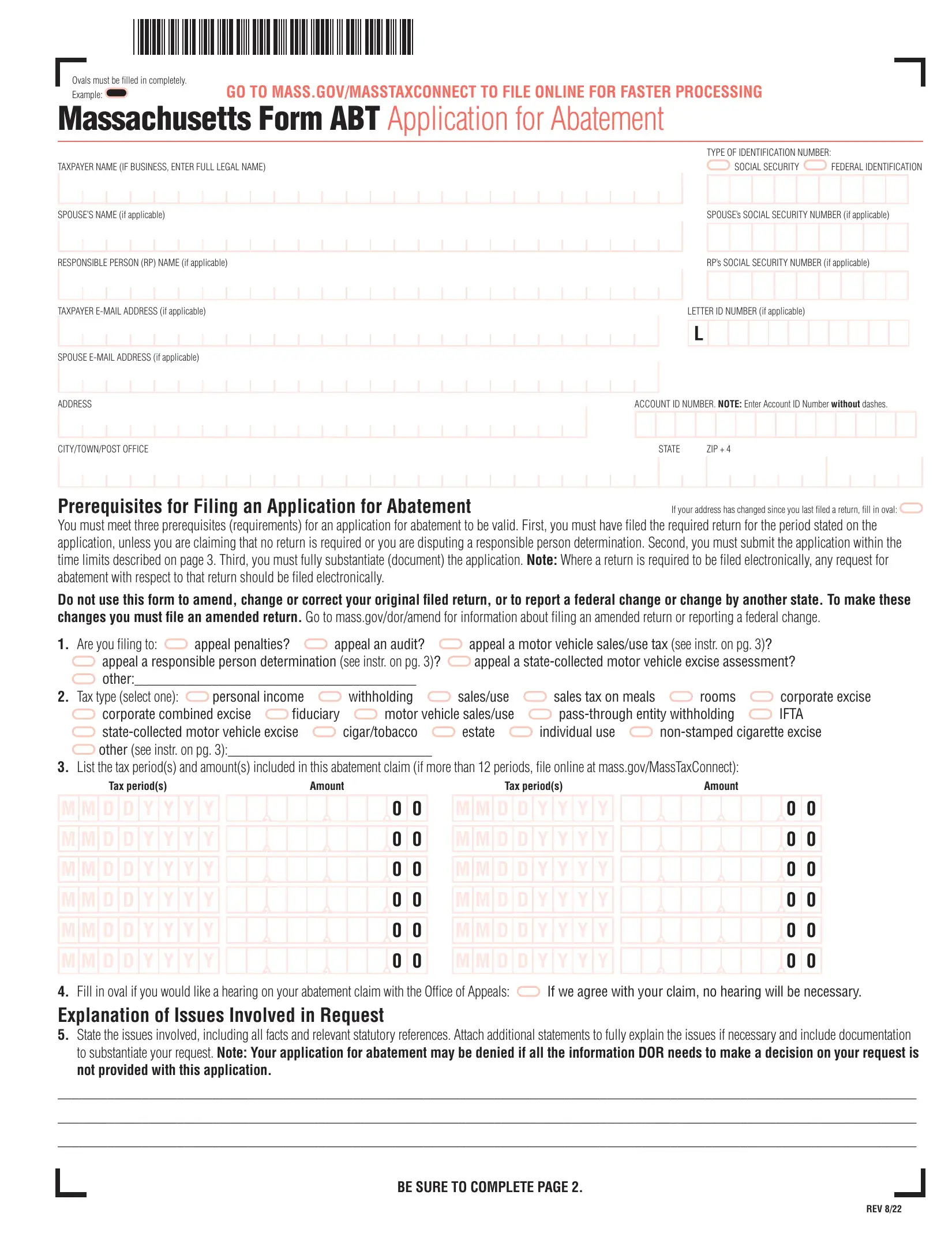

Ovals must be filled in completely.

Example: |

|

|

|

|

GO TO MASS.GOV/MASSTAXCONNECT TO FILE ONLINE FOR FASTER PROCESSING |

|

|

|

|

|

|

Massachusetts Form ABT Application for Abatement |

|

|

|

|

|

|

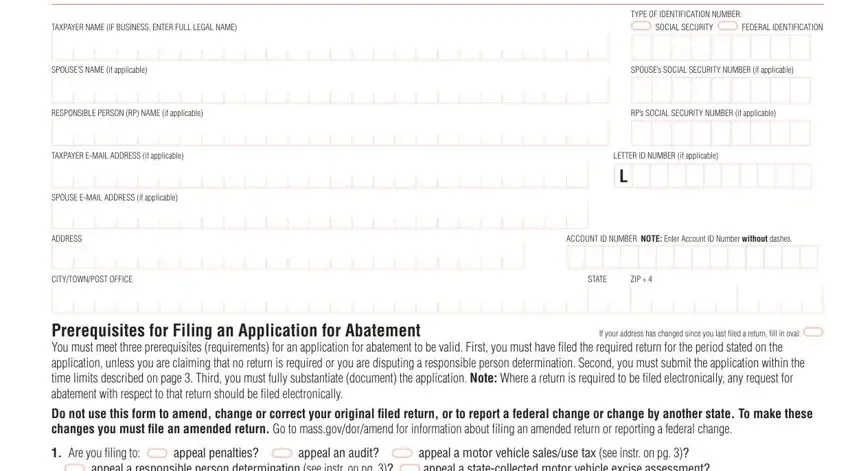

TAXPAYER NAME (IF BUSINESS, ENTER FULL LEGAL NAME) |

|

TYPE OF IDENTIFICATION NUMBER: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOCIAL SECURITY |

|

|

FEDERAL IDENTIFICATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

– |

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPOUSE’s SOCIAL SECURITY NUMBER (if applicable) |

SPOUSE’S NAME (if applicable)

RP’s SOCIAL SECURITY NUMBER (if applicable)

RESPONSIBLE PERSON (RP) NAME (if applicable)

––

LETTER ID NUMBER (if applicable)

L

ADDRESS |

CITY/TOWN/POST OFFICE |

STATE ZIP + 4 |

Prerequisites for Filing an Application for Abatement

If your address has changed since you last filed a return, fill in oval:

You must meet three prerequisites (requirements) for an application for abatement to be valid. First, you must have filed the required return for the period stated on the application, unless you are claiming that no return is required or you are disputing a responsible person determination. Second, you must fully substantiate (document) the application. Third, you must submit the application within the time limits described on page 2.

Do not use this form to amend, change or correct your original filed return, or to report a federal change or change by another state. To make these changes you must file an amended return. Go to mass.gov/dor/amend for information about filing an amended return or reporting a federal change.

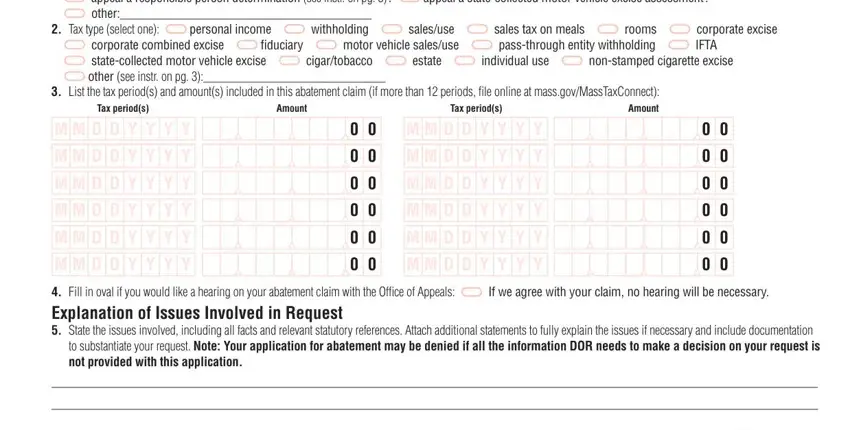

1.Are you filing to dispute penalties? dispute an audit? dispute a motor vehicle sales/use tax? (see instr. on pg. 3) dispute a respon-

sible person determination? dispute a state-collected motor vehicle excise assessment? other:

2.Tax type (select one): personal income withholding sales/use sales tax on meals rooms corporate excise

fiduciary motor vehicle sales/use alcohol beverage excise IFTA state-collected motor vehicle excise cigar/tobacco

estate individual use non-stamped cigarette excise other:

3.List the tax period(s) and amount(s) included in this abatement claim (if more than 12 periods, attach statement):

Tax period(s) |

Amount |

Tax period(s) |

Amount |

0 0

0 0

0 0

0 0

0 0

0 0

4. Fill in oval if you would like a hearing on your abatement claim with the Office of Appeals:

0 0

0 0

0 0

0 0

0 0

0 0

If we agree with your claim, no hearing will be necessary.

5.Fill in oval if you are filing for a reduction in sales, meals, room occupancy or withholding tax(es) but have not withheld or collected the tax:

Explanation of Issues Involved in Request

6.State the issues involved, including all facts and relevant statutory references. Attach additional statements to fully explain the issues if necessary and include documentation to substantiate your request. Note: Your application for abatement may be denied if all the information DOR needs to make a decision on your request is not provided with this application.

Mail to Massachusetts Department of Revenue, PO Box 7058, Boston, MA 02204.

BE SURE TO COMPLETE PAGE 2.

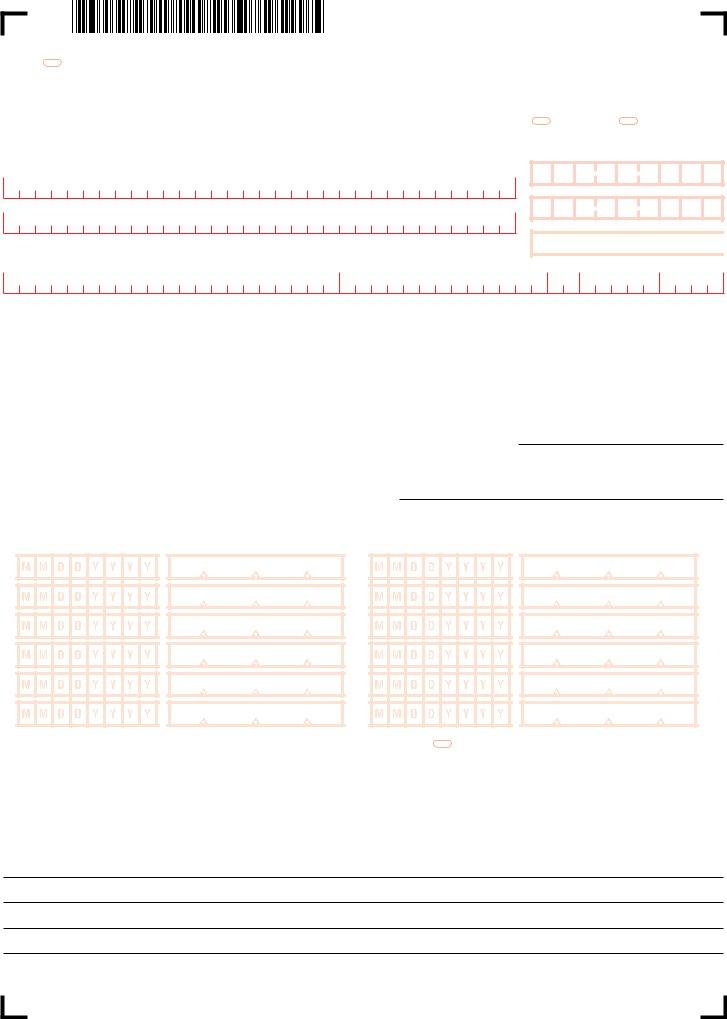

FORM ABT, PAGE 2

Taxpayer or Responsible Person Consent

By filing this application for abatement, the taxpayer or responsible person gives consent for the Commissioner of Revenue to act on the application after six months from the date of filing pursuant to MGL ch 58A, § 6. You may withdraw your consent at any time. If you do not consent to allow more than six months, the application for abatement is deemed denied (1) six months from the date of filing or (2) the date consent is withdrawn, whichever is later. If you choose not to consent, fill in oval

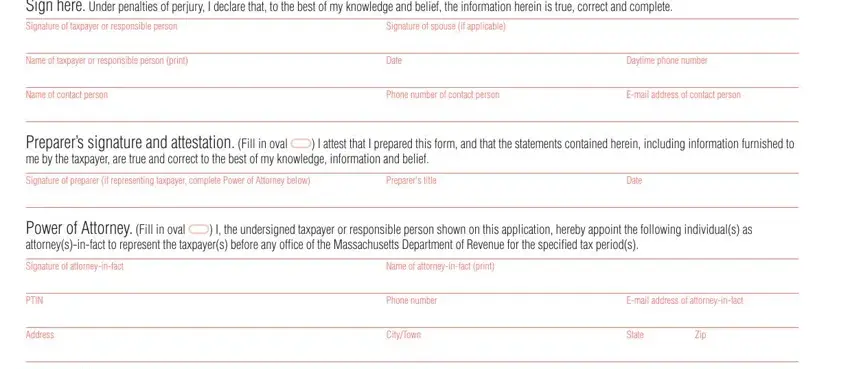

Sign here. Under penalties of perjury, I declare that, to the best of my knowledge and belief, the information herein is true, correct and complete.

Signature of taxpayer or responsible person |

Signature of spouse (if applicable) |

|

|

|

|

Name of taxpayer or responsible person (print) |

Date |

Daytime phone number |

|

|

|

Name of contact person |

Phone number of contact person |

E-mail address of contact person |

Preparer’s signature and attestation. (Fill in oval ) I attest that I prepared this form, and that the statements contained herein, including information furnished to me by the taxpayer, are true and correct to the best of my knowledge, information and belief.

Signature of preparer (if representing taxpayer, complete Power of Attorney below) |

Preparer’s title |

Date |

Power of Attorney. (Fill in oval ) I, the undersigned taxpayer or responsible person shown on this application, hereby appoint the following indi- vidual(s) as attorney(s)-in-fact to represent the taxpayer(s) before any office of the Massachusetts Department of Revenue for the specified tax period(s).

Signature of attorney-in-fact |

Name of attorney-in-fact (print) |

|

|

|

|

|

|

PTIN |

Phone number |

|

|

|

|

|

|

Address |

City/Town |

State |

Zip |

The attorney(s)-in-fact is authorized, subject to limitations set forth below or to revocation, to receive confidential information and to perform any and all acts that the taxpayer(s) can perform with respect to the above-specified tax matters. The authority does not include the power to substitute another representative (unless specifically added below) or to receive refund checks.

Attorney-in-fact is not authorized to:

Signature of taxpayer or responsible person |

Signature of spouse (if applicable) |

Signature of attorney-in-fact |

Instructions

Line 1. Use this form to dispute an audit assessment; request waiver of penalties; challenge a responsible person determination; or request an abatement of motor vehicle excise or motor vehicle sales or use tax billed by DOR. Do not use this form to amend, change or correct your original filed return, or to report a federal change or change by another state. To make these changes you must file an amended return. Go to mass.gov/dor/amend for infor- mation about filing an amended return or reporting a federal change.

Line 6. Explain why you are requesting an abatement and attach all information necessary to support your claim. Be sure to attach Form 84, Application for Relief From Joint Income Tax Liability, if requesting innocent spouse relief. You can find guidance about appropriate documentation in DOR’s online Tax Guides at mass.gov/dor or call us at (617) 887-MDOR or toll-free in Massachusetts 1-800-392-6089.

Time limits:

You must submit your application for abatement to DOR within the time limits provided in MGL ch 62C, § 37. Generally, this means:

a. Within three years from the date of the filing of the return (or within three years from the due date, if the return was filed before the due date). b. Within two years from the date the tax was assessed or deemed to be assessed;

c.Within one year from the date the tax was paid;

d.Within two years of DOR’s determination of a responsible person’s liability;

e.Within any agreed-upon extension of time for assessment of taxes under MGL ch 62C, § 27.

Additional information

To give DOR permission to discuss this application with someone other than you, complete the Power of Attorney section above.

Interest and, in some cases, penalties will accrue on any unpaid amounts. Although collection activity will generally be suspended during the appeal process, you may wish to pay the amount you are disputing to stop the accrual of interest and penalties. Note: In some cases DOR is allowed to abate penalties, but is not generally allowed to abate interest. If the abatement is approved after the assessment has been paid, a refund, with applicable interest, will be issued.

To request settlement consideration, submit Form DR-1, Office of Appeals Form, with this application for abatement. See AP 628 at mass.gov/dor/appeals.

FORM ABT, PAGE 3

Important Information if Disputing Tax on Motor Vehicle

Are you disputing the amount of sales tax paid when registering a motor vehicle?

The Registry of Motor Vehicles (RMV) and the Department of Revenue (DOR) must follow Massachusetts law in determining the amount of sales tax to be paid. The amount must be the higher of the National Automobile Dealers Association (NADA) value of the vehicle as published in the Used Car Guide as “clean trade-in” value or actual price paid for the vehicle. The condition of the car has no additional impact on how the sales tax is determined.

When should I dispute the amount of motor vehicle sales or use tax?

If the sales tax charged was incorrectly calculated for the motor vehicle purchased. For example, if the NADA “clean trade-in” value used in the calculation was not specifically for the car you purchased. Or, if the actual price paid for the vehicle, as used in the calculation, was an incorrect amount. Those are good reasons to dispute the sales tax.

What if I think the NADA value is too high based on the condition of the car?

Massachusetts law requires the RMV to use the higher of the NADA value or the purchase price in determining the sales tax. The Department of Revenue cannot take the condition of the vehicle into account when considering an abatement request. If the NADA value is higher than the purchase price, the NADA value must be used, regardless of the vehicle’s condition. DOR will not allow a different value.

Rescission or cancellation of sale

If the abatement request is related to a rescission of sale, attach copies of:

•Bill of sale;

•Registration reflecting sales tax paid; and

•Completed Form MV-AB2, Affidavit – Rescission of Sale of a Motor Vehicle.

DO NOT SUBMIT PAGE 3

FOR YOUR INFORMATION ONLY