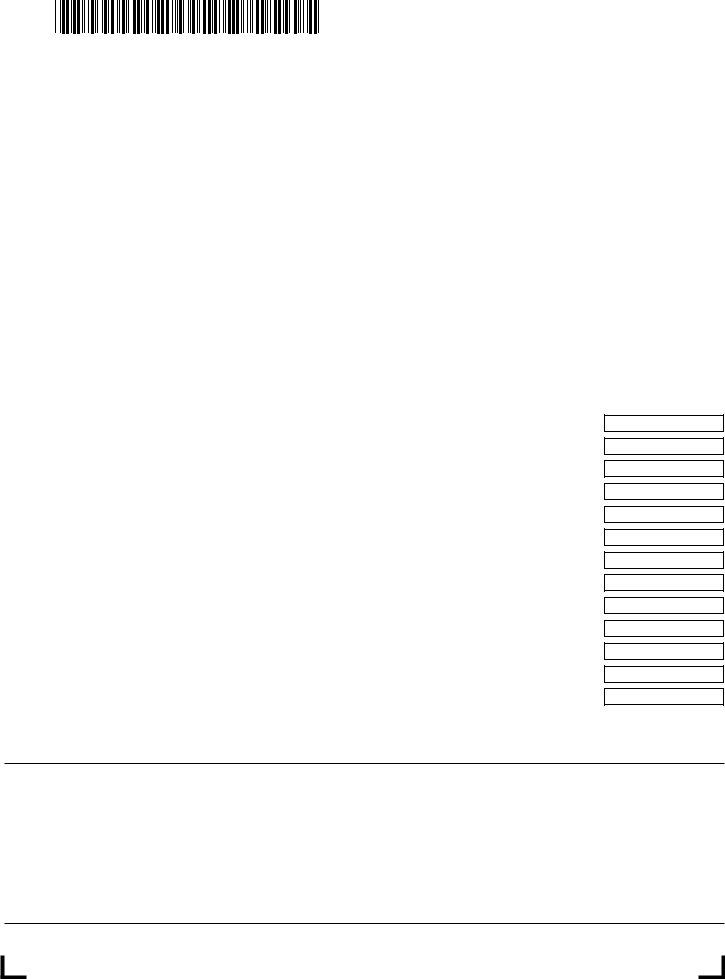

The Massachusetts Department of Revenue requires clubs, labor unions, political committees, taxable fraternal organizations, certain unincorporated homeowners associations, and similar entities not engaged in business for profit to file the Form 3M. This form, specifically designed for the 2020 tax year or for fiscal years beginning in 2020, details income taxation specific to these organizations. It meticulously captures information ranging from the club or organization's name, federal identification, the principal activity, to the caretaker of the organization's books, thereby ensuring a comprehensive account of the entity's financial status. The form also delineates sections for computation of tax, encompassing income such as interest from Massachusetts banks, dividends, capital gains, and specific adjustments for amended returns. Instructions included with the form guide organizations through the process of detailing their income, calculating taxes due on various forms of income including 5% income categories, taxable 12% capital gains, and taxes due to long-term capital gains. Moreover, it outlines the steps for organizations that need to adjust their returns due to federal changes or to file final returns. The form's design caters to the unique fiscal responsibilities of non-profit entities within Massachusetts, offering a structured method for these organizations to comply with state income tax regulations effectively.

| Question | Answer |

|---|---|

| Form Name | Massachusetts Form 3M |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | ma form 3m 2020, massachusetts 3m, form 3m mass, form 3m massachusetts 2020 |

|

Massachusetts Department of Revenue |

|

|

|

|

||

|

|

|

Form 3M |

|

|

|

|

|

Income Tax Return for Clubs and Other |

|

|

|

|||

|

Organizations not Engaged in Business for Profit |

2020 |

|||||

|

|

|

|

|

|

|

|

For calendar year 2020 or taxable year beginning |

|

2020 and ending |

|

|

|

||

|

|

|

|

|

|

|

|

Name of organization |

Federal Identification number |

Phone number |

|

|

|

||

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/Town |

State |

Zip |

Date of organization |

|

|

|

|

|

|

|

|

|

|

|

|

Organization’s books are in care of |

|

|

Principal organization activity |

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City/Town |

State |

Zip |

Phone number |

|

|

|

|

|

|

|

|

|

|

|

|

Fill in if |

|

|

|

|

|

|

|

● Amended return (see “Amended Return” in instructions) |

● Amended return due to federal change |

● Final return ● Filing Schedule TDS |

|||||

|

|

|

|

|

|

|

|

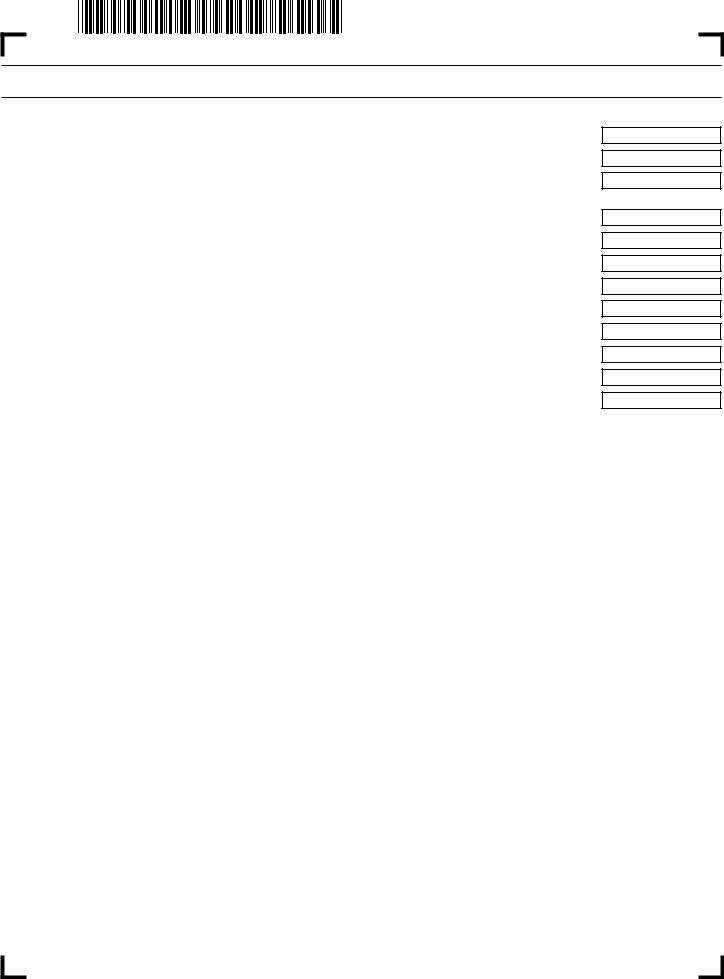

Computation of tax

1 5.0% income, including interest from Massachusetts banks.* List sources and amounts . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2 Interest and dividend income (from Massachusetts Schedule B, line 28). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 3 Total 5.0% income. Add line 1 and line 2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 4 Tax on 5.0% income. Multiply line 3 by .05 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 5 Taxable 12% capital gains (from Massachusetts Schedule B, line 29). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 6 Tax on 12% capital gains. Multiply line 5 by .12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 7 Tax on

10 AMENDED RETURN ONLY. Overpayment from original return. Not less than 0. See instructions . . . . . . . . . . . . . . . . . 10 11 Total. Add lines 9 and 10. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 12 2019 overpayment applied to your 2020 estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 13 2020 Massachusetts estimated tax payments (do not include amount in line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

Declaration

I declare under the pains and penalty of perjury that to the best of my knowledge, the information contained herein is accurate and complete.

Signature of appropriate officer |

Print name |

|

Date |

Phone number |

|

|

|

|

|

Title |

Name of firm |

|

|

PTIN or SSN |

|

|

|

|

|

Signature of paid preparer |

Print name |

|

Date |

Employer Identification number |

|

|

|

|

|

Address of paid preparer |

|

|

|

|

|

|

|

|

|

City/Town |

State |

Zip |

|

Phone number |

Fill this return with payment in full to: Massachusetts Department of Revenue, PO Box 7018, Boston, MA 02204.

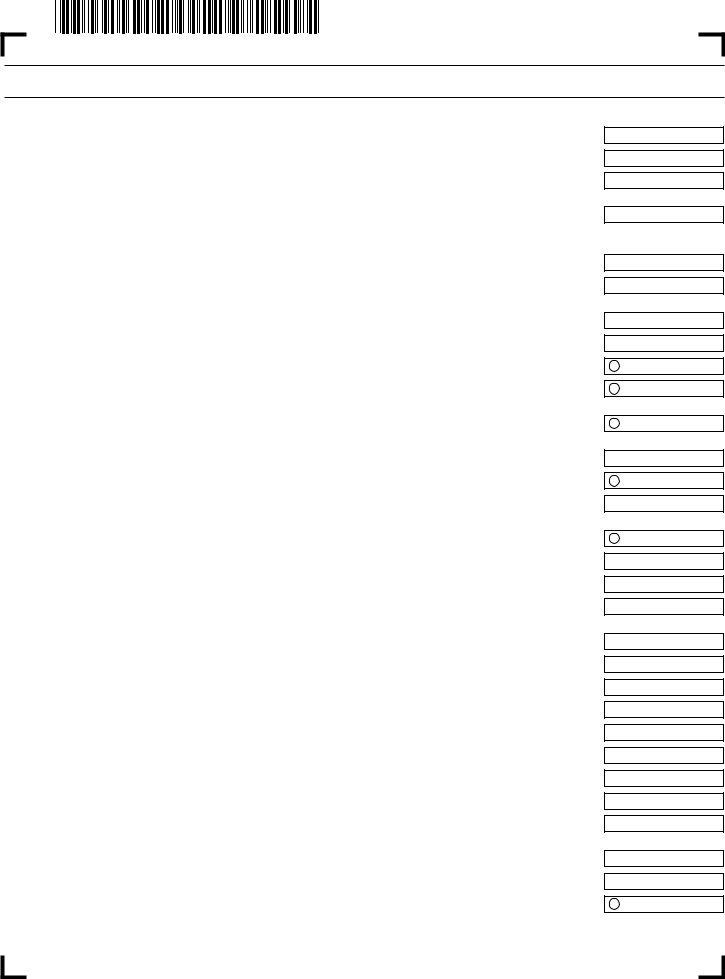

2020 FORM 3M, PAGE 2

Name of organization |

Federal Identification number |

Computation of tax (cont’d.)

14 Payments made with extension . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14 15 AMENDED RETURN ONLY. Payments made with original return. Not less than 0. See instructions . . . . . . . . . . . . . . . 15 16 Total payments. Add lines 12 through 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17Overpayment. If line 11 is smaller than line 16, subtract line 11 from line 16. If line 11 is larger than line 16, go to

line 20 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

18Amount of overpayment to be credited to your 2021 estimated tax.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Amount of your refund. Subtract line 18 from line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19 20 Amount of tax due. If line 16 is smaller than line 11, subtract line 16 from line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20 21a

2020 FORM 3M, PAGE 3

Name of organizationFederal Identification number

Schedule B. Interest, dividends and certain capital gains and losses |

5 Fill in oval if showing a loss |

|

1 Enter taxable interest (other than interest from Massachusetts banks) received during the year . . . . . . . . . . . . . . . . . . . . 1 2 Enter taxable dividends received during the year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 3 Add lines 1 and 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4Enter taxable interest (other than interest from Massachusetts banks) and dividends from all partnerships and

5Subtotal. Add lines 3 and 4. If you have no

Enter this amount in line 28 and on Form 3M, line 2. Omit lines 29 and 30. Otherwise complete Schedule B. . . . . . . . . . . 5

6

7

see Form 1 instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Add lines 6 and 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 9

11Combine lines 8 through 10. If 0 or greater, omit lines 12 through 15 and enter this amount in line 16.

If the total is a loss, go to line 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12

Not more than $2,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Subtotal. Combine lines 11 and 12 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 14

15

omit lines 16 through 20 and complete lines 21 through 29 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16

19

of line 7 minus 50% of losses in lines 9, 10 and 17, but not less than 0. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

20

28If line 27 is greater than or equal to line 5, enter the amount from line 5 here and on Form 3M, line 2. If line 27 is

less than line 5, enter line 27 here and on Form 3M, line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28

29 Taxable 12% capital gains. Subtract line 28 from line 27. Not less than 0. Enter result here and on Form 3M, line 5 . . . . 29 30 Available

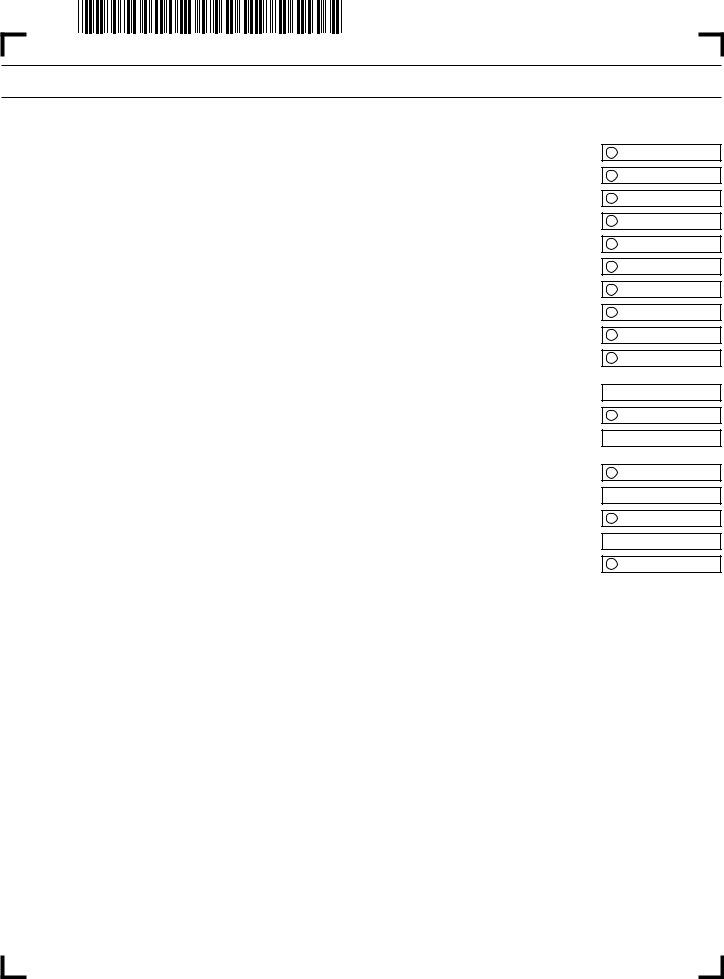

2020 FORM 3M, PAGE 4

Name of organization |

Federal Identification number |

|

|

Schedule D. |

|

||

|

|

|

5 Fill in oval if showing a loss |

Attach copy of U.S. Schedule D. |

|

|

|

1 |

Enter amounts included in U.S. Schedule D, lines 8a and 8b, col. h |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. 1 |

2 |

Enter amounts included in U.S. Schedule D, line 9, col. h |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. 2 |

3 |

Enter amounts included in U.S. Schedule D, line 10, col. h |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. 3 |

4 |

Enter amounts included in U.S. Schedule D, line 11, col. h |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. 4 |

5 |

Enter amounts included in U.S. Schedule D, line 12, col. h |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. 5 |

6 |

Enter amounts included in U.S. Schedule D, line 13, col. h |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. 6 |

7 |

Carryover losses from prior years (see instructions) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. 7 |

8 |

Combine lines 1 through 7 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. 8 |

9 |

Massachusetts differences, if any (see Form 1 instructions; attach additional statement) |

. 9 |

|

10 |

Massachusetts 2020 gains or losses. Exclude/subtract line 9 from line 8 |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

10 |

11

Schedule B, line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Subtotal. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 13 Capital losses applied against capital gains (see instructions). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14Subtotal. If line 12 is greater than 0, subtract line 13 from line 12. If line 12 is less than 0, combine lines 12 and

13. If line 14 is a loss, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15

Form 3M Instructions

This form is solely for the use of clubs, labor unions, political committees, taxable fraternal organizations, certain unincorporated homeowners as- sociations and all other similar organizations not engaged in business for profit, and consequently having only taxable dividends, interest, capital gains, Massachusetts savings deposit interest and other miscellaneous income. If such an organization has taxable business or other income, even if the organization is not a partnership, the return should be made on Form 3, Partnership Return of Income, and each member must in- clude his/her share by class of income on his/her individual income tax return. Unincorporated exempt organizations that file U.S. Forms 990 or

Schedule B, Line 14 and Schedule D, Line 13

If Schedule B, line 13 is a loss and Schedule D, line 12 is a positive amount, enter the smaller of Schedule B, line 13 (considered as a pos- itive amount) or Schedule D, line 12 on Schedule B, line 14 and on Schedule D, line 13.

Schedule B, Line 17 and Schedule D, Line 13

If Schedule B, line 16 is a positive amount and Schedule D, line 12 is a loss, enter the smaller of Schedule B, line 16 or Schedule D, line 12 (con- sidered as a positive amount) on Schedule B, line 17 and on Schedule D, line 13.

Schedule B, Line 24 and Schedule D, Line 15

If Schedule B, line 23 is a positive amount and Schedule D, line 14 is a loss, you must complete a pro forma version of the

Schedule D, Line 7

If you have a carryover loss from a prior year, enter in line 7 the amount of carryover losses from your 2017 Schedule D, line 17.

Schedule D, Line 14

If Schedule D, line 14 is a loss and Schedule B, line 16 is 0 or greater and Schedule B, line 23 is a positive amount, complete line 15. If Schedule D, line 14 is a loss and Schedule B, line 13 is 0 or less, omit Schedule D, line 15, enter the amount from Schedule D, line 14 in Schedule D, line 16, omit Schedule D, line 17 and enter the amount from Schedule D, line 16 in Schedule D, line 18 and enter 0 on Form 3M, line 7.

Where to file

Mail Form 3M and all accompanying schedules to Massachusetts Department of Revenue, PO Box 7018, Bos ton, MA 02204.