We found the most efficient programmers to develop our PDF editor. This software will assist you to create the medical redetermination form file easily and won't eat up a lot of your time. This straightforward instruction will allow you to begin.

Step 1: Hit the orange button "Get Form Here" on the following web page.

Step 2: At the moment you're on the file editing page. You can enhance and add content to the file, highlight specified content, cross or check selected words, include images, put a signature on it, get rid of unwanted fields, or remove them altogether.

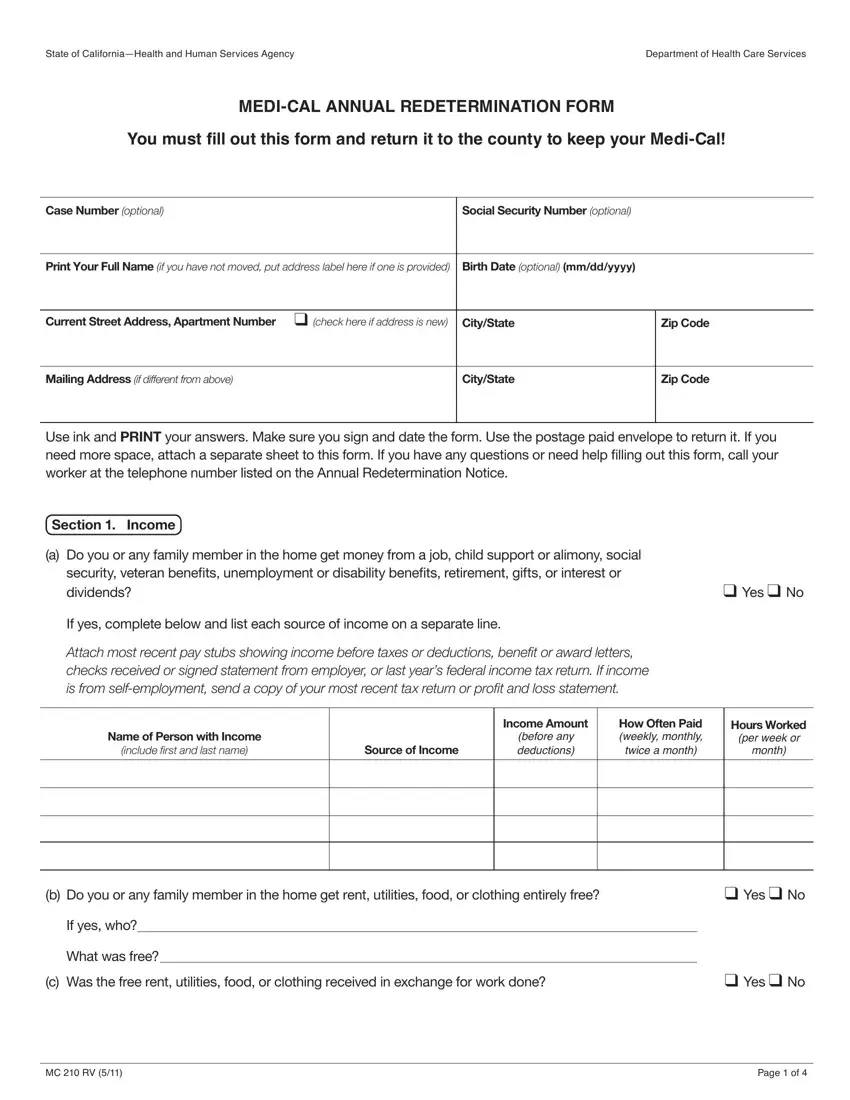

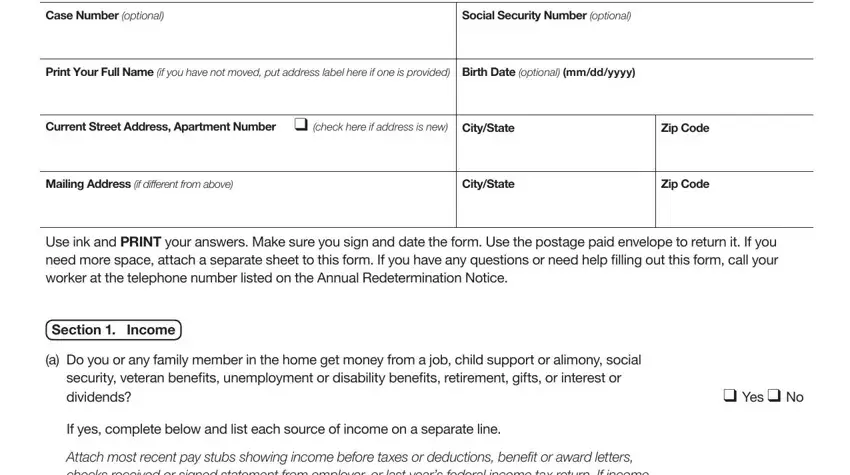

The PDF document you desire to prepare will include the next areas:

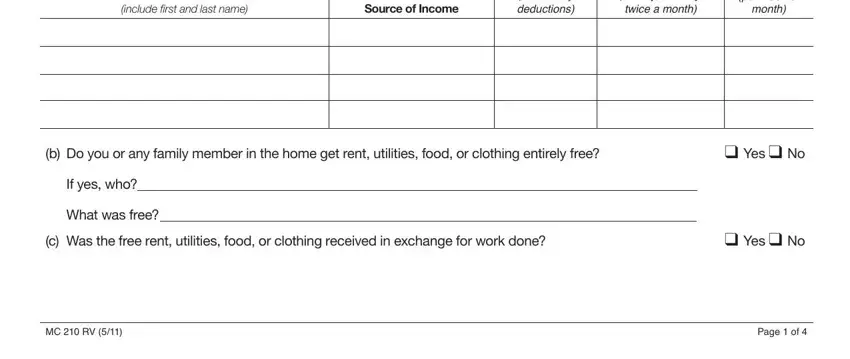

Provide the requested data in the Name of Person with income include, Source of income, income Amount before any deductions, How Often Paid weekly monthly, Hours Worked per week or month, b Do you or any family member in, Yes No, If yes who, What was free, c Was the free rent utilities food, Yes No, and MC RV Page of field.

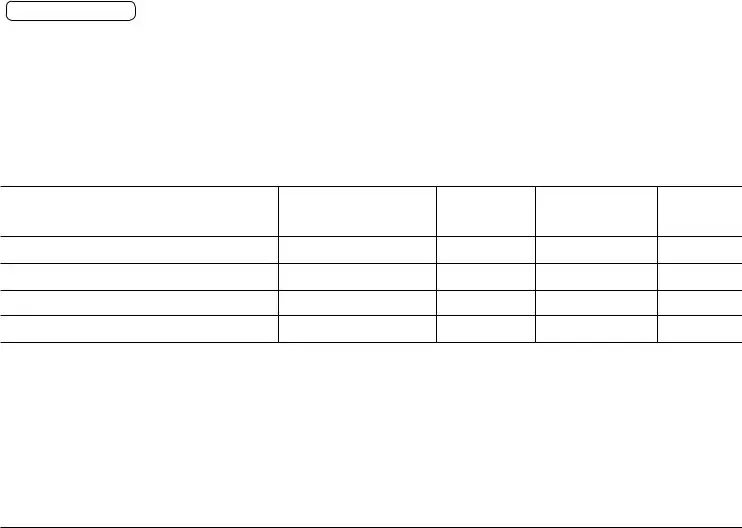

The application will request information to conveniently prepare the section Do you or any family member in the, Yes No, If yes complete below and list, Attach proof of expensesdeductions, Name of Person with, type of Expense or Deduction, Amount of Payment, Paid to Whom, How Often Paid weekly monthly, Section Other Health insurance, a Did you or any family member, coverage or insurance within the, If yes who has the, Which type of coverageinsurance, and b Is any family member living in.

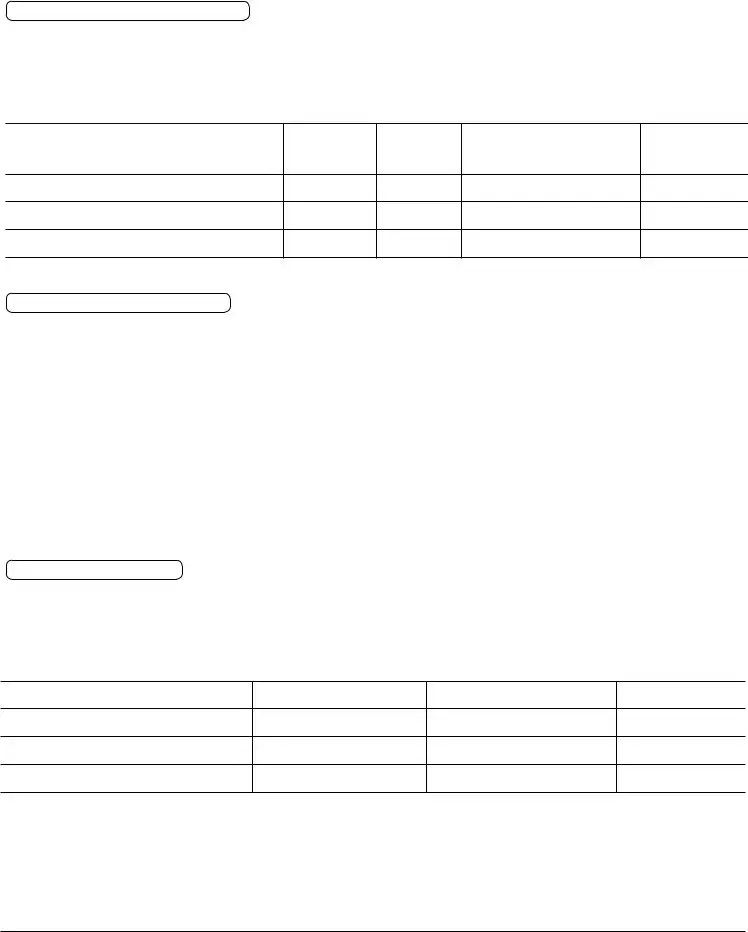

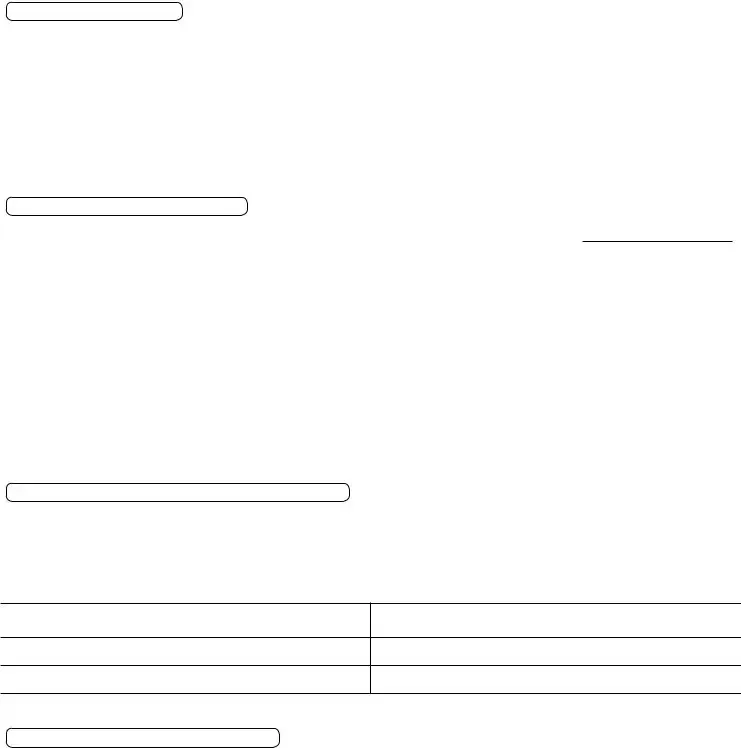

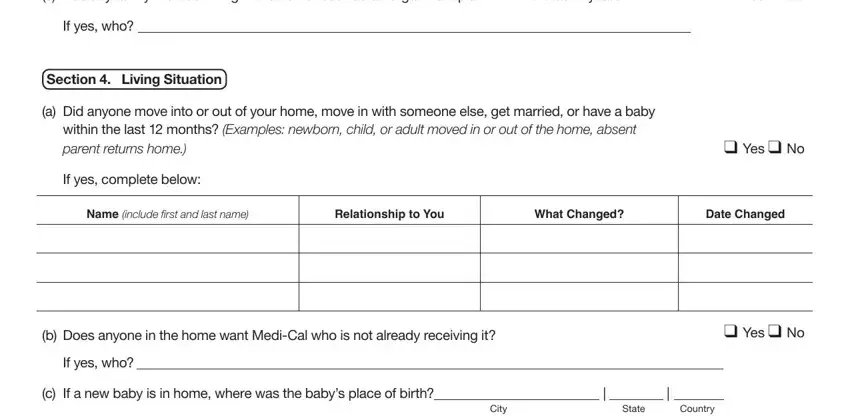

When it comes to paragraph c Has any family member living in, If yes who, Section Living Situation, a Did anyone move into or out of, parent returns home, If yes complete below, Yes No, Yes No, Name include first and last name, Relationship to You, What Changed, Date Changed, b Does anyone in the home want, Yes No, and If yes who, state the rights and responsibilities.

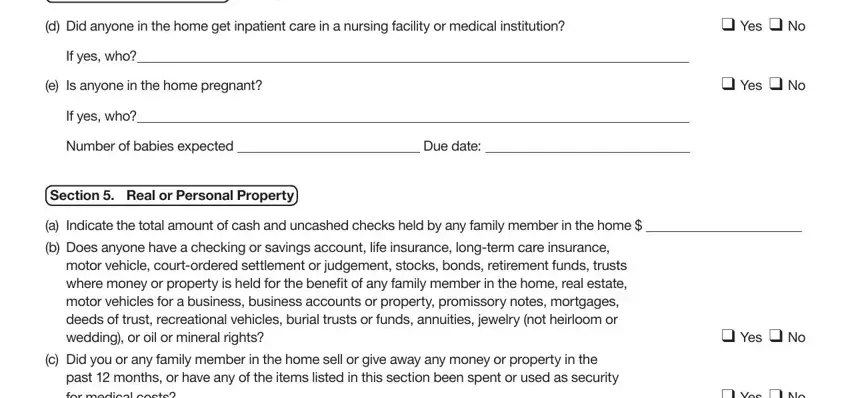

Look at the sections Section Living Situation, continued, d Did anyone in the home get, If yes who, e Is anyone in the home pregnant, Yes No, Yes No, If yes who, Number of babies expected Due date, Section real or Personal Property, a Indicate the total amount of, b Does anyone have a checking or, wedding or oil or mineral rights, c Did you or any family member in, and past months or have any of the and thereafter complete them.

Step 3: Hit the Done button to confirm that your completed document may be transferred to every electronic device you use or forwarded to an email you specify.

Step 4: In avoiding potential future difficulties, make sure to obtain more than two copies of each separate form.