It's simple to fill in the massachusetts department of revenue ifta gaps. Our PDF tool will make it almost effortless to prepare almost any PDF. Down the page are the only four steps you should follow:

Step 1: The first step should be to click the orange "Get Form Now" button.

Step 2: The file editing page is now open. Include text or enhance present data.

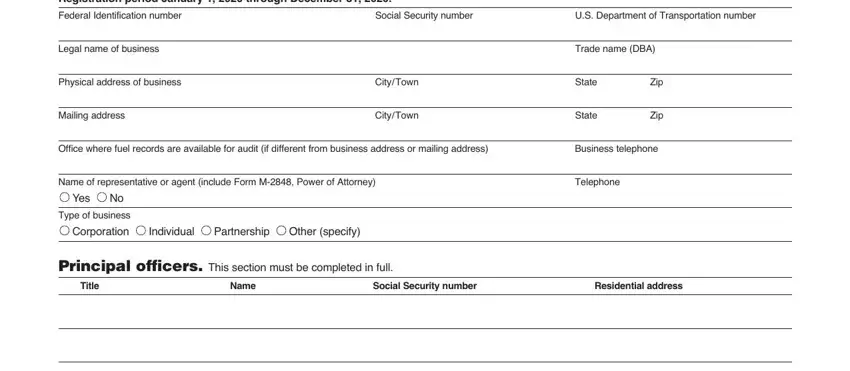

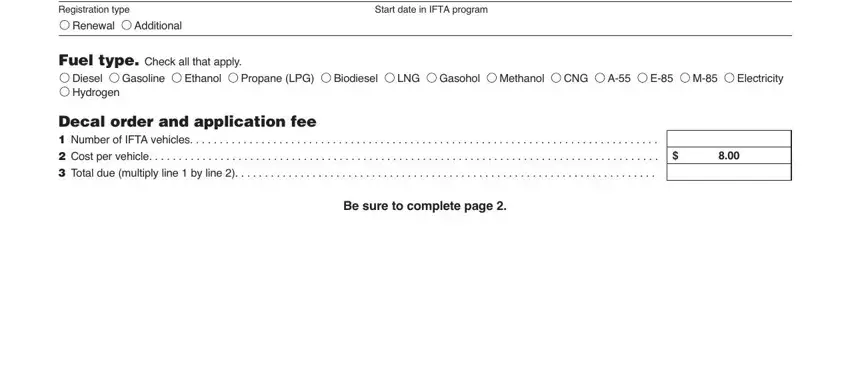

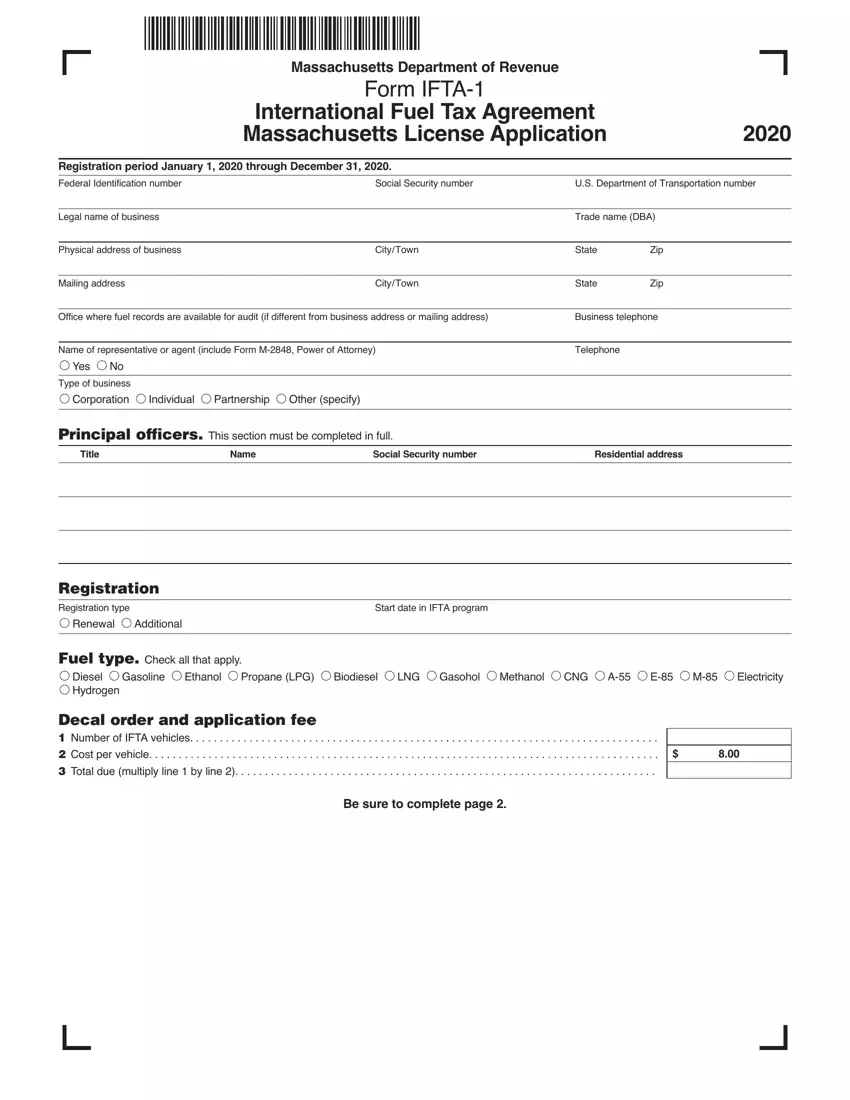

Fill in the massachusetts department of revenue ifta PDF and enter the material for every segment:

You should put down the information inside the part Registration Registration type, Renewal, Additional, Fuel type Check all that apply, Start date in IFTA program, Diesel Gasoline Hydrogen, Ethanol, Propane LPG, Biodiesel, LNG Gasohol Methanol, CNG, E M, Electricity, Decal order and application fee, and Be sure to complete page.

The system will demand for further information in order to easily prepare the area .

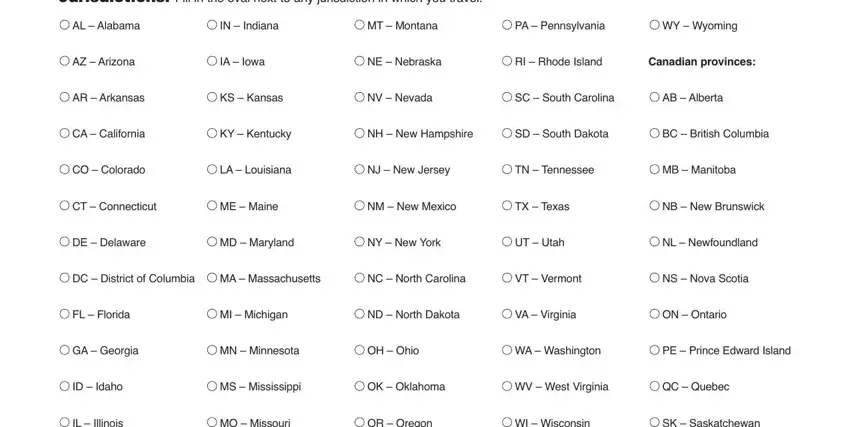

The field Jurisdictions Fill in the oval, AL Alabama, IN Indiana, MT Montana, PA Pennsylvania, WY Wyoming, AZ Arizona, IA Iowa, NE Nebraska, RI Rhode Island, Canadian provinces, AR Arkansas, KS Kansas, NV Nevada, and SC South Carolina will be where to add all parties' rights and obligations.

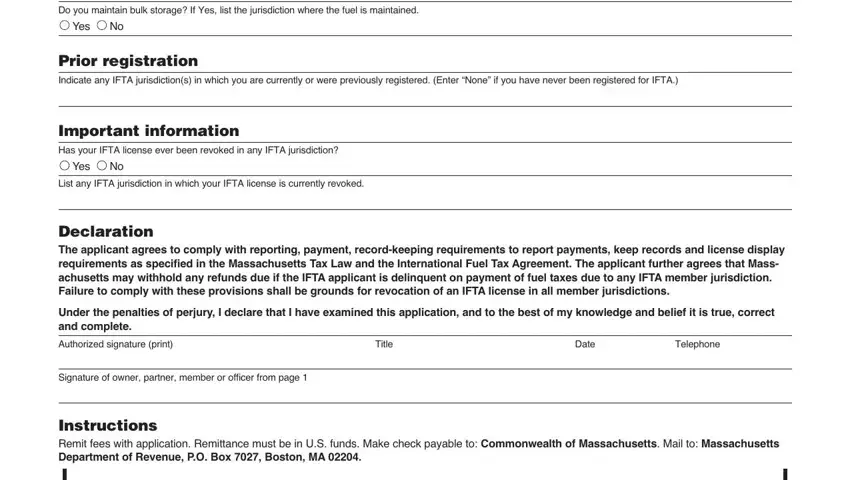

End up by taking a look at all these sections and filling them out as required: Bulk storage Do you maintain bulk, Yes, Prior registration Indicate any, Important information Has your, Yes, List any IFTA jurisdiction in, Declaration The applicant agrees, Under the penalties of perjury I, Authorized signature print Title, Signature of owner partner member, and Instructions Remit fees with.

Step 3: As soon as you select the Done button, your finalized file can be simply transferred to each of your devices or to email stated by you.

Step 4: To prevent potential future troubles, you should always possess more than several copies of every file.

Yes

Yes

Yes

Yes