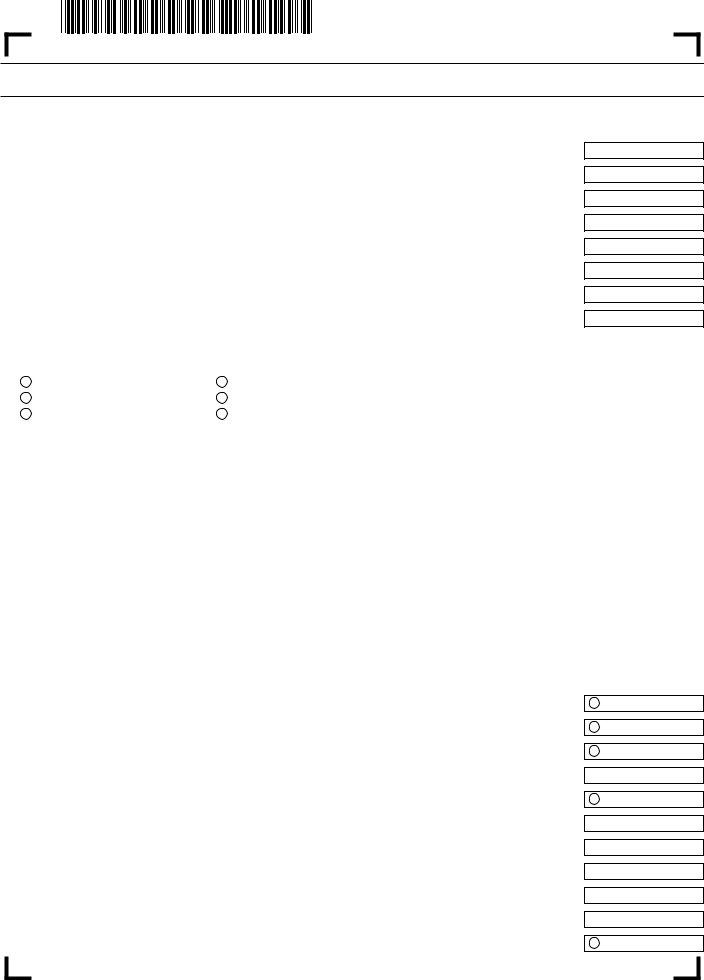

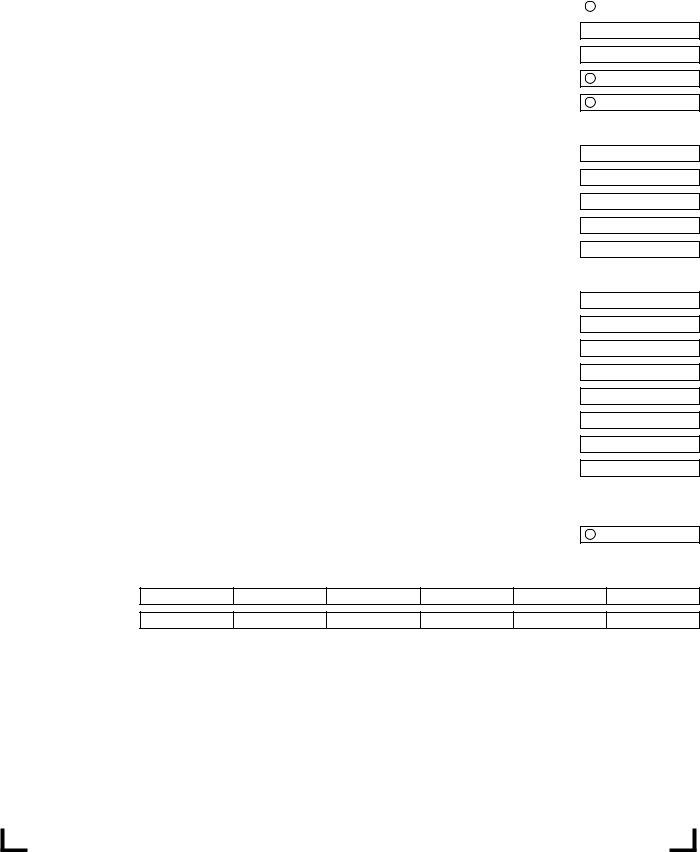

The Massachusetts 3 form, designed by the Department of Revenue for the tax year 2020, plays a critical role in the state's taxation framework, particularly for partnerships. In black ink, partnerships are required to pen down specifics from the basic identification details like name and federal identification number to the intricate financials comprising incomes, losses, adjustments, and credits. The form, serving both calendar year and fiscal year filers, mandates detailed disclosures of principal business activities, total assets, and reasons for amendment if applicable, alongside a choice of accounting method. It accommodates various partnership classifications, including those subjected to amendments due to federal changes, technical terminations, and those filing an initial or final return. Importantly, it stipulates electronic filing for partnerships with more than 25 partners, supporting transparency and efficiency in tax reporting. Additionally, the form extends to capture detailed schedules for income apportionment, indicative of a partnership’s operational spectrum across jurisdictions, mandating the articulation of tangible property, payroll, and sales to exact the apportionment percentage for tax purposes. The dense set of instructions and categories encapsulated in the Massachusetts 3 form underscores its substantiality in the spectrum of state taxation, drawing a comprehensive fiscal blueprint of partnerships operating within Massachusetts.

| Question | Answer |

|---|---|

| Form Name | Massachusetts Form 3 |

| Form Length | 10 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 2 min 30 sec |

| Other names | 2020 Form 3 Partnership Return of Income - Mass.gov |

Fill out in black ink.

Massachusetts Department of Revenue |

|

|

|

2020 |

|||

Form 3 |

|

|

|

Tax year beginning |

Tax year ending |

||

Calendar year filers enter |

|||||||

NAME OF PARTNERSHIP |

|

|

|

|

|

FEDERAL IDENTIFICATION NUMBER (FID) |

|

MAILING ADDRESS |

|

|

CITY/TOWN/POST OFFICE |

STATE |

ZIP + 4 |

|

|

C/O NAME |

|

|

|

|

|

|

|

C/O ADDRESS |

|

|

CITY/TOWN/POST OFFICE |

STATE |

ZIP + 4 |

|

|

A. PRINCIPAL BUSINESS ACTIVITY |

|

|

B. PRINCIPAL PRODUCT OR SERVICE |

|

|

|

|

C. BUSINESS CODE NUMBER |

|

D. DATE BUSINESS STARTED M M D D Y Y Y Y E. TOTAL ASSETS |

|

|

0 0 |

||

F. Fill in if amended return (see instructions) |

|

|

|

|

|

|

|

G. Reason for filing (fill in all that apply) |

|

Amended return due to federal change |

Technical termination |

|

Filing Schedule TDS |

Initial return |

|

|

|

Final return |

Name change |

Enclosing Schedule FCI |

|

||

H. Accounting method (fill in one) |

Cash |

Accrual |

Other |

|

|

|

|

I. How many Schedules |

. . . . . . . . . . . |

||||||

Note: Partnerships with more than 25 partners must file electronically. See TIR |

|

|

|

||||

J. Fill in if you are a member of a |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . |

||

K. Fill in if this partnership is an investment partnership as defined in the

L. Fill in if this partnership elected out of the federal centralized partnership audit regime this tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1 Gross income (from worksheet in instructions). See Partnership |

.1 |

0 |

0 |

|

|

2

3

4

5

6

Fill in if this partnership is engaged exclusively in buying, selling, dealing in or holding securities on its own behalf and not as a broker . . . . . . . . . . . . . . . . . . . . .

Fill in if this partnership is organized as a Limited Liability Company and treated as a partnership for federal income tax purposes . . . . . . . . . . . . . . . . . . . . . . . . . .

Fill in if this partnership is a publicly traded partnership as defined in IRC § 469(k)2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Fill in if there has been a sale or transfer or liquidation of a partnership interest during the period reported on this return . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Income apportionment percentage (from line 46 of Income Apportionment Schedule, or 100%, whichever applies). . . . . . . . . . . . . . .6

SIGN HERE. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

SIGNATURE OF GENERAL PARTNER |

DATE |

PRINT PAID PREPARER’S NAME |

|

|

PAID PREPARER’S SSN OR PTIN |

|

/ |

/ |

|

|

|

TITLE |

DATE |

PAID PREPARER’S PHONE |

|

|

PAID PREPARER’S EIN |

|

/ |

/ |

|

|

|

MAY DOR DISCUSS THIS RETURN WITH THE PREPARER? |

PAID PREPARER’S SIGNATURE |

DATE |

|

IS PAID PREPARER |

|

Yes |

|

|

/ |

/ |

Yes |

NAME OF DESIGNATED TAX MATTERS PARTNER |

IDENTIFYING NUMBER OF TAX MATTERS PARTNER |

|

|

|

|

BE SURE TO COMPLETE ALL 10 PAGES OF FORM 3. MAIL TO MASSACHUSETTS DEPARTMENT OF REVENUE, PO BOX 7017, BOSTON, MA 02204.

2020 FORM 3, PAGE 2

NAME OF PARTNERSHIP |

FEDERAL IDENTIFICATION NUMBER |

7 |

Fill in if any partners in this partnership file as part of a nonresident composite income tax return |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

If filled in, enter Federal Identification number under which the composite return is filed |

. .7 |

|

Number of partners included in composite return |

. . . . . . . . . . . . . . . . . . . . . . . . . |

8 |

Fill in if this partnership is under audit by the IRS, or has been audited in a prior year |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

9 |

Withholding amount. Add all Schedules |

. .9 |

10 |

Payments made with composite return. Add all Schedules |

.10 |

11 |

Credit for amounts withheld by |

.11 |

12 |

Payments made with a composite filing by |

.12 |

13

14 Other income or loss (from U.S. Form 1065, Schedule K, line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15 State, local and foreign income and unincorporated business taxes or excises . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15 16 Subtotal. Add lines 13 through 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 17 IRC § 1231 gains or losses included in line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 18 Subtotal. Subtract line 17 from line 16. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19Adjustments (if any) to line 18. Enter the applicable line number from U.S. Form 1065 and the amount of the adjustment.

a. Line number |

Amount |

b. Line number |

Amount |

00

00

Total adjustments 19

20 Massachusetts ordinary income or loss. Combine lines 18 and 19 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 21 Net income or loss from rental real estate activities (from U.S. Form 1065, Schedule K, line 2) . . . . . . . . . . . . . . . 21

22Adjustments (if any) to line 21. Enter the applicable line number from U.S. Form 8825 and the amount of the adjustment.

a. Line number |

Amount |

b. Line number |

Amount |

00

00

Total adjustments 22

23 Adjusted Massachusetts net income or loss from rental real estate activities. Combine lines 21 and 22 . . . . . . . . . 23 24 Net income or loss from other rental activities (from U.S. Form 1065, Schedule K, line 3c) . . . . . . . . . . . . . . . . . . 24

25Adjustments (if any) to line 24. Enter the applicable line number from U.S. Form 1065 and the amount of the adjustment.

a. Line number |

Amount |

b. Line number |

Amount |

00

00

Total adjustments 25

26 Adjusted Massachusetts net income or loss from other rental activities. Combine lines 24 and 25 . . . . . . . . . . . . . 26

2020 FORM 3, PAGE 3

NAME OF PARTNERSHIP |

FEDERAL IDENTIFICATION NUMBER |

27 |

U.S. interest, dividend and royalty income, not including capital gains (from U.S. Form 1065, Schedule K, lines 5, |

|

|

0 |

0 |

|

6a and 7) |

.27 |

|||

|

|

|

|||

28 |

Interest on U.S. debt obligations included in line 27 |

.28 |

0 |

0 |

|

|

|

||||

29 |

5.0% interest from Massachusetts banks included in line 27 |

.29 |

0 |

0 |

|

|

|

||||

30 |

Interest (other than Massachusetts bank interest) and dividend income included in line 27 |

.30 |

0 |

0 |

|

|

|

||||

31 |

.31 |

0 |

0 |

||

|

|

||||

32 |

Royalty income included in line 27 |

.32 |

0 |

0 |

|

|

|

||||

33 |

Total |

.33 |

0 |

0 |

|

|

|

||||

34 |

Total |

34 |

|

0 |

0 |

|

|

|

|||

35 |

Gain on the sale, exchange or involuntary conversion of property used in a trade or business and held for one year |

|

|

0 |

0 |

|

or less (from U.S. Form 4797) |

.35 |

|||

|

|

|

|||

36 |

Loss on the sale, exchange or involuntary conversion of property used in a trade or business and held for one year |

|

|

0 |

0 |

|

or less (from U.S. Form 4797) |

36 |

|

||

|

|

|

|

||

37 |

Net |

37 |

|

0 |

0 |

|

|

|

|||

38 |

38 |

|

0 |

0 |

|

|

|

|

|||

39 |

.39 |

0 |

0 |

||

|

|

||||

40Adjustments to lines 33 through 39, including any gain or loss from Massachusetts fiduciaries. Enter the line number and amount from U.S. Form 1065 to which the adjustment applies.

a. Line number |

Amount |

b. Line number |

Amount |

00

00

Total adjustments 40 |

0 |

0 |

|

|

2020 FORM 3, PAGE 4

NAME OF PARTNERSHIP |

FEDERAL IDENTIFICATION NUMBER |

Income Apportionment Schedule

41Complete the Income Apportionment Schedule only if: there is one or more corporate or nonresident individual partners; income was derived from business activities in another state; and such activities provide that state with the jurisdiction to levy an income tax or a franchise tax.

|

SPECIFY WHETHER FACTORY, SALES OFFICE, |

ACCEPTS |

REGISTERED TO DO |

FILES RETURNS |

CITY AND STATE |

WAREHOUSE, CONSTRUCTION SITE, ETC. |

ORDERS |

BUSINESS IN STATE |

IN STATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

42 |

Tangible property |

|

|

|

a. Property owned (averaged) |

Massachusetts |

Worldwide |

|

b. Property rented (capitalized) |

Massachusetts |

Worldwide |

|

c. Total property owned and rented |

Massachusetts |

Worldwide |

|

d. Tangible property apportionment percentage. Divide Massachusetts total by worldwide total (from line 42c) |

. . . . . .42d |

|

43 |

Payroll |

|

|

a. Total payroll |

Massachusetts |

Worldwide |

b. Payroll apportionment percentage. Divide Massachusetts total payroll by worldwide total payroll (from line 43a) |

. . . . . .43b |

|

44 Sales |

|

|

a. Tangibles |

Massachusetts |

Worldwide |

b. Services (including mutual fund sales) |

Massachusetts |

Worldwide |

c. Rents and royalties |

Massachusetts |

Worldwide |

d. Other |

Massachusetts |

Worldwide |

e. Total sales |

Massachusetts |

Worldwide |

f. Sales apportionment percentage. Divide Massachusetts total sales by worldwide total sales (from line 44e) |

. . . . . . 44f |

|

45 Apportionment percentage. Add lines 42d, 43b and (44f x 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .45

46Massachusetts apportionment percentage. Divide line 45 by 4. Note: If an apportionment factor is inapplicable, divide by the

number of times each applicable factor is used (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .46

2020 FORM 3, PAGE 5

NAME OF PARTNERSHIP |

FEDERAL IDENTIFICATION NUMBER |

47Credits available

|

a. Taxes due to another jurisdiction |

. . . . |

. . . . . |

.47a |

|

|

b. Other credits (from Schedule CMS) |

. . . . |

. . . . . |

.47b |

|

48 |

Credit recapture (from Schedule CRS) |

|

.48 |

0 |

0 |

. . . . |

|

|

|||

49 |

Gross receipts or sales (from Part 2, Federal Information, line 1a) |

|

.49 |

0 |

0 |

. . . . |

|

|

|||

50 |

Total income or loss (from Part 2, Federal Information, line 8) |

50 |

|

0 |

0 |

|

|

|

|||

51 |

Bad debts (from Part 2, Federal Information, line 12) |

|

.51 |

0 |

0 |

. . . . |

|

|

|||

52 |

Interest (from Part 2, Federal Information, line 15) |

|

.52 |

0 |

0 |

. . . . |

|

|

|||

53 |

Fill in if during the tax year the partnership had any debt that was cancelled, was forgiven, or had the terms modified |

|

|

|

|

|

so as to reduce the principal amount of the debt |

. . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

|

54 |

Investment interest expense (from Part 2, Federal Information, line 50b) |

|

.54 |

0 |

0 |

. . . . |

|

|

|||

2020 FORM 3, PAGE 6

NAME OF PARTNERSHIP |

FEDERAL IDENTIFICATION NUMBER |

Part 2. Federal Information

Income. From U.S. Form 1065.

Note: Include only trade or business income and expenses on lines 1a through 22. See instructions.5 Fill in oval if showing a loss 1a Gross receipts or sales. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1a

1b Returns and allowances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1b

1c Total. Subtract line 1b from line 1a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1c

2 |

Cost of goods sold (attach Form |

. 2 |

3 |

Gross profit. Subtract line 2 from line 1c |

. 3 |

4 |

Ordinary income or loss from other partnerships, estates and trusts (attach statement) |

. 4 |

5 |

Net farm profit or loss (from U.S. Form 1040, Schedule F) |

. 5 |

6 |

Net gain or loss (from U.S. Form 4797, Part II, line 17; attach U.S. Form 4797) |

. 6 |

7 |

Other income or loss (attach statement) |

. 7 |

8 |

Total income or loss. Combine lines 3 through 7 |

. 8 |

Deductions. From U.S. Form 1065. See instructions for limitations. |

|

|

9 |

Salaries and wages (other than to partners; less employment credits) |

. 9 |

10 |

Guaranteed payments to partners |

10 |

11 |

Repairs and maintenance |

11 |

12 |

Bad debts |

12 |

13 |

Rent |

13 |

14 |

Taxes and licenses |

14 |

15 |

Interest |

15 |

16a Depreciation (from U.S. Form 4562) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16a

16b Less depreciation reported on Form

16c Total. Subtract line 16b from line 16a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16c

17 Depletion (do not deduct oil and gas depletion) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Retirement plans, etc . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Employee benefit programs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20 Other deductions (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

21 Total deductions. Add lines 9 through 20 (do not include lines 16a and 16b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Ordinary business income or loss. Subtract line 21 from line 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

2020 FORM 3, PAGE 7

NAME OF PARTNERSHIP |

FEDERAL IDENTIFICATION NUMBER |

Part 2. Federal Information (cont’d.)

Cost of goods sold. From U.S. Form

23 Inventory at beginning of year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

24 Purchases less cost of items withdrawn for personal use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24

25 Cost of labor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25

26 Additional IRC § 263A costs (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 26

27 Other costs (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27

28 Total. Add lines 23 through 27 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Inventory at end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 29

30 Cost of goods sold. Subtract line 29 from line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

Other information. From U.S. Form 1065, Schedule B.

31Type of entity filing this return (fill in one):

Domestic general partnership |

Domestic limited partnership |

Domestic limited liability company |

Domestic limited liability partnership |

Foreign partnership |

REIT |

Other (specify) ____________________________________________________________________________________________________

32Fill in if at any time during the tax year any partner in the partnership was a disregarded entity, a partnership (including an entity treated as

a partnership), a trust, an S corporation, an estate (other than an estate of a deceased partner) or a nominee or similar person . . . . . . . . . . . . .

33 Fill in if this partnership is a publicly traded partnership as defined in IRC § 469(k)(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

34Fill in if during the tax year the partnership had any debt that was cancelled, was forgiven, or had the terms modified so as to reduce the

principal amount of the debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

35Fill in if the partnership is making, or had previously made (and not revoked), an IRC § 754 election (see instructions for details regarding an

IRC §754 election.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

36Fill in if the partnership made for this tax year an optional basis adjustment under IRC § 743(b) or 734(b). If Yes, attach a statement showing

the computation and allocation of the basis adjustment (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37Fill in if during the current or prior tax year the partnership engaged in a

exchange, or contributed such property to another entity (other than entities

Partners’ Distributive Share Items. From U.S. Form 1065, Schedule K. |

|

Income or loss |

5 Fill in oval if showing a loss |

38 Ordinary business income or loss |

38 |

39 Net rental real estate income or loss (from U.S. Form 8825) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

40a Other gross rental income or loss. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40a

40b Expenses from other rental activities (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40b

40c Other net rental income or loss. Subtract line 40b from line 40a . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 40c

41 Guaranteed payments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

42 Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

43a Ordinary dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43a

43b Qualified dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43b

44 Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

45 Net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 FORM 3, PAGE 8 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

NAME OF PARTNERSHIP |

FEDERAL IDENTIFICATION NUMBER |

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

||||||||||||||||||||||||||||||||||

Partners’ Distributive Share Items (cont’d.) |

|

|

5 Fill in oval if showing a loss |

|||||||||||||||||||||||||||||||||||

. . . . . . . . . . . . . . . . . .46a Net |

. . . . . . . . . . . . . . . . 46a |

|

|

|||||||||||||||||||||||||||||||||||

46b Collectibles (28%) gain or loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46b

46c Unrecaptured IRC § 1250 gain (attach statement). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46c

47 Net IRC § 1231 gain or loss (from U.S. Form 4797) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 47

48 Other income or loss (see instructions). Type ______________________________________________________ 48

Deductions

49 IRC § 179 deduction (from U.S. Form 4562) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

50a Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50a

50b Investment interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 50b

50c IRC §59(e)(2) expenditures. Type _____________________________________________________________ |

50c |

50d Other deductions (see instructions). Type_______________________________________________________ |

50d |

Other information

51a

51b Other

51c Nondeductible expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 51c

52a Distributions of cash and marketable securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52a

52b Distributions of other property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 52b

53a Investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53a

53b Investment expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53b

53c Other items and amounts (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 53c

Analysis of Net Income or Loss

54Net income or loss. Combine U.S. Form 1065, Schedule K, lines 1 through 11. From the result, subtract the

sum of U.S. Form 1065, Schedule K, lines 12 through 13d, and 16p . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54

|

|

Individual |

Individual |

|

Exempt |

Nominee / |

55 Analysis by partner type |

Corporate |

(active) |

(passive) |

Partnership |

organization |

other |

a General partners . . . . .

b Limited partners . . . . . .

2020 FORM 3, PAGE 9

NAME OF PARTNERSHIP |

FEDERAL IDENTIFICATION NUMBER |

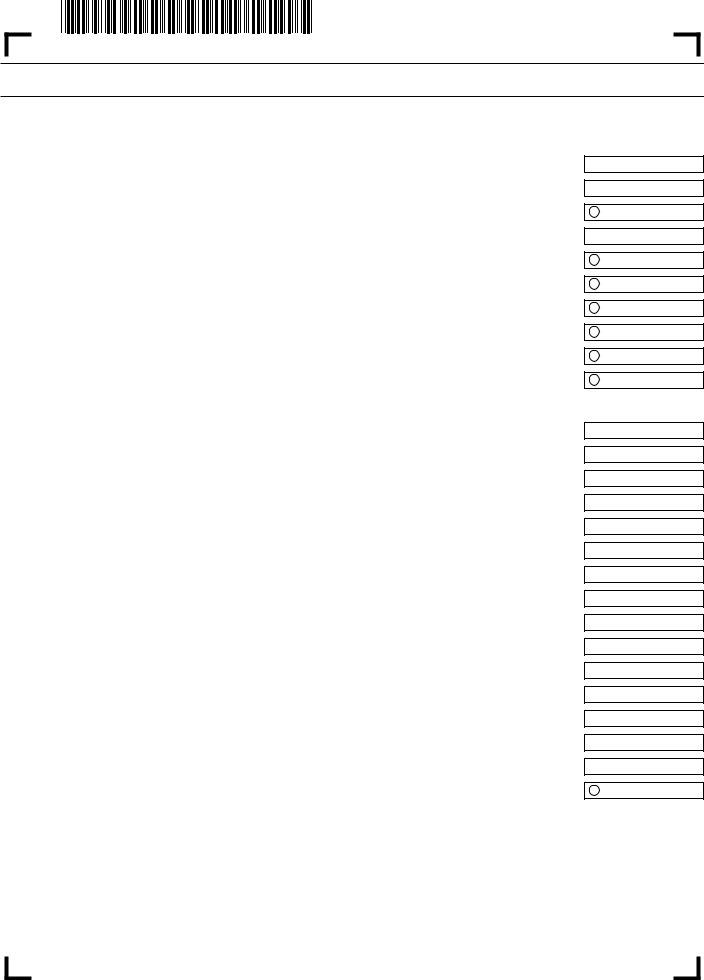

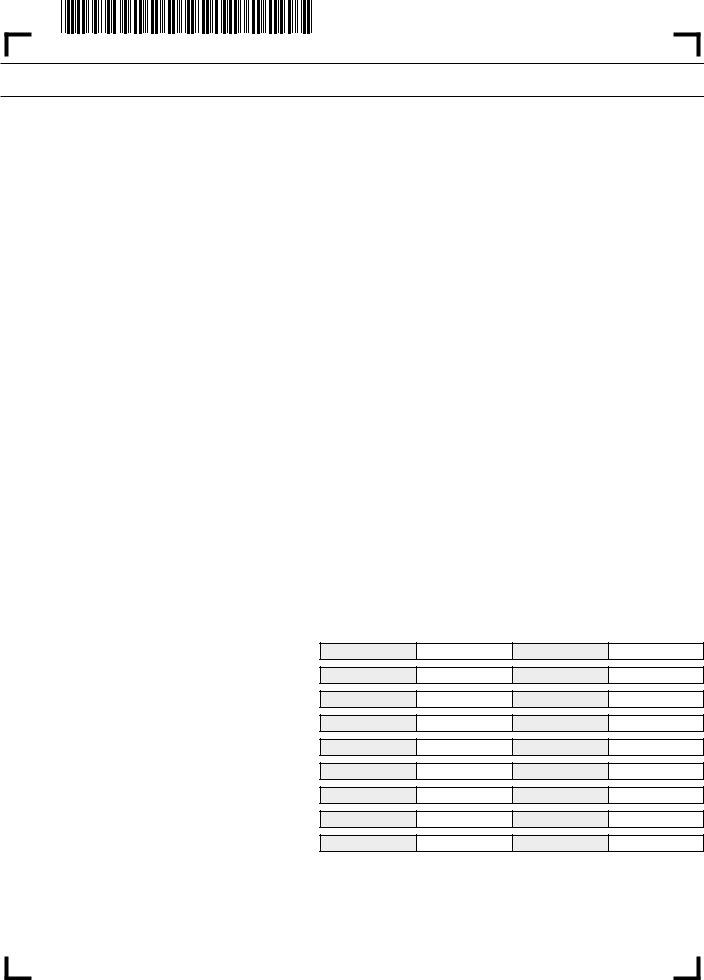

Balance sheets per books

From U.S. Form 1065, Schedule L.

Assets

56 Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

57a Trade notes and accounts receivable . . . . . . . . . . . . . . . . . . .

b Less allowance for bad debts . . . . . . . . . . . . . . . . . . . . . . . . .

58 Inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

59 U.S. government obligations . . . . . . . . . . . . . . . . . . . . . . . . . . .

60 Federally

61 Other current assets (attach statement) . . . . . . . . . . . . . . . . . .

62a Loans to partners (or persons related to partners). . . . . . . . .

b Mortgage and real estate loans . . . . . . . . . . . . . . . . . . . . . . .

63 Other investments (attach statement). . . . . . . . . . . . . . . . . . . .

64a Buildings and other depreciable assets . . . . . . . . . . . . . . . . .

b Less accumulated depreciation . . . . . . . . . . . . . . . . . . . . . . .

65a Depletable assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Less accumulated depletion . . . . . . . . . . . . . . . . . . . . . . . . . .

66 Land (net of any amortization) . . . . . . . . . . . . . . . . . . . . . . . . .

67a Intangible assets (amortizable only) . . . . . . . . . . . . . . . . . . . .

b Less accumulated amortization . . . . . . . . . . . . . . . . . . . . . . .

68 Other assets (attach statement) . . . . . . . . . . . . . . . . . . . . . . . .

69 Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Liabilities and capital

70 Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

– Beginning of tax year – |

|

– End of tax year – |

||

a. |

b. |

c. |

|

d. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a.b.c.d.

71 Mortgages, notes, bonds payable in less than one year. . . . . .

72 Other current liabilities (attach statement) . . . . . . . . . . . . . . . .

73 All nonrecourse loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

74a Loans from partners (or persons related to partners). . . . . . .

b Mortgages, notes, bonds payable in one year or more . . . . .

75 Other liabilities (attach statement) . . . . . . . . . . . . . . . . . . . . . .

76 Partners’ capital accounts . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

77 Total liabilities and capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2020 FORM 3, PAGE 10

NAME OF PARTNERSHIP |

FEDERAL IDENTIFICATION NUMBER |

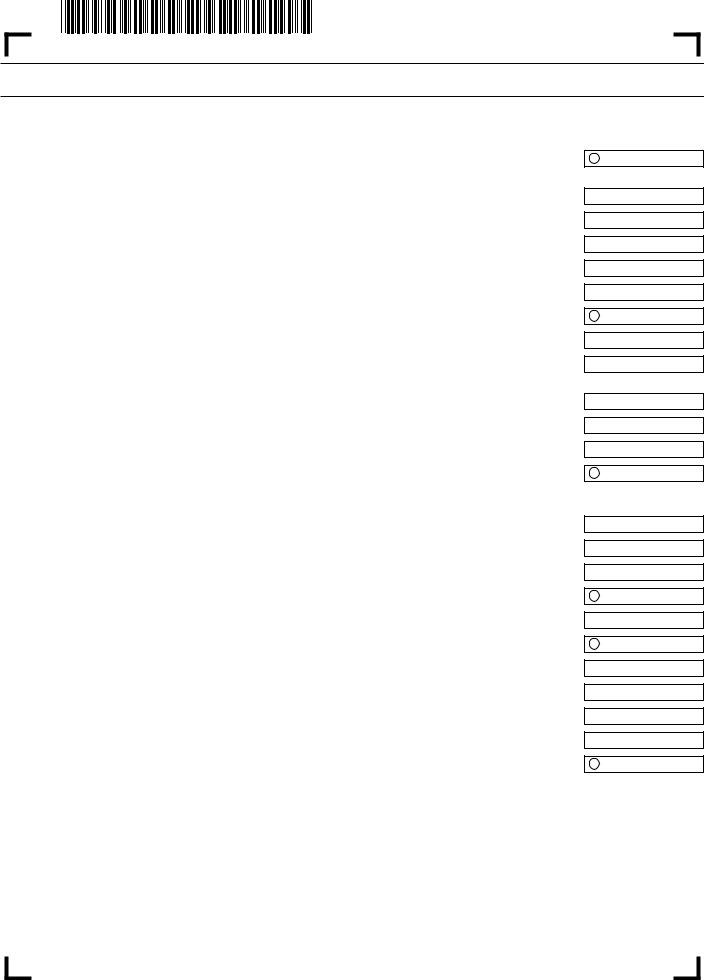

Reconciliation of income or loss per books with income or loss per return

From U.S. Form 1065, Schedule

5 Fill in oval if showing a loss

78 Net income or loss per books . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 78

79Income included in Schedule K, lines 1, 2, 3c, 5, 6a, 7, 8, 9a, 10 and 11, not recorded on books this year attach

statement). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79

80 Guaranteed payments (other than health insurance) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

81 Expenses recorded on books this year not included in Schedule K, lines 1 through 13d and 16p (attach statement) 81

a Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81a

b Travel and entertainment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 81b

82 Add lines 78 through 81 (do not include lines 81a and 81b). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 82

83 Income recorded on books this year not included in Schedule K, lines 1 through 11 (attach statement). . . . . . . . . . . 83

a Federally

84Deductions included in Schedule K, lines 1 through 13d and 16p, not charged against book income this year

(attach statement). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84

a Depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84a

85 Add lines 83 and 84 (do not include lines 83a and 84a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

86 Income or loss. Subtract line 85 from line 82 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 86

From U.S. Form 1065, Schedule

87 Balance as of beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 87

88a Capital contributed: cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88a

b Capital contributed: property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88b

89 Net income or loss per books . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89

90 Other increases (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 90

91 Add lines 87 through 90 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

92a Distributions: cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92a

b Distributions: property. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 92b

93 Other decreases (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 93

94 Add lines 92a, 92b and 93 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94

95 Balance at end of year. Subtract line 94 from line 91 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95