In the realm of tax compliance and payroll management, the Form MW507, or Maryland Employee Withholding Exemption Certificate, emerges as a pivotal document for both employers and employees within Maryland State Government. This form, designed to be filled out with black ink, encompasses comprehensive sections including employee information, Maryland withholding particulars, and a requisite signature to validate the entries under the penalty of perjury. It meticulously guides Maryland state employees through the process of specifying their withholding allowances, thus enabling tailored tax withholding that aligns with their individual financial situation. The inclusion of multiple categories—ranging from personal exemption claims to specific exemption cases for residents of bordering states or beneficiaries under the Servicemembers Civil Relief Act—underscores the form’s adaptability to varied taxpayer circumstances. Additionally, the form serves as a declaration of exemption for those who, based on their residency or expected income level, anticipate no tax liability. Available through the Comptroller of Maryland's official website, this certificate plays a critical role in ensuring that employees' withholdings accurately mirror their tax obligations, thereby averting under or over-withholding of state income taxes.

| Question | Answer |

|---|---|

| Form Name | Maryland Form W4 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | maryland w4, maryland state w4 form, maryland w 4 form 2019, maryland form w4 pdf |

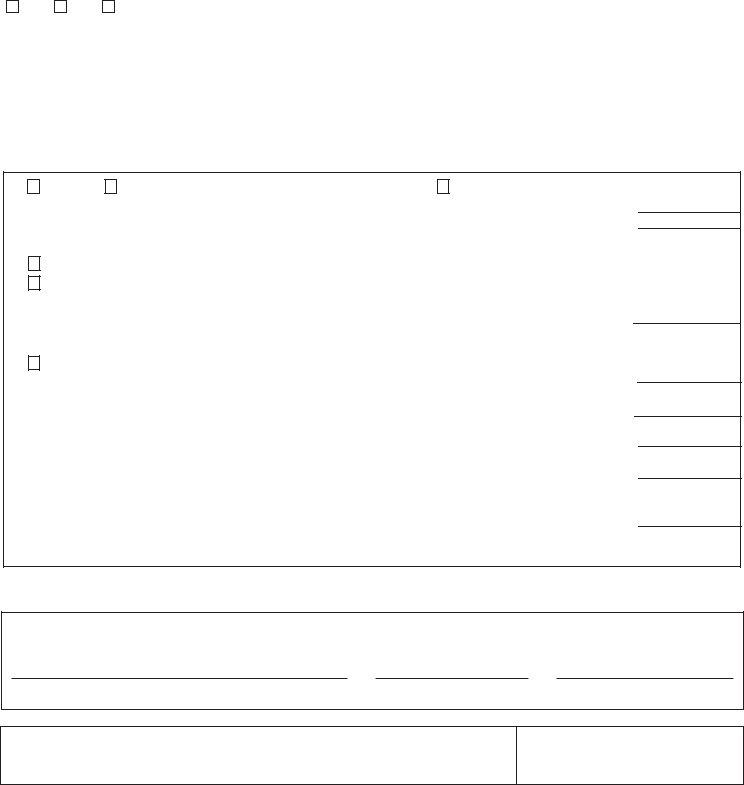

Form MW507 |

Employee Withholding Exemption Certificate |

2020 |

|||||

Comptroller or Maryland |

FOR MARYLAND STATE GOVERNMENT EMPLOYEES ONLY |

|

|||||

|

Section 1 – Employee Information (Please complete form in black ink.) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

Payroll System (check one) |

|

Name of Employing Agency |

|

|

|

|

|

RG CT |

UM |

|

|

|

|

|

|

Agency Number |

|

|

Social Security Number |

Employee Name |

|

|

|

|

|

|

|

|||

|

Home Address (number and street or rural route) |

|

(apartment number, if any) |

||||

|

|

|

|

|

|

|

|

|

City |

|

|

State |

Zip Code |

County of Residence (required) Nonresidents enter Maryland |

|

|

|

|

|

|

|

|

County or Baltimore City |

|

|

|

|

|

|

|

where you are employed |

|

|

|

|

|

|

||

|

Section 2 – Maryland Withholding |

Maryland worksheet is available online at https://www.marylandtaxes.gov/forms/20_forms/mw507.pdf |

|||||

Single

Married (surviving spouse or unmarried Head of Household) Rate

Married, but withhold at Single Rate

1. |

Total number of exemptions you are claiming not to exceed line f in Personal Exemption Worksheet on page 2 |

1. |

2. |

Additional withholding per pay period under agreement with employer |

2. |

3.I claim exemption from withholding because I do not expect to owe Maryland tax. See instructions and check boxes thatapply.

a.Last year I did not owe any Maryland income tax and had a right to a full refund of all income tax withheld and

b.This year I do not expect to owe any Maryland income tax and expect to have the right to a full refund of all income

|

tax withheld. (This includes seasonal and student employees whose annual income will be below the minimum filing |

|

||||

|

requirements). |

|

|

|

||

|

If both a and b apply, enter year applicable |

(year effective) Enter “EXEMPT” here |

3. |

|||

|

|

|

|

|||

4. I claim exemption from withholding because I am domiciled in the following state. |

|

|||||

|

Virginia |

|

|

|

||

|

I further certify that I do not maintain a place of abode in Maryland as described in the instructions. Enter "EXEMPT" here |

4. |

||||

5. |

I claim exemption from Maryland state withholding because I am domiciled in the Commonwealth of Pennsylvania and |

|

||||

|

I do not maintain a place of abode in Maryland as described in the instructions on Form MW507. Enter “EXEMPT” here |

5. |

||||

6. |

I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction within Yorkor |

|

||||

|

Adams counties. Enter “EXEMPT” here and on line 4 of Form MW507 |

6. |

||||

7. |

I claim exemption from Maryland local tax because I live in a local Pennsylvania jurisdiction that does not impose |

|

||||

|

an earnings or income tax on Maryland residents. Enter “EXEMPT” here and on line 4 of Form MW507 |

7. |

||||

8. |

I certify that I am a legal resident of the state of |

|

and am not subject to Maryland withholding because I meet the |

|

||

|

|

|

|

|

|

|

|

requirements set forth under the Servicemembers Civil Relief Act, as amended by the Military spouses |

|

||||

|

Residency Relief Act. Enter “EXEMPT” here |

|

8. |

|||

Section 3 – Employee Signature

Under the penalty of perjury, I further certify that I am entitled to the number of withholding allowances claimed on line 1 above, or if claiming exemption from withholding, that I am entitled to claim the exempt status on whichever line(s) I completed.

Employee’s signature |

Date |

Daytime PhoneNumber |

|

|

(In case CPB needs to contact you regarding your MW507) |

Employer’s name and address (Employer: Complete name, address & EIN only if sending to IRS)

CentralPayrollBureau

P.O. Box 2396

Annapolis, MD 21404

Federal Employer identification number (EIN)

Important: The information you supply must be complete. This form will replace in total any certificate you previously submitted.

Web Site -