mc 52 writ garnishment can be filled in online with ease. Simply use FormsPal PDF editing tool to perform the job in a timely fashion. To have our tool on the forefront of efficiency, we aim to put into action user-driven features and improvements regularly. We're routinely looking for suggestions - join us in remolding how you work with PDF docs. To start your journey, take these basic steps:

Step 1: Firstly, open the editor by clicking the "Get Form Button" above on this webpage.

Step 2: The editor will let you customize PDF forms in many different ways. Modify it by writing your own text, adjust what's originally in the file, and add a signature - all doable within minutes!

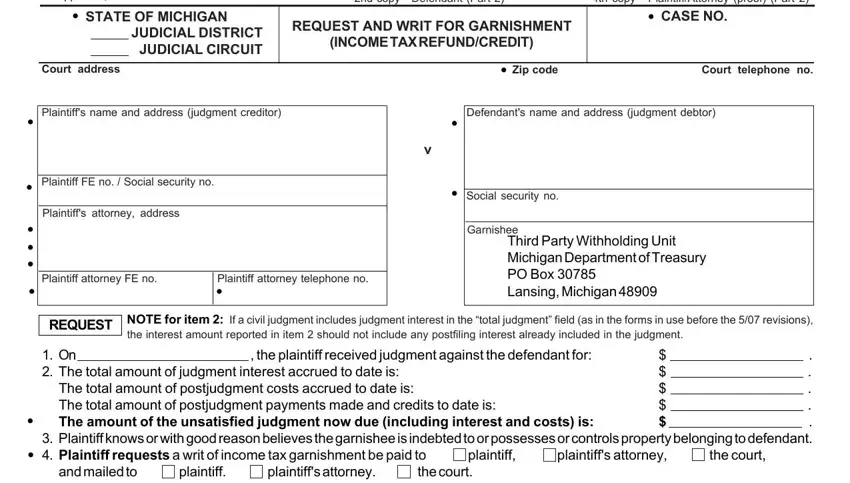

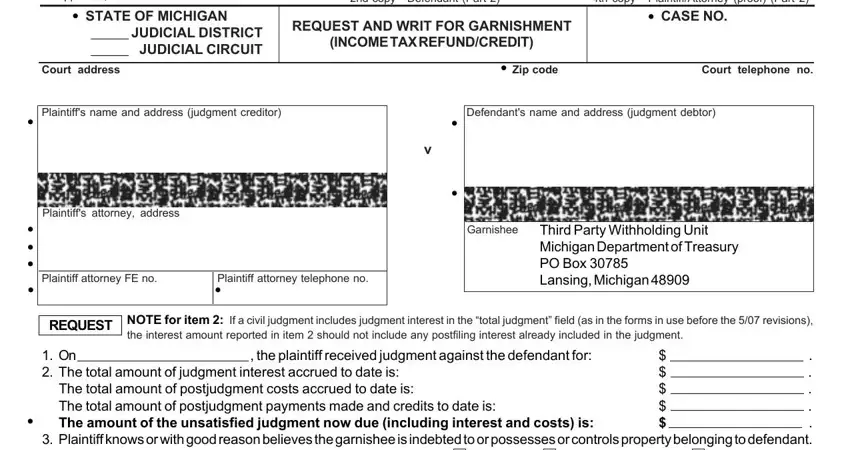

For you to complete this form, ensure that you enter the required details in each and every blank:

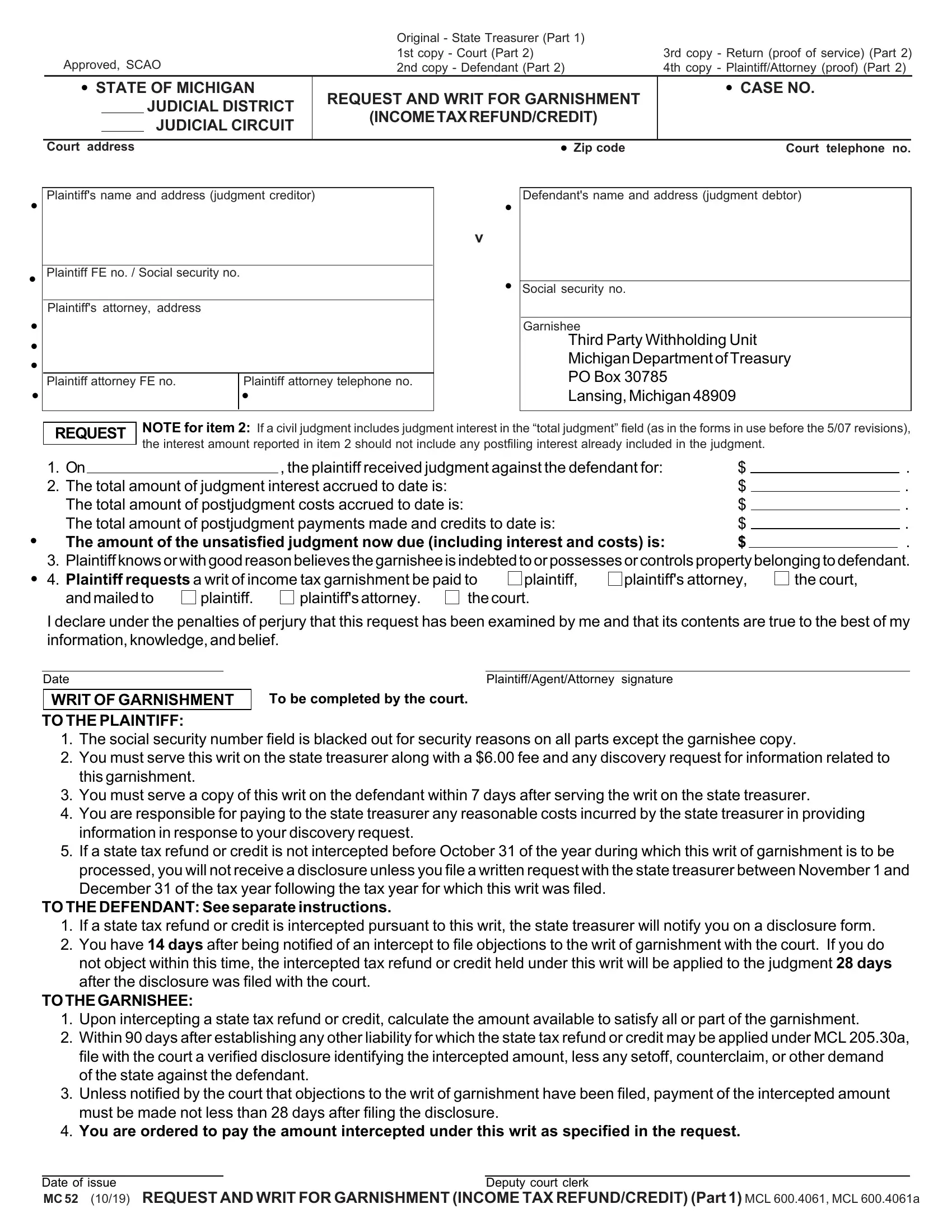

1. It is advisable to fill out the mc 52 writ garnishment correctly, so take care when filling in the areas comprising all these fields:

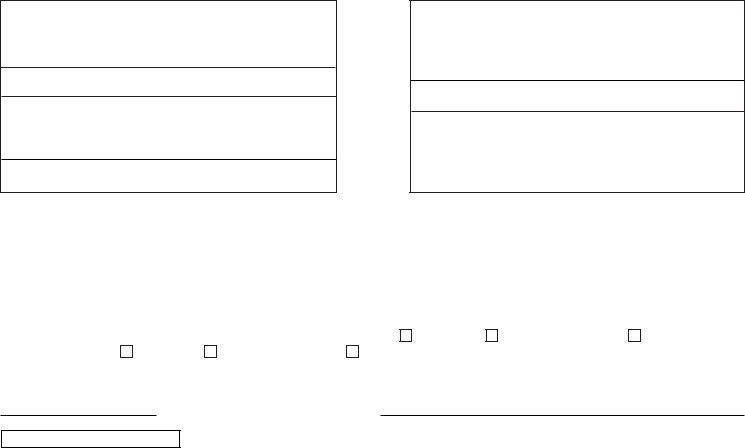

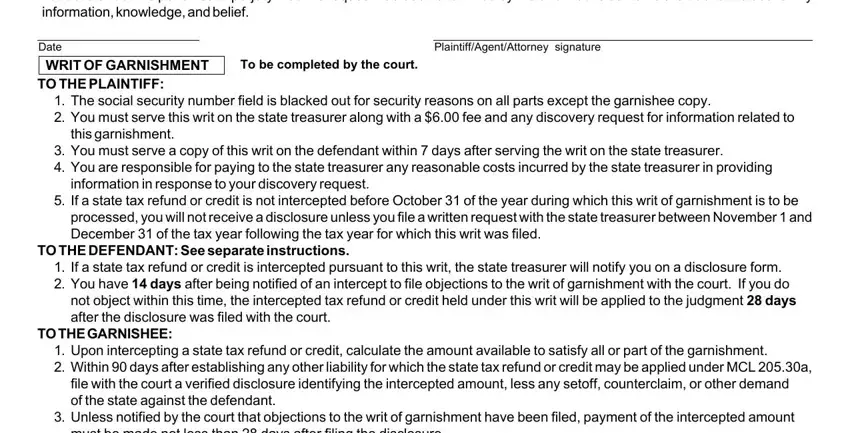

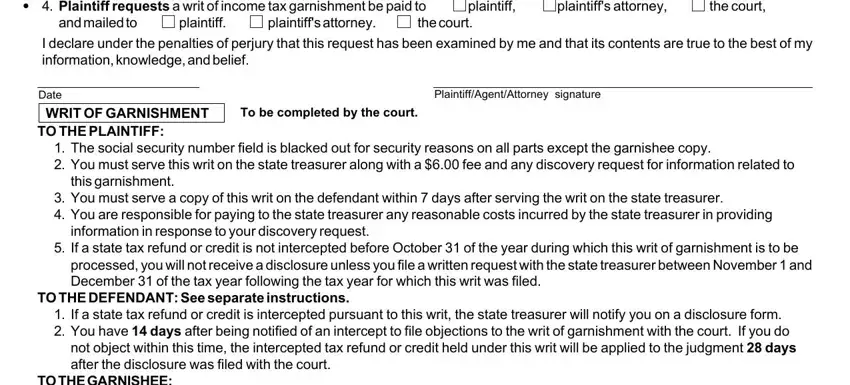

2. The next part is usually to submit all of the following fields: I declare under the penalties of, Date WRIT OF GARNISHMENT TO THE, To be completed by the court, PlaintiffAgentAttorney signature, The social security number field, this garnishment, You must serve a copy of this, information in response to your, If a state tax refund or credit, processed you will not receive a, TO THE DEFENDANT See separate, If a state tax refund or credit, not object within this time the, TO THE GARNISHEE, and Upon intercepting a state tax.

3. This third part should also be quite simple, You are ordered to pay the amount, Date of issue MC REQUEST AND, and Deputy court clerk - every one of these blanks will need to be filled out here.

4. The fourth part comes next with the next few fields to complete: cid, cid cid cid cid, cid, cid, Approved SCAO, cid, STATE OF MICHIGAN, JUDICIAL DISTRICT JUDICIAL CIRCUIT, Court address, Plaintiffs name and address, Plaintiff FE no Social security no, Plaintiffs attorney address, Plaintiff attorney FE no, Plaintiff attorney telephone no cid, and Original State Treasurer Part st.

5. Last of all, this final segment is precisely what you will have to wrap up prior to submitting the PDF. The blank fields you're looking at include the next: cid, Plaintiff knows or with good, plaintiff, plaintiffs attorney, the court, and mailed to, plaintiff, plaintiffs attorney, the court, I declare under the penalties of, Date WRIT OF GARNISHMENT TO THE, To be completed by the court, PlaintiffAgentAttorney signature, The social security number field, and this garnishment.

People generally get some points wrong when completing plaintiff in this section. You should definitely review what you enter right here.

Step 3: When you have reviewed the details you given, simply click "Done" to complete your FormsPal process. Right after setting up afree trial account here, you'll be able to download mc 52 writ garnishment or send it via email at once. The form will also be readily available in your personal cabinet with your every single edit. We do not share or sell any details you use whenever dealing with documents at our site.