MGL can be filled in online without any problem. Just make use of FormsPal PDF editing tool to complete the task fast. Our expert team is constantly endeavoring to expand the editor and enable it to be even easier for clients with its cutting-edge features. Enjoy an ever-improving experience today! Getting underway is effortless! Everything you need to do is take the next easy steps down below:

Step 1: Simply hit the "Get Form Button" at the top of this webpage to see our form editor. This way, you'll find all that is required to fill out your file.

Step 2: This editor lets you modify PDF forms in many different ways. Enhance it by including your own text, adjust original content, and place in a signature - all when you need it!

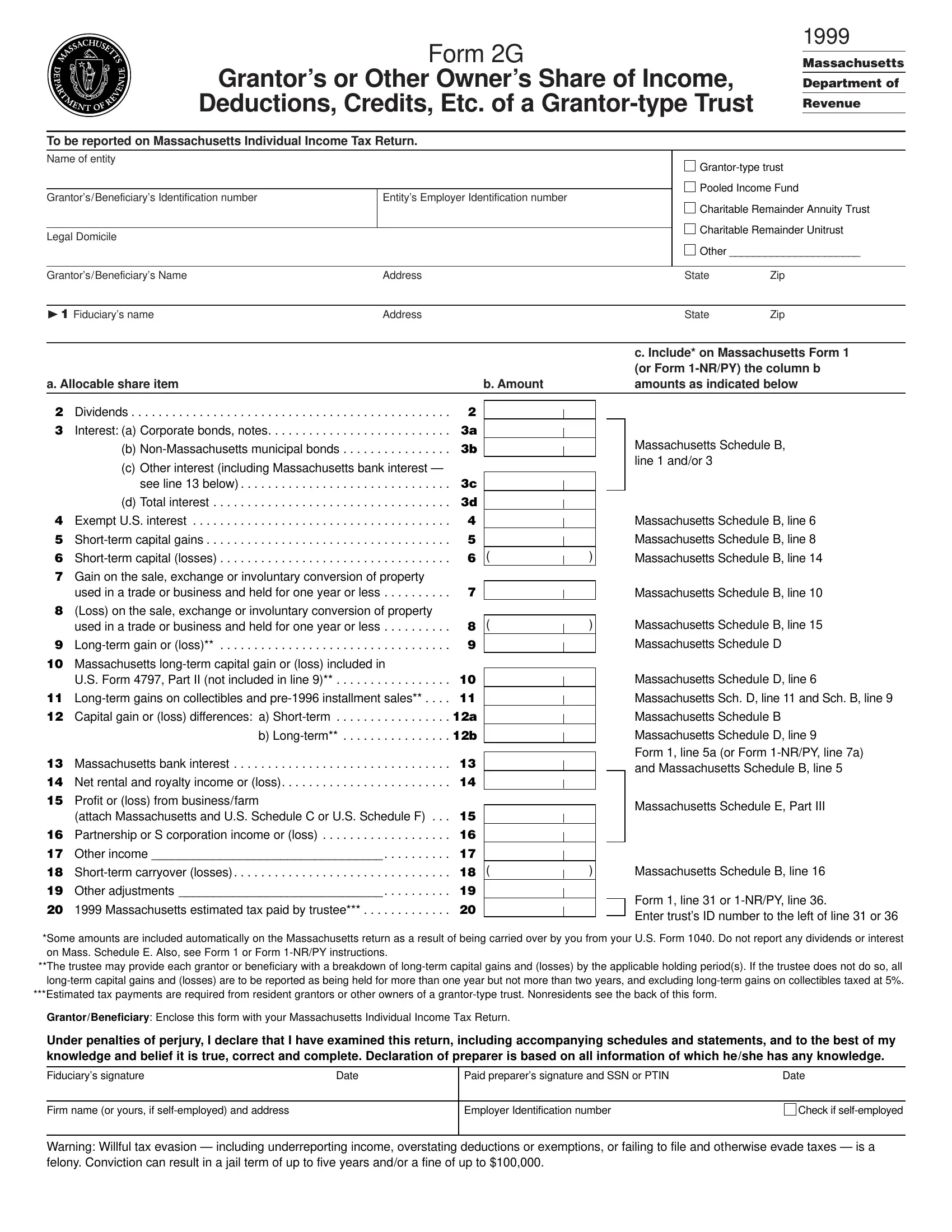

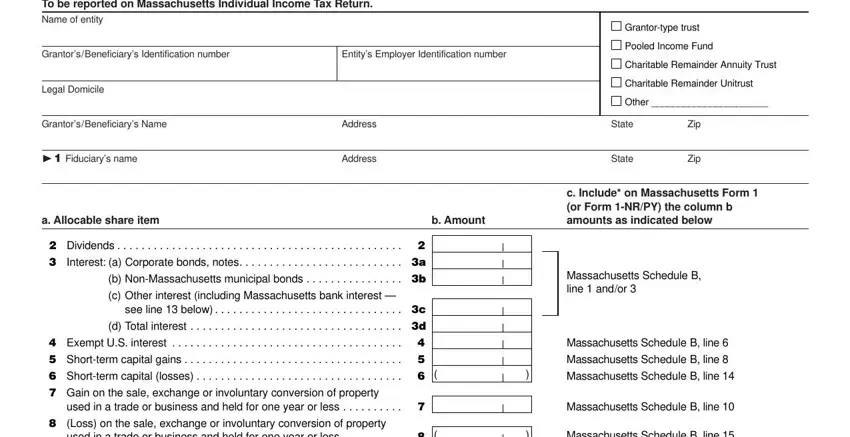

So as to fill out this PDF form, be sure to type in the necessary details in every single blank field:

1. Begin filling out the MGL with a number of essential blanks. Gather all the required information and ensure nothing is overlooked!

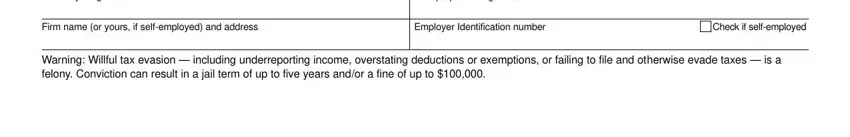

2. After finishing the previous step, go to the next stage and fill in all required particulars in these fields - Fiduciarys signature, Date, Paid preparers signature and SSN, Date, Firm name or yours if selfemployed, Employer Identification number, Check if selfemployed, and Warning Willful tax evasion.

When it comes to Warning Willful tax evasion and Paid preparers signature and SSN, make sure that you don't make any mistakes in this section. These two are the key fields in this form.

Step 3: Right after looking through the filled out blanks, press "Done" and you're done and dusted! Create a free trial option with us and acquire immediate access to MGL - downloadable, emailable, and editable from your personal account page. Here at FormsPal.com, we do our utmost to be certain that all of your details are maintained protected.