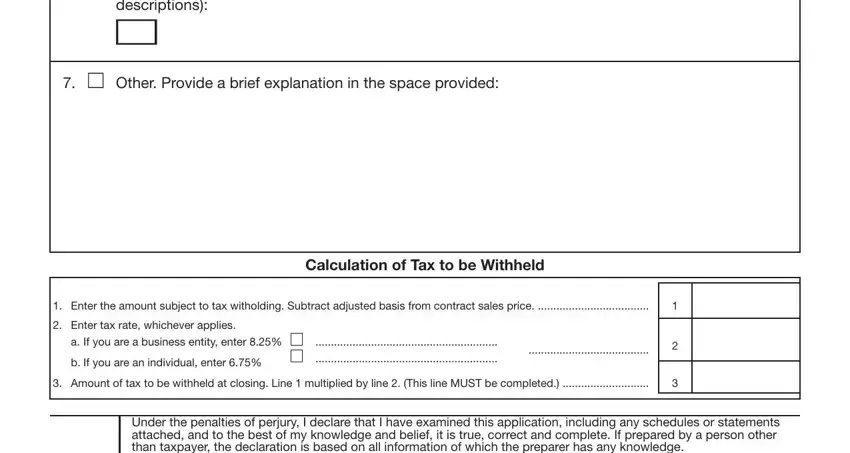

5. This very last point to finalize this form is crucial. Ensure you fill out the necessary fields, such as other code Place code letter for, Other Provide a brief, Calculation of Tax to be Withheld, Enter the amount subject to tax, Enter tax rate whichever applies, a If you are a business entity, b If you are an individual enter, Amount of tax to be withheld at, and Under the penalties of perjury I, prior to using the file. Failing to do it might end up in an incomplete and possibly nonvalid form!

Step 3: As soon as you've looked once again at the information you filled in, press "Done" to finalize your document generation. Join us today and instantly access 2011, available for downloading. All changes you make are preserved , making it possible to change the form at a later time if required. We do not sell or share any information that you provide while filling out forms at our website.